What is Cost in Economics?

In the context of economics, cost refers to the value of resources used to produce a good or service. It plays a vital role in decision-making and resource allocation, as it directly affects a business’s profitability, competitiveness, and sustainability. There are various types of costs, including fixed costs, variable costs, and opportunity costs, each with its unique characteristics and implications. For instance, fixed costs remain constant even when production levels change, whereas variable costs fluctuate with the quantity produced. Understanding the different types of costs is essential for businesses to make informed decisions about resource allocation and investment. As we explore the concept of cost further, a critical question arises: is cost discrete or continuous? This distinction has significant implications for businesses, policymakers, and individuals alike.

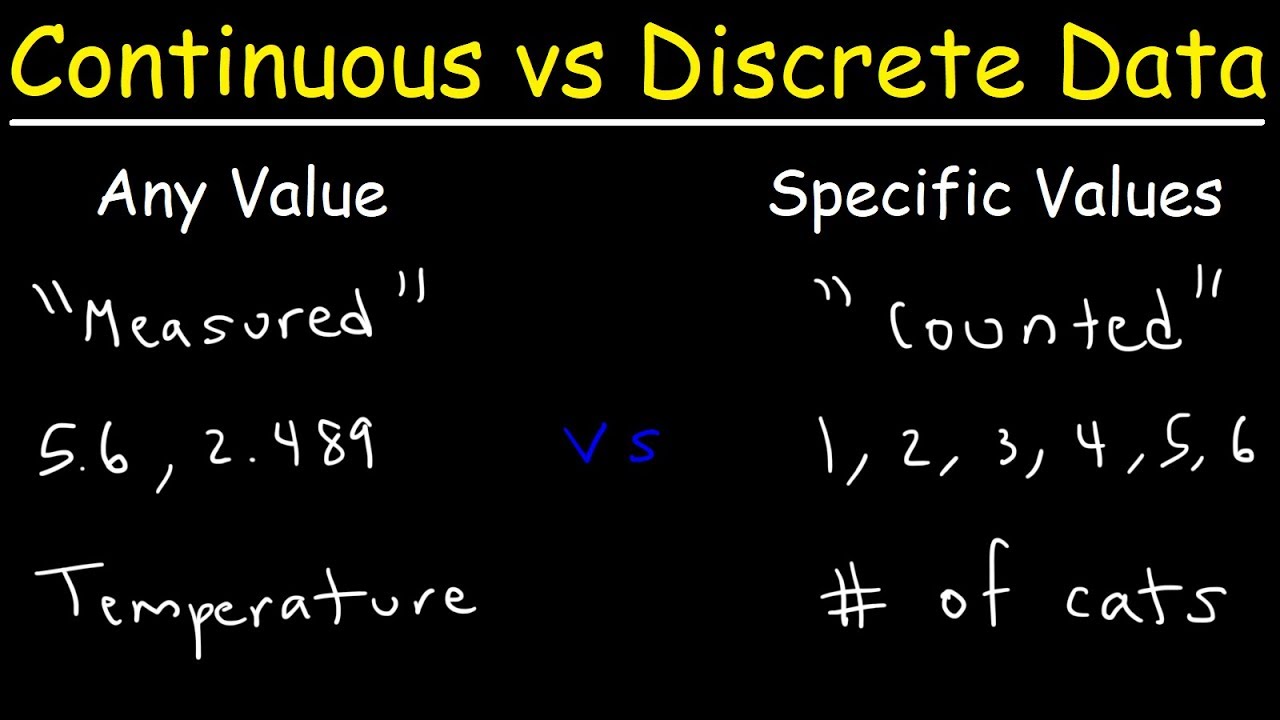

The Nature of Cost: Discrete or Continuous?

In the realm of economics, variables can be classified as either discrete or continuous. Discrete variables are those that can only take on specific, distinct values, whereas continuous variables can take on any value within a certain range or interval. When it comes to cost, this distinction is crucial, as it affects how businesses approach decision-making and resource allocation. The question of whether cost is discrete or continuous depends on the context in which it is being considered. For instance, the cost of producing individual units of a product may be discrete, whereas the cost of labor or raw materials may be continuous. Understanding the nature of cost as discrete or continuous is essential for businesses to make informed decisions about pricing, production, and investment. Is cost discrete or continuous? The answer to this question has significant implications for businesses, policymakers, and individuals alike.

