What Happens When Supply and Demand Are Out of Sync

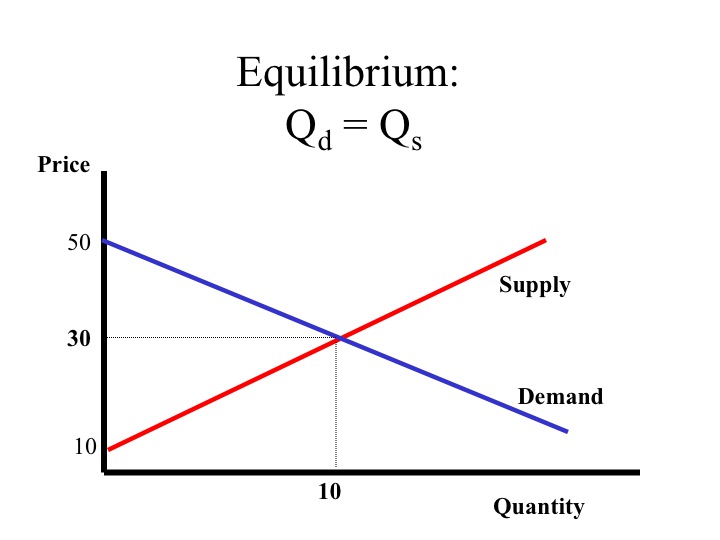

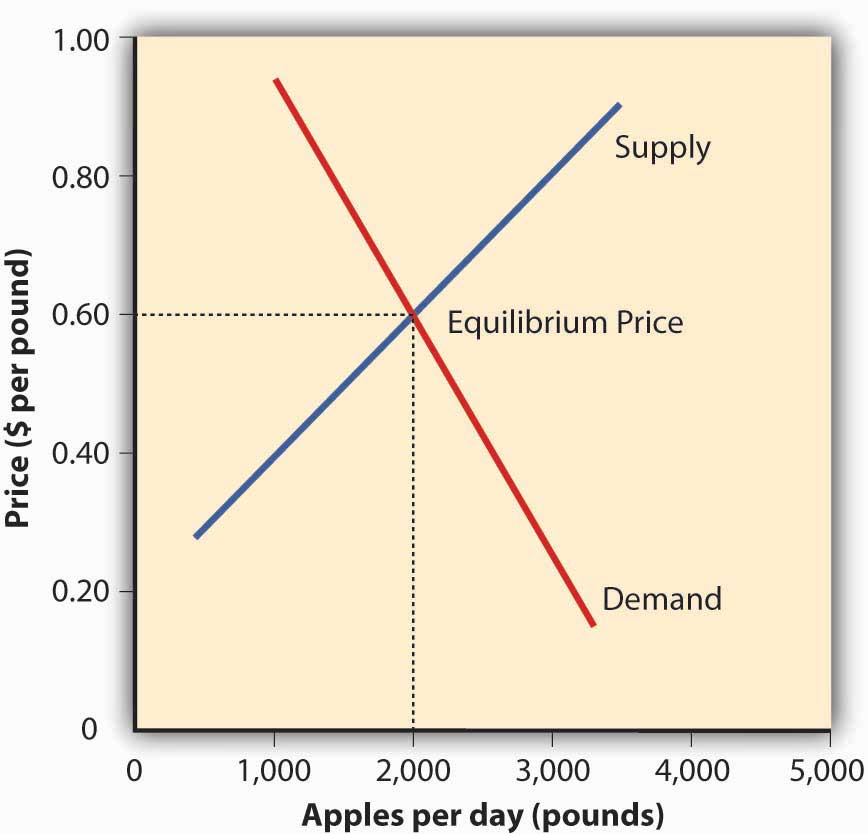

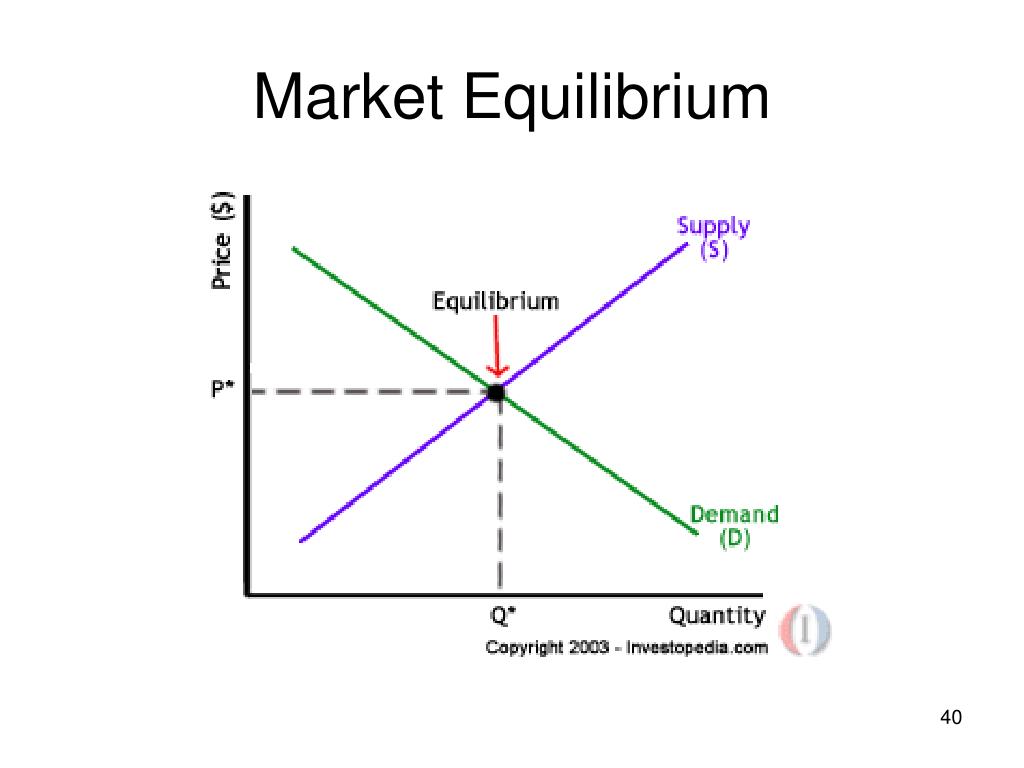

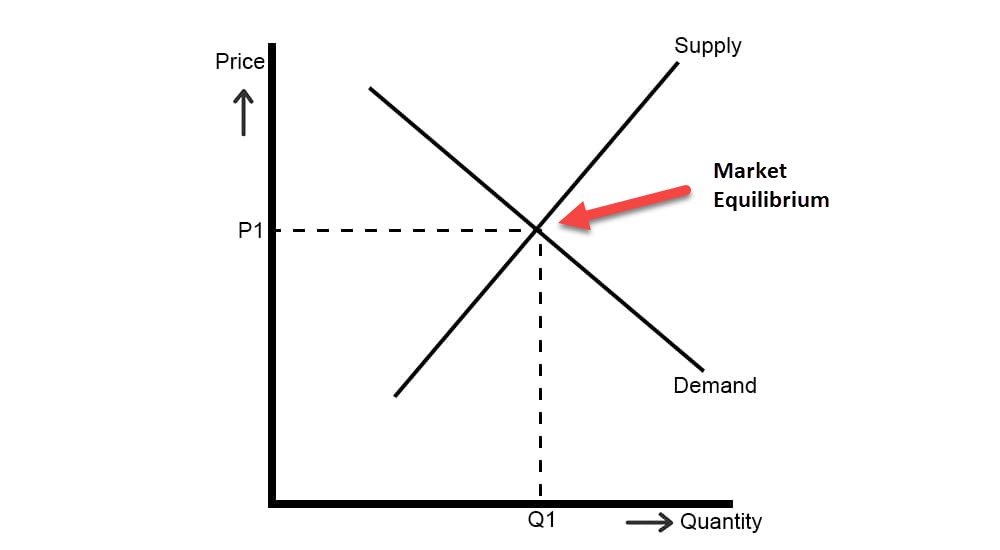

In a perfectly competitive market, the forces of supply and demand work together to achieve equilibrium, where the quantity of a good or service that consumers are willing to buy equals the quantity that producers are willing to supply. However, if a market is not at equilibrium, the consequences can be far-reaching. When supply and demand are out of sync, prices can fluctuate wildly, leading to uncertainty and instability in the market. This, in turn, can affect the overall economy, as businesses and consumers struggle to adapt to the changing market conditions.

