Why a Comprehensive List of Stock Symbols Matters

Investors, traders, and financial analysts rely heavily on having access to a complete and up-to-date list of stock symbols to make informed decisions in the stock market. A reliable list of stock symbols serves as a foundation for research, analysis, and decision-making, helping to minimize risk and maximize returns. With a comprehensive list of all ticker symbols, investors can identify potential investment opportunities, track market performance, and analyze company data. This enables them to stay updated on market trends, analyze company performance, and adjust their portfolios accordingly. A list of all ticker symbols provides a solid basis for investment research, portfolio management, and market analysis, ultimately leading to more informed investment decisions. By having access to a complete list of all ticker symbols, investors can make data-driven decisions, optimize their portfolios, and achieve their investment objectives. In today’s fast-paced financial landscape, having a trustworthy list of stock symbols is essential for achieving investment goals and staying ahead of the competition. A comprehensive list of all ticker symbols is a valuable resource that can help investors navigate the complexities of the stock market and make informed decisions, ultimately leading to greater success in the stock market. Having a complete list of all ticker symbols at their disposal enables investors to make more accurate predictions, identify profitable opportunities, and avoid costly mistakes. By leveraging a comprehensive list of all ticker symbols, investors can gain a competitive edge in the market and achieve their investment goals.

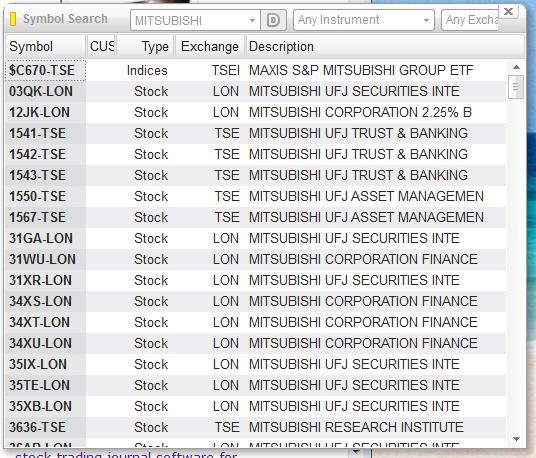

How to Find a Reliable List of Stock Symbols

Finding a trustworthy and comprehensive list of stock symbols is crucial for investors, traders, and financial analysts. With the abundance of online resources, financial databases, and stock exchange websites, it can be overwhelming to determine which sources provide accurate and reliable information. To find a reliable list of stock symbols, it’s essential to look for sources that are updated regularly, provide accurate information, and offer a comprehensive list of all ticker symbols. Some reputable sources include financial websites such as Yahoo Finance, Google Finance, and Bloomberg, as well as stock exchange websites like the New York Stock Exchange (NYSE) and NASDAQ. Additionally, financial databases like EDGAR and Quandl provide access to a vast list of stock symbols, company data, and financial information. When searching for a list of all ticker symbols, it’s vital to verify the credibility of the source and ensure that the information is up-to-date and accurate. By doing so, investors can rely on the list of stock symbols to make informed investment decisions, track market performance, and analyze company data. A reliable list of stock symbols is a valuable resource that can help investors navigate the complexities of the stock market and achieve their investment goals.

