Understanding Implied Volatility: A Market’s Expectation

Implied volatility (IV) is a crucial concept in options trading. It represents the market’s forecast of a stock’s price fluctuations over an option’s lifespan. Unlike historical volatility, which looks at past price movements, implied volatility reflects current market sentiment and expectations about future volatility. Traders use implied volatility black scholes model calculations to price options. The implied volatility black scholes model is a cornerstone of options pricing, but it has limitations. A higher implied volatility suggests the market anticipates greater price swings, leading to higher option premiums. Conversely, lower implied volatility indicates a calmer market outlook and lower option prices. Understanding implied volatility is fundamental for effective option trading strategies. The implied volatility black scholes model provides a framework for this understanding.

Implied volatility is not directly observable. It’s derived from option prices using models like the implied volatility black scholes model. This model requires inputs such as the underlying asset’s price, strike price, time to expiration, risk-free interest rate, and the implied volatility itself. Since the implied volatility is unknown, an iterative process is used to find the volatility figure that makes the model’s theoretical option price match the market’s observed price. This iterative process often involves specialized calculators or software. Accurate implied volatility calculation is crucial for effective option pricing and trading strategies. The accuracy of implied volatility derived from the implied volatility black scholes model depends heavily on the model’s assumptions, which can be unrealistic in certain market conditions.

The relationship between implied volatility and option prices is direct. Higher implied volatility generally results in higher option premiums, as traders are willing to pay more for the increased potential for profit (or reduced risk of loss) associated with greater price movement. Conversely, lower implied volatility typically translates into lower option premiums. The implied volatility black scholes model helps quantify this relationship. However, it’s essential to remember that implied volatility is a forward-looking measure, representing market sentiment rather than a guaranteed prediction of future price movements. Experienced traders utilize implied volatility alongside other market indicators to make informed trading decisions. The implied volatility black scholes model serves as a valuable tool but should be used with caution, given its inherent limitations.

