Deciphering the Annualized Yield of Short-Term Treasury Bills

Treasury Bills (T-Bills) are short-term debt obligations backed by the U.S. government, making them a safe and liquid investment option. These securities are issued with maturities of a year or less and are sold at a discount to their face value. The difference between the purchase price and the face value represents the investor’s return. T-Bills play a crucial role in government finance, helping to manage short-term cash flow needs. They are bought and sold in the secondary market, providing investors with flexibility and liquidity. Understanding the concept of yield is essential when evaluating fixed income securities. Yield, in this context, refers to the return an investor receives on their investment. It’s expressed as an annualized percentage of the investment’s cost. Is the 3 month t bill rate annualized? The yield reflects the income generated relative to the amount invested. For T-Bills, the yield is derived from the discount at which they are purchased.

The yield on a T-Bill is not directly stated as an interest rate like a bond’s coupon rate. Instead, it’s calculated based on the discount from the face value. The yield represents the annualized return an investor can expect if they hold the T-Bill until maturity. Different factors can affect the yield of T-Bills. The Federal Reserve’s monetary policy, inflation expectations, and the overall economic climate are the most important ones. A higher demand for T-Bills generally lowers their yield, while increased supply can push yields higher. Investors use T-Bills as a safe haven during times of economic uncertainty. This increased demand can impact the yield.

When considering T-Bills as an investment, it’s important to understand that the quoted rate is often for a period shorter than a year. For example, a 3-month T-Bill’s rate reflects the return for that specific three-month period. Is the 3 month t bill rate annualized? To make meaningful comparisons with other investments, this rate is typically annualized. Annualizing allows investors to compare the return of a 3-month T-Bill with investments that have different maturities, such as a one-year certificate of deposit (CD) or a longer-term bond. Without annualization, it would be difficult to accurately assess the true return potential of the T-Bill relative to other options. The process of annualizing the rate provides a standardized metric for evaluating investment performance across different time horizons.

How to Calculate the True Annual Return on a 3-Month T-Bill

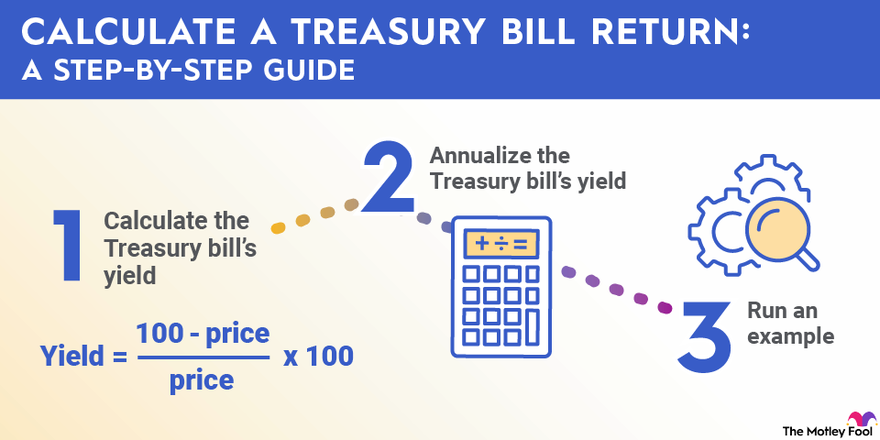

Understanding how the quoted rate on a 3-month Treasury Bill (T-Bill) translates into an actual annual return is crucial for investors. The quoted rate, often referred to as the discount rate, represents the annualized percentage reduction from the face value of the T-Bill. However, since T-Bills mature in less than a year, typically 4, 8, 13, 17, 26, or 52 weeks, the quoted rate must be adjusted to reflect the return an investor would receive if they held the T-Bill for a full year. This process is essential to determine what *is the 3 month t bill rate annualized*.

The calculation involves annualizing the discount rate. The formula to approximate the annual return is: Annualized Return = (Discount Rate / Term of T-Bill in Years). Because it *is the 3 month t bill rate annualized*, we have to convert it to an anual rate. Considering a 3-month T-Bill, the term is 3/12 = 0.25 years. Let’s illustrate with an example. Suppose a 3-month T-Bill has a quoted discount rate of 5%. To calculate the annualized return, we divide 0.05 by 0.25, resulting in an annualized return of 20%. This multiplication is vital because it extrapolates the return earned over the 3-month period to represent a full year. The annualized return allows for a direct comparison to investments with longer maturities, even though the actual T-Bill matures in just three months. To be accurate, the investor would have to reinvest the proceeds at the same rate for the remaining three quarters of the year. This illustrates why it *is the 3 month t bill rate annualized*.

