What is Beta and Why Does it Matter?

In the world of finance, understanding risk is crucial for making informed investment decisions. One key metric that helps investors gauge risk is beta, a measure of a stock’s or portfolio’s volatility relative to the overall market. Beta is a critical component in modern portfolio theory, allowing investors to assess the potential return on investment and make informed decisions. By understanding beta, investors can better navigate the complexities of the market, making more informed decisions about their investments. This is particularly important when considering the impact of debt on a company’s risk profile, as reflected in levered beta and unlevered beta. In this article, we will explore the differences between these two metrics and how they can be used to optimize portfolio risk and returns.

Demystifying Levered Beta: The Impact of Debt on Risk

Levered beta is a critical concept in finance that takes into account the impact of debt on a company’s risk profile. Unlike unlevered beta, which measures a company’s underlying risk without considering debt, levered beta provides a more comprehensive picture of a company’s risk exposure. This is because debt can significantly increase a company’s risk, making it more volatile and susceptible to market fluctuations. By understanding the differences between levered beta and unlevered beta, investors and analysts can gain a deeper insight into a company’s risk profile and make more informed investment decisions. In this article, we will explore the concept of levered beta, its significance in finance, and how it differs from unlevered beta.

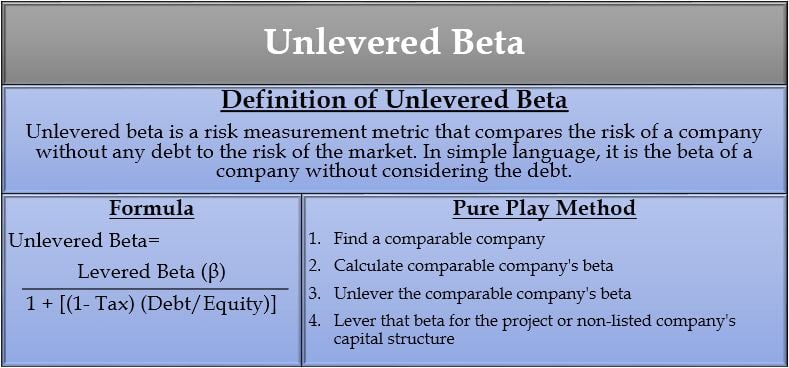

How to Calculate Unlevered Beta: A Step-by-Step Guide

Calculating unlevered beta is a crucial step in understanding a company’s underlying risk. Unlike levered beta, which takes into account the impact of debt on a company’s risk profile, unlevered beta provides a more accurate measure of a company’s intrinsic risk. To calculate unlevered beta, investors and analysts can use the following formula: Unlevered Beta = Levered Beta / (1 + (1 – Tax Rate) \* (Debt/Equity)). This formula adjusts for the impact of debt on a company’s risk profile, providing a more accurate measure of its underlying risk. For example, let’s say a company has a levered beta of 1.2, a debt-to-equity ratio of 0.5, and a tax rate of 25%. Using the formula, we can calculate the unlevered beta as follows: Unlevered Beta = 1.2 / (1 + (1 – 0.25) \* 0.5) = 0.96. This indicates that the company’s underlying risk is lower than its levered beta suggests. By understanding how to calculate unlevered beta, investors and analysts can gain a deeper insight into a company’s risk profile and make more informed investment decisions.

The Difference Between Levered and Unlevered Beta: A Real-World Example

To illustrate the difference between levered beta and unlevered beta, let’s consider a real-world example. Suppose we have two companies, Company A and Company B, both operating in the same industry. Company A has a high debt-to-equity ratio of 2:1, while Company B has a low debt-to-equity ratio of 0.5:1. Using historical data, we calculate the levered beta of Company A to be 1.5 and the levered beta of Company B to be 1.2. At first glance, it may seem that Company A is riskier than Company B due to its higher levered beta. However, when we calculate the unlevered beta of both companies, we get a different picture. Company A’s unlevered beta is 1.1, while Company B’s unlevered beta is 1.0. This suggests that Company A’s underlying risk is actually lower than Company B’s, despite its higher levered beta. The difference lies in the impact of debt on Company A’s risk profile, which is captured by the levered beta but not by the unlevered beta. This example highlights the importance of considering both levered beta and unlevered beta when assessing a company’s risk profile, and demonstrates how unlevered beta can provide a more accurate measure of a company’s underlying risk.

