What is Intrinsic Value and Why Does it Matter?

In the complex world of options trading, understanding the intrinsic value of a put option is crucial for making informed investment decisions. The intrinsic value of a put option represents the option’s minimum value, derived from the underlying asset’s price and other factors. This inherent worth provides a foundation for traders to evaluate the option’s potential profitability. By grasping the concept of intrinsic value, traders can better navigate the risks and opportunities associated with options trading, ultimately maximizing their returns. In essence, the intrinsic value of a put option serves as a benchmark, helping traders determine whether an option is overvalued or undervalued, and make strategic decisions about buying or selling. As such, it is essential to comprehend the significance of intrinsic value in options trading and how it can be leveraged to achieve success in the markets.

How to Calculate Intrinsic Value of a Put Option

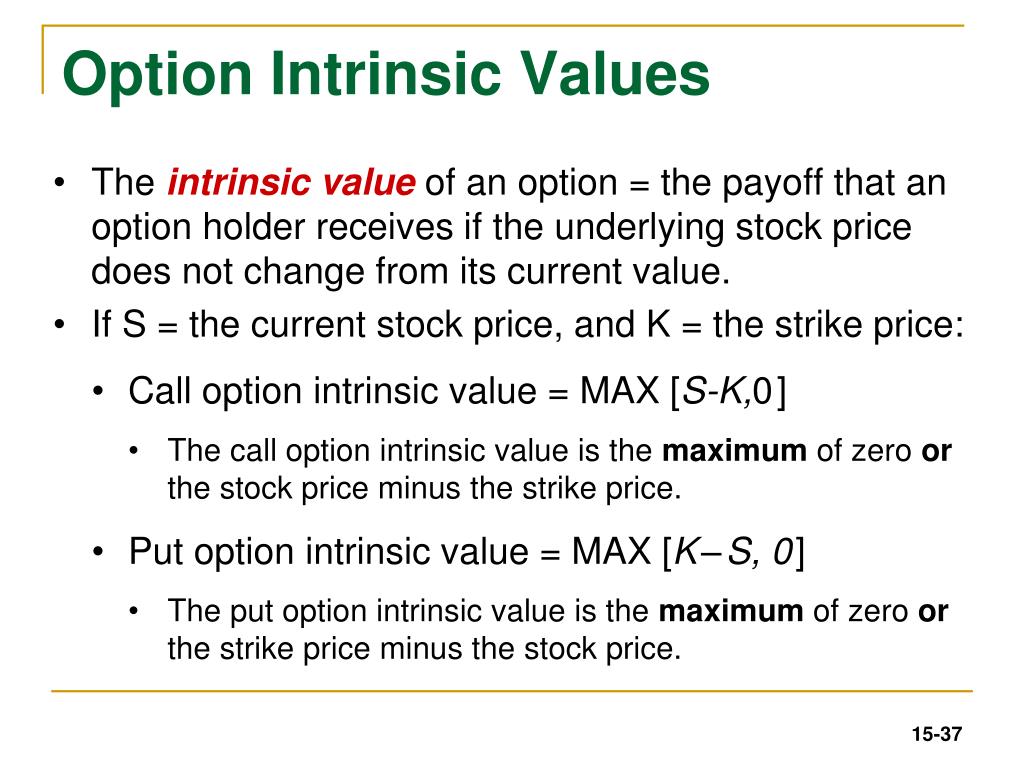

Calculating the intrinsic value of a put option is a straightforward process that involves understanding the underlying variables. The intrinsic value of a put option is the difference between the strike price and the current market price of the underlying asset, if the option is in the money. Mathematically, this can be represented as:

Intrinsic Value = Strike Price – Current Market Price of Underlying Asset

For example, let’s consider a put option with a strike price of $50 and the current market price of the underlying asset is $40. In this scenario, the intrinsic value of the put option would be:

Intrinsic Value = $50 – $40 = $10

This means that the option has an intrinsic value of $10, making it a profitable trade. On the other hand, if the current market price of the underlying asset is $60, the intrinsic value would be zero, as the option is out of the money.

It’s essential to note that the intrinsic value of a put option does not take into account other factors that affect the option’s value, such as time decay, volatility, and interest rates. These factors will be discussed in subsequent sections, providing a comprehensive understanding of the intrinsic value of a put option.