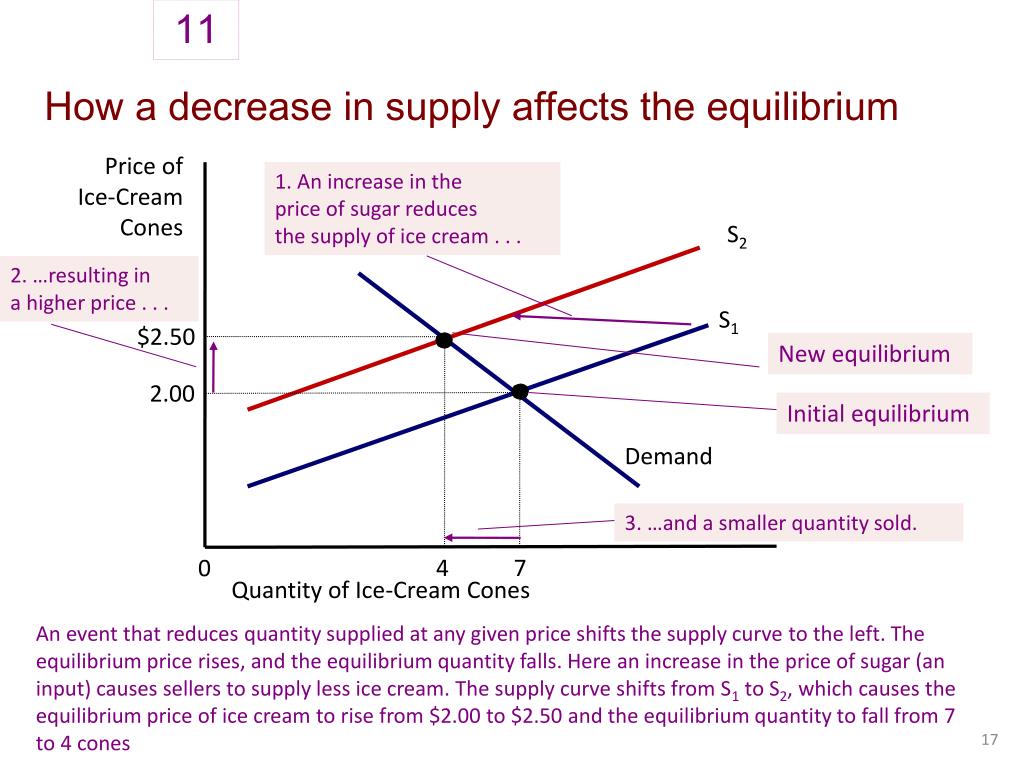

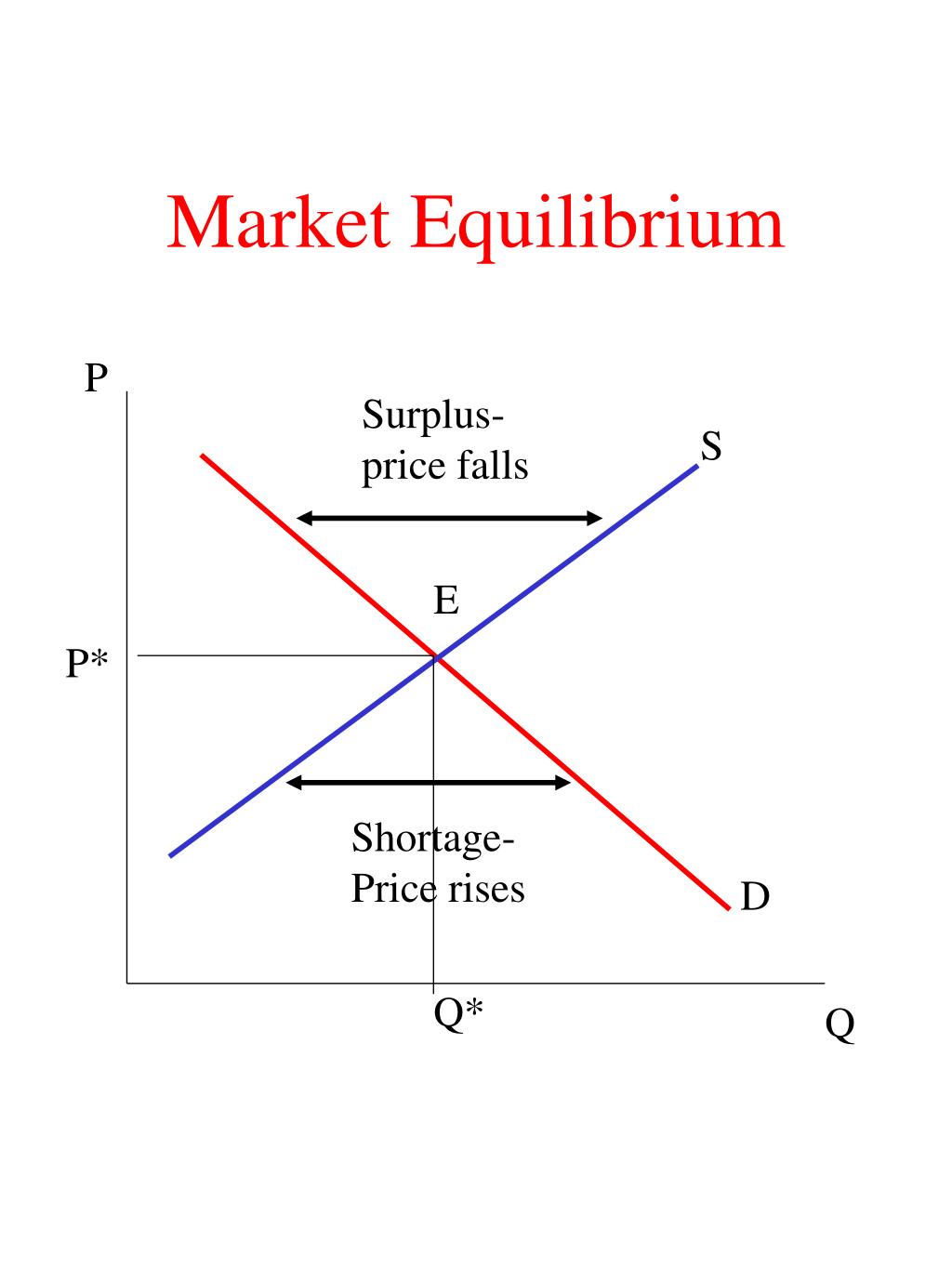

If a market is not at equilibrium, it can lead to a surplus or shortage of goods and services. For instance, if the supply of a particular product exceeds demand, businesses may be left with unsold inventory, leading to losses and decreased production. On the other hand, if demand outstrips supply, consumers may face shortages, leading to increased prices and decreased satisfaction. In both cases, the market is not functioning efficiently, and resources are not being allocated in the most effective way.

The effects of a market not at equilibrium can also be seen in the prices of goods and services. If demand is high and supply is low, prices tend to rise, making it difficult for consumers to afford the products they need. Conversely, if supply is high and demand is low, prices may fall, making it difficult for businesses to remain profitable. In either case, the market is not in a state of equilibrium, and the consequences can be felt throughout the economy.

