Understanding the Dynamics of a Benchmark Rate Swap

Interest rate swaps play a vital role in managing interest rate risk. They allow parties to exchange interest rate obligations. A benchmark rate, traditionally LIBOR, serves as the reference for these exchanges. The 5 year libor swap rate was a common benchmark. It influenced many financial products. The significance of a benchmark rate in the swap market cannot be overstated. It provides a standardized measure for calculating interest payments.

However, the financial landscape is evolving. The transition away from LIBOR is underway. Alternative benchmark rates are gaining prominence. SOFR, or Secured Overnight Financing Rate, is one such alternative. This shift impacts the dynamics of interest rate swaps. Participants must adapt to the new benchmarks. Understanding these changes is crucial for effective risk management. The 5 year libor swap rate is transitioning to SOFR. This change requires careful consideration.

The libor swap rate 5 year was a key indicator. It reflected market expectations. Now, SOFR-based swaps are becoming more common. These swaps offer similar functionality. They allow entities to manage interest rate exposure. The move to SOFR aims to enhance market stability. It also increases transparency. The 5 year libor swap rate’s legacy continues. It informs the development of new benchmarks. These benchmarks include SOFR. The adoption of SOFR is reshaping the interest rate swap market. This change impacts various financial instruments. The libor swap rate 5 year is now part of financial history. It is being replaced by more robust alternatives.

Decoding the Mechanics: How a Rate Swap Works

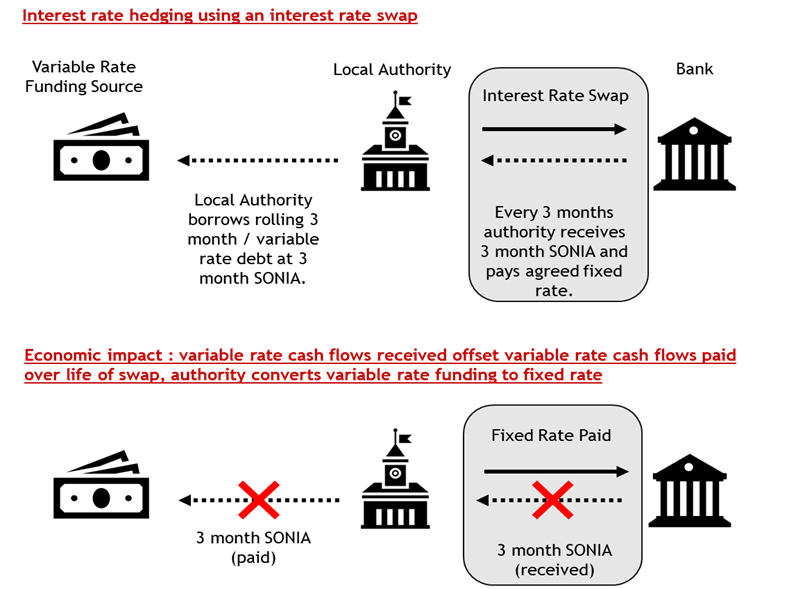

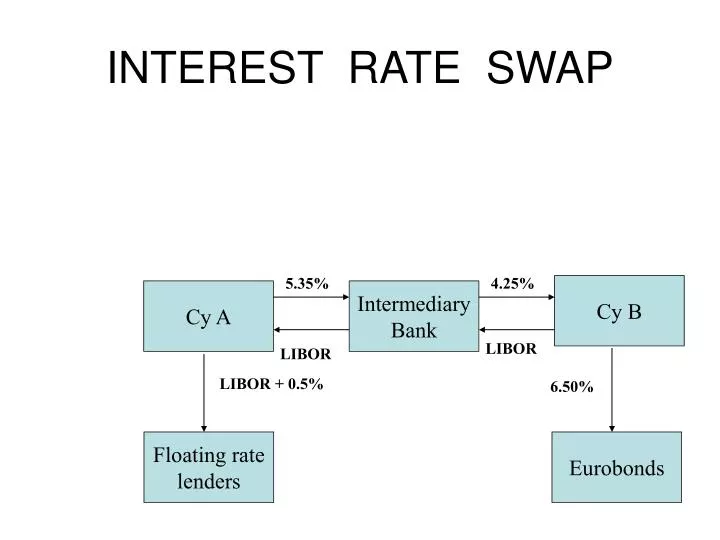

An interest rate swap represents a contract between two parties to exchange interest rate obligations. It’s a derivative instrument primarily used to manage interest rate risk or speculate on interest rate movements. Think of it as an agreement where one party pays a fixed interest rate, while the other pays a floating rate, both calculated on the same notional principal amount. The principal itself is not exchanged; it’s simply used to calculate the interest payments. A common example involves swapping a fixed rate for a floating rate benchmarked to a rate like the now-transitioning LIBOR. As financial markets evolve, alternative benchmarks are emerging and their associated swap rates are also becoming more prevalent. The 5 year tenor is a very liquid and popular tenor to trade for the libor swap rate 5 year.