The Black-Scholes Model and Its Role in Option Valuation

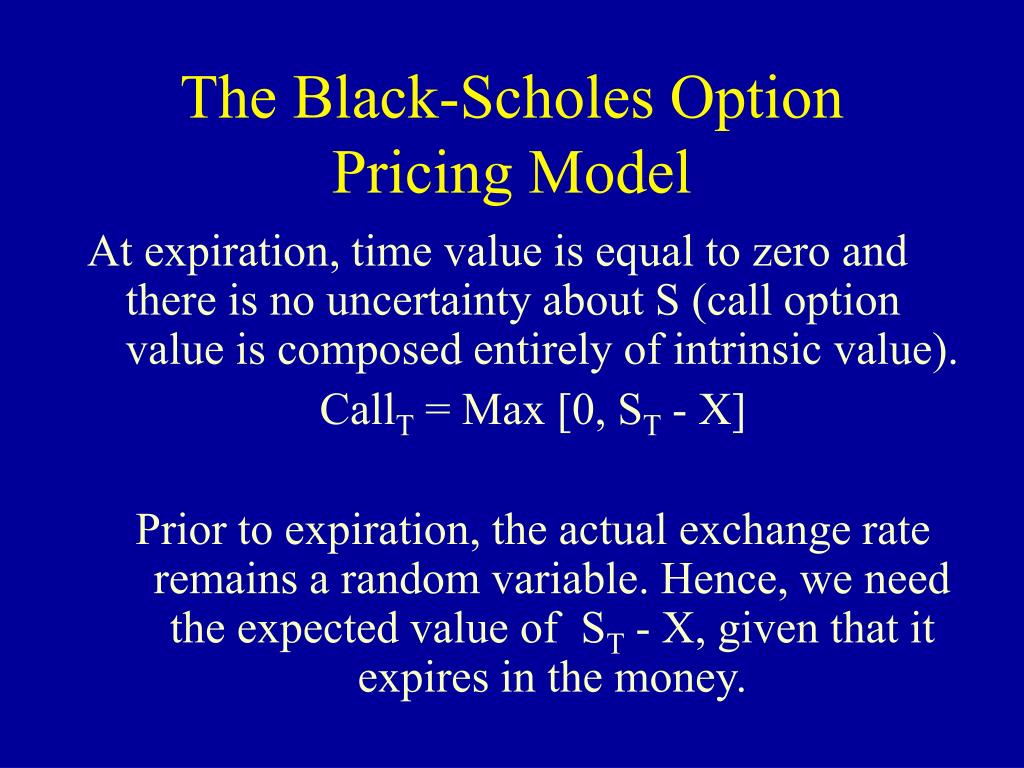

The Black-Scholes model provides a foundational framework for option pricing. This model uses several key assumptions, including constant volatility, efficient markets, and no dividends. It calculates a theoretical price for European-style options, which can be compared to market prices. The implied volatility black scholes model, while simplified, offers a baseline for understanding option values and the relationship between price and volatility. Understanding its limitations is crucial for practical application.

A core element of the Black-Scholes model is its reliance on volatility as a key input. The model assumes a constant volatility throughout the option’s life. This assumption, however, often deviates from real-world market behavior. Volatility fluctuates constantly, driven by various market factors. This discrepancy between the model’s constant volatility assumption and real-world volatility dynamics affects the accuracy of the option price derived from the implied volatility black scholes model. The model, therefore, works best for short-dated options on liquid underlying assets where volatility changes are relatively small.

Despite its limitations, the Black-Scholes model remains a vital tool in finance. It allows traders and investors to price options and calculate theoretical values. By comparing the model’s output to observed market prices, one can derive implied volatility. This implied volatility then reflects market participants’ expectations regarding the future volatility of the underlying asset. The implied volatility black scholes model provides a starting point for more complex option pricing models that account for time-varying volatility and other market realities.

How to Extract Implied Volatility from Option Prices

The extraction of implied volatility (IV) from observed option prices involves an iterative numerical process when using the Black-Scholes model. Since implied volatility is not directly observable in the market, it must be derived. The core principle involves adjusting the volatility input within the Black-Scholes model until the theoretical option price matches the actual market price. This reconciliation is crucial for understanding market sentiment. This process relies heavily on the relationship between option prices and volatility as described by the Black-Scholes model.

The methodology leverages the Black-Scholes model, which provides a theoretical framework for option pricing. The challenge lies in the fact that the model requires volatility as an input, whereas in practice, we observe the option price and need to infer the corresponding volatility. To accomplish this, numerical methods, such as the Newton-Raphson method or bisection method, are employed. These methods iteratively refine the volatility estimate until the Black-Scholes price converges to the market price of the option. Various financial calculators and specialized software packages are readily available to perform these calculations, streamlining the process for traders and analysts. The implied volatility black scholes model calculation is a cornerstone of options trading.

The iterative process begins with an initial guess for the implied volatility. The Black-Scholes model is then used to calculate the theoretical option price based on this initial guess. The calculated price is compared to the actual market price of the option. If there is a discrepancy, the numerical method adjusts the volatility estimate and the Black-Scholes model is re-applied. This cycle continues until the difference between the calculated price and the market price falls within an acceptable threshold. This extracted implied volatility black scholes model represents the market’s consensus view on the expected future volatility of the underlying asset over the option’s lifespan. The accurate extraction of implied volatility is essential for implementing effective option trading strategies and risk management techniques. This constant interplay between the market price and the Black-Scholes model underscores the importance of understanding the model’s assumptions and limitations.

