Understanding Money Supply Metrics: M1 and M2

Money supply, a crucial concept in economics, represents the total amount of money circulating in an economy at a specific time. Understanding the dynamics of money supply is vital for analyzing economic performance and predicting future trends. Different measures of money supply, like M1 and M2, categorize money based on its liquidity. These metrics provide insights into the overall health of an economy and how monetary policy impacts it. M1 and M2 money supply measures offer a comprehensive picture of the money supply, ranging from highly liquid assets to those with lower liquidity. M1 measures the most readily available money, while M2 encompasses a broader range of financial assets. Analyzing these measures helps economists assess short-term and long-term economic activity.

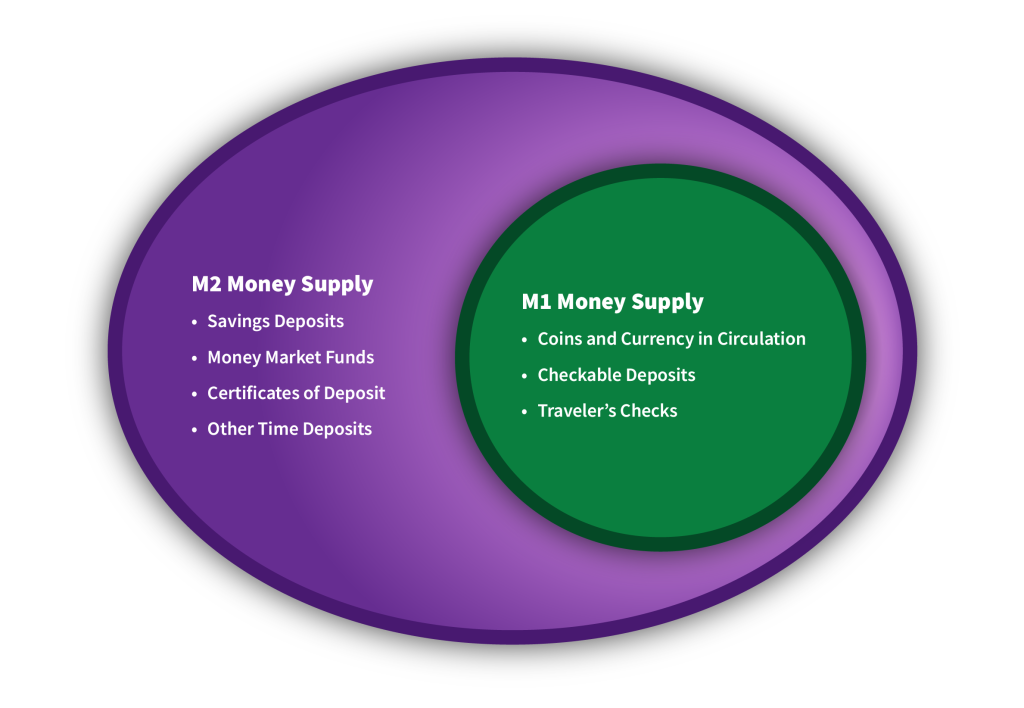

The calculation of M1 and M2 money supply involves specific components. M1 includes physical currency, traveler’s checks, and demand deposits, which are readily available for immediate transactions. M2 incorporates M1, along with savings deposits, money market mutual funds, and other time deposits. The difference in liquidity between M1 and M2 components reflects the different uses of these funds. M1’s high liquidity directly influences short-term economic activity like consumer spending and business transactions. M2, with its less liquid components, is more indicative of longer-term economic trends, such as investment and saving patterns. Analyzing both M1 and M2 money supply provides a more complete view of the economy.

The money supply plays a pivotal role in economic activity. Changes in the money supply directly affect interest rates, influencing investment decisions and economic growth. Understanding these relationships is crucial for comprehending how monetary policy can impact the economy. M1 and M2 money supply figures are closely watched by economists, policymakers, and financial analysts. Understanding how these measures are calculated and interpreted is fundamental for assessing the economic environment and potential future developments. The analysis of historical trends and the impact of monetary policy can inform a deeper understanding of this crucial aspect of economic life.

