What is a Trading Bot and How Does it Work with Interactive Brokers?

A trading bot, also known as an automated trading system or algorithmic trading, is a software program designed to execute trades based on predefined criteria and strategies. These bots can analyze market conditions, identify trading opportunities, and execute trades at optimal times, enabling traders to maximize profits and minimize risks. Interactive Brokers, a leading online brokerage firm, supports the integration of trading bots, offering a wide range of tools and resources for traders looking to harness the power of automated trading.

Trading bots can significantly enhance trading efficiency by automating repetitive tasks, reducing human error, and executing trades at the perfect moment. By leveraging advanced algorithms and data analysis techniques, these bots can identify trends and patterns that might be overlooked by human traders. Interactive Brokers provides traders with access to various trading bots, catering to different experience levels, trading goals, and risk appetites.

Key Features to Consider When Choosing an Interactive Brokers Trading Bot

When selecting an Interactive Brokers trading bot, it is crucial to consider several key features to ensure a seamless and efficient trading experience. These features include customizability, backtesting capabilities, risk management, and user interface.

Customizability

A top-tier trading bot should offer a high degree of customizability, allowing traders to tailor the bot to their specific trading goals and strategies. Customizable parameters may include entry and exit rules, risk management settings, and position sizing. By fine-tuning these settings, traders can create a bot that aligns with their unique trading style and preferences.

Backtesting Capabilities

Backtesting is an essential feature of any trading bot, enabling traders to test their strategies using historical data. This process allows traders to evaluate a bot’s performance, identify potential weaknesses, and fine-tune settings before deploying the bot in live trading. Interactive Brokers trading bots with robust backtesting capabilities can help traders gain confidence in their strategies and make more informed decisions.

Risk Management

Effective risk management is crucial for long-term trading success. An Interactive Brokers trading bot should include features that help traders manage and mitigate risk, such as stop-loss orders, take-profit orders, and position sizing tools. By incorporating these risk management measures, traders can protect their capital and minimize potential losses.