Interpreting Implied Volatility Surfaces: A Visual Guide

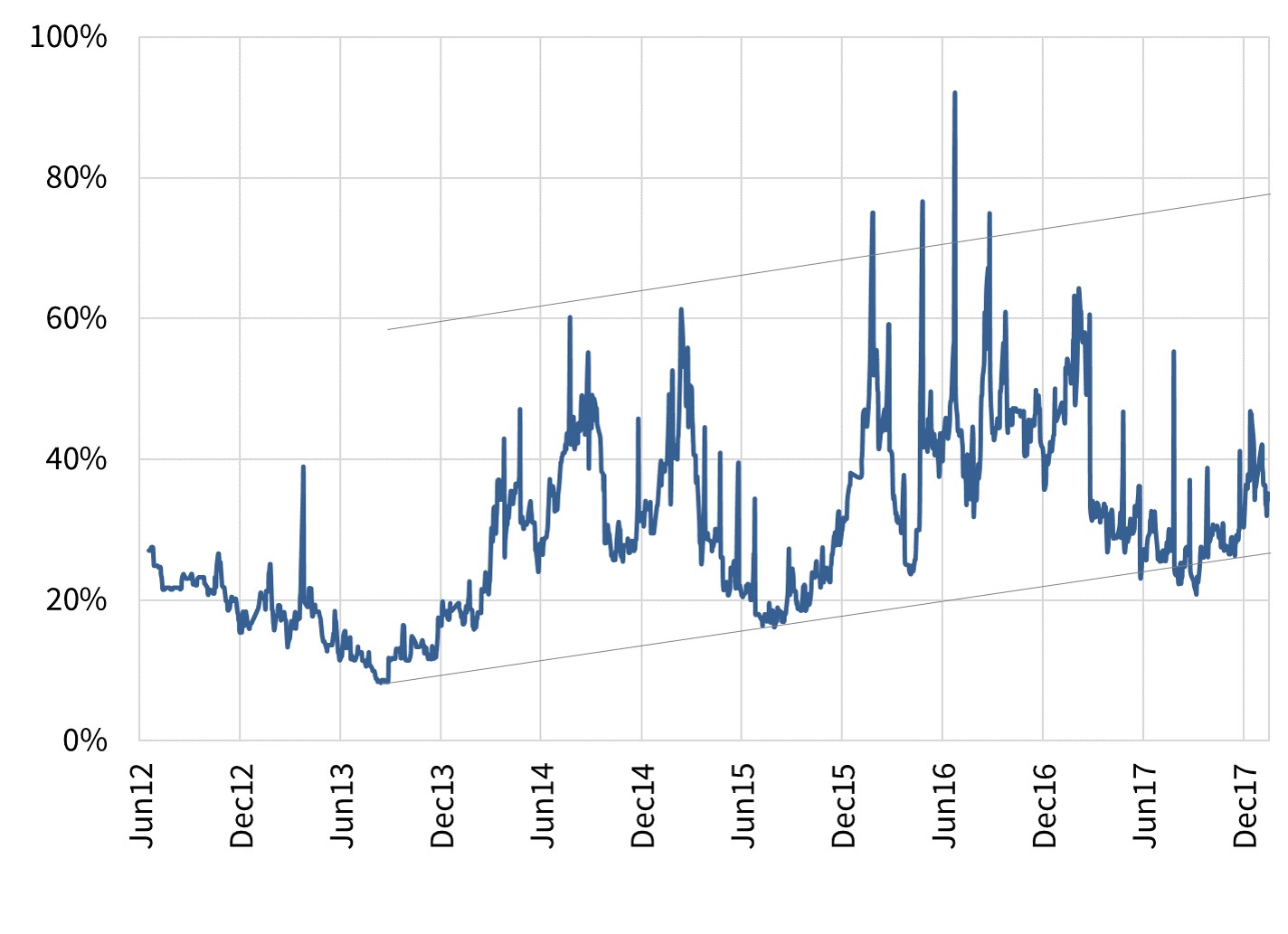

The implied volatility surface provides a visual representation of implied volatility (IV) across a range of strike prices and expiration dates for a particular underlying asset. It is often referred to as a volatility smile or skew, depending on its shape. Understanding this surface is crucial for option traders as it reflects the market’s expectations of future price movements at different price levels. The implied volatility black scholes model is the foundation for calculating and interpreting these surfaces.