Why Unlevered Beta is a Better Measure of Risk

Levered beta, while widely used, has several limitations that can lead to inaccurate risk assessments. One of the main drawbacks of levered beta is that it is heavily influenced by a company’s capital structure, which can mask its underlying risk. This is because levered beta takes into account the impact of debt on a company’s risk profile, which can be misleading. For instance, a company with a high debt-to-equity ratio may appear riskier than it actually is, simply because of its high leverage. Unlevered beta, on the other hand, provides a more accurate measure of a company’s underlying risk by stripping away the impact of debt. This is particularly important for investors and analysts who need to compare the risk profiles of companies with different capital structures. By using unlevered beta, investors can gain a more nuanced understanding of a company’s risk profile and make more informed investment decisions. Additionally, unlevered beta is a more stable measure of risk, as it is less susceptible to changes in a company’s capital structure. This makes it a more reliable tool for long-term risk assessment and portfolio management.

https://www.youtube.com/watch?v=7Q5pCcEfJkI

Applications of Unlevered Beta in Portfolio Management

In portfolio management, unlevered beta plays a crucial role in optimizing portfolio risk and returns. By using unlevered beta, investors and analysts can gain a more accurate understanding of a company’s underlying risk, which can inform investment decisions and portfolio construction. One of the key applications of unlevered beta is in portfolio optimization, where it can be used to identify the optimal mix of assets that maximize returns while minimizing risk. Unlevered beta can also be used to construct a diversified portfolio, by selecting assets with low correlations and unlevered betas that are less than 1. This can help to reduce overall portfolio risk and increase returns. Additionally, unlevered beta can be used to evaluate the performance of a portfolio manager, by comparing the unlevered beta of the portfolio to that of a benchmark. This can provide a more accurate assessment of the manager’s ability to manage risk and generate returns. Furthermore, unlevered beta can be used in risk parity strategies, where it can help to allocate risk more efficiently across different asset classes. By using unlevered beta in these ways, investors and analysts can make more informed investment decisions and achieve better portfolio outcomes.

Common Pitfalls to Avoid When Working with Beta

When working with beta, investors and analysts must be aware of common pitfalls that can lead to incorrect calculations and misinterpretation of results. One common mistake is to confuse levered beta and unlevered beta, which can lead to inaccurate risk assessments. Another pitfall is to use historical beta values without adjusting for changes in a company’s capital structure or business operations. This can result in outdated and irrelevant risk measures. Additionally, investors should avoid using beta values that are not adjusted for industry or market-specific factors, as this can lead to misleading comparisons between companies. Furthermore, beta calculations should be based on a sufficient amount of data, as small sample sizes can lead to unreliable estimates. Finally, investors should be cautious when using beta values from different sources, as they may be calculated using different methodologies or assumptions. By avoiding these common pitfalls, investors and analysts can ensure that they are using beta values accurately and effectively in their investment decisions. By understanding the differences between levered beta and unlevered beta, and avoiding common mistakes, investors can make more informed decisions and achieve better investment outcomes.

Conclusion: Mastering the Art of Risk Assessment with Levered and Unlevered Beta

In conclusion, understanding the concepts of levered beta and unlevered beta is crucial for investors and analysts seeking to make informed investment decisions. By grasping the differences between these two measures of risk, investors can gain a more accurate understanding of a company’s underlying risk profile. This, in turn, can inform portfolio construction, risk management, and investment decisions. It is essential to recognize the limitations of levered beta and the advantages of unlevered beta in providing a more accurate measure of risk. By avoiding common pitfalls and mistakes when working with beta, investors can ensure that they are using these metrics effectively. Ultimately, mastering the art of risk assessment with levered and unlevered beta is critical for achieving success in the world of finance. By applying the concepts and principles outlined in this article, investors and analysts can make more informed decisions, optimize portfolio risk and returns, and achieve their investment goals.