Unveiling the Russell 2000: A Guide to Small-Cap Companies

The Russell 2000 index serves as a benchmark for the performance of small-cap companies in the United States. Small-cap companies are generally defined as those with relatively small market capitalizations. Investors are often drawn to these companies because of their potential for high growth. These companies may be in emerging industries or have innovative business models, offering the possibility of significant returns. Understanding the composition and dynamics of the Russell 2000 is crucial for investors interested in this segment of the market. The Russell 2000 index includes a list of stocks in the russell 2000 that represents a diverse range of smaller companies across various sectors.

The Russell 2000’s methodology involves specific criteria for inclusion, primarily based on market capitalization. While the exact range can fluctuate, it generally includes companies that fall below a certain market cap threshold. The index undergoes annual reconstitution, a process where the constituent companies are reviewed and adjusted to ensure accurate representation. This reconstitution involves adding and deleting companies based on their current market capitalization and other eligibility requirements. The annual reshuffling ensures that the index accurately reflects the current landscape of small-cap U.S. equities. Investors seeking exposure to small-cap stocks often use the Russell 2000 as a guide, monitoring the list of stocks in the russell 2000 for potential investment opportunities.

While the index offers exposure to the small-cap segment, understanding its nuances is essential. The list of stocks in the russell 2000 is not static; it evolves with market conditions and company performance. Investors should be aware of the potential for both higher growth and higher volatility associated with small-cap investments. The Russell 2000 provides a valuable tool for tracking this segment, but thorough research and due diligence are always recommended before making any investment decisions. The dynamic list of stocks in the russell 2000 reflects the ever-changing nature of the small-cap market.

Navigating the World of the Russell 2000 Constituents: A Comprehensive Overview

Understanding that access to a current list of stocks in the Russell 2000 is crucial, this article will guide you through the process of locating this information. However, it’s important to recognize that the composition of the Russell 2000 is not static. The index undergoes regular reconstitution, meaning that companies are added and removed based on their market capitalization and other eligibility criteria. Therefore, any list of stocks in the Russell 2000 represents a snapshot in time and is subject to change.

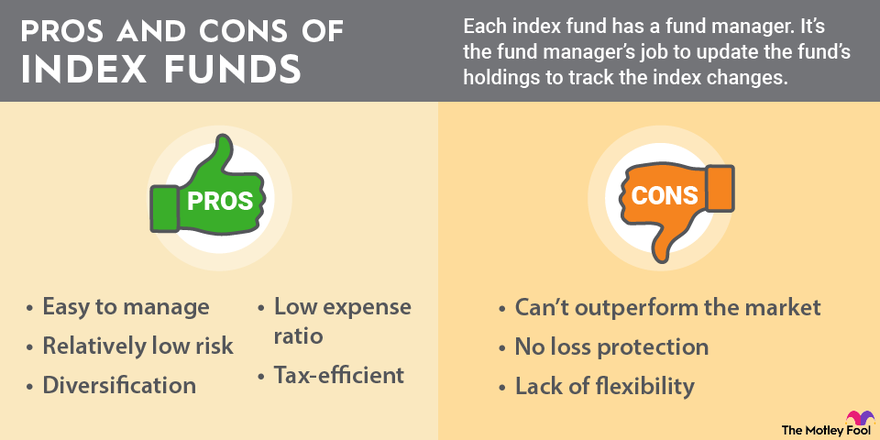

Due to the dynamic nature of the index, it is essential to rely on reputable and frequently updated resources to obtain the most accurate list of stocks in the Russell 2000. A static list quickly becomes obsolete. The FTSE Russell, the index provider, offers official data and resources, and several financial data providers and brokerage platforms also furnish regularly updated lists. This article will explore several avenues for accessing a current list of stocks in the Russell 2000, highlighting the pros and cons of each approach. Remember that regularly checking and updating the list of stocks in the Russell 2000 is vital for accurate tracking.

The following sections will delve into the specifics of how to find the list of stocks in the Russell 2000 using various methods. This includes navigating the official FTSE Russell website, leveraging brokerage platforms, and utilizing the capabilities of financial data providers. While stock screeners can sometimes be employed to identify potential Russell 2000 constituents, a degree of caution is advised due to potential inaccuracies. Understanding the ever-changing nature of the list of stocks in the Russell 2000 and employing reliable resources are key to staying informed about the small-cap market landscape. Always prioritize current data when analyzing the list of stocks in the Russell 2000.

How to Discover the Companies Within the Russell 2000 Index

Discovering the companies within the Russell 2000 index requires utilizing various resources. This section details practical methods for finding a list of stocks in the russell 2000. The index is dynamic, so the list of stocks in the russell 2000 changes. Therefore, it is critical to consult reliable and up-to-date sources.