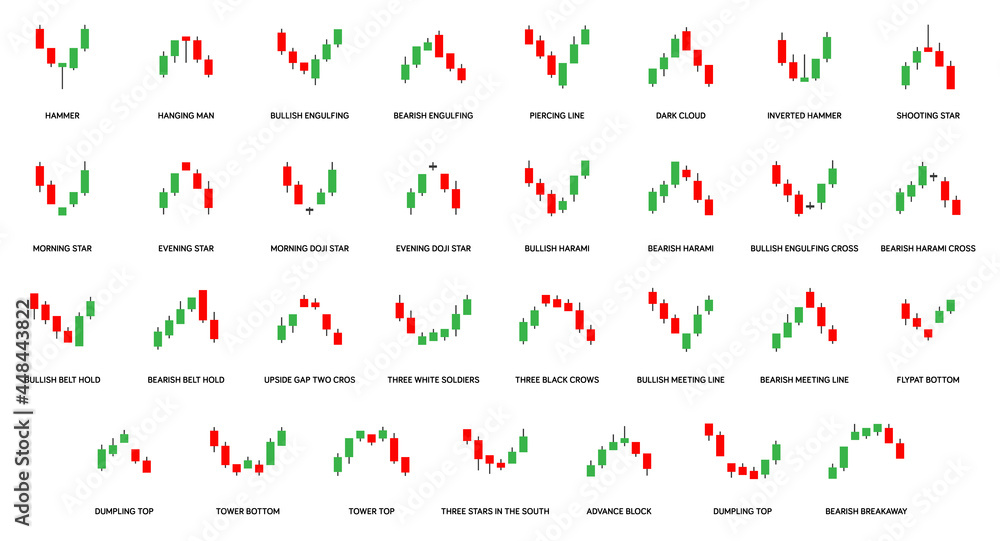

Understanding the Different Types of Stock Symbols

In the stock market, there are various types of stock symbols that serve as unique identifiers for publicly traded companies. Understanding the different types of stock symbols is essential for investors, traders, and financial analysts to navigate the market effectively. The three main types of stock symbols are NYSE (New York Stock Exchange), NASDAQ (National Association of Securities Dealers Automated Quotations), and OTC (Over-the-Counter) symbols. NYSE symbols are assigned to companies listed on the New York Stock Exchange, one of the largest stock exchanges in the world. NASDAQ symbols, on the other hand, are assigned to companies listed on the NASDAQ exchange, which is known for hosting technology and growth companies. OTC symbols are assigned to companies that are not listed on a major exchange, but rather trade on the over-the-counter market. Having a comprehensive list of all ticker symbols, including these different types, enables investors to access a vast range of investment opportunities, track market performance, and make informed investment decisions. By understanding the different types of stock symbols, investors can better navigate the stock market, identify potential investment opportunities, and achieve their investment goals.

The Benefits of Using a Stock Symbol List for Investment Research

Having access to a comprehensive list of all ticker symbols is a crucial tool for investors, traders, and financial analysts. A stock symbol list provides a wealth of information that can be used to identify trends, analyze performance, and make informed investment decisions. With a list of all ticker symbols, investors can quickly and easily research potential investment opportunities, track market performance, and stay up-to-date on company news and announcements. By using a stock symbol list, investors can also identify patterns and trends in the market, analyze the performance of specific companies or industries, and make data-driven investment decisions. Additionally, a stock symbol list can be used to screen for stocks that meet specific criteria, such as market capitalization, sector, or dividend yield, allowing investors to focus on the most promising opportunities. By leveraging the power of a stock symbol list, investors can gain a competitive edge in the market, make more informed investment decisions, and ultimately achieve their investment goals.