Imagine Company A has a loan with a floating interest rate tied to a benchmark. They’re concerned that interest rates will rise. To hedge this risk, they enter into an interest rate swap with Company B. Company A agrees to pay Company B a fixed interest rate (e.g., 3%) on a notional principal of, say, $10 million. In return, Company B agrees to pay Company A a floating interest rate (e.g., benchmark rate plus a spread) on the same $10 million. If the benchmark rate increases, Company A receives more from Company B, offsetting the increased interest expense on their floating-rate loan. This exemplifies how a libor swap rate 5 year, or any other tenor swap, operates to manage interest rate exposure. Conversely, Company B benefits if interest rates fall.

The periodic payments are typically made quarterly or semi-annually. Only the net difference between the fixed and floating interest amounts is exchanged. This simplifies the process. For example, if the fixed rate payment is $300,000 and the floating rate payment is $250,000, the party owing the higher amount (in this case the fixed rate payer) pays the difference of $50,000. The 5 year tenor is used very often when companies are modeling cashflows and need to hedge them. This process continues until the swap’s maturity date. This mechanism allows entities to effectively convert a floating rate liability into a fixed rate liability, or vice versa, providing greater certainty in their cash flow management. It’s important to remember that the risk lies in the fluctuation of interest rates and the creditworthiness of the counterparty, particularly with products like the libor swap rate 5 year where the agreement spans several years.

Factors Influencing Rate Swap Values

The valuation of an interest rate swap, including a libor swap rate 5 year, is influenced by a constellation of interconnected factors. Prevailing interest rate levels form the bedrock upon which swap pricing is built. When interest rates rise across the board, the value of swaps where one receives fixed payments generally increases, and vice versa. The shape of the yield curve, reflecting the relationship between interest rates and maturities, also plays a pivotal role. A steepening yield curve, where long-term rates are significantly higher than short-term rates, can impact the attractiveness of longer-dated swaps like a libor swap rate 5 year.

Credit spreads, representing the difference in yield between corporate bonds and risk-free government bonds, further affect swap values. Wider credit spreads often indicate increased perceived risk in the market, potentially influencing the pricing of swaps, especially those involving counterparties with lower credit ratings. Moreover, expectations about future interest rate movements are paramount. If market participants anticipate that interest rates will rise substantially in the future, this expectation will be reflected in the current pricing of interest rate swaps, including the libor swap rate 5 year. Supply and demand for libor swap rate 5 year also plays an important role in determining the price, more demand means a higher price.

These factors do not operate in isolation; rather, they interact dynamically to shape swap pricing. For example, a steepening yield curve coupled with rising interest rate expectations could significantly increase the value of a libor swap rate 5 year where one pays floating and receives fixed. Similarly, widening credit spreads could offset some of the positive impact of rising interest rates. Understanding these intricate relationships is crucial for anyone involved in trading or utilizing interest rate swaps for risk management purposes. The discontinuation of LIBOR as a benchmark has led to a transition towards alternative rates, which also influences the pricing dynamics of interest rate swaps across various tenors.

How to Utilize Rate Swaps for Interest Rate Management

Interest rate swaps offer versatile tools for businesses and investors seeking to manage interest rate exposure. Companies routinely employ these swaps to hedge against the financial impact of fluctuating interest rates on both debt and investment portfolios. A common application involves converting variable-rate debt into a fixed rate, thereby providing certainty in budgeting and financial planning. For instance, a company with a floating-rate loan tied to a benchmark like the overnight libor swap rate 5 year might enter into a swap agreement to pay a fixed rate while receiving floating-rate payments equivalent to their loan’s interest obligations. This effectively transforms their variable-rate debt into fixed-rate debt. Another scenario includes hedging investment portfolios, protecting them from decreases in interest rates which would reduce earnings.

Consider a manufacturing firm anticipating rising interest rates. To mitigate this risk, the company can enter a receive-fixed, pay-floating libor swap rate 5 year. If interest rates rise as expected, the floating-rate payments received from the swap will increase, offsetting the higher interest expenses on its existing debt or reducing the cost to the company for future loans. Conversely, investors holding fixed-income assets, who are concerned about falling rates, might use a pay-fixed, receive-floating swap. If rates decrease, the floating-rate payments they receive will decline, but this loss will be compensated by the increased value of their fixed-income holdings. The choice of a specific tenor, such as a 5-year libor swap rate 5 year, depends on the duration of the underlying assets or liabilities being hedged, aligning the swap’s maturity with the exposure’s time horizon. Interest rate swaps are frequently implemented to help companies protect their margins and maintain profitability in uncertain economic environments.