One primary source is the official FTSE Russell website. Here, one can often find the most current list of stocks in the russell 2000. Brokerage platforms also frequently provide access to this information for their clients. Major financial data providers, such as Bloomberg Terminal, FactSet, and Refinitiv, are other valuable resources. These services offer comprehensive data, including the current list of stocks in the russell 2000, historical compositions, and analytical tools. While financial screeners can be used to identify stocks that meet the Russell 2000 criteria, caution is advised. Screeners may not always be perfectly accurate due to data delays or differing methodologies. Always cross-reference the results with a confirmed source.

Several common errors can occur when searching for the list of stocks in the russell 2000. One frequent mistake is relying on outdated information. Index constituents change due to market fluctuations, company performance, and the regular reconstitution process. Another error involves using unreliable sources that may not accurately reflect the index’s composition. To avoid these pitfalls, always verify the information with the official FTSE Russell data or a reputable financial data provider. Pay close attention to the date of the list to ensure its currency. Consistently updating the list of stocks in the russell 2000 used in your analysis is essential for informed decision-making. Keeping the list current by using reliable sources will ensure accuracy and prevent misinformed financial strategies that could be costly.

Understanding the Sectors and Industries Represented in the Index

The Russell 2000 index offers a broad representation of the U.S. small-cap market, reflecting a diverse range of sectors and industries. Examining its sector breakdown provides valuable insight into the composition of these smaller companies and how they differ from larger, more established firms found in indices like the S&P 500. The Russell 2000’s sector allocation reveals which areas of the economy are most heavily populated by small-cap businesses, which is crucial for investors seeking exposure to specific industries within this market segment. Investors often seek a list of stocks in the Russell 2000 to understand the sector allocation.

Typically, the Financials, Healthcare, and Technology sectors constitute a significant portion of the Russell 2000. The weighting of Financials often reflects the presence of numerous regional banks, insurance companies, and other financial service providers. The Healthcare sector’s substantial representation highlights the prevalence of smaller biotech firms, medical device manufacturers, and healthcare service companies within the small-cap universe. Technology, while present, may have a different composition compared to the S&P 500, potentially featuring software companies, IT service providers, and specialized technology manufacturers. Understanding these key sector weightings is essential for investors analyzing the overall risk and opportunity profile of the Russell 2000 and for those seeking a list of stocks in the Russell 2000 by sector.

The sector allocation in the Russell 2000 can differ substantially from that of the S&P 500. The S&P 500 is dominated by large-cap companies, often with a greater emphasis on established technology giants, consumer staples, and energy conglomerates. In contrast, the Russell 2000 tends to be more sensitive to the performance of domestically focused, growth-oriented sectors. Investors should consider these differences in sector exposure when allocating capital between small-cap and large-cap equities. Examining the list of stocks in the Russell 2000 allows for a better understanding of sector specific dynamics and investment opportunities within the small-cap market. Because the list of stocks in the Russell 2000 changes, it’s important to review it regularly for the most current sector weightings.

The Significance of Tracking the Performance of Small-Cap Stocks

Investors and analysts closely monitor the Russell 2000 because its performance offers valuable insights into the broader economy. Small-cap stocks, which constitute the list of stocks in the russell 2000, often act as a barometer of economic health. Their movements can reflect overall market sentiment and risk appetite. When small-cap companies thrive, it can signal confidence in economic growth and a willingness to invest in emerging or expanding businesses. Conversely, underperformance in this sector might indicate concerns about economic slowdown or increased risk aversion.

One key reason for tracking the list of stocks in the russell 2000 lies in the potential for higher growth. Small-cap companies, by their nature, have more room to expand compared to established large-cap corporations. This growth potential attracts investors seeking higher returns. However, this potential comes with increased volatility. Small-cap stocks are generally more susceptible to market fluctuations and economic uncertainties than their large-cap counterparts. Therefore, tracking the Russell 2000 helps investors gauge the balance between potential reward and risk within the small-cap segment of the market.

Analyzing the Russell 2000 also provides a window into specific sectors and industries. Because the list of stocks in the russell 2000 represents a diverse range of smaller companies, its performance can highlight emerging trends and opportunities within niche markets. Investors can utilize this information to identify promising sectors or individual companies poised for growth. Furthermore, comparing the Russell 2000’s performance against large-cap indices like the S&P 500 can reveal shifts in investor preference and highlight the relative strength or weakness of small-cap stocks in different economic cycles. Keeping a close watch in the list of stocks in the russell 2000 enables informed decision-making and a better understanding of the market dynamics at play.