It’s important to note that this calculation provides an approximation. The actual annual return may vary slightly due to the compounding effect if the T-Bill proceeds are reinvested. Nevertheless, the annualized rate provides a standardized metric for comparing different short-term investment options and helps investors assess the true potential return of a T-Bill. Understanding how *is the 3 month t bill rate annualized* is critical for making informed investment decisions. Because it *is the 3 month t bill rate annualized*, it can be easily compared to other investments, allowing investors to accurately evaluate opportunities.

Why the Annualized Rate Matters for Investors

Understanding the annualized rate of return on a 3-month T-Bill is paramount for making informed investment decisions. The quoted rate on a short-term Treasury Bill represents the return for its specific term, such as three months. However, to accurately compare it with other investment opportunities, it must be expressed as an annualized figure. This standardization allows investors to evaluate different investments on an equal footing, regardless of their maturities. Without annualization, directly comparing a 3-month T-Bill to, say, a one-year Certificate of Deposit (CD) becomes misleading. The annualized rate provides a clear picture of the potential return if the T-Bill were held for a full year, assuming consistent reinvestment at the same rate.

Consider two scenarios: a 3-month T-Bill with a quoted rate of 1.25% and a one-year CD offering 5%. At first glance, the CD might seem significantly more attractive. However, to truly understand the potential, the 3-month T-Bill rate needs to be annualized. Multiplying the 3-month rate by four (since there are four 3-month periods in a year) gives an annualized rate of 5%. Now, the comparison becomes much clearer: both investments offer a similar potential return. The importance of the annualized rate of return is underscored when comparing the 3 month t bill rate annualized to other investments with varying terms, allowing for an apples-to-apples comparison. Ignoring this vital step can lead to suboptimal investment choices based on incomplete or misinterpreted information.

The annualized rate also plays a crucial role in assessing the opportunity cost of investing in T-Bills. By understanding the potential yearly return, investors can weigh the benefits of safety and liquidity against the potential for higher returns offered by riskier assets, like stocks or corporate bonds. For example, if a 3-month T-Bill is the 3 month t bill rate annualized shows a 5% return, but a comparable risk corporate bond yields 7%, an investor can make a more informed decision about whether the additional risk is worth the extra 2% return. Therefore, understanding the annualized rate is not just about calculating a number; it is about placing the investment within a broader financial context and making strategic decisions that align with individual risk tolerance and financial goals. The is the 3 month t bill rate annualized is a key metric for any investor considering Treasury Bills.

Factors Influencing T-Bill Yields: A Market Overview

Treasury Bill (T-Bill) yields are not static figures; they fluctuate based on a complex interplay of economic forces. Understanding these forces is crucial for investors seeking to navigate the short-term investment landscape. One of the most significant drivers of T-Bill yields is the monetary policy of the Federal Reserve (the Fed). The Fed utilizes various tools, such as adjusting the federal funds rate and engaging in open market operations, to influence interest rates across the economy. When the Fed raises interest rates, T-Bill yields typically follow suit, and vice versa. This is because T-Bills must offer competitive returns to attract investors in a rising rate environment. Another key factor is inflation expectations. If investors anticipate higher inflation in the future, they will demand higher yields on T-Bills to compensate for the erosion of purchasing power. Conversely, if inflation expectations are subdued, T-Bill yields may remain relatively low. Ultimately affecting their yields, is the 3 month t bill rate annualized.

Overall economic conditions also play a vital role in shaping T-Bill yields. During periods of economic expansion, demand for credit tends to increase, putting upward pressure on interest rates, including those of T-Bills. Conversely, during economic slowdowns or recessions, demand for credit may weaken, leading to lower interest rates. Investor sentiment and risk appetite also influence T-Bill yields. In times of uncertainty or market volatility, investors often flock to safe-haven assets like T-Bills, driving up demand and pushing down yields. This “flight to safety” phenomenon can cause T-Bill yields to decouple from underlying economic fundamentals, at least temporarily. It is also necessary to keep in mind that the 3 month t bill rate annualized is very sensitive to any quick economic movement.

