Understanding the Levered Cost of Equity

The levered cost of equity represents the return a company must offer equity investors to compensate them for the risk associated with its financial leverage. This leverage is the result of the company’s debt-to-equity ratio, meaning the proportion of debt used to finance its assets. Accurate calculation is crucial for several reasons. Investors utilize it to assess the risk-adjusted return of an investment. Businesses need it for capital budgeting decisions, determining the cost of new projects, and overall financial planning. A company’s capital structure, specifically its mix of debt and equity, directly impacts the levered cost of equity. High levels of debt increase financial risk, thereby increasing the cost of equity. Understanding this relationship is vital for effective financial management and investment decisions. A key comparison point is the unlevered cost of equity, which represents the cost of equity without considering the effects of debt. This provides a benchmark against which to compare the levered cost, offering a clearer picture of the impact of financial leverage. Using a levered cost of equity calculator can streamline this process.

The levered cost of equity is distinct from the unlevered cost of equity. The unlevered cost reflects the inherent risk of the business itself, irrespective of its financing choices. Conversely, the levered cost incorporates the added risk stemming from debt financing. This added risk is due to the fixed obligations associated with debt repayment. Failing to meet these obligations can lead to financial distress or even bankruptcy. Therefore, equity investors demand a higher return to compensate for this increased risk. This difference highlights the importance of considering a company’s capital structure when assessing its cost of equity. Investors and businesses alike need to understand both the levered and unlevered costs for a comprehensive financial analysis. A levered cost of equity calculator simplifies the calculations and makes the process more efficient.

Understanding the levered cost of equity is essential for making sound financial decisions. It provides insights into a company’s risk profile and its cost of capital. Accurate calculation relies on using a levered cost of equity calculator or carefully applying the relevant formula, considering all factors, and employing accurate data. A levered cost of equity calculator can streamline this process, ensuring efficient and accurate results. The levered cost of equity, when correctly calculated, serves as a valuable tool in capital budgeting, investment analysis, and overall business valuation, enabling informed strategic choices. However, it’s crucial to remember that this calculation should be used in conjunction with other financial metrics, offering a holistic view instead of relying solely on this single factor. A thorough analysis considers a wider range of variables for a more complete financial assessment.

Factors Influencing Levered Cost of Equity

Several key factors significantly influence the levered cost of equity. Understanding these factors is crucial for accurate calculation and insightful interpretation. The risk-free rate serves as the foundation, representing the return on a virtually risk-free investment like a government bond. A higher risk-free rate increases the levered cost of equity, reflecting a higher overall cost of capital. The market risk premium, representing the excess return investors demand for taking on market risk, also plays a vital role. A higher market risk premium leads to a higher levered cost of equity, as investors require greater compensation for bearing additional risk. Beta, a measure of a company’s systematic risk relative to the overall market, is another critical factor. A higher beta signifies greater volatility and thus a higher levered cost of equity. Companies with higher betas face higher costs of equity. The company’s capital structure, specifically its debt-to-equity ratio, influences the levered cost of equity. A higher debt-to-equity ratio generally increases financial risk, leading to a higher levered cost of equity. Using a levered cost of equity calculator can simplify the process of incorporating these factors.

The accuracy of the levered cost of equity calculation heavily relies on the precision of the input data. Reliable data sources are essential for obtaining accurate risk-free rates, market risk premiums, and betas. Financial statements provide information on the company’s debt-to-equity ratio. Financial databases and market data providers offer reliable figures for risk-free rates and market risk premiums. Inconsistent or inaccurate data can significantly distort the levered cost of equity, leading to flawed financial decisions. Utilizing a reputable levered cost of equity calculator can help mitigate some data-related errors by employing established formulas and data sources. Proper selection and validation of input data are crucial steps for any accurate calculation. Investors and businesses need to carefully consider each variable and its impact on the final result. A comprehensive understanding of the factors is essential for using a levered cost of equity calculator effectively.

Moreover, the choice of the appropriate risk-free rate deserves careful consideration. Different maturities and government bonds may yield varying risk-free rates. The selection should align with the investment’s time horizon. Similarly, the beta estimation method can influence the calculation. Different methods, such as the capital asset pricing model (CAPM), can produce slightly different results. A levered cost of equity calculator often employs a standard beta estimation method, but understanding the underlying assumptions is crucial. The debt-to-equity ratio should reflect the company’s current capital structure. Changes in the capital structure will necessitate recalculating the levered cost of equity. Using a levered cost of equity calculator allows for easy recalculation when the inputs change. Ultimately, employing a robust and reliable levered cost of equity calculator, coupled with careful data selection, ensures a more precise and informative result for strategic decision-making.