Utilizing Financial Tools to Analyze Individual Russell 2000 Stocks

When evaluating companies in the list of stocks in the russell 2000, it’s crucial to employ a range of financial metrics. These metrics offer insights into a company’s financial health, profitability, and valuation. Examining these figures allows for a more informed investment decision, especially when navigating the small-cap market.

One key metric is the price-to-earnings (P/E) ratio. It indicates how much investors are willing to pay for each dollar of a company’s earnings. A high P/E ratio might suggest that a stock is overvalued, while a low P/E ratio could indicate undervaluation. Another useful metric is the price-to-book (P/B) ratio, which compares a company’s market capitalization to its book value. This ratio can help investors determine if a stock is trading at a reasonable price relative to its net asset value. Furthermore, return on equity (ROE) measures a company’s profitability relative to shareholders’ equity. A higher ROE suggests that a company is effectively using its equity to generate profits. The debt-to-equity ratio is also important, as it assesses the proportion of debt a company uses to finance its assets relative to equity. A high ratio could signal higher financial risk.

Analyzing the list of stocks in the russell 2000 through these metrics requires careful consideration of industry-specific benchmarks and prevailing market conditions. Comparing a company’s financial ratios to those of its peers within the same industry provides valuable context. For example, a technology company might typically have a higher P/E ratio than a utility company. Moreover, understanding the overall economic environment and investor sentiment is crucial for interpreting these metrics accurately. Remember that these financial ratios offer a snapshot of a company’s financial standing and should be used in conjunction with qualitative factors, such as management quality, competitive landscape, and growth opportunities, to form a comprehensive investment thesis about companies from the list of stocks in the russell 2000.

Beyond the Initial List: Keeping Abreast of Changes to the Index Composition

The composition of the Russell 2000 is not static. It undergoes periodic rebalancing to accurately reflect the small-cap market. Stocks are added and removed based on changes in their market capitalization and other eligibility criteria. This dynamic nature means that any list of stocks in the Russell 2000 is only a snapshot in time. Investors need to be aware of these changes to make informed decisions.

The Russell 2000 index typically undergoes its primary reconstitution annually in June. FTSE Russell announces provisional lists of additions and deletions in advance of the effective date. This allows market participants to prepare for the changes. The reconstitution process can lead to increased trading volume in the affected stocks. Understanding the rebalancing schedule is crucial for anyone tracking or investing in the list of stocks in the Russell 2000. Being aware of potential additions can highlight emerging small-cap companies. Conversely, deletions may signal concerns about a company’s growth prospects or financial health.

Staying informed about changes to the list of stocks in the Russell 2000 requires proactive monitoring. Subscribing to market newsletters from reputable financial news sources is a good way to receive updates on index changes. Many financial data providers also offer alerts and notifications related to index reconstitutions. Reviewing the official FTSE Russell website for announcements and press releases is also recommended. By actively tracking these changes, investors can maintain an accurate view of the small-cap landscape. This knowledge helps in making well-informed investment decisions related to the list of stocks in the Russell 2000 and the broader small-cap market. Understanding these changes will give the investor more clarity to navigate the volatility and to stay on top of the ever-changing small-cap equities.

Considerations When Investing in Small-Cap Companies: Risks and Opportunities

Investing in small-cap companies, particularly those included in the list of stocks in the Russell 2000, presents both considerable opportunities and inherent risks. The potential for higher growth is a primary attraction. Small-cap companies often possess the agility to adapt to changing market conditions and capitalize on emerging trends more quickly than their larger counterparts. This can translate into significant capital appreciation for investors. Many investors seek to add the list of stocks in the russell 2000 to their portfolio, to leverage the opportunities of this segment.

However, it’s crucial to acknowledge the heightened volatility associated with small-cap stocks. Their prices can fluctuate more dramatically than those of large-cap companies, making them susceptible to market downturns and economic uncertainties. Lower liquidity is another factor to consider. Trading volumes for small-cap stocks are generally lower, which can make it more difficult to buy or sell large positions without impacting the stock’s price. This is important to consider when building a list of stocks in the russell 2000.

Furthermore, small-cap companies may be more vulnerable to economic headwinds. They often have less access to capital and fewer resources to weather challenging economic times. It is advisable that before including any of the list of stocks in the russell 2000 in your portfolio, conduct thorough due diligence, carefully assess your own risk tolerance, and consider diversifying your investments across different asset classes. Understanding these risks and opportunities is paramount when considering an investment in the list of stocks in the Russell 2000 and the broader small-cap market.