The Role of Underlying Asset Price in Intrinsic Value

The underlying asset price plays a crucial role in determining the intrinsic value of a put option. The intrinsic value of a put option is directly affected by the current market price of the underlying asset. When the underlying asset price decreases, the intrinsic value of the put option increases, making it more valuable. Conversely, when the underlying asset price increases, the intrinsic value of the put option decreases, making it less valuable.

The relationship between the underlying asset price and the intrinsic value of a put option can be illustrated through a simple example. Suppose we have a put option with a strike price of $50 and the current market price of the underlying asset is $45. In this scenario, the intrinsic value of the put option would be $5 ($50 – $45). If the underlying asset price were to decrease to $40, the intrinsic value of the put option would increase to $10 ($50 – $40). On the other hand, if the underlying asset price were to increase to $55, the intrinsic value of the put option would decrease to zero, as the option would be out of the money.

Understanding the relationship between the underlying asset price and the intrinsic value of a put option is essential for traders to make informed investment decisions. By monitoring changes in the underlying asset price, traders can adjust their strategies to maximize their returns. For instance, if a trader expects the underlying asset price to decrease, they may consider buying a put option to capitalize on the potential increase in intrinsic value. Conversely, if a trader expects the underlying asset price to increase, they may consider selling a put option to minimize potential losses.

Time Decay and Its Impact on Intrinsic Value

Time decay is a critical concept in options trading that affects the intrinsic value of a put option. Time decay refers to the gradual decrease in the value of an option over time, resulting from the option’s limited lifespan. As the expiration date approaches, the option’s value decreases, making it less valuable to the holder. This erosion of value is particularly significant for put options, as the intrinsic value is directly impacted by time decay.

The impact of time decay on the intrinsic value of a put option can be substantial. As the option approaches expiration, the likelihood of the underlying asset price reaching the strike price decreases, reducing the option’s value. For instance, consider a put option with a strike price of $50 and an expiration date in three months. If the current market price of the underlying asset is $45, the intrinsic value of the put option would be $5. However, as the expiration date approaches, the option’s value may decrease to $3 or even $1, due to time decay.

Traders must consider time decay when making investment decisions involving put options. By understanding the impact of time decay on the intrinsic value of a put option, traders can adjust their strategies to maximize their returns. For example, a trader may consider selling a put option with a shorter expiration date to take advantage of time decay, or buying a put option with a longer expiration date to give themselves more time to capitalize on potential price movements.

It’s essential to note that time decay is not the only factor affecting the intrinsic value of a put option. Other factors, such as changes in the underlying asset price, volatility, and interest rates, can also impact the option’s value. By considering these factors in conjunction with time decay, traders can make more informed investment decisions and maximize their returns.

Volatility’s Influence on Intrinsic Value

Volatility plays a significant role in determining the intrinsic value of a put option. Volatility refers to the fluctuations in the price of the underlying asset, which can impact the option’s value. When volatility increases, the intrinsic value of a put option also increases, making it more valuable to the holder. Conversely, when volatility decreases, the intrinsic value of a put option decreases, making it less valuable.

The relationship between volatility and intrinsic value can be attributed to the increased uncertainty surrounding the underlying asset’s price movements. When volatility is high, the likelihood of the underlying asset price reaching the strike price increases, making the put option more valuable. For instance, consider a put option with a strike price of $50 and an underlying asset with high volatility. If the current market price of the underlying asset is $45, the intrinsic value of the put option would be higher due to the increased likelihood of the underlying asset price reaching the strike price.

Traders can adjust their strategies to capitalize on changes in volatility. For example, a trader may consider buying a put option when volatility is high, as the option’s value is likely to increase. Conversely, a trader may consider selling a put option when volatility is low, as the option’s value is likely to decrease. By understanding the impact of volatility on the intrinsic value of a put option, traders can make more informed investment decisions and maximize their returns.

It’s essential to note that volatility is not the only factor affecting the intrinsic value of a put option. Other factors, such as changes in the underlying asset price, time decay, and interest rates, can also impact the option’s value. By considering these factors in conjunction with volatility, traders can gain a more comprehensive understanding of the intrinsic value of a put option and make more informed investment decisions.

Interest Rates and Their Effect on Intrinsic Value

Interest rates play a crucial role in determining the intrinsic value of a put option. The relationship between interest rates and intrinsic value is complex, but understanding it can help traders make more informed investment decisions. When interest rates rise, the intrinsic value of a put option decreases, making it less valuable to the holder. Conversely, when interest rates fall, the intrinsic value of a put option increases, making it more valuable.