Ideally, according to the basic Black-Scholes model, implied volatility should be the same across all strike prices for a given expiration date. However, in reality, this is rarely the case. The ‘smile’ effect, commonly observed, shows that options with strike prices further away from the current market price (both in-the-money and out-of-the-money) tend to have higher implied volatilities than those closer to the money. This indicates that the market perceives a greater probability of extreme price movements than what is predicted by a normal distribution, an assumption of the Black-Scholes model. The degree of the skew or smile can also provide insights into market sentiment. For instance, a steeper skew suggests a greater demand for downside protection, as investors are willing to pay more for out-of-the-money put options. Changes in the shape of the implied volatility surface can signal shifts in market expectations and potential trading opportunities.

Several factors can influence the shape of the implied volatility surface. Supply and demand for specific options, market events, and news announcements all play a role. For example, an upcoming earnings announcement might increase the implied volatility for options expiring shortly after the announcement date. Similarly, geopolitical uncertainty or economic data releases can also lead to changes in the surface. The Black-Scholes model provides a theoretical framework, but real-world market dynamics significantly impact implied volatility. Analyzing the implied volatility surface helps traders understand the market’s perception of risk and potential price movements, enabling them to make more informed decisions about option pricing and trading strategies. Traders often use the implied volatility black scholes model results as a benchmark to compare with the surface shape.

Factors Influencing Implied Volatility: Market Dynamics and News Events

External factors significantly influence implied volatility (IV) levels. These factors impact option prices and trading strategies. Earnings announcements often cause a surge in IV. The anticipation of news releases affects market sentiment. Economic news, such as inflation reports, can lead to large IV swings. Geopolitical events also play a crucial role. Unexpected events increase uncertainty. This increased uncertainty translates into higher option premiums. This is reflected in the increased implied volatility black scholes model calculations use.

Company-specific news profoundly impacts individual stock options. For instance, a pharmaceutical company awaiting FDA approval may see heightened IV in its options. This reflects the binary outcome of approval or rejection. Macroeconomic events influence the overall market. Interest rate decisions by central banks can affect all equities. Changes in investor confidence drive volatility levels. Periods of economic expansion often see lower IV. Conversely, recessions and market downturns correlate with higher IV. This dynamic interplay emphasizes the role of the implied volatility black scholes model in interpreting market expectations.

Furthermore, unexpected shocks, or “black swan” events, can trigger substantial jumps in IV. Examples include natural disasters or surprise political outcomes. Such events create widespread uncertainty. Market participants rush to buy options for protection. This increased demand drives up option prices. Consequently, implied volatility rises sharply. Understanding the factors that impact implied volatility is crucial for option traders. It is essential to evaluate these factors alongside the implied volatility black scholes model. Traders can then make informed decisions about buying or selling options. They can also design effective hedging strategies.

Using Implied Volatility in Trading Strategies: Exploiting Volatility Skews

Traders actively utilize implied volatility to inform their option trading strategies, seeking to capitalize on perceived mispricings and market inefficiencies. One common approach involves identifying discrepancies between implied volatility and subsequent realized volatility. Realized volatility is the actual volatility observed in the market over a specific period. If a trader believes that the implied volatility priced into an option is higher than what the actual volatility will be, they might consider selling that option, hoping to profit from the volatility contraction. Conversely, if they anticipate higher volatility than the market is pricing in, they might buy options. The implied volatility black scholes model framework is essential for this comparison.

Several option strategies are specifically designed to exploit volatility skews and movements. A straddle involves simultaneously buying a call and a put option with the same strike price and expiration date. This strategy profits from significant price movements in either direction, regardless of whether the price goes up or down. A strangle is similar to a straddle but uses out-of-the-money options (a call with a strike price above the current market price and a put with a strike price below). Strangles are generally cheaper to implement than straddles but require a larger price movement to become profitable. Volatility arbitrage strategies aim to profit from differences in implied volatility between different options on the same underlying asset or between related assets. These strategies often involve complex hedging techniques to minimize directional risk.