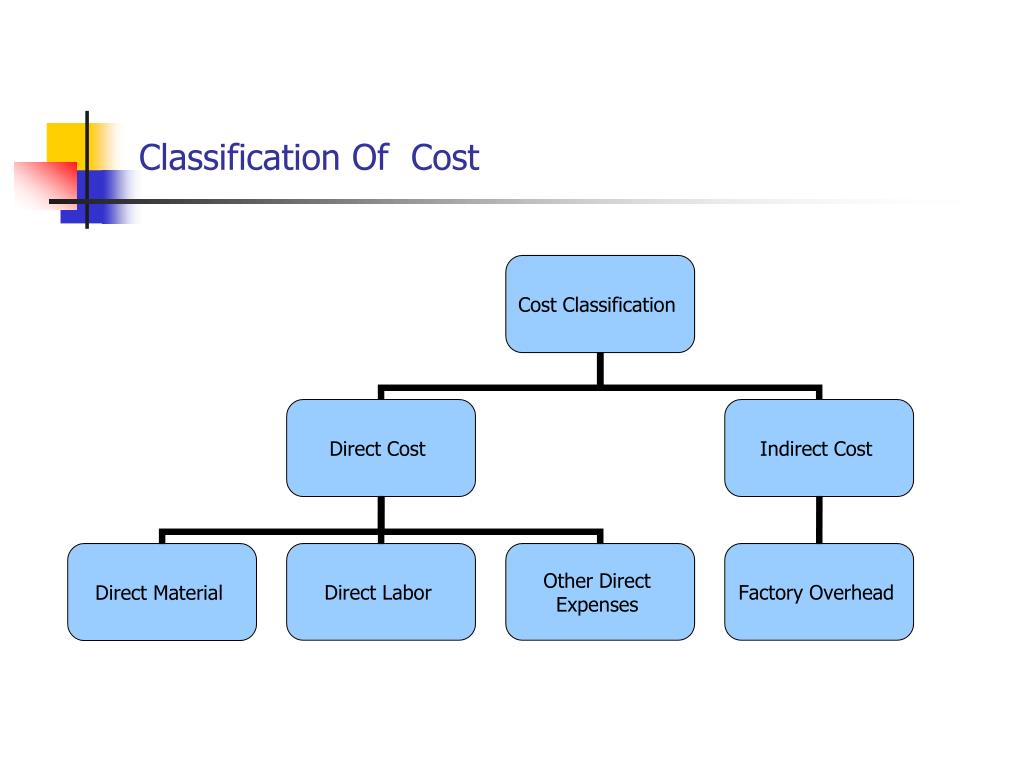

How to Identify Discrete Costs

Discrete costs are those that can be attributed to specific, individual units of a product or service. In a business setting, identifying discrete costs is crucial for accurate cost accounting and informed decision-making. For instance, the cost of producing individual units of a product, such as the cost of raw materials, labor, and overhead, are discrete costs. These costs can be directly traced to specific products or services, allowing businesses to calculate the cost of each unit produced. To identify discrete costs, businesses can use techniques such as job costing, process costing, or standard costing. By accurately identifying discrete costs, businesses can determine the profitability of individual products or services, set prices, and make informed decisions about production and investment. In contrast, is cost discrete or continuous? Understanding the nature of cost is essential for businesses to make informed decisions about resource allocation and investment.

The Role of Continuous Costs in Business Decision-Making

Continuous costs, on the other hand, are those that cannot be attributed to specific, individual units of a product or service. These costs are often incurred continuously over time, such as the cost of labor, raw materials, or utilities. In a business setting, continuous costs play a significant role in decision-making, as they can affect pricing, production, and investment strategies. For instance, a company that incurs continuous labor costs may need to adjust its pricing strategy to ensure profitability. Similarly, a company that incurs continuous costs of raw materials may need to adjust its production strategy to minimize waste and optimize resource allocation. Understanding continuous costs is essential for businesses to make informed decisions about resource allocation and investment. Is cost discrete or continuous? The answer to this question has significant implications for businesses, as it affects how they approach decision-making and resource allocation. By accurately identifying and classifying continuous costs, businesses can make informed decisions about pricing, production, and investment, ultimately leading to improved profitability and competitiveness.