Beyond simple hedging, rate swaps can also facilitate speculation and arbitrage. While less common for risk-averse entities, some participants might use swaps to profit from anticipated interest rate movements. For example, if a trader anticipates a decrease in the libor swap rate 5 year, they may enter into a receive-fixed, pay-floating swap, hoping to profit from the declining floating rate. However, such strategies involve significant risk, as interest rate predictions are not always accurate, and adverse movements can result in substantial losses. Whether used for hedging, speculation, or arbitrage, a thorough understanding of swap mechanics, market dynamics, and risk management is crucial for successful implementation. Furthermore, the careful selection of the appropriate swap tenor, like the libor swap rate 5 year, plays a vital role in aligning the swap’s characteristics with the specific needs and objectives of the user. The strategic use of libor swap rate 5 year allows for more accurate financial forecasts.

The Role of Credit Risk in Rate Swaps

Interest rate swaps, while offering effective tools for managing interest rate risk, inherently involve credit risk. This risk, also known as counterparty risk, stems from the possibility that the other party in the swap agreement might default on its obligations. For instance, imagine a company enters a 5-year libor swap rate agreement. If its counterparty fails to make its scheduled payments, the company faces a financial loss. The magnitude of this loss depends on various factors, including the remaining life of the swap and prevailing interest rates. Mitigating counterparty risk is crucial, and several mechanisms help achieve this goal. Understanding this risk is vital, especially when considering a libor swap rate 5 year contract, because longer-term swaps naturally expose parties to greater credit risk.

One primary method of mitigating credit risk involves collateralization. This means both parties post collateral, usually cash or high-quality securities, as security for their obligations. The amount of collateral required fluctuates with the value of the swap, ensuring that sufficient funds are always available to cover potential losses in case of default. Netting agreements also play a significant role. These agreements allow parties to offset their obligations under multiple swaps, reducing the net exposure to any single counterparty. Instead of managing numerous individual exposures, netting simplifies the process and reduces the overall risk. This is particularly useful for institutions involved in numerous interest rate swaps, possibly including those based on libor swap rate 5 year arrangements. Effective netting significantly diminishes the impact of a single counterparty default.

Central counterparties (CCPs) further enhance risk mitigation in the interest rate swap market. CCPs act as intermediaries, standing between the two parties in a swap agreement. They provide clearing and settlement services, reducing counterparty risk by becoming the guarantor for both sides of the trade. This central clearing significantly minimizes systemic risk, preventing a single default from triggering a cascade of failures across the market. The use of CCPs, combined with collateralization and netting agreements, enhances the stability and reliability of the interest rate swap market, making it a safer environment for managing interest rate exposures even with products like a libor swap rate 5 year.

Comparing Different Interest Rate Swap Tenors

Interest rate swaps come in various tenors, each catering to specific risk management needs. Understanding the nuances between short-term, medium-term, and long-term swaps is crucial for effective financial planning. The choice of tenor significantly impacts the swap’s sensitivity to interest rate fluctuations and its overall effectiveness as a hedging tool. Specifically, the 5-year tenor occupies a unique position in the interest rate swap market, balancing responsiveness to market changes with a reasonable time horizon for strategic planning. The selection depends on aligning the swap’s maturity with the underlying asset or liability being hedged, as well as the anticipated duration of the interest rate risk.

Short-term interest rate swaps, typically with maturities of less than two years, are often used for tactical adjustments to interest rate exposure or for hedging short-term floating rate debt. Long-term swaps, extending beyond ten years, are favored for managing long-dated liabilities, such as pension obligations or infrastructure projects. The 5-year tenor, representing a mid-term horizon, serves as a versatile tool for businesses seeking to manage interest rate risk associated with medium-term debt or investments. The popularity of the 5 year tenor also makes the 5 year libor swap rate a liquid product, making it easier to enter and exit positions. A 5 year libor swap rate is often used as a benchmark rate or as a hedging tool by financial institutions and corporations. The decision to utilize a 5-year interest rate swap involves carefully assessing the duration of the exposure being hedged and the company’s outlook on interest rate movements over the medium term. The 5 year libor swap rate is a balance between short term volatility and long-term interest rate projections.

