Differentiating Loan Exposure and Loan Outstanding: A Crucial Distinction

Loan exposure and loan outstanding are two essential concepts in the lending landscape, each carrying unique implications for lenders and borrowers alike. Loan exposure, also known as ‘credit risk’ or ‘lending risk,’ signifies the total risk a lender assumes when extending credit to a borrower. In contrast, loan outstanding, or the ‘current debt‘ and ‘outstanding balance,’ represents the amount a borrower owes to a lender at any given time.

Understanding the distinction between loan exposure and loan outstanding is crucial for both parties. For lenders, assessing loan exposure helps manage risk, allocate resources, and maintain a healthy loan portfolio. For borrowers, monitoring loan outstanding is vital for effective financial planning, debt management, and maintaining a strong credit profile. By differentiating these two concepts, lenders and borrowers can make informed decisions and build successful, sustainable lending relationships.

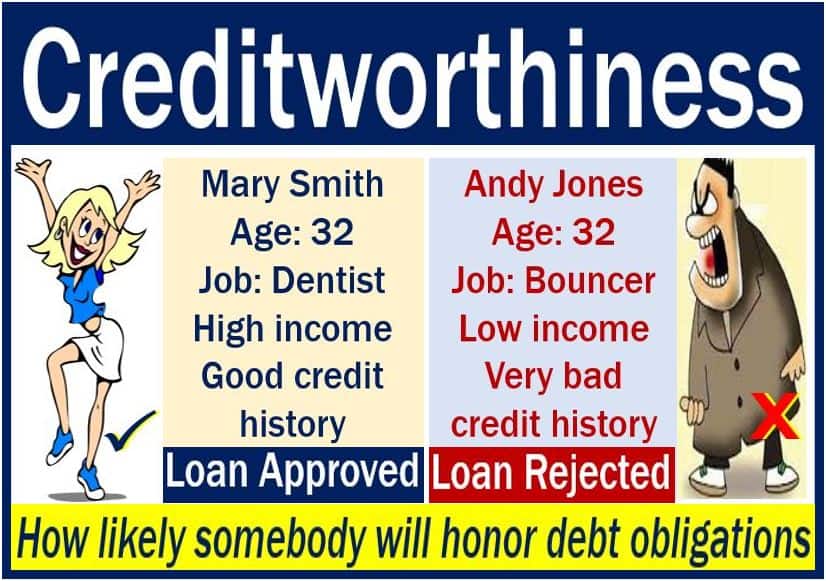

Loan Exposure: Assessing Lending Risk and Creditworthiness

Loan exposure, also referred to as ‘credit risk’ or ‘lending risk,’ represents the total risk a lender assumes when extending credit to a borrower. This metric is crucial for lenders in evaluating the potential risk associated with a loan and determining a borrower’s creditworthiness. By accurately assessing loan exposure, lenders can make informed decisions, manage risk, and maintain a healthy loan portfolio.

Calculating loan exposure typically involves estimating the potential loss a lender may incur if a borrower defaults on their loan obligations. Lenders often consider factors such as the borrower’s credit history, financial stability, collateral, and the loan’s terms and conditions. Various risk assessment methods are available, including credit scoring models, financial analysis, and stress testing.

For instance, a lender might calculate loan exposure using the following formula:

Loan Exposure = (Loan Amount * Probability of Default) – Recovery Rate

In this formula, the ‘Probability of Default’ reflects the likelihood that a borrower will fail to meet their debt obligations, while the ‘Recovery Rate‘ indicates the percentage of the loan that the lender could potentially recover in the event of a default. By incorporating these factors, lenders can better understand their loan exposure and implement appropriate risk management strategies.

Loan Outstanding: Monitoring Current Debt and Financial Obligations

Loan outstanding, or the ‘current debt‘ and ‘outstanding balance,’ signifies the amount a borrower owes to a lender at any given time. This figure is a critical component of financial planning and debt management for both individuals and businesses. By keeping track of loan outstanding, borrowers can better understand their financial obligations, create realistic budgets, and work towards reducing their debt burden.

Calculating loan outstanding typically involves determining the remaining balance on a loan after accounting for any payments made. For example, if a borrower has taken a loan of $10,000 with a 12-month repayment term and has already paid off $2,000, their loan outstanding would be $8,000.

Loan outstanding calculations can vary depending on the type of loan. For instance, amortizing loans, such as mortgages and auto loans, are gradually paid down over the loan term, with each payment consisting of both principal and interest components. In contrast, non-amortizing loans, like credit cards and lines of credit, may require only interest payments or minimum payments, resulting in a fluctuating loan outstanding balance.

