Understanding the Concept of Discount Factor

In finance, the discount factor is a crucial concept used to calculate the present value of future cash flows. It’s a fundamental principle that helps investors and analysts determine the net present value (NPV) of a project, investment, or asset. To accurately work out discount factor, it’s essential to grasp its underlying principles and applications. The discount factor is a multiplier that reduces the value of future cash flows to their present-day equivalent, allowing for informed decisions about investments and resource allocation. By understanding how to work out discount factor, financial professionals can make better decisions about investments, capital budgeting, and risk management.

Why Discount Factor Matters in Investment Decisions

The discount factor plays a pivotal role in investment decisions, as it directly affects the net present value (NPV) of a project and the cost of capital. By understanding how to work out discount factor, investors and analysts can accurately calculate the NPV of a project, which is essential for making informed investment decisions. A project’s NPV is the difference between its expected cash inflows and outflows, discounted back to their present value using the discount factor. A higher discount factor reduces the NPV, making the project less attractive, while a lower discount factor increases the NPV, making it more appealing. Furthermore, the discount factor influences the cost of capital, which is the minimum return required by investors to justify an investment. A thorough understanding of discount factor is crucial for investors to make informed decisions about resource allocation and to achieve their financial goals.

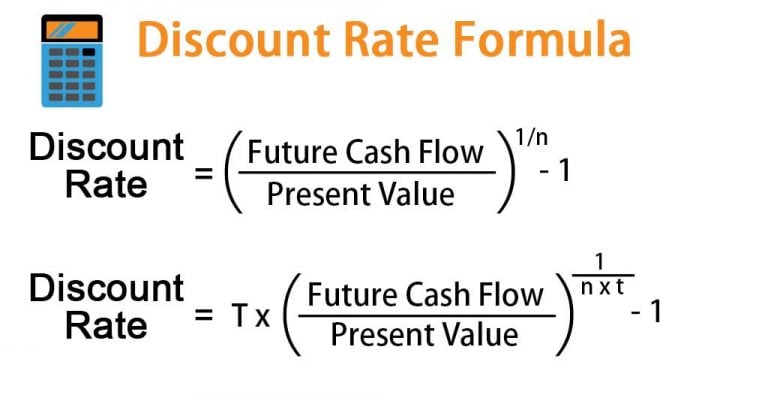

How to Calculate Discount Factor: A Step-by-Step Guide

To accurately calculate the present value of future cash flows, it’s essential to know how to work out discount factor. The discount factor formula is: Discount Factor = 1 / (1 + r)^n, where r is the discount rate and n is the number of periods. To illustrate the process, let’s consider an example. Suppose an investor expects to receive $100 in 5 years, and the discount rate is 10%. To calculate the discount factor, plug in the values: Discount Factor = 1 / (1 + 0.10)^5 = 0.638. This means that $100 received in 5 years is equivalent to $63.80 today. By following this step-by-step guide, investors and analysts can accurately calculate the discount factor and make informed decisions about investments and resource allocation.

Factors Affecting Discount Factor: Risk, Time, and Opportunity Cost

The discount factor is influenced by several key factors, including risk, time, and opportunity cost. Understanding how these factors impact the discount factor is crucial for accurately calculating the present value of future cash flows. Risk, for instance, plays a significant role in determining the discount factor. A higher-risk investment requires a higher discount rate to compensate for the increased uncertainty, which in turn reduces the present value of future cash flows. Time is another critical factor, as the longer the time period, the higher the discount factor. This is because the present value of future cash flows decreases as the time period increases. Opportunity cost, which represents the value of alternative investments, also affects the discount factor. A higher opportunity cost increases the discount rate, reducing the present value of future cash flows. By considering these factors, investors and analysts can accurately calculate the discount factor and make informed decisions about investments and resource allocation. For example, when calculating the present value of a future cash flow, understanding how to work out discount factor involves considering the risk associated with the investment, the time period, and the opportunity cost. By doing so, investors can determine the appropriate discount rate and accurately calculate the present value.

Common Applications of Discount Factor in Finance

The discount factor has numerous applications in finance, playing a critical role in various decision-making processes. One of the most common applications is in capital budgeting, where the discount factor is used to evaluate the feasibility of projects and determine their net present value (NPV). By understanding how to work out discount factor, analysts can accurately calculate the NPV of a project and make informed decisions about investments. Another key application is in investment analysis, where the discount factor is used to calculate the present value of future cash flows and determine the expected return on investment. Additionally, the discount factor is used in risk management to assess the potential risks associated with investments and determine the appropriate risk premium. In corporate finance, the discount factor is used to evaluate the cost of capital and determine the optimal capital structure. Furthermore, the discount factor is used in real estate to evaluate the present value of future cash flows from property investments. By applying the discount factor in these various contexts, finance professionals can make more informed decisions and achieve their financial goals.

Discount Factor vs. Interest Rate: What’s the Difference?

When it comes to financial calculations, the terms “discount factor” and “interest rate” are often used interchangeably, but they have distinct meanings and applications. Understanding the difference between these two concepts is crucial for accurate financial analysis and decision-making. The interest rate represents the rate at which an investment grows in value over time, whereas the discount factor is used to calculate the present value of future cash flows. In other words, the interest rate is used to determine the future value of an investment, while the discount factor is used to determine the present value of future cash flows. To illustrate the difference, consider a scenario where an investor expects to receive a cash flow of $100 in one year. If the interest rate is 10%, the future value of the cash flow would be $110. However, to calculate the present value of the cash flow, the investor would need to know how to work out discount factor, which would be 0.909 (1 / (1 + 0.10)). By understanding the distinction between discount factor and interest rate, finance professionals can make more accurate calculations and informed decisions.

Real-World Examples of Discount Factor in Action

The discount factor is a powerful tool used in various industries to make informed financial decisions. In finance, the discount factor is used to evaluate the present value of future cash flows from investments, such as bonds and stocks. For instance, a financial analyst may use the discount factor to calculate the present value of a bond’s future cash flows, such as interest payments and principal repayment. In real estate, the discount factor is used to evaluate the present value of future cash flows from property investments, such as rental income and property appreciation. For example, a real estate investor may use the discount factor to determine the present value of a property’s future cash flows and decide whether to invest in the property. In corporate finance, the discount factor is used to evaluate the present value of future cash flows from projects, such as capital expenditures and investments. By understanding how to work out discount factor, companies can make more informed decisions about which projects to invest in and how to allocate their resources. These real-world examples demonstrate the importance of the discount factor in various industries and its role in making informed financial decisions.

Mastering Discount Factor for Better Financial Decision-Making

In today’s fast-paced financial landscape, making informed decisions is crucial for achieving long-term financial goals. One key concept that can help investors and finance professionals make better decisions is the discount factor. By understanding how to work out discount factor, individuals can accurately calculate the present value of future cash flows, making it easier to evaluate investment opportunities and make informed decisions. The discount factor is a powerful tool that can help investors and finance professionals navigate complex financial calculations and make more accurate predictions about future cash flows. By mastering the discount factor, individuals can gain a competitive edge in the financial industry and make more informed decisions that drive long-term success. Whether you’re a seasoned finance professional or just starting out, understanding the discount factor is essential for achieving financial goals and staying ahead of the curve. By applying the concepts outlined in this article, individuals can unlock the power of discounted cash flows and make better financial decisions that drive long-term success.