Identifying the Causes of Market Disequilibrium

Market disequilibrium can occur due to a variety of factors, including changes in consumer preferences, technological advancements, and external shocks. For instance, if consumer preferences shift towards more sustainable products, the demand for eco-friendly goods may increase, leading to a surplus of traditional products and a shortage of sustainable ones. This can cause prices to fluctuate and the market to become unstable.

Technological advancements can also lead to market disequilibrium. The introduction of new production methods or products can increase supply, leading to a surplus of goods and a decrease in prices. On the other hand, if the technology is not widely adopted, it can lead to a shortage of goods and an increase in prices. External shocks, such as natural disasters or global pandemics, can also disrupt the balance of supply and demand, leading to market disequilibrium.

In addition, changes in government policies, trade agreements, and global events can also contribute to market disequilibrium. For example, if a government imposes tariffs on imported goods, it can lead to a decrease in demand and a surplus of goods. Similarly, if a trade agreement is signed, it can lead to an increase in demand and a shortage of goods. If a market is not at equilibrium, it can have far-reaching consequences, including price volatility, reduced investment, and decreased economic growth.

How to Recognize the Signs of a Disequilibrated Market

Identifying the signs of a market that is not in equilibrium is crucial for businesses, investors, and policymakers to make informed decisions. If a market is not at equilibrium, it can exhibit certain characteristics that can be recognized and addressed. One of the primary signs of a disequilibrated market is a change in price trends. If prices are rising or falling rapidly, it may indicate that the market is not in equilibrium.

Another sign of a disequilibrated market is a change in inventory levels. If businesses are holding excess inventory or struggling to meet demand, it can be a sign that the market is not in equilibrium. Additionally, changes in market sentiment, such as a shift in consumer confidence or a change in investor attitudes, can also indicate that a market is not in equilibrium.

Other signs of a disequilibrated market include changes in production levels, employment rates, and resource allocation. If a market is not at equilibrium, it can lead to inefficiencies and misallocations of resources, which can have far-reaching consequences for the economy. By recognizing the signs of a disequilibrated market, stakeholders can take steps to address the imbalance and restore equilibrium.

The Consequences of Prolonged Disequilibrium

If a market is not at equilibrium, it can have far-reaching consequences for the economy. One of the primary consequences of prolonged disequilibrium is market volatility. When supply and demand are out of sync, prices can fluctuate rapidly, making it difficult for businesses and investors to make informed decisions. This volatility can lead to reduced investment, as investors become cautious in uncertain market conditions.

Another consequence of prolonged disequilibrium is decreased economic growth. If a market is not at equilibrium, resources may be misallocated, leading to inefficiencies and reduced productivity. This can result in decreased economic growth, as businesses and industries struggle to operate in an unstable market environment.

In addition, prolonged disequilibrium can lead to social and political unrest. If a market is not at equilibrium, it can lead to income inequality, as some individuals or groups may benefit from the imbalance at the expense of others. This can result in social and political unrest, as those who are negatively affected by the imbalance demand change.

Furthermore, prolonged disequilibrium can also lead to a decrease in consumer confidence. If a market is not at equilibrium, consumers may become uncertain about the future, leading to reduced spending and investment. This can have a ripple effect throughout the economy, leading to reduced economic growth and stability.

Strategies for Restoring Market Equilibrium

When a market is not at equilibrium, it is essential to implement strategies to restore balance and stability. One potential strategy is government intervention, which can take the form of monetary or fiscal policy changes. For example, if a market is experiencing a surplus, the government may reduce taxes or increase government spending to stimulate demand.

Another strategy for restoring market equilibrium is to adjust production levels. If a market is experiencing a shortage, businesses may need to increase production to meet demand. Conversely, if a market is experiencing a surplus, businesses may need to reduce production to avoid overstocking.

Adjustments to pricing strategies can also help to restore market equilibrium. If a market is not at equilibrium, businesses may need to adjust their prices to reflect changes in supply and demand. For example, if a market is experiencing a shortage, businesses may need to increase prices to reduce demand and incentivize production.

In addition, businesses can also use marketing strategies to influence demand and supply. For instance, if a market is experiencing a surplus, businesses may need to launch targeted marketing campaigns to increase demand and reduce inventory levels.

