What is Prepaid Insurance and How Does it Work?

Prepaid insurance is a type of insurance policy where the policyholder pays the entire premium upfront, often resulting in a discounted rate. This payment is then applied to the insurance policy, providing coverage for a specified period. In contrast to traditional insurance, where premiums are paid periodically, prepaid insurance offers a unique approach to managing risk and cash flow. Understanding prepaid insurance is crucial for businesses and individuals alike, as it can have a significant impact on financial statements and overall financial health. As we delve into the world of prepaid insurance, a critical question arises: is prepaid insurance an asset, liability, or equity? This question has sparked debate among accountants and financial experts, and its answer has far-reaching implications for financial reporting and decision-making.

Classifying Prepaid Insurance: Asset, Liability, or Equity?

The accounting classification of prepaid insurance is a topic of ongoing debate among financial experts and accountants. The question of whether prepaid insurance is an asset, liability, or equity has sparked intense discussion, with different perspectives emerging on this complex issue. Some argue that prepaid insurance is an asset, as it represents a prepaid expense that will provide future benefits. Others contend that it is a liability, as the insurer is obligated to provide coverage for a specified period. Meanwhile, a third perspective suggests that prepaid insurance is an equity, as it represents a form of prepaid capital that can be used to offset future premiums. The classification of prepaid insurance as an asset, liability, or equity has significant implications for financial reporting, risk management, and decision-making. Understanding the different perspectives on this topic is crucial for businesses and individuals seeking to navigate the complexities of prepaid insurance.

How to Determine the Accounting Treatment of Prepaid Insurance

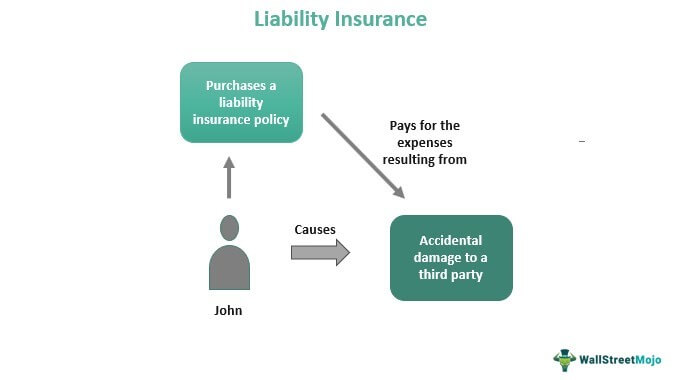

Determining the correct accounting treatment of prepaid insurance is crucial for accurate financial reporting and compliance with accounting standards. To classify prepaid insurance as an asset, liability, or equity, several factors must be considered. Firstly, the nature of the insurance policy and the type of coverage provided must be evaluated. For instance, is the policy providing protection against a specific risk or event, or is it a general liability policy? Secondly, the duration of the policy and the timing of the premium payments must be considered. If the premium is paid upfront and the policy provides coverage for a specified period, it may be classified as a prepaid asset. On the other hand, if the premium is paid periodically, it may be classified as a liability. The relevant accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), must also be consulted to ensure compliance. Ultimately, the accounting treatment of prepaid insurance depends on a thorough analysis of the policy’s terms and conditions, as well as the applicable accounting standards. By understanding these factors, businesses and individuals can accurately classify prepaid insurance and ensure accurate financial reporting. The question of whether prepaid insurance is an asset, liability, or equity can be answered by carefully evaluating these factors and applying the relevant accounting standards.