The supply of T-Bills also affects yields. The government issues T-Bills to finance its operations. An increase in the supply of T-Bills can lead to a decrease in prices and an increase in yields, assuming demand remains constant. Conversely, a decrease in supply can lead to higher prices and lower yields. In summary, T-Bill yields are influenced by a range of factors, including the Federal Reserve’s monetary policy, inflation expectations, economic conditions, investor sentiment, and the supply of T-Bills. Monitoring these factors can provide valuable insights into potential movements in T-Bill yields and help investors make informed investment decisions. A key element to watch for is the 3 month t bill rate annualized, as its shifts reflect broader economic trends.

Treasury Bill Investments: Weighing the Advantages and Disadvantages

Investing in Treasury Bills (T-Bills) offers a unique blend of security and liquidity, making them attractive to a wide range of investors. However, like any investment, T-Bills also come with certain drawbacks. A balanced perspective is essential for making informed decisions about incorporating them into a portfolio. The question “is the 3 month t bill rate annualized?” is crucial to consider when evaluating potential returns.

One of the primary advantages of T-Bills is their safety. Backed by the full faith and credit of the U.S. government, they are considered virtually risk-free in terms of default. This makes them an ideal choice for risk-averse investors seeking to preserve capital. Another key benefit is their high liquidity. T-Bills are easily bought and sold in the secondary market, allowing investors to access their funds quickly if needed. The ease of purchase is also a plus. T-Bills can be acquired through TreasuryDirect.gov, banks, or brokerage firms, making them accessible to both individual and institutional investors. However, is the 3 month t bill rate annualized in a way that makes them competitive with other investments? This safety and liquidity often come at the cost of lower returns compared to other asset classes.

A significant disadvantage of T-Bills is their relatively low yield. Compared to stocks, corporate bonds, or even some high-yield savings accounts, T-Bills typically offer lower returns. This can be a concern for investors seeking to grow their wealth significantly over time. Another factor to consider is the potential for inflation to erode returns. If the inflation rate exceeds the T-Bill yield, the real return (after accounting for inflation) can be negative. Understanding whether the quoted rate is the actual annualized return is crucial for comparing T-Bills to other investments and assessing their true value. Therefore, while T-Bills provide a safe and liquid investment option, understanding their limitations and how “is the 3 month t bill rate annualized” is essential for determining their suitability within a broader investment strategy. Investors should carefully weigh these advantages and disadvantages based on their individual financial goals, risk tolerance, and investment horizon.

Interpreting T-Bill Auction Results: A Detailed Explanation

Treasury Bills are sold to the public through auctions conducted by the U.S. Department of the Treasury. Understanding the results of these auctions provides valuable insights into market sentiment and future interest rate expectations. The auction process involves investors submitting competitive bids, specifying the quantity of T-Bills they wish to purchase and the price they are willing to pay. These prices translate directly into yields; higher prices mean lower yields, and vice versa. The auction results are typically summarized by key metrics like the “high yield,” “median yield,” and “tail,” all of which help to understand if the 3 month t bill rate is annualized properly.

The “high yield” represents the highest yield accepted by the Treasury at the auction. This is the yield that winning bidders at the margin received. The “median yield” is the yield at which half of the accepted bids were higher and half were lower. This figure provides a sense of the average yield demanded by investors. The “tail” refers to the difference between the high yield and the median yield. A larger tail may indicate weaker demand, as it suggests that a significant portion of the accepted bids were at a higher yield (lower price) than the median. Interpreting these auction results requires understanding that they reflect the collective expectations of market participants regarding future interest rates and economic conditions. For example, if the high yield is significantly higher than previous auctions, it could signal that investors anticipate rising interest rates or increased economic uncertainty. Conversely, a lower high yield may indicate expectations of stable or declining interest rates, and the annualized rate is a key component of this expectation.