Ultimately, the key to restoring market equilibrium is to identify the underlying causes of the imbalance and implement targeted strategies to address them. If a market is not at equilibrium, it is essential to take proactive steps to restore balance and stability, as prolonged disequilibrium can have far-reaching consequences for the economy.

The Role of Market Forces in Achieving Equilibrium

In a market economy, market forces play a crucial role in achieving equilibrium. Supply and demand are the two primary market forces that interact to determine the prices of goods and services. When supply and demand are in balance, the market is said to be in equilibrium.

If a market is not at equilibrium, market forces can help to restore balance. For example, if there is a surplus of a particular good, the price will tend to fall, which will incentivize consumers to buy more and reduce the surplus. Conversely, if there is a shortage, the price will tend to rise, which will incentivize producers to increase production and reduce the shortage.

It is essential to allow market forces to operate freely, without government intervention or other external influences. When market forces are allowed to operate freely, they can help to allocate resources efficiently and promote economic growth.

In addition, market forces can also help to correct market disequilibrium by providing signals to producers and consumers. For instance, changes in prices can signal to producers whether they need to increase or decrease production, while changes in quantity demanded can signal to consumers whether they need to adjust their consumption patterns.

Overall, market forces play a vital role in achieving equilibrium in a market economy. By allowing market forces to operate freely, markets can self-correct and achieve a state of balance, which is essential for promoting economic growth and stability.

Real-World Examples of Market Disequilibrium

Market disequilibrium is not just a theoretical concept, but a real-world phenomenon that has been observed in various markets. One notable example is the housing market bubble that occurred in the United States in the mid-2000s. During this period, housing prices skyrocketed, leading to a surplus of housing supply. However, the demand for housing was not sufficient to absorb the surplus, leading to a market disequilibrium. The consequences of this disequilibrium were severe, including a sharp decline in housing prices, widespread foreclosures, and a global financial crisis.

Another example of market disequilibrium is the impact of COVID-19 on global supply chains. The pandemic led to a sudden and unexpected increase in demand for certain goods, such as masks and hand sanitizers, while also disrupting supply chains due to lockdowns and border closures. This led to a shortage of these goods, causing prices to rise sharply. If a market is not at equilibrium, such shocks can have far-reaching consequences, including market volatility and reduced economic growth.

Other examples of market disequilibrium include the oil price shocks of the 1970s, the dot-com bubble of the late 1990s, and the European sovereign debt crisis of the 2010s. In each of these cases, market disequilibrium led to significant economic consequences, including market volatility, reduced investment, and decreased economic growth.

These real-world examples illustrate the importance of understanding market equilibrium and disequilibrium. By recognizing the signs of market disequilibrium and taking steps to restore equilibrium, policymakers and businesses can mitigate the negative consequences of market imbalances and promote economic stability and growth.

Lessons Learned from Market Disequilibrium

In conclusion, market disequilibrium is a complex phenomenon that can have significant consequences for businesses, policymakers, and individuals. By understanding the causes and consequences of market disequilibrium, we can better navigate the complexities of the market and make informed economic decisions.

The key takeaways from this article are that market disequilibrium can occur due to various factors, including changes in consumer preferences, technological advancements, and external shocks. If a market is not at equilibrium, it can lead to market volatility, reduced investment, and decreased economic growth. However, by recognizing the signs of market disequilibrium and implementing strategies to restore equilibrium, we can mitigate these negative consequences.

Moreover, the role of market forces in achieving equilibrium cannot be overstated. By allowing market forces to operate freely, we can promote economic stability and growth. The real-world examples of market disequilibrium, such as the housing market bubble and the impact of COVID-19 on global supply chains, serve as a reminder of the importance of understanding market equilibrium and disequilibrium.

Ultimately, the lessons learned from market disequilibrium can be applied to a wide range of economic contexts. By recognizing the importance of market equilibrium and taking steps to maintain it, we can promote economic stability, growth, and prosperity.