The Formula for Calculating Levered Cost of Equity

The levered cost of equity represents the return a company needs to earn on its equity investments to satisfy its equity holders, considering the impact of its debt financing. It reflects the higher risk associated with equity investments in leveraged companies. Several models can be used to calculate this, but a common approach utilizes the Modigliani-Miller theorem with adjustments for financial leverage. This theorem establishes a relationship between a company’s cost of equity and its capital structure. A simplified formula is: Re = Ru + (Ru – Rd) * (D/E) * (1 – Tc), where Re is the levered cost of equity, Ru is the unlevered cost of equity (cost of equity if the company had no debt), Rd is the cost of debt, D/E is the debt-to-equity ratio, and Tc is the corporate tax rate. Understanding each component is crucial for accurate calculation, and obtaining these inputs from financial statements or market data is essential. A levered cost of equity calculator can simplify this process considerably.

Let’s break down the formula. The unlevered cost of equity (Ru) represents the cost of equity if the firm were entirely equity-financed. It’s often calculated using the Capital Asset Pricing Model (CAPM): Ru = Rf + βu * (Rm – Rf), where Rf is the risk-free rate, βu is the unlevered beta (measuring systematic risk without the effect of leverage), and Rm is the market risk premium. The cost of debt (Rd) reflects the interest rate a company pays on its debt. The debt-to-equity ratio (D/E) illustrates the proportion of debt to equity in a company’s capital structure. The corporate tax rate (Tc) accounts for the tax shield benefits of debt. Finding accurate data for each variable is crucial. A financial statement will provide data for the debt-to-equity ratio and often the cost of debt. Market data sources, like those provided by financial information companies, will offer information on beta and risk-free rates. Consider using a reliable levered cost of equity calculator to streamline this process. Using a levered cost of equity calculator allows for efficient calculations and minimizes the chance of calculation errors.

For example, consider a company with an unlevered cost of equity (Ru) of 10%, a cost of debt (Rd) of 5%, a debt-to-equity ratio (D/E) of 0.5, and a corporate tax rate (Tc) of 25%. Using the formula, the levered cost of equity (Re) would be: Re = 0.10 + (0.10 – 0.05) * 0.5 * (1 – 0.25) = 11.875%. This simple example demonstrates the impact of financial leverage on the cost of equity. A higher debt-to-equity ratio leads to a higher levered cost of equity because of the increased financial risk. Remember, this calculation is just one component of a broader financial analysis. Using a levered cost of equity calculator alongside other valuation metrics provides a more comprehensive understanding of a company’s financial health. Utilizing a levered cost of equity calculator ensures efficient and accurate results, while minimizing the potential for manual calculation errors. Moreover, understanding how to interpret the output from a levered cost of equity calculator is equally important for informed decision-making.

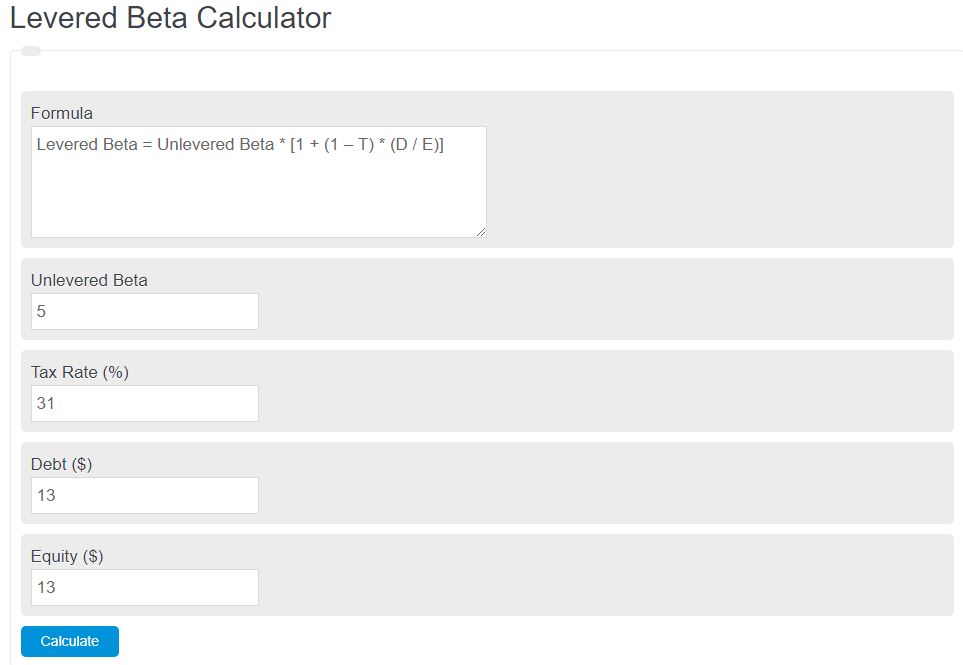

How to Use a Levered Cost of Equity Calculator

A levered cost of equity calculator simplifies the complex calculations involved in determining a company’s cost of equity, considering its debt. Many free online calculators are available. To use a levered cost of equity calculator effectively, begin by identifying a reputable tool. Inputting the correct data is critical for accurate results. The calculator will typically require the risk-free rate of return (often based on government bond yields), the market risk premium (the expected return on the market minus the risk-free rate), the company’s beta (a measure of its volatility relative to the market), and its debt-to-equity ratio. Ensure you use reliable sources for each piece of data; financial statements and market data providers are excellent resources.