M1 Money Supply: A Closer Look

M1 money supply represents the most liquid forms of money. It comprises physical currency in circulation, traveler’s checks, demand deposits, and other checkable deposits. The high liquidity of these components makes them readily available for transactions. M1’s strong link to short-term economic activity makes it a valuable tool for assessing immediate economic conditions. Changes in M1 often precede shifts in consumer spending and business activity. Examining M1 and M2 money supply trends provides insight into the speed and intensity of economic activity. Analyzing this data helps understand the relationship between money supply and economic activity. Understanding M1’s role provides insight into the dynamics of the economy. This understanding forms a crucial basis for comprehending broader economic themes. The next money supply measure, M2, offers a more comprehensive perspective.

M1’s components are easily convertible to cash, reflecting its immediate use in daily transactions. The ease of conversion underscores its substantial role in facilitating day-to-day economic activity. Changes in M1 can act as a significant indicator of upcoming shifts in short-term economic behavior. For instance, an increase in M1 might suggest heightened consumer spending and business investments, potentially leading to a boost in economic activity. Conversely, a decline in M1 might indicate reduced consumer confidence, potentially resulting in a slowdown in economic growth. M1 and M2 money supply are essential for economic analysis and forecasting.

The relative liquidity of M1 components, such as cash and checking accounts, allows for rapid spending and investment. This inherent liquidity makes it highly sensitive to short-term economic fluctuations. This sensitivity is crucial in detecting immediate changes in economic activity. M1’s immediate responsiveness and direct impact on short-term economic outcomes make it an important metric for assessing the immediate economic health of a nation. The connection between M1 and the economy underscores the importance of understanding this measure. Understanding M1 and M2 money supply provides a foundation for comprehending economic dynamics. Understanding this connection is important for economic analysis. The understanding of M1 serves as a basis for understanding the more comprehensive M2 measurement.

M2 Money Supply: A Broader Perspective

M2 money supply encompasses a wider range of financial assets than M1. It includes M1 components plus less liquid accounts, such as savings accounts and money market funds. This broader measure reflects a larger segment of the economy’s financial activity. Analysis of M2 is valuable for forecasting longer-term economic trends. Unlike M1, which primarily captures readily available funds, M2 captures a more comprehensive picture of financial assets, including those used for longer-term investments and savings. This makes M2 a crucial indicator for understanding broader economic trends. The inclusion of these savings and investment accounts allows for a more holistic perspective on the money supply’s influence on the economy. M2 reflects not just transactions but also financial planning and investment activity. This crucial distinction between M1 and M2 money supply provides different perspectives on economic activity. Changes in M2 often precede and predict shifts in the overall economy. Tracking M2 provides insights into future economic performance. The differing liquidity properties of M1 and M2 money supply components are key to understanding these separate measures.

The liquidity of M2 components is generally lower than that of M1. This implies that assets categorized under M2 are less readily convertible into cash compared to M1. This lower liquidity directly correlates to the longer-term nature of the investments and savings represented within M2. Comparing M1 and M2 money supply provides crucial insights into the overall financial health of the economy. Understanding how these measures change and their correlations with economic data is critical to financial analysis. Analyzing the correlation between changes in M2 and economic growth provides deeper understanding of market trends. The different liquidity characteristics of M1 and M2 money supply are essential to understanding the timing of the influence of these monetary aggregates on the broader economy.

The two measures, M1 and M2 money supply, offer distinct views of economic activity. M1 focuses on the immediate flow of transactions, while M2 offers a broader picture of financial resources available for longer-term investments and savings. Both measurements are critical in assessing the current state and potential trajectory of the economy. M1 offers a shorter-term view of economic activity, while M2 provides insights into the overall health of the financial system. This makes both M1 and M2 critical in making informed economic decisions. This provides a comprehensive approach to assessing the money supply, offering distinct perspectives on economic activity and potential for financial forecasting.