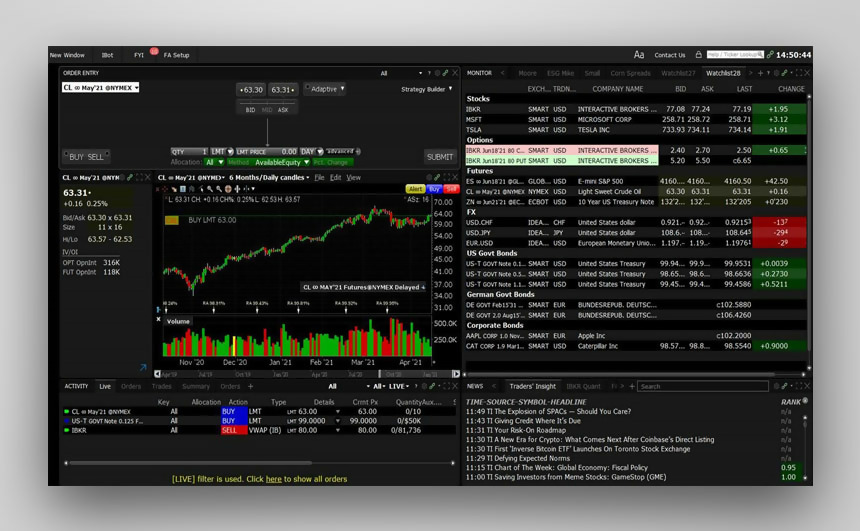

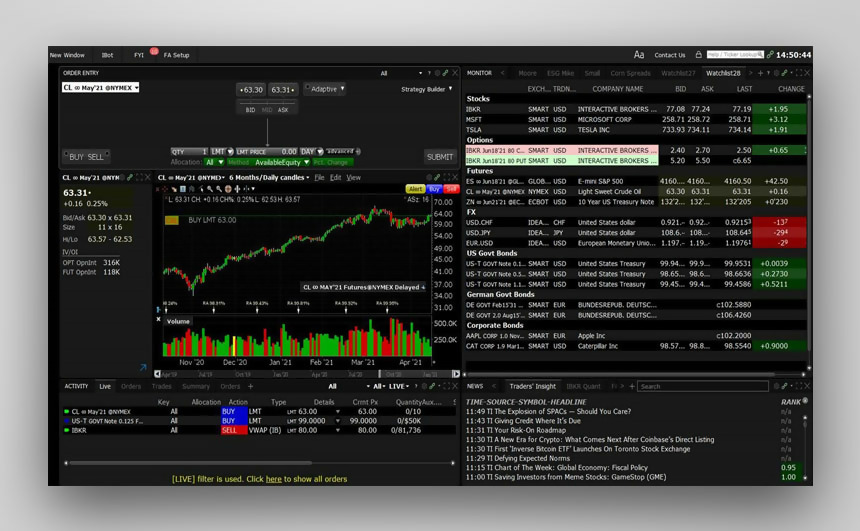

User Interface

An intuitive and user-friendly interface is essential for a positive trading experience. A well-designed user interface allows traders to easily navigate the platform, configure settings, and monitor performance. When evaluating Interactive Brokers trading bots, consider the overall design and functionality of the interface to ensure a smooth and efficient trading experience.

Ultimately, the best Interactive Brokers trading bot for you will depend on your individual trading goals, experience level, and risk appetite. By carefully considering these key features, you can select a bot that aligns with your needs and supports your trading journey.

Top Interactive Brokers Trading Bots: A Comparative Analysis

When selecting an Interactive Brokers trading bot, it is essential to compare the leading options to make an informed decision. This comparative analysis will highlight the unique features, pricing, and user reviews of the top Interactive Brokers trading bots, providing a balanced assessment of their strengths and weaknesses.

AlgoTrader

Features: AlgoTrader is a comprehensive trading bot solution designed for professional traders and institutions. It offers advanced features such as automated strategy execution, real-time risk management, and support for multiple asset classes. AlgoTrader also provides a user-friendly interface and extensive documentation, making it accessible to less experienced traders.

Pricing: AlgoTrader operates on a subscription-based model, with pricing starting at $1,500 per month. Customized enterprise solutions are also available for larger institutions.

User Reviews: Users praise AlgoTrader for its robust feature set and excellent customer support. However, some users note that the platform has a steep learning curve and may be overwhelming for beginners.

T3 Bot

Features: T3 Bot is a cloud-based trading bot designed for Interactive Brokers that offers a range of features, including customizable trading strategies, backtesting capabilities, and real-time market data. T3 Bot also supports multiple programming languages, allowing traders to create and implement their own algorithms.

Pricing: T3 Bot operates on a subscription-based model, with pricing starting at $49 per month. A free trial is also available for new users.

User Reviews: Users appreciate T3 Bot’s flexibility and customization options. However, some users note that the platform’s user interface could be more intuitive and user-friendly.

HaasBot

Features: HaasBot is a powerful trading bot that supports multiple exchanges, including Interactive Brokers. It offers a range of features, including advanced order types, customizable trading strategies, and real-time market data. HaasBot also includes a visual scripting interface, making it easier for less experienced traders to create and implement their own algorithms.

Pricing: HaasBot operates on a subscription-based model, with pricing starting at 0.12 BTC per three months. Lifetime subscriptions are also available.

User Reviews: Users praise HaasBot for its powerful features and flexibility. However, some users note that the platform’s pricing can be steep, especially for less experienced traders.

Freqtrade

Features: Freqtrade is an open-source trading bot that supports Interactive Brokers. It offers a range of features, including customizable trading strategies, backtesting capabilities, and real-time market data. Freqtrade also includes a user-friendly interface and extensive documentation.

Pricing: Freqtrade is free and open-source, making it an attractive option for traders on a budget.

User Reviews: Users appreciate Freqtrade’s flexibility and customization options. However, some users note that the platform’s user interface could be more intuitive and user-friendly.

Ultimately, the best Interactive Brokers trading bot for you will depend on your individual trading goals, experience level, and budget. By carefully comparing the top options, you can select a bot that aligns with your needs and supports your trading journey.

How to Set Up and Optimize Your Interactive Brokers Trading Bot

Setting up and optimizing an Interactive Brokers trading bot can be a straightforward process if you follow the right steps. Here is a comprehensive guide to help you get started:

Step 1: Create an Interactive Brokers Account

To use an Interactive Brokers trading bot, you first need to create an account with Interactive Brokers. Visit their website and follow the instructions to sign up for an account. Ensure that you provide all the necessary information and complete the verification process.

Step 2: Choose a Trading Bot

Once you have created your Interactive Brokers account, you need to choose a trading bot that aligns with your trading goals and experience level. Consider factors such as customizability, backtesting capabilities, risk management, and user interface when selecting a bot. Some popular Interactive Brokers trading bots include AlgoTrader, T3 Bot, HaasBot, and Freqtrade.