Effective debt management involves regularly monitoring loan outstanding and creating a plan to reduce debt over time. Strategies for optimizing loan outstanding may include:

- Prioritizing high-interest loans first to minimize the overall interest paid.

- Making extra payments when possible to accelerate debt repayment.

- Refinancing loans to secure a lower interest rate or more favorable terms.

- Negotiating loan terms with lenders to extend the repayment period or modify payment schedules.

How to Manage Loan Exposure and Loan Outstanding: Best Practices for Lenders

Managing loan exposure and loan outstanding is crucial for lenders to maintain a healthy loan portfolio and minimize risk. By implementing effective strategies, lenders can protect their investments, ensure timely debt repayment, and promote long-term profitability. Here are some best practices for managing loan exposure and loan outstanding:

Diversification

Diversifying a loan portfolio across various industries, borrower types, and loan products can help lenders mitigate risk and avoid over-concentration in any single area. This strategy can help maintain a stable return on investment, even if individual loans underperform.

Risk Assessment and Monitoring

Regularly assessing loan exposure and monitoring borrower creditworthiness is essential for lenders. Utilizing credit scoring models, financial analysis, and stress testing can help lenders identify potential risks and adjust their lending strategies accordingly.

Proactive Debt Collection

Implementing proactive debt collection practices can help lenders minimize delinquencies and defaults. This may include setting clear payment expectations, offering payment plans, and leveraging technology to automate reminders and facilitate communication with borrowers.

Collateral Management

For secured loans, managing collateral effectively is crucial. Lenders should ensure that collateral is adequately valued, monitored, and secured to minimize the risk of loss in the event of a default.

Loan Servicing and Administration

Efficient loan servicing and administration can help lenders maintain accurate records, minimize errors, and streamline operations. Utilizing loan management software and automating processes can help lenders save time, reduce costs, and improve the borrower experience.

How to Optimize Loan Exposure and Loan Outstanding: Tips for Borrowers

Borrowers can take several steps to optimize their loan exposure and loan outstanding, promoting responsible debt management and financial planning. By implementing these strategies, borrowers can minimize their debt burden, improve their creditworthiness, and secure a more stable financial future. Here are some practical tips for borrowers:

Consistent Debt Repayment

Making timely debt payments is crucial for maintaining a healthy credit profile and minimizing loan exposure. Borrowers should prioritize debt repayment and consider setting up automatic payments to avoid missing deadlines.

Refinancing

Refinancing loans to secure lower interest rates or more favorable terms can help borrowers reduce their loan outstanding and loan exposure. Borrowers should regularly review their loan agreements and explore refinancing options when appropriate.

Negotiating Loan Terms

Borrowers should not hesitate to negotiate loan terms with their lenders. This may include requesting extended repayment periods, modified payment schedules, or reduced interest rates to help manage debt more effectively.

Budgeting and Financial Planning

Creating and adhering to a realistic budget is essential for responsible debt management. Borrowers should prioritize debt repayment, allocate funds for savings and investments, and avoid unnecessary expenses to optimize their loan exposure and loan outstanding.

Monitoring Credit Reports and Scores

Regularly reviewing credit reports and scores can help borrowers identify potential issues, correct errors, and track their progress in improving their creditworthiness. Borrowers should aim to maintain a high credit score to secure better loan terms and minimize loan exposure.

Loan Exposure vs Loan Outstanding: A Comparative Analysis

Loan exposure and loan outstanding are two critical concepts in the lending landscape, each with unique implications for lenders and borrowers. Understanding the differences and similarities between loan exposure and loan outstanding can help both parties make informed decisions and effectively manage their financial obligations.

Key Differences

Loan exposure, also known as ‘credit risk’ or ‘lending risk,’ represents the total risk a lender assumes when extending credit to a borrower. In contrast, loan outstanding signifies the current debt or balance a borrower owes to a lender. While loan exposure focuses on the lender’s risk, loan outstanding is more concerned with the borrower’s financial obligations.

Implications for Lenders

Lenders must manage loan exposure to ensure long-term profitability and maintain a healthy loan portfolio. By accurately assessing loan exposure, lenders can make informed lending decisions, allocate resources effectively, and implement appropriate risk mitigation strategies. Loan outstanding, on the other hand, helps lenders monitor borrower compliance, track debt repayment, and maintain accurate records.