Analyzing M1 and M2 Money Supply Trends

Historical trends in M1 and M2 money supply offer valuable insights into economic performance. Analyzing fluctuations in these measures over time provides a framework for understanding past economic outcomes. Visual representations, such as charts and graphs, effectively illustrate these fluctuations. These visual tools clearly highlight changes in M1 and M2 money supply over time. Historical data allows for an examination of the relationship between changes in M1 and M2 money supply and corresponding economic outcomes. Understanding these relationships is critical for effective forecasting and policy-making.

Examining long-term trends reveals potential correlations between the evolution of M1 and M2 money supply and key economic indicators. For instance, periods of rapid M1 and M2 money supply growth might coincide with inflationary pressures or robust economic expansion. Conversely, declining M1 and M2 money supply measures could be indicative of economic contraction. Data visualization plays a crucial role in highlighting these potential relationships. Identifying patterns and correlations in the historical data helps analysts understand the impact of M1 and M2 money supply on various economic metrics.

The analysis of M1 and M2 money supply trends, supported by comprehensive data visualization, empowers a deeper understanding of economic history. It also helps inform future economic decisions. By observing these trends, economists and policymakers can recognize potential economic developments. These observed trends, in turn, inform more accurate forecasts and contribute to effective policy adjustments.

The Impact of Monetary Policy on Money Supply

Central bank monetary policy significantly influences the m1 and m2 money supply. Key tools employed include adjustments to interest rates and quantitative easing. Adjusting interest rates directly affects borrowing costs for businesses and consumers. Lowering interest rates encourages borrowing and spending, potentially stimulating economic growth but also increasing inflation risks. Conversely, raising interest rates can curb inflation but might slow economic activity. Quantitative easing involves central banks injecting liquidity into money markets by purchasing government bonds or other assets. This increases the money supply, potentially lowering borrowing costs and boosting economic activity. However, it can also lead to inflationary pressures if not carefully managed.

The effects of these policies on m1 and m2 money supply, inflation, economic growth, and employment are multifaceted. Increased money supply might lower borrowing costs, encourage investment, and potentially lead to higher employment rates. This effect can be seen in reduced borrowing costs, which can make businesses more inclined to invest and expand, resulting in the creation of new jobs. Conversely, rapid increases in the money supply might lead to higher inflation, potentially diminishing purchasing power and affecting the economy adversely. Inflation erodes the value of money, making goods and services more expensive. Therefore, central banks need to carefully balance policies to support economic growth without excessively increasing inflation.

Understanding the intricate relationship between monetary policy and the m1 and m2 money supply is crucial for economic stability. By analyzing historical data and economic trends, policymakers can make informed decisions to mitigate the risks associated with rapid fluctuations in the money supply. Furthermore, understanding these factors also allows for better projections of future economic scenarios. Central banks continually monitor various economic indicators to gauge the impact of their policies on the m1 and m2 money supply and adjust measures as needed to achieve stable economic growth.

How to Interpret M1 and M2 Money Supply Data

Interpreting M1 and M2 money supply data requires a keen eye for detail. Analyzing charts and graphs, along with economic reports, provides valuable insights into current economic conditions. Look for patterns in the data to identify potential shifts in economic activity. Changes in M1 and M2 money supply can reveal trends impacting consumer spending and overall economic health. This analysis helps understand the nuances of economic fluctuations. Be aware that the relationship between money supply and economic activity isn’t always straightforward. External factors influence the intricate relationship. Recognizing these complexities strengthens interpretations.

A crucial aspect of interpreting M1 and M2 money supply data involves considering the context of economic reports. For example, a sudden increase in M1 money supply might indicate a surge in consumer spending or business activity. However, understanding other data points, such as interest rates and inflation rates, is equally important. Analyze the relationship between changes in the M1 and M2 money supply and broader economic indicators to form a comprehensive understanding. Examining the data through a historical lens adds context, enabling a more insightful interpretation of current trends. Crucially, understand that M1 and M2 money supply data alone doesn’t provide a complete picture of the economy. Consider other relevant factors, including economic policies and global events, when interpreting the data.