Step 3: Set Up the Trading Bot

After selecting a trading bot, you need to set it up to work with your Interactive Brokers account. This typically involves creating an API key or connecting the bot to your Interactive Brokers account. Follow the instructions provided by the bot’s developer to complete the setup process.

Step 4: Configure the Trading Bot

Once you have set up the trading bot, you need to configure it to suit your trading strategy. This involves setting up the bot’s parameters, such as the assets to trade, the trading frequency, and the risk management settings. Ensure that you test the bot’s configuration thoroughly before deploying it in a live trading environment.

Step 5: Implement the Trading Strategy

After configuring the trading bot, you can implement your trading strategy. This involves setting up the bot’s trading rules, such as the entry and exit criteria, the position sizing, and the risk management settings. Ensure that you monitor the bot’s performance closely and adjust the strategy as necessary to optimize its performance.

Step 6: Monitor and Optimize the Trading Bot

Finally, you need to monitor the trading bot’s performance regularly and optimize its settings as necessary. This involves tracking the bot’s trades, analyzing its performance, and adjusting its parameters to improve its results. Ensure that you stay up-to-date with market conditions and adjust the bot’s strategy accordingly to maximize its profits and minimize its risks.

By following these steps, you can set up and optimize an Interactive Brokers trading bot that aligns with your trading goals and enhances your trading efficiency. Remember to choose a bot that aligns with your experience level and trading strategy, and to monitor its performance regularly to optimize its results.

Maximizing Profits and Minimizing Risks with Interactive Brokers Trading Bots

When using trading bots on Interactive Brokers, it’s essential to implement strategies that maximize profits while minimizing risks. Here are some tips and best practices to help you achieve this:

Implement Risk Management Strategies

Risk management is crucial when using trading bots. Implement strategies such as setting stop-loss orders, position sizing, and diversification to minimize potential losses. Additionally, consider using a risk management tool or feature offered by the trading bot to help you manage your risk more effectively.

Monitor Performance Regularly

Regularly monitoring the performance of your trading bot is essential to ensure that it’s performing as expected. Analyze the bot’s trades, evaluate its performance, and adjust its parameters as necessary to optimize its results. Consider setting up alerts or notifications to stay informed about the bot’s performance in real-time.

Diversify Your Portfolio

Diversification is a key strategy for minimizing risk in trading. Consider using a trading bot that supports multiple assets or markets, and implement a diversified trading strategy that spreads your risk across different assets or markets.

Implement a Sound Trading Strategy

Implementing a sound trading strategy is essential when using a trading bot. Ensure that the bot’s trading rules align with your trading goals and risk tolerance. Consider backtesting the strategy using historical data to evaluate its performance before deploying it in a live trading environment.

Stay Up-to-Date with Market Conditions

Staying up-to-date with market conditions is essential when using a trading bot. Monitor market trends, news, and events that may impact your trading strategy. Consider adjusting the bot’s parameters or strategy as necessary to adapt to changing market conditions.

Use a Reputable Trading Bot

Using a reputable trading bot is essential for minimizing risks. Choose a bot that has a proven track record, positive user reviews, and robust risk management features. Consider selecting a bot that offers a free trial or demo account to test its performance before investing in it.

By implementing these tips and best practices, you can maximize profits and minimize risks when using trading bots on Interactive Brokers. Remember to stay up-to-date with market conditions, implement sound risk management strategies, and choose a reputable trading bot to enhance your trading experience.

Navigating Legal and Ethical Considerations in Automated Trading

When using trading bots on Interactive Brokers, it’s essential to consider legal and ethical concerns related to automated trading activities. Here are some regulations, guidelines, and potential pitfalls to avoid when engaging in automated trading:

Regulations

Interactive Brokers is regulated by various financial authorities, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). These regulatory bodies have guidelines and rules regarding automated trading activities. Ensure that your use of trading bots complies with these regulations to avoid legal issues.

Guidelines

Interactive Brokers has guidelines for using trading bots on its platform. These guidelines aim to prevent market manipulation, fraud, and other unethical practices. Ensure that your use of trading bots complies with these guidelines to avoid account restrictions or termination.

Potential Pitfalls

Using trading bots on Interactive Brokers can lead to potential pitfalls, such as market manipulation, algorithm errors, and unethical practices. To avoid these pitfalls, ensure that your trading bot complies with regulations and guidelines, uses reliable data sources, and implements robust risk management strategies.