Linking auction results back to the annualized rate discussion is crucial. The yields quoted in auction results are typically annualized, meaning they represent the return an investor would receive if they held the T-Bill for a full year. However, since T-Bills have maturities of less than a year (e.g., 4, 8, 13, 17, 26, or 52 weeks), the annualized rate is a projection based on the short-term yield determined at auction. Therefore, a higher annualized yield at auction might suggest that the market anticipates interest rates to remain elevated or even increase over the coming year. Monitoring T-Bill auction results and understanding how to interpret the high yield, median yield, and tail provides investors with valuable information for making informed decisions about their short-term investments. This understanding allows for comparison against other short-term investment options and contributes to effective portfolio management, especially considering how the 3 month t bill rate is annualized for comparison purposes.

Differentiating Between Yield and Discount Rate on Government Securities

Understanding the nuances between yield and discount rate is crucial when dealing with government securities like Treasury Bills (T-Bills). While both concepts relate to the profitability of these investments, they represent different aspects of the return. Confusing them can lead to misinterpretations of the actual return an investor receives. The discount rate is the percentage reduction from the face value of the T-Bill. This reflects the interest earned upfront. Conversely, the yield represents the actual return on investment, taking into account the purchase price and the time to maturity. Knowing if the 3 month t bill rate is annualized is important in this calculation.

The discount rate is used to determine the purchase price of a T-Bill. For instance, imagine a one-year T-Bill with a face value of $10,000 and a discount rate of 5%. The investor would purchase the T-Bill for $9,500 ($10,000 less 5% of $10,000). At maturity, the investor receives the full face value of $10,000. The difference of $500 represents the earnings. The yield, however, calculates the return relative to the purchase price. In this instance, the yield would be slightly higher than the discount rate because the return is based on the discounted purchase price. Understanding if the 3 month t bill rate is annualized is key to comparing it to other investment options.

To further clarify, consider a 3-month T-Bill with a face value of $1,000 that’s bought at a discount. The discount rate might be presented as 4% annually, but since it is a 3-month T-Bill, the actual discount is 1% (4% / 4). Therefore, you pay $990 for the T-Bill and receive $1,000 at maturity. The yield considers this $10 gain relative to the $990 investment. It’s crucial to differentiate this from the annualized discount rate. The annualized yield provides a standardized measure for comparison against other investments with varying terms. Many investors want to know, is the 3 month t bill rate annualized?, because this allows for easier comparison with investments such as bonds or certificates of deposit (CDs). Always carefully analyze both the discount rate and calculate the true annualized yield to make informed investment decisions.

Maximizing Returns on Short-Term Investments: Strategic Approaches

To potentially enhance returns on short-term investments, several strategies can be considered. One approach involves laddering Treasury Bills. This means purchasing T-Bills with staggered maturity dates. As each T-Bill matures, the proceeds can be reinvested into a new T-Bill, creating a consistent stream of returns and potentially capitalizing on fluctuating interest rates. Understanding how the 3 month t bill rate is annualized is crucial when employing this laddering strategy, enabling accurate comparisons between different maturity lengths.

Another avenue for maximizing returns is exploring tax-advantaged accounts. Depending on individual circumstances and location, utilizing accounts like Tax-Sheltered Annuities (TSA) or other similar investment vehicles can offer tax benefits that boost overall returns. These accounts may provide tax deferral or even tax-free growth, making them attractive options for short-term savings goals. Always consider the tax implications of any investment decision, as taxes can significantly impact the net return. It’s essential to remember that the quoted rate is the 3 month t bill rate annualized; therefore, compare after-tax returns for effective decision-making.

Diversification, even within the realm of low-risk assets, can be a worthwhile strategy. While T-Bills offer safety, allocating a portion of short-term funds to other low-risk options, such as high-yield savings accounts or money market funds, may provide slightly higher returns. When evaluating these alternatives, always ensure a thorough understanding of any associated fees or restrictions. Comparing the annualized yield of these options with the annualized 3 month t bill rate is critical. Remember, the advertised rate for many short-term investments, including T-Bills, is the 3 month t bill rate annualized to facilitate accurate comparisons across various investment durations. Understanding how the 3 month t bill rate is annualized allows investors to make informed decisions and optimize their short-term investment strategies effectively.

:max_bytes(150000):strip_icc()/FederalFundsRate-8064baabc82d47bf81b735e57a5c4557.jpg)

:max_bytes(150000):strip_icc()/Treasury-yield-8782292e8ad64d4a9669cbc61f73b06a.jpg)