The impact of interest rates on the intrinsic value of a put option can be attributed to the cost of carrying the underlying asset. When interest rates are high, the cost of carrying the underlying asset increases, making it more expensive to hold the asset. As a result, the intrinsic value of a put option decreases, as the holder is less likely to exercise the option. For instance, consider a put option with a strike price of $50 and an underlying asset with a high interest rate. If the current market price of the underlying asset is $45, the intrinsic value of the put option would be lower due to the increased cost of carrying the asset.

Traders can adjust their strategies to capitalize on changes in interest rates. For example, a trader may consider buying a put option when interest rates are low, as the option’s value is likely to increase. Conversely, a trader may consider selling a put option when interest rates are high, as the option’s value is likely to decrease. By understanding the impact of interest rates on the intrinsic value of a put option, traders can make more informed investment decisions and maximize their returns.

It’s essential to note that interest rates are not the only factor affecting the intrinsic value of a put option. Other factors, such as changes in the underlying asset price, time decay, and volatility, can also impact the option’s value. By considering these factors in conjunction with interest rates, traders can gain a more comprehensive understanding of the intrinsic value of a put option and make more informed investment decisions.

Real-World Examples of Intrinsic Value in Action

Intrinsic value plays a crucial role in options trading, and understanding its practical application can help traders make informed investment decisions. Let’s consider a few real-world examples to illustrate the concept’s significance.

Case Study 1: A put option with a strike price of $50 and an underlying asset price of $45 has an intrinsic value of $5. In this scenario, the option is in the money, and the holder can exercise the option to sell the underlying asset at the strike price, earning a profit of $5. This example demonstrates how intrinsic value can help traders identify profitable opportunities.

Case Study 2: A put option with a strike price of $60 and an underlying asset price of $65 has no intrinsic value. In this scenario, the option is out of the money, and the holder would not exercise the option. This example illustrates how intrinsic value can help traders avoid unprofitable trades.

Scenario 1: A trader buys a put option with a strike price of $40 and an underlying asset price of $35. The intrinsic value of the option is $5. As the underlying asset price falls to $30, the intrinsic value of the option increases to $10. This scenario demonstrates how changes in the underlying asset price can impact the intrinsic value of a put option.

Scenario 2: A trader sells a put option with a strike price of $50 and an underlying asset price of $55. The intrinsic value of the option is $0. As the underlying asset price falls to $45, the intrinsic value of the option increases to $5. This scenario illustrates how changes in the underlying asset price can impact the intrinsic value of a put option and affect the trader’s profit or loss.

These examples and scenarios demonstrate the practical application of intrinsic value in options trading. By understanding how intrinsic value is calculated and how it’s affected by various factors, traders can make more informed investment decisions and maximize their returns.

Maximizing Returns with Intrinsic Value Analysis

To maximize returns in options trading, it’s essential to combine intrinsic value analysis with other technical and fundamental analysis tools. By doing so, traders can make informed investment decisions and increase their chances of success.

One strategy is to use intrinsic value analysis in conjunction with technical indicators, such as moving averages and relative strength index (RSI). This approach can help traders identify overbought or oversold conditions in the market and make more accurate predictions about future price movements.

Another strategy is to combine intrinsic value analysis with fundamental analysis, such as examining a company’s financial statements and industry trends. This approach can provide a more comprehensive understanding of the underlying asset’s value and help traders make more informed investment decisions.

Traders can also use intrinsic value analysis to identify mispriced options and capitalize on arbitrage opportunities. By comparing the intrinsic value of a put option with its market price, traders can identify options that are undervalued or overvalued and make profitable trades.

In addition, traders can use intrinsic value analysis to adjust their strategies in response to changes in market conditions. For example, if interest rates rise, traders can use intrinsic value analysis to determine how the change will impact the value of their put options and adjust their positions accordingly.

By incorporating intrinsic value analysis into their trading strategy, traders can gain a deeper understanding of the options market and make more informed investment decisions. By combining intrinsic value analysis with other technical and fundamental analysis tools, traders can maximize their returns and achieve long-term success in options trading.

Ultimately, the key to maximizing returns with intrinsic value analysis is to stay flexible and adapt to changing market conditions. By continuously monitoring the intrinsic value of put options and adjusting their strategies accordingly, traders can stay ahead of the curve and achieve their investment goals.

:max_bytes(150000):strip_icc()/intrinsicvalue-11e4051f0881435d91c0df4f68e9395e.jpg)