The unique characteristics of the 5-year tenor make it a frequently traded and closely watched segment of the interest rate swap market. Its liquidity and relative stability compared to shorter-term swaps make it an attractive option for a wide range of market participants. For example, a company financing a 5-year capital project might use a 5-year interest rate swap to convert a floating rate loan into a fixed rate, thereby locking in their borrowing costs and mitigating the risk of rising interest rates. Similarly, an investor holding a portfolio of 5-year bonds could use a 5 year libor swap rate to hedge against potential declines in bond values due to rising interest rates. Understanding the specific features and applications of the 5-year tenor is essential for navigating the complexities of the interest rate swap market and effectively managing interest rate risk. The 5 year libor swap rate allows institutions to mitigate uncertainty.

Analyzing Historical Rate Swap Trends

Historical data related to interest rate swaps offers valuable insights into market behavior. Examination of past trends helps to illuminate the dynamics of these financial instruments. Studying historical patterns can reveal how interest rate swaps respond to various economic conditions. This understanding is invaluable for assessing current market conditions. It also helps in identifying potential opportunities and risks associated with these products. Analyzing historical data does not guarantee future success. It provides a framework for making more informed decisions. Market participants can gain a deeper appreciation for the factors that influence swap valuations. The fluctuations in the 5 year libor swap rate 5 year provide critical insights. These insights inform strategies in the present. Examining how different economic indicators correlate with libor swap rate 5 year movements allows for better risk assessment. This is essential for effective interest rate risk management.

A comprehensive review of historical interest rate swap data can offer a broader perspective. This perspective includes understanding the impact of events on swap pricing. It is important to recognize that past performance does not dictate future outcomes. However, it is a valuable tool for enhancing comprehension of market dynamics. The 5 year libor swap rate 5 year, in particular, is a focal point for many market participants. This is due to its relevance as a benchmark for medium-term interest rate exposures. Analyzing historical volatility in the 5 year libor swap rate 5 year can inform decisions about hedging strategies. Additionally, understanding how regulatory changes have influenced the market for libor swap rate 5 year provides crucial context. This context is vital for navigating the current landscape and anticipating future shifts. The 5 year libor swap rate 5 year history serves as a crucial resource.

By investigating past trends, market participants can develop a more nuanced understanding of potential opportunities. They can also understand the risks associated with interest rate swaps. This involves scrutinizing how various factors, such as changes in monetary policy and geopolitical events, have historically affected swap rates. Moreover, studying the historical relationship between different swap tenors helps in assessing the relative value of different points on the yield curve. Remember that the usefulness of historical data depends on the depth and breadth of the analysis conducted. Examining the past movements of the 5 year libor swap rate 5 year supports informed risk management. This also allows for the strategic employment of these products in different market environments. Historical analysis of the 5 year libor swap rate 5 year remains a cornerstone of effective decision-making in the world of interest rate swaps.

Potential Risks of Rate Swaps

Interest rate swaps, including the popular 5-year tenor often used in the context of a libor swap rate 5 year, present several potential risks that participants should carefully consider. Market risk, primarily stemming from fluctuations in interest rates, is a significant concern. Changes in prevailing interest rates can adversely affect the value of the swap, leading to potential losses for one party. For example, if a company has entered into a swap to pay a fixed rate and receive a floating rate, and interest rates fall, the floating rate payments received will decrease, potentially making the swap less beneficial or even causing a loss. Understanding the dynamics of the libor swap rate 5 year and its sensitivity to interest rate movements is crucial for effective risk management.

Credit risk, also known as counterparty risk, is another critical factor. This arises from the possibility that the other party to the swap may default on its obligations. The risk is that one party will be unable to make the agreed-upon payments. Credit risk is more pronounced in over-the-counter (OTC) swaps compared to those cleared through central counterparties (CCPs), which provide a guarantee of performance. Liquidity risk can also be a concern, especially for less actively traded swap tenors. If a party needs to exit a swap position before maturity, it may be difficult to find a willing counterparty, potentially resulting in unfavorable pricing. Even a standard instrument like a libor swap rate 5 year can experience liquidity constraints under certain market conditions.

Operational risk, while often overlooked, can also impact rate swap transactions. This encompasses errors in documentation, settlement, or valuation. Proper internal controls and reconciliation processes are necessary to mitigate operational risk. Furthermore, regulatory changes can introduce uncertainty and create new challenges for participants in the interest rate swap market. Careful monitoring of market dynamics, including those influencing the libor swap rate 5 year, is vital for informed decision-making and effective risk management. To manage these risks effectively, businesses and investors use various techniques such as collateralization, netting agreements, and stress testing scenarios, to analyze the potential impact of adverse market movements on their swap positions. Furthermore, selecting reputable counterparties with strong credit ratings is a prudent approach to reduce credit risk exposure associated with the libor swap rate 5 year.