Preventing Market Manipulation

Market manipulation is a significant concern in automated trading. To prevent market manipulation, ensure that your trading bot complies with regulations and guidelines, avoids aggressive trading strategies, and implements robust risk management strategies.

Avoiding Algorithm Errors

Algorithm errors can occur when using trading bots, leading to significant losses. To avoid algorithm errors, ensure that your trading bot is thoroughly tested, uses reliable data sources, and implements robust risk management strategies.

Preventing Unethical Practices

Unethical practices, such as insider trading and front-running, can occur when using trading bots. To prevent unethical practices, ensure that your trading bot complies with regulations and guidelines, avoids using confidential information, and implements robust risk management strategies.

By considering legal and ethical concerns related to automated trading activities, you can avoid potential pitfalls and ensure that your use of trading bots on Interactive Brokers is compliant with regulations and guidelines. Remember to stay informed about regulatory updates, comply with guidelines, and implement robust risk management strategies to enhance your trading experience.

The Future of Interactive Brokers Trading Bots: Trends and Predictions

As technology advances, the world of automated trading is poised for significant changes. Here are some emerging trends and future predictions for Interactive Brokers trading bots, including the potential impact of advancements in artificial intelligence (AI), machine learning (ML), and data analysis on automated trading:

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are becoming increasingly important in automated trading, enabling trading bots to make more informed decisions based on vast amounts of data. AI-powered trading bots can analyze market trends, identify patterns, and execute trades more efficiently than traditional bots. As AI and ML technologies continue to evolve, we can expect to see more sophisticated and intelligent trading bots on Interactive Brokers.

Data Analysis

Data analysis is a critical component of automated trading, and advancements in data analysis techniques are transforming the way trading bots operate. With the ability to process and analyze vast amounts of data in real-time, trading bots can make more informed decisions and execute trades more efficiently. As data analysis techniques continue to improve, we can expect to see more accurate and reliable trading bots on Interactive Brokers.

Integration with Other Platforms

As automated trading becomes more popular, there is a growing demand for trading bots that can integrate with other platforms, such as social media, news sites, and financial analysis tools. By integrating with these platforms, trading bots can access real-time data and market insights, enabling them to make more informed decisions and execute trades more efficiently. As integration with other platforms becomes more prevalent, we can expect to see more sophisticated and versatile trading bots on Interactive Brokers.

Customizability and Personalization

Customizability and personalization are becoming increasingly important in automated trading, as traders seek bots that can be tailored to their specific trading goals and strategies. With the ability to customize and personalize trading bots, traders can create bots that align with their unique trading styles and preferences. As customizability and personalization become more prevalent, we can expect to see more personalized and specialized trading bots on Interactive Brokers.

Regulations and Compliance

As automated trading becomes more widespread, regulatory bodies are paying closer attention to the use of trading bots. To ensure compliance with regulations, trading bots must be transparent, secure, and reliable. As regulations and compliance become more stringent, we can expect to see more secure and reliable trading bots on Interactive Brokers.

By staying informed about emerging trends and future predictions for Interactive Brokers trading bots, traders can leverage the power of AI, ML, data analysis, integration with other platforms, customizability, and personalization to enhance their trading experience. As automated trading continues to evolve, traders can look forward to more sophisticated and intelligent trading bots that can help them maximize profits and minimize risks.

Conclusion: Making the Most of Interactive Brokers Trading Bots

Throughout this comprehensive review, we have explored the world of Interactive Brokers trading bots, their key features, top choices, and setup processes. We have also discussed best practices for maximizing profits, minimizing risks, and navigating legal and ethical considerations. By understanding the potential of trading bots and how to use them effectively, Interactive Brokers traders can significantly enhance their trading experience.

When selecting an Interactive Brokers trading bot, it is crucial to consider essential features such as customizability, backtesting capabilities, risk management, and user interface. By aligning the trading bot with your specific goals and experience level, you can ensure a more efficient and profitable trading journey. It is also important to stay informed about emerging trends and future predictions, such as advancements in artificial intelligence, machine learning, and data analysis, which can further transform the automated trading landscape.

In conclusion, Interactive Brokers trading bots offer a powerful and efficient way to participate in the financial markets. By carefully considering your options, setting up and optimizing your bot, and adhering to best practices, you can unlock the full potential of these innovative tools. For more information and resources on Interactive Brokers trading bots, we encourage you to continue exploring reputable sources and communities dedicated to automated trading.

By harnessing the power of trading bots, Interactive Brokers traders can gain a competitive edge and achieve their financial goals with greater ease and confidence.

ARTICLE