When examining graphs and charts, pay close attention to the timeframes displayed. Consider whether the trends observed reflect short-term or long-term shifts. Interpreting M1 and M2 money supply data requires a holistic perspective. Look for correlations between money supply changes and other economic indicators. Understanding the interplay between M1 and M2 money supply and economic indicators provides a more nuanced understanding of the data. Focus on the overall direction and magnitude of changes in M1 and M2 money supply, as well as how they relate to other economic developments. Use historical precedents to aid in drawing conclusions about potential future outcomes. For instance, a sustained increase in M1 and M2 money supply may suggest potential inflation. However, other economic factors may contradict these observations, so evaluate the data thoughtfully and objectively. This cautious approach yields a more complete and nuanced understanding of economic trends. Combining multiple perspectives is crucial for developing a comprehensive interpretation of M1 and M2 money supply data and to predict future economic scenarios.

Using M1 and M2 for Economic Forecasting

Economic analysts frequently utilize M1 and M2 money supply metrics to anticipate future economic conditions. Changes in these measures can signal shifts in consumer spending, investment patterns, and the overall economic landscape. By closely tracking these indicators, analysts can potentially predict and interpret market movements.

Analyzing trends in M1 and M2 money supply can provide crucial insights into potential shifts in consumer behavior. Increased M1 and M2 money supply often correlates with increased consumer spending. This is because more available money in the economy gives consumers more purchasing power. Conversely, a decrease in the money supply might indicate a slowdown in consumer spending. Similarly, changes in M1 and M2 money supply can reflect shifts in investment activity. An increase might suggest a positive outlook on the economy, encouraging companies to invest more. Conversely, a decline could signal a cautious approach from investors.

Examining these two measures in tandem offers a more comprehensive view of the economy. For example, a rise in M2 money supply, often representing a broader range of financial assets, while M1 remains relatively stable, might indicate a shift towards longer-term investment rather than immediate spending. A sharp increase in M1 but a decline in M2 could suggest increased spending but a decrease in investment activity, which might point to a fluctuation in market sentiment. By combining these insights from M1 and M2 money supply data, economic forecasters can gain a more nuanced understanding of the prevailing economic environment. Analyzing historical patterns of M1 and M2 money supply and relating them to economic conditions can also be beneficial in forecasting and making informed decisions.

Limitations of M1 and M2 Money Supply Metrics

While M1 and M2 money supply metrics offer valuable insights into short-term and long-term economic activity, relying solely on these measures for comprehensive economic forecasting carries inherent limitations. Technological advancements and globalization have significantly altered the relationship between money supply and economic activity. Modern financial instruments and the increasing prevalence of digital transactions redefine traditional definitions of liquidity.

Consider the impact of mobile payments and peer-to-peer (P2P) transfers. These innovations can circumvent traditional banking systems, potentially affecting the accuracy of M1 and M2 calculations. Similarly, the rise of cryptocurrency and decentralized finance (DeFi) introduces new forms of value storage and exchange, further complicating the relationship between money supply and economic indicators. Analyzing the impact of such innovations on traditional economic models and metrics demands careful consideration. Furthermore, the rapid evolution of financial markets, coupled with complex international transactions, makes it challenging to capture the complete picture of economic activity reflected in M1 and M2 money supply data. The increasing complexity of global financial flows poses a challenge for accurately interpreting trends in m1 and m2 money supply.

Changes in consumer behavior and financial preferences also influence the relationship between money supply and economic performance. These factors are not easily captured in simplified metrics. Finally, it is important to acknowledge the inherent limitations of statistical models and the potential for unforeseen events to disrupt any economic forecast. Thus, while m1 and m2 money supply measures remain valuable tools for monitoring economic conditions, analysts must recognize the limitations of relying solely on them and consider additional factors when developing and interpreting economic forecasts.