Real-World Examples of Discrete and Continuous Costs

Understanding the difference between discrete and continuous costs is crucial for businesses to make informed decisions about resource allocation and investment. Let’s consider some real-world examples of businesses that incur discrete and continuous costs. A manufacturing company, such as a car manufacturer, incurs discrete costs when producing individual units of a product. The cost of raw materials, labor, and overhead can be directly attributed to each unit produced, making it a discrete cost. On the other hand, a service-based company, such as a consulting firm, incurs continuous costs, such as labor costs, which are incurred continuously over time and cannot be attributed to specific units of service. Another example is a retail company, which incurs discrete costs when purchasing inventory, but continuous costs when it comes to utilities and rent. Is cost discrete or continuous? The answer to this question depends on the context and the type of business. By understanding the nature of cost, businesses can make informed decisions about pricing, production, and investment, ultimately leading to improved profitability and competitiveness.

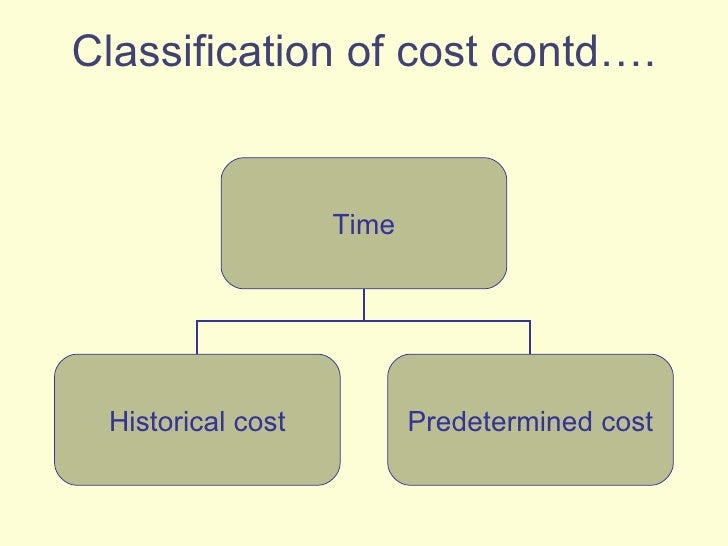

Understanding the Implications of Cost Classification

The classification of costs as discrete or continuous has significant implications for businesses. Accurate cost classification affects financial reporting, budgeting, and forecasting, ultimately influencing business decision-making and resource allocation. For instance, if a company misclassifies a continuous cost as discrete, it may underestimate its total costs and overestimate its profitability. This can lead to poor business decisions, such as investing in unprofitable projects or setting prices that are too low. On the other hand, accurate cost classification enables businesses to identify areas of inefficiency and opportunities for cost reduction. Is cost discrete or continuous? The answer to this question has a significant impact on financial reporting, as discrete costs are typically reported as separate line items, while continuous costs are often reported as a single aggregate amount. Furthermore, accurate cost classification is essential for budgeting and forecasting, as it enables businesses to predict future costs and make informed decisions about resource allocation. By understanding the implications of cost classification, businesses can make informed decisions and optimize their operations for improved profitability and competitiveness.

Common Misconceptions About Cost Classification

One of the most common misconceptions about cost classification is the assumption that all costs are either discrete or continuous. However, this is not always the case. In reality, many businesses incur both discrete and continuous costs, and accurately classifying these costs is crucial for informed decision-making. For instance, a manufacturing company may incur discrete costs when producing individual units of a product, but also incur continuous costs such as labor and raw materials. Another misconception is that cost classification is only relevant for large businesses. However, small businesses and startups also need to accurately classify their costs to make informed decisions about pricing, production, and investment. Is cost discrete or continuous? The answer to this question depends on the context and the type of business. Incorrect cost classification can lead to poor business decisions, such as underestimating costs, overestimating profitability, and making poor investment decisions. By understanding the differences between discrete and continuous costs, businesses can avoid these common misconceptions and make informed decisions about resource allocation and investment.

Conclusion: The Importance of Accurate Cost Classification

In conclusion, understanding the nature of cost variables as discrete or continuous is crucial for businesses to make informed decisions about resource allocation and investment. Accurate cost classification has significant implications for financial reporting, budgeting, and forecasting, ultimately affecting a company’s profitability and competitiveness. By recognizing the differences between discrete and continuous costs, businesses can avoid common misconceptions and make informed decisions about pricing, production, and investment. Is cost discrete or continuous? The answer to this question depends on the context and the type of business. By understanding the importance of accurate cost classification, businesses can optimize their operations, improve profitability, and achieve long-term success. In today’s competitive business landscape, accurate cost classification is no longer a luxury, but a necessity for businesses that want to stay ahead of the curve.