Implications for Borrowers

Borrowers should be aware of their loan outstanding to effectively manage their debt, create realistic budgets, and plan for future financial needs. Understanding the lender’s loan exposure can also help borrowers negotiate better loan terms, secure lower interest rates, and demonstrate their creditworthiness.

Visual Aid

The following table provides a side-by-side comparison of loan exposure and loan outstanding, highlighting their key differences, similarities, and implications for both lenders and borrowers:

| Loan Exposure | Loan Outstanding |

|---|---|

| Total lending risk assumed by a lender | Current debt or balance owed by a borrower |

| Implications for lender profitability and risk management | Implications for borrower debt management and financial planning |

| Mitigated through diversification, risk assessment, and proactive debt collection | Managed through consistent debt repayment, refinancing, and negotiating loan terms |

Emerging Trends and Innovations in Loan Exposure and Loan Outstanding Management

The lending landscape is continuously evolving, with new technologies and methodologies shaping the way lenders manage loan exposure and borrowers handle loan outstanding. Here are some of the latest trends and innovations in loan exposure and loan outstanding management:

AI-Driven Risk Assessment

Artificial intelligence (AI) and machine learning (ML) are revolutionizing risk assessment in lending. By analyzing vast amounts of data, AI-driven models can provide lenders with more accurate credit risk assessments, enabling them to make better-informed lending decisions and manage loan exposure more effectively.

Blockchain-Based Lending Platforms

Blockchain technology offers increased transparency, security, and efficiency in lending processes. Decentralized lending platforms built on blockchain can help lenders and borrowers manage loan exposure and loan outstanding more effectively, reducing the risk of fraud and errors while streamlining transactions.

Alternative Credit Scoring Models

Traditional credit scoring models often overlook borrowers with limited credit histories or unconventional financial backgrounds. Alternative credit scoring models, which consider factors like education, employment history, and utility payments, can help lenders better assess creditworthiness and manage loan exposure when dealing with these borrowers.

Instant Loan Approval and Disbursement

Advancements in technology have led to faster loan approval and disbursement processes, allowing lenders to quickly assess loan exposure and borrowers to access funds more efficiently. This trend benefits both parties, as lenders can minimize risk by promptly adjusting loan exposure, and borrowers can receive funds when they need them most.

Data-Driven Personalization

Leveraging data analytics and AI, lenders can now offer personalized loan products and terms tailored to individual borrowers’ needs and credit profiles. This approach can help lenders better manage loan exposure by aligning lending risk with borrower creditworthiness and financial capacity.

Navigating the Complexities of Loan Exposure and Loan Outstanding: Insights and Perspectives

Understanding loan exposure and loan outstanding is crucial for both lenders and borrowers, as it impacts lending decisions, risk management, financial planning, and debt management. By staying informed about industry developments and best practices, lenders and borrowers can effectively navigate the complexities of loan exposure and loan outstanding, ensuring long-term financial success.

The Importance of Effective Debt Management

Effective debt management is vital for both lenders and borrowers. Lenders must manage loan exposure to maintain profitability and minimize risk, while borrowers must manage loan outstanding to avoid excessive debt burdens and ensure financial stability. By prioritizing debt management, lenders and borrowers can build strong, mutually beneficial relationships based on trust, transparency, and responsible lending practices.

Seeking Professional Advice

Navigating the complexities of loan exposure and loan outstanding can be challenging, especially for those without a background in finance or lending. Seeking professional advice from financial advisors, loan officers, or credit counselors can help lenders and borrowers make informed decisions, optimize their financial strategies, and avoid potential pitfalls. Professional guidance can also help lenders and borrowers stay up-to-date on industry trends, regulations, and best practices.

Staying Informed About Industry Developments

The lending landscape is constantly evolving, with new technologies, regulations, and trends shaping the way lenders manage loan exposure and borrowers handle loan outstanding. Staying informed about industry developments can help lenders and borrowers adapt to changing circumstances, capitalize on new opportunities, and mitigate potential risks. Regularly reading industry publications, attending conferences, and participating in professional networks can help lenders and borrowers stay ahead of the curve and maintain a competitive edge.

Long-Term Benefits of Effective Debt Management and Lending Practices

Effective debt management and lending practices offer numerous long-term benefits for lenders and borrowers. For lenders, responsible lending can lead to increased profitability, reduced risk, and enhanced reputation. For borrowers, responsible debt management can result in improved credit scores, reduced debt burdens, and greater financial stability. By prioritizing loan exposure and loan outstanding management, lenders and borrowers can build a solid foundation for long-term financial success.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)