Once you’ve entered all the necessary data into the levered cost of equity calculator, review your inputs to verify accuracy. Many calculators offer a preview or summary of the data entered before final calculation. The output will be the levered cost of equity, expressed as a percentage. This represents the minimum return a company needs to earn on its equity investments to satisfy its investors, given its existing debt load. Understanding how each input impacts the final result is vital. For instance, a higher beta indicates higher risk and thus a higher levered cost of equity. Similarly, a higher debt-to-equity ratio increases financial risk and therefore increases the levered cost of equity. Utilizing a levered cost of equity calculator efficiently ensures that you understand each variable’s influence on the final calculation. Remember to always cross-check your results with other sources when possible.

Different levered cost of equity calculators may present the data in slightly different formats or offer additional features. Some might provide sensitivity analysis, allowing users to see how changes in the input variables affect the output. Others might incorporate more sophisticated models or adjustments. However, the core principle remains the same: accurate input data leads to a reliable levered cost of equity calculation. The levered cost of equity calculator is a powerful tool, but it’s essential to remember that it is just one component of a broader financial analysis. Interpret the output within the context of other financial metrics and industry benchmarks for a comprehensive understanding of the company’s financial health and investment potential. The levered cost of equity calculator offers a simplified approach; however, always remember that a thorough understanding of the underlying financial principles is key to effective interpretation and utilization of its results.

Comparing Different Levered Cost of Equity Calculators

Several levered cost of equity calculators are available online. A comparative analysis helps users choose the best tool for their needs. Some calculators offer a simple, straightforward approach, focusing solely on the core calculation. Others incorporate additional features, such as sensitivity analysis or the ability to adjust various input parameters. The choice depends on the user’s level of expertise and the complexity of the analysis required. Consider factors like ease of use and data input requirements. A user-friendly interface simplifies the calculation process. Clear instructions minimize confusion and errors. The availability of different input options increases the calculator’s versatility. Some advanced levered cost of equity calculators offer visualizations of the results, making them easier to interpret. Reliable data sources are critical. Calculators should clearly identify their data sources, which is vital for ensuring calculation accuracy. The use of up-to-date market data is also essential for providing relevant results. Accurate estimations are crucial for the levered cost of equity calculation. Therefore, users should compare the levered cost of equity calculator’s methodology with published academic research. The most dependable calculators will explicitly state their underlying methodology.

When selecting a levered cost of equity calculator, one should prioritize accuracy and transparency. Understanding the limitations of each calculator is equally crucial. For instance, some calculators may rely on simplified assumptions regarding the company’s capital structure or market conditions. Others may have limited capabilities for handling complex financial instruments or specialized scenarios. A thorough review of a levered cost of equity calculator’s documentation is essential. This review will reveal the tool’s capabilities and limitations. Users should also examine the calculator’s support system and available resources. Reliable calculators often include comprehensive documentation, frequently asked questions (FAQs), and contact information for technical assistance. The availability of these support options is valuable when users encounter problems or need clarification. Selecting a reputable levered cost of equity calculator can significantly improve the accuracy and efficiency of financial analysis. Thorough research and careful consideration of various factors will ensure the selection of a tool suited to individual needs.

Ultimately, the best levered cost of equity calculator will depend on individual preferences and specific needs. Users should weigh the benefits and drawbacks of different calculators. They should select a tool that meets their requirements for accuracy, user-friendliness, and support. By carefully comparing several options, users can find a levered cost of equity calculator that provides accurate and reliable results. Remember that the output of any levered cost of equity calculator should be considered within a broader context. It is one factor among many when making investment or financial decisions. A thorough financial analysis considers multiple aspects before making final investment decisions. The levered cost of equity calculator should only be considered one tool in a larger analysis process.

Interpreting the Results and Making Informed Decisions

The calculated levered cost of equity represents the minimum return a company must earn on its equity investments to satisfy its investors, considering its financial leverage. A high levered cost of equity suggests higher risk and potentially lower profitability. Investors might demand a higher return to compensate for the increased risk. Conversely, a low levered cost of equity indicates lower risk and potentially higher profitability, attracting investors seeking less volatile returns. Understanding this metric is crucial for effective financial analysis and decision-making. Using a levered cost of equity calculator can streamline this process.

