What is Money Supply and Why Does it Matter?

The money supply is a crucial component of a nation’s economy, playing a vital role in shaping the overall economic landscape. It refers to the total amount of money circulating in an economy, encompassing various forms of currency, deposits, and other liquid assets. The money supply has a profound impact on key economic indicators such as inflation, employment, and economic growth. Understanding the dynamics of money supply is crucial for policymakers, businesses, and individuals alike, as it influences the overall direction of the economy. In fact, a clear grasp of the M2 definition of the money supply is essential for making informed economic decisions.

How to Measure Money Supply: A Deep Dive into M2

Measuring money supply is a complex task, and economists have developed various methods to quantify it. The most commonly used measures of money supply are M1, M2, and M3, each capturing a different aspect of the money supply. The M2 definition of the money supply is a widely used measure, which includes all currency in circulation, checking and savings accounts, money market funds, and other liquid assets. The M2 definition is calculated by adding up the values of these components, providing a comprehensive picture of the money supply. Understanding the M2 definition of the money supply is essential for policymakers and economists, as it helps them track changes in the money supply and make informed decisions about monetary policy.

The Role of Central Banks in Regulating Money Supply

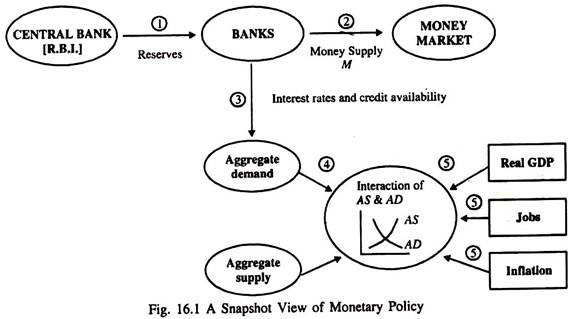

Central banks play a crucial role in regulating the money supply, using various monetary policy tools to control the amount of money circulating in the economy. One of the primary objectives of central banks is to maintain price stability, which is achieved by managing the money supply to keep inflation in check. To achieve this, central banks use tools such as interest rates, open market operations, and reserve requirements to influence the money supply. For instance, by lowering interest rates, central banks can increase the money supply, stimulating economic growth. Conversely, by raising interest rates, they can reduce the money supply, curbing inflation. The M2 definition of the money supply is a key metric used by central banks to monitor the money supply and make informed decisions about monetary policy. By understanding the M2 definition and its components, central banks can effectively regulate the money supply, promoting economic stability and growth.

The Impact of Money Supply on Economic Indicators

Changes in the money supply have a profound impact on key economic indicators, including GDP, inflation rate, and unemployment rate. An increase in the money supply, as measured by the M2 definition of the money supply, can stimulate economic growth by increasing aggregate demand, leading to higher GDP. Conversely, a decrease in the money supply can lead to a contraction in economic activity, resulting in lower GDP. The money supply also has a significant impact on the inflation rate, as an excessive increase in the money supply can lead to higher inflation, while a decrease can lead to deflation. Furthermore, the money supply affects the unemployment rate, as an increase in the money supply can lead to job creation, while a decrease can lead to higher unemployment. Understanding the impact of money supply on these economic indicators is crucial for policymakers and economists, as it enables them to make informed decisions about monetary policy and promote economic stability.

Understanding the Relationship Between Money Supply and Inflation

The relationship between money supply and inflation is a crucial aspect of monetary policy, as it has a direct impact on the overall economy. The money supply curve, which illustrates the relationship between the money supply and the inflation rate, is a key concept in understanding this relationship. According to the quantity theory of money, an increase in the money supply, as measured by the M2 definition of the money supply, leads to a proportionate increase in the price level, resulting in higher inflation. This is because an excess supply of money chases a constant quantity of goods and services, driving up prices. Conversely, a decrease in the money supply leads to lower inflation or even deflation. Central banks, therefore, use monetary policy tools to regulate the money supply and maintain a stable inflation rate, which is typically around 2-3% per annum. Understanding the relationship between money supply and inflation is essential for policymakers to make informed decisions about monetary policy and promote economic stability.

The Limitations of M2 as a Measure of Money Supply

While the M2 definition of the money supply is widely used, it has several limitations that make it an imperfect measure of money supply. One of the main limitations is its failure to capture the complexity of modern financial systems. The M2 measure only includes traditional bank deposits and currency in circulation, neglecting other forms of money, such as digital currencies, cryptocurrencies, and shadow banking activities. This omission can lead to an underestimation of the true money supply, particularly in economies with a high degree of financial innovation. Furthermore, the M2 measure does not account for the velocity of money, which can affect the overall money supply. Additionally, the M2 measure is based on a narrow definition of money, which may not be relevant in today’s economy, where money is increasingly digital and intangible. These limitations highlight the need for alternative measures of money supply, such as M1 and M3, which can provide a more comprehensive understanding of the money supply and its impact on the economy.

Alternative Measures of Money Supply: A Look at M1 and M3

In addition to the M2 definition of the money supply, there are other measures of money supply that provide a more nuanced understanding of the money supply. M1, also known as the narrow money supply, includes only the most liquid forms of money, such as currency in circulation and checking accounts. This measure is useful for understanding the money supply’s impact on short-term economic activity. On the other hand, M3, also known as the broad money supply, includes a wider range of money types, such as savings deposits, time deposits, and repurchase agreements. This measure provides a more comprehensive understanding of the money supply’s impact on long-term economic activity. While M1 and M3 have their advantages, they also have limitations. For instance, M1 may not capture the full range of money types, while M3 may include money types that are not readily available for spending. Understanding the strengths and weaknesses of these alternative measures can help policymakers and economists make more informed decisions about monetary policy and economic growth.

Conclusion: The Importance of Understanding Money Supply in Today’s Economy

In conclusion, understanding the concept of money supply and its various measures, including the M2 definition of the money supply, is crucial for making informed economic decisions. The money supply plays a vital role in shaping the economy, influencing inflation, employment, and economic growth. Central banks, through their monetary policy tools, aim to regulate the money supply to achieve economic stability. However, the limitations of traditional measures, such as M2, highlight the need for alternative measures, like M1 and M3, to provide a more comprehensive understanding of the money supply. By grasping the complexities of money supply, policymakers, economists, and individuals can better navigate the intricacies of the economy, making more informed decisions that promote economic growth and stability. In today’s economy, where the money supply is increasingly influenced by digital currencies and modern financial systems, understanding the money supply is more important than ever.