The Role of Prepaid Insurance in Financial Statements

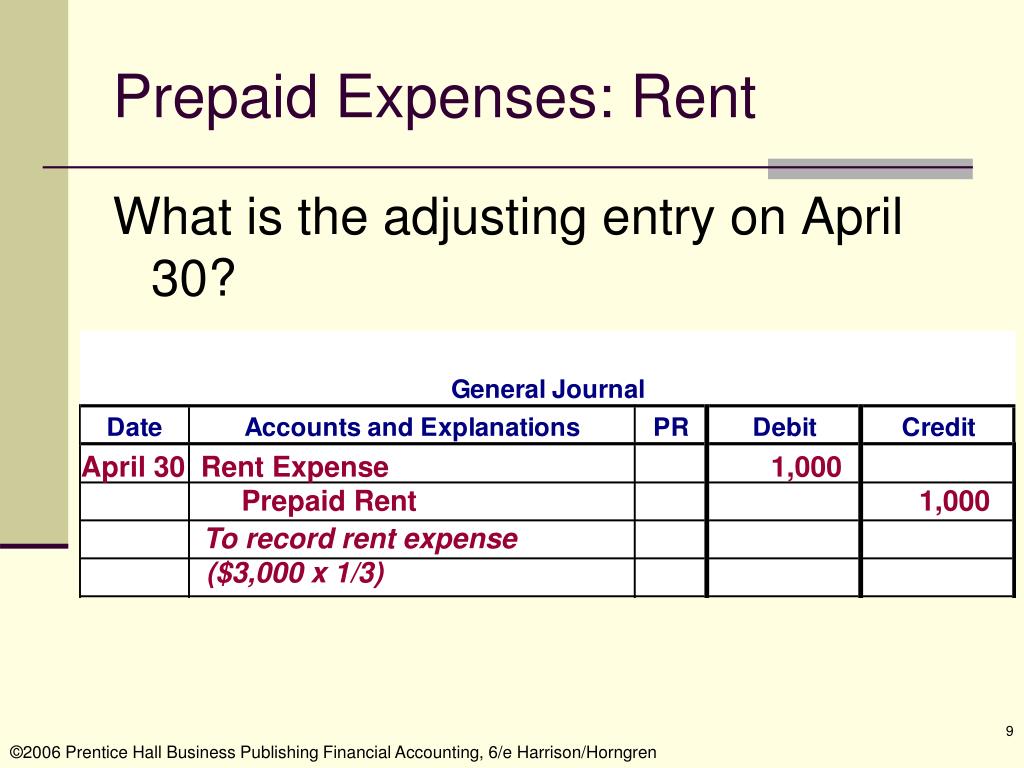

Prepaid insurance plays a significant role in financial statements, as it can impact a company’s financial health and performance. On the balance sheet, prepaid insurance is typically represented as a current asset, as it provides future benefits to the company. The prepaid premium is initially recorded as an asset, and then gradually expensed over the policy period as the insurance coverage is provided. This treatment is in accordance with the matching principle, which requires that expenses be matched with the revenues they help to generate. On the income statement, the expensed portion of the prepaid premium is reported as an insurance expense, which reduces net income. The classification of prepaid insurance as an asset, liability, or equity has a direct impact on a company’s financial statements, and therefore, it is essential to accurately determine its accounting treatment. For instance, if prepaid insurance is classified as an asset, it will increase a company’s total assets and net income. On the other hand, if it is classified as a liability, it will decrease net income and increase total liabilities. Understanding the role of prepaid insurance in financial statements is crucial for investors, analysts, and other stakeholders to make informed decisions about a company’s financial health and performance. The question of whether prepaid insurance is an asset, liability, or equity has significant implications for financial reporting and decision-making.

Real-World Examples of Prepaid Insurance in Action

Prepaid insurance is widely used in various industries, and its application can be seen in many real-world examples. For instance, a company like Amazon may purchase prepaid insurance to cover its inventory against damage or loss during transportation. In this case, Amazon would classify the prepaid premium as a current asset on its balance sheet, as it provides future benefits to the company. As the insurance coverage is provided over time, the prepaid premium would be gradually expensed on the income statement, reducing net income. Another example is a construction company that purchases prepaid insurance to cover its equipment against damage or loss. The company would classify the prepaid premium as a current asset, and then expense it over the policy period as the insurance coverage is provided. Understanding how companies classify and account for prepaid insurance is essential to appreciate its role in financial reporting and decision-making. The question of whether prepaid insurance is an asset, liability, or equity is crucial in these examples, as it directly impacts the financial statements and performance of these companies. By examining these real-world examples, it becomes clear that prepaid insurance is an essential component of risk management and financial planning for businesses.

The Benefits and Drawbacks of Prepaid Insurance

Prepaid insurance offers several benefits to companies, including improved cash flow management, enhanced risk management, and better financial reporting. By paying premiums upfront, companies can avoid unexpected insurance costs and better manage their cash flow. Additionally, prepaid insurance provides companies with a sense of security, knowing that they are protected against potential risks and losses. Furthermore, prepaid insurance can be classified as an asset, liability, or equity, depending on the accounting treatment, which can have significant implications for financial reporting and decision-making. For instance, if prepaid insurance is classified as an asset, it can increase a company’s total assets and net income. On the other hand, if it is classified as a liability, it can decrease net income and increase total liabilities. However, prepaid insurance also has some drawbacks, including the potential for overpayment or underpayment of premiums, which can lead to financial losses. Moreover, the accounting treatment of prepaid insurance can be complex and may require significant resources and expertise. Understanding the benefits and drawbacks of prepaid insurance is essential for companies to make informed decisions about their insurance policies and financial reporting. The question of whether prepaid insurance is an asset, liability, or equity is critical in this context, as it directly impacts the financial health and performance of companies.

Common Misconceptions About Prepaid Insurance

Despite its widespread use, prepaid insurance is often shrouded in misconceptions and myths. One common misconception is that prepaid insurance is always classified as an asset, when in fact, its accounting treatment can vary depending on the circumstances. For instance, if a company prepays for insurance coverage that extends beyond the current accounting period, it may be classified as a liability or equity. Another misconception is that prepaid insurance is only used by large corporations, when in reality, companies of all sizes can benefit from prepaid insurance. Additionally, some people believe that prepaid insurance is only used for property and casualty insurance, when it can be applied to various types of insurance, including liability and workers’ compensation insurance. Furthermore, there is a common misconception that prepaid insurance is not relevant to financial reporting, when in fact, it can have a significant impact on a company’s financial statements and performance. Understanding the truth about prepaid insurance and its accounting classification is essential to making informed decisions about insurance policies and financial reporting. The question of whether prepaid insurance is an asset, liability, or equity is critical in this context, as it directly impacts the financial health and performance of companies. By dispelling these common misconceptions, companies can better utilize prepaid insurance to manage risk and improve their financial health.

Conclusion: Unraveling the Complexity of Prepaid Insurance

In conclusion, prepaid insurance is a complex and multifaceted concept that requires a deep understanding of its definition, accounting classification, and implications on financial statements. By grasping the nuances of prepaid insurance, companies can make informed decisions about their insurance policies and financial reporting. The question of whether prepaid insurance is an asset, liability, or equity is critical in this context, as it directly impacts the financial health and performance of companies. It is essential to dispel common misconceptions and myths surrounding prepaid insurance and to recognize its benefits and drawbacks. Ultimately, a thorough understanding of prepaid insurance can help companies navigate the complexities of risk management and financial reporting, leading to improved financial health and performance. By unraveling the mystery of prepaid insurance, companies can unlock the full potential of this valuable financial tool and make informed decisions about their insurance policies and financial reporting.

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-recirc-blue-1d8d154bf0c94ba6858fe12907d2b694.jpg)