Businesses utilize the levered cost of equity in various strategic decisions. In capital budgeting, it serves as a crucial discount rate for evaluating potential projects. Only projects with expected returns exceeding the levered cost of equity should be undertaken. Investment analysts use it to assess a company’s intrinsic value. A higher levered cost of equity can lead to a lower valuation. Accurate calculation, often aided by a levered cost of equity calculator, is vital for sound investment decisions. This metric helps businesses optimize their capital structure, balancing debt and equity to minimize the overall cost of capital.

For investors, the levered cost of equity provides insights into a company’s risk profile and potential for future growth. A higher levered cost of equity might signal a riskier investment, potentially requiring a higher return. Conversely, a lower cost might suggest a relatively safer investment, with a lower potential return. A levered cost of equity calculator simplifies this assessment, allowing investors to quickly compare investment opportunities. Remember, however, the levered cost of equity is just one piece of the puzzle. Investors should consider other factors, such as financial statements and industry trends, before making investment decisions. Careful analysis using resources such as a levered cost of equity calculator helps to inform those decisions.

Addressing Common Challenges in Levered Cost of Equity Calculation

Accurately calculating the levered cost of equity presents several potential challenges. Data availability is a primary concern. Reliable and up-to-date market data, such as the risk-free rate and beta, are crucial for accurate results. These figures can be difficult to obtain, especially for smaller, less-liquid companies. Using outdated or inaccurate data significantly impacts the levered cost of equity calculation and subsequent financial decisions. A levered cost of equity calculator can help streamline the process, but the accuracy of the output depends entirely on the quality of the inputs. Therefore, careful sourcing of reliable data is paramount. A thorough understanding of financial statements is also vital to obtain the correct data. For instance, determining the appropriate debt-to-equity ratio requires careful scrutiny of a company’s balance sheet.

Another significant challenge involves beta estimation. Beta measures a company’s systematic risk. Different methods exist for calculating beta, and the choice of method affects the final result. Moreover, betas are often based on historical data, which may not accurately reflect future volatility. Variations in beta calculations can lead to discrepancies in the levered cost of equity. Using a levered cost of equity calculator can simplify the calculation, but the user must understand the limitations of the chosen beta. Consider using multiple beta estimation methods and comparing results to mitigate the impact of methodological uncertainties. This will also assist in identifying a more accurate range for the levered cost of equity. Furthermore, selecting an appropriate risk-free rate presents another challenge. The risk-free rate typically represents the return on a virtually risk-free investment, often a government bond. However, the choice of government bond (e.g., short-term vs. long-term) influences the final calculation. Therefore, careful consideration must be given to choosing the most relevant risk-free rate that accurately reflects the investment horizon.

Finally, it’s important to remember that the levered cost of equity is only one factor in a broader financial analysis. Over-reliance on a single calculation, even one performed with a sophisticated levered cost of equity calculator, can lead to flawed conclusions. The calculation should be used in conjunction with other valuation metrics and qualitative factors before making investment decisions. Understanding the limitations and potential sources of error is vital for using the levered cost of equity effectively and for interpreting the results responsibly. While a levered cost of equity calculator simplifies the computation, it does not eliminate the need for critical evaluation and the consideration of various perspectives within a broader financial framework.

Levered Cost of Equity vs. Unlevered Cost of Equity: Key Differences

The levered cost of equity reflects a company’s cost of equity financing, considering its existing debt. It incorporates the financial leverage effect on equity returns. Conversely, the unlevered cost of equity represents the cost of equity if the company had no debt. It focuses solely on the inherent risk of the company’s assets. A levered cost of equity calculator simplifies determining this key metric. Understanding both perspectives is crucial for comprehensive financial analysis. The choice between them depends on the specific analytical goal.

A key distinction lies in the inclusion of financial leverage. The levered cost of equity is higher than the unlevered cost because debt increases financial risk. This increased risk demands a higher return from equity investors. Using a levered cost of equity calculator provides a clear numerical comparison. The unlevered cost, unaffected by debt, assesses the intrinsic risk of the business operations themselves. Investors and businesses utilize these calculations differently. For example, when evaluating potential acquisitions or comparing companies with varying capital structures, the unlevered cost of equity offers a standardized comparison point. This allows a more accurate assessment of the underlying business profitability irrespective of the financing approach. Employing a levered cost of equity calculator alongside an understanding of unlevered cost helps make informed investment decisions.

Ultimately, both the levered and unlevered cost of equity provide valuable insights. They are not mutually exclusive but rather complementary measures. While a levered cost of equity calculator is a useful tool for determining the levered cost, it’s essential to remember that neither calculation alone should dictate investment decisions. Both should be used in conjunction with other financial metrics and a thorough understanding of the company’s overall financial health and market conditions. A comprehensive analysis considers numerous factors beyond cost of equity. Remember, a levered cost of equity calculator aids in evaluating financial health, but it should never be the sole basis of an investment strategy.