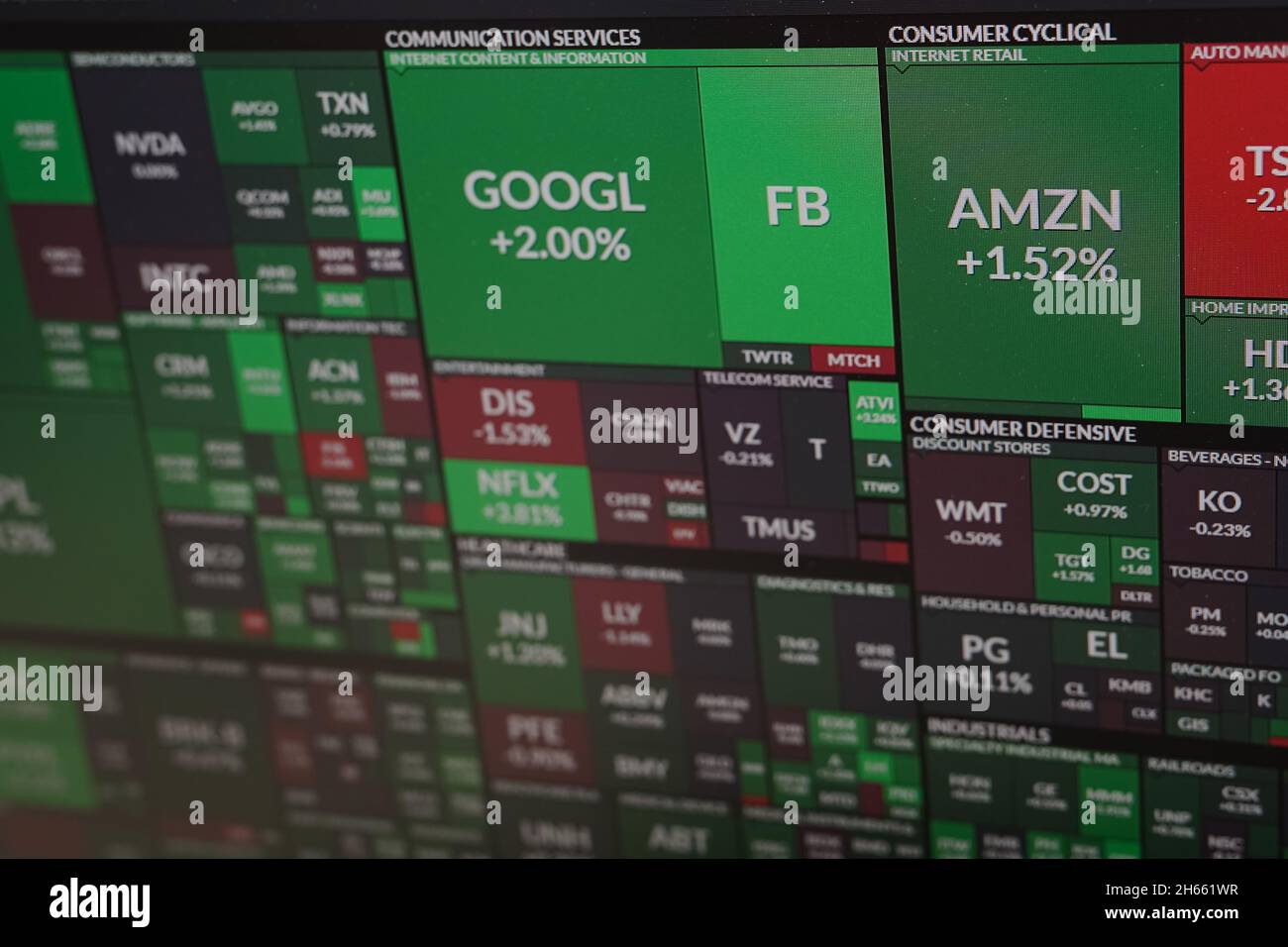

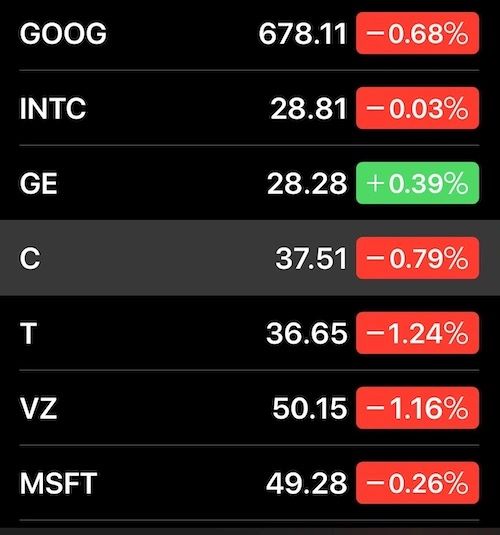

How to Use Stock Symbols to Track Market Performance

Tracking market performance is a crucial aspect of investing, and stock symbols play a vital role in this process. By using a list of all ticker symbols, investors can create a watchlist of stocks they are interested in, set up alerts for specific market events, and analyze market trends. This enables investors to stay up-to-date on market developments, identify potential investment opportunities, and make informed investment decisions. For instance, investors can use stock symbols to track the performance of specific industries or sectors, identify trends and patterns, and adjust their investment strategy accordingly. Additionally, stock symbols can be used to set up alerts for specific market events, such as earnings announcements or dividend declarations, allowing investors to react quickly to changes in the market. By leveraging the power of stock symbols, investors can gain a deeper understanding of the market, make more informed investment decisions, and ultimately achieve their investment goals.

The Role of Stock Symbols in Portfolio Management

In portfolio management, stock symbols play a crucial role in helping investors diversify their portfolio, manage risk, and optimize returns. By using a list of all ticker symbols, investors can identify potential investment opportunities, analyze the performance of specific stocks, and make informed decisions about their portfolio. For instance, investors can use stock symbols to screen for stocks that meet specific criteria, such as market capitalization, sector, or dividend yield, and create a diversified portfolio that minimizes risk and maximizes returns. Additionally, stock symbols can be used to track the performance of specific stocks, identify trends and patterns, and adjust the portfolio accordingly. By leveraging the power of stock symbols, investors can create a portfolio that is tailored to their investment goals and risk tolerance, and ultimately achieve long-term success in the stock market.

Common Mistakes to Avoid When Working with Stock Symbols

When working with stock symbols, it’s essential to avoid common mistakes that can lead to inaccurate research, poor investment decisions, and financial losses. One of the most critical mistakes to avoid is incorrect symbol usage, which can occur when investors confuse similar symbols or use outdated information. For instance, using an incorrect symbol can lead to analyzing the wrong stock, resulting in misguided investment decisions. Another mistake to avoid is relying on outdated information, which can occur when investors fail to update their list of all ticker symbols regularly. This can lead to missing out on new investment opportunities or failing to adjust to changes in the market. Additionally, inadequate research is a common mistake that can occur when investors fail to thoroughly analyze a stock symbol before making an investment decision. By avoiding these common mistakes, investors can ensure that they are using their stock symbol list effectively and making informed investment decisions.

Maximizing the Potential of Your Stock Symbol List

To maximize the potential of a list of all ticker symbols, investors should use it to identify opportunities, minimize risk, and achieve their investment goals. One effective strategy is to use the list to screen for stocks that meet specific criteria, such as market capitalization, sector, or dividend yield. This can help investors identify potential investment opportunities that align with their investment goals and risk tolerance. Additionally, investors can use their stock symbol list to track the performance of specific stocks, identify trends and patterns, and adjust their portfolio accordingly. By leveraging the power of a comprehensive list of stock symbols, investors can make informed investment decisions, minimize risk, and optimize returns. Furthermore, investors can use their list to stay up-to-date with market developments, identify emerging trends, and capitalize on new investment opportunities. By maximizing the potential of a stock symbol list, investors can gain a competitive edge in the stock market and achieve long-term success.