Trading strategies based on implied volatility are not without risk. Volatility is inherently difficult to predict, and even sophisticated models can be wrong. A sudden market event or unexpected news can dramatically shift volatility levels, leading to losses for traders who are incorrectly positioned. The Black-Scholes model, while useful for understanding implied volatility black scholes model concepts, relies on assumptions that may not always hold true in the real world. For example, the assumption of constant volatility is often violated, especially during periods of market stress. Furthermore, transaction costs and the bid-ask spread can erode profits, particularly for short-term trading strategies. Therefore, a thorough understanding of risk management principles and careful consideration of market dynamics are crucial for success in volatility-based trading. The implied volatility black scholes model continues to be a fundamental tool, its limitations notwithstanding.

Limitations of the Black-Scholes Model in Implied Volatility Calculation

The Black-Scholes model, while foundational in option pricing, operates under several assumptions that can impact the accuracy of implied volatility calculations. A primary limitation lies in its assumption of constant volatility over the option’s life. In reality, volatility fluctuates due to market dynamics and news events, rendering the constant volatility assumption unrealistic. This is a critical consideration when utilizing the implied volatility black scholes model.

The constant volatility assumption is particularly problematic for options with longer maturities. Over extended periods, the likelihood of significant volatility shifts increases, making the implied volatility derived from the Black-Scholes model less reliable. Similarly, options with extreme strike prices, far away from the current market price, often exhibit implied volatilities that deviate substantially from the model’s output. This phenomenon, known as the volatility smile or skew, highlights the model’s inability to accurately capture the full range of market expectations. The implied volatility black scholes model struggles to account for these market realities.

To address these limitations, more sophisticated models have been developed. These alternative models attempt to relax the constant volatility assumption and better reflect observed market behavior. While the Black-Scholes model provides a useful starting point for understanding option pricing and extracting implied volatility, it is essential to acknowledge its inherent limitations. Recognizing these shortcomings is crucial for traders and analysts who rely on implied volatility black scholes model data to make informed decisions and implement effective trading strategies. The accuracy of implied volatility calculations depends on understanding these limitations and, when necessary, employing more advanced modeling techniques.

Beyond Black-Scholes: Advanced Volatility Modeling Techniques

The Black-Scholes model, while foundational in option pricing, operates under simplifying assumptions that can limit its accuracy, particularly when dealing with complex market dynamics or exotic options. One of its key limitations is the assumption of constant volatility. The real world exhibits volatility that fluctuates over time and varies across different strike prices and expiration dates. To address these shortcomings, more advanced volatility modeling techniques have been developed. These models strive to provide a more realistic and nuanced representation of volatility dynamics, leading to potentially more accurate option pricing and risk management. These advancements are essential for sophisticated trading strategies and a deeper understanding of market behavior, moving beyond the constraints of the basic implied volatility black scholes model framework.

Stochastic volatility models represent a significant step forward. Unlike the Black-Scholes model, these models treat volatility as a random process, acknowledging that it changes unpredictably over time. A prominent example is the Heston model, which incorporates factors like volatility’s mean reversion and its own volatility (vol of vol) to better capture market realities. These models often provide a better fit to observed option prices, especially for longer-dated options where the constant volatility assumption of the implied volatility black scholes model is most problematic. Another approach involves local volatility models. These models aim to construct a volatility surface that is consistent with observed market prices of options with different strikes and maturities. By calibrating the volatility to market data, local volatility models can better capture the volatility smile or skew, offering a more precise pricing tool for complex option strategies.

The use of these advanced models requires more computational power and specialized knowledge compared to the Black-Scholes model. However, they offer several advantages in terms of accuracy and the ability to capture complex market phenomena. By incorporating time-varying volatility, volatility clustering, and other realistic features, these models provide a more robust framework for option pricing and risk management. Traders and financial institutions increasingly rely on these advanced techniques to navigate the complexities of the options market and to effectively manage their exposure to volatility risk. Understanding the nuances of these models is crucial for anyone seeking to move beyond the basics of option pricing and delve into the sophisticated world of implied volatility black scholes model analysis and its extensions. The future of option pricing undoubtedly lies in the continued development and refinement of these advanced volatility modeling techniques.