Unlocking the Power of Your Financial Calculator for Cash Flow

Understanding cash flow is critical for sound financial decision-making. It provides insights into a business’s ability to meet its obligations and fund future growth. Whether evaluating investment opportunities, managing personal finances, or analyzing business performance, proficiency in cash flow analysis is essential. Financial calculators, such as the HP 12C and the Texas Instruments BA II Plus, are powerful tools for performing these analyses quickly and accurately. These calculators offer specialized functions that simplify complex calculations like Net Present Value (NPV), Internal Rate of Return (IRR), and payback period. This article focuses on explaining how to use cash flow on financial calculator effectively, empowering you to efficiently calculate and interpret cash flows, ultimately leading to more informed financial choices. Mastering how to use cash flow on financial calculator will enable you to confidently assess investments and projects.

Many individuals and businesses rely on financial calculators because of their portability and dedicated functions. Learning how to use cash flow on financial calculator makes it easier to determine if an investment is worthwhile. These calculators are pre-programmed with the formulas necessary for time value of money calculations, which are at the heart of cash flow analysis. The following sections will provide step-by-step guidance on using these functions to perform common cash flow calculations. Understanding how to use cash flow on financial calculator features will allow for efficient and accurate decision-making in the financial sector. The emphasis will be on practical application, ensuring readers can immediately apply the knowledge to real-world scenarios. We aim to clarify how to use cash flow on financial calculator for different financial situations.

By mastering how to use cash flow on financial calculator, you gain a competitive edge in financial analysis. This article’s goal is to transform the way you approach financial problems, turning complex cash flow scenarios into manageable calculations. With a solid understanding of how to use cash flow on financial calculator, users can confidently assess investment opportunities and optimize financial strategies. Become proficient in how to use cash flow on financial calculator to unlock the true potential of your financial calculator and elevate your financial acumen. Improving your knowledge of how to use cash flow on financial calculator contributes directly to enhanced financial literacy and decision-making capabilities.

Step-by-Step Guide: Calculating Net Present Value (NPV)

Net Present Value (NPV) is a critical metric for evaluating investment opportunities. It determines the present value of expected cash inflows and outflows, discounted at a specific rate. Understanding how to use cash flow on financial calculator to compute NPV is essential for sound financial decisions. This section provides a step-by-step guide on how to use cash flow on financial calculator to calculate NPV efficiently.

First, clear the calculator’s cash flow register. This usually involves pressing the “CF” button followed by “2nd” and “CLR WORK” on a Texas Instruments BA II Plus, or a similar function on other models. Next, input the initial investment. This is typically a negative value since it’s an outflow. Enter the amount and press the “CF0” button. For subsequent cash flows, enter each inflow or outflow, pressing “CFj” for each. If a cash flow occurs multiple times consecutively, use the “Fj” (frequency) key to indicate the number of periods it repeats. Once all cash flows are entered, input the discount rate (the required rate of return) by pressing the “I/YR” button. Finally, compute the NPV by pressing the “NPV” button followed by “CPT” (compute). The displayed value is the Net Present Value of the investment. A positive NPV suggests the investment is likely profitable, while a negative NPV indicates a potential loss. Learning how to use cash flow on financial calculator for NPV helps in comparing different investments. Remember the correct sign conventions are crucial for accurate calculations: outflows as negative values and inflows as positive values.

Let’s illustrate how to use cash flow on financial calculator with an example. Suppose an initial investment of $1,000 (CF0 = -1000) is expected to generate cash flows of $300 (CF1 = 300), $400 (CF2 = 400), and $500 (CF3 = 500) over the next three years. Assume a discount rate of 10%. After inputting these values into the financial calculator as described above, and computing the NPV, you will get $145.62. This positive NPV indicates that the investment is potentially worthwhile at a 10% required rate of return. If the NPV were negative, the investment would not meet the desired return threshold. Understanding how to use cash flow on financial calculator empowers you to quickly assess different financial scenarios and make informed decisions. Regular practice is key to mastering these techniques and minimizing errors.

Computing Internal Rate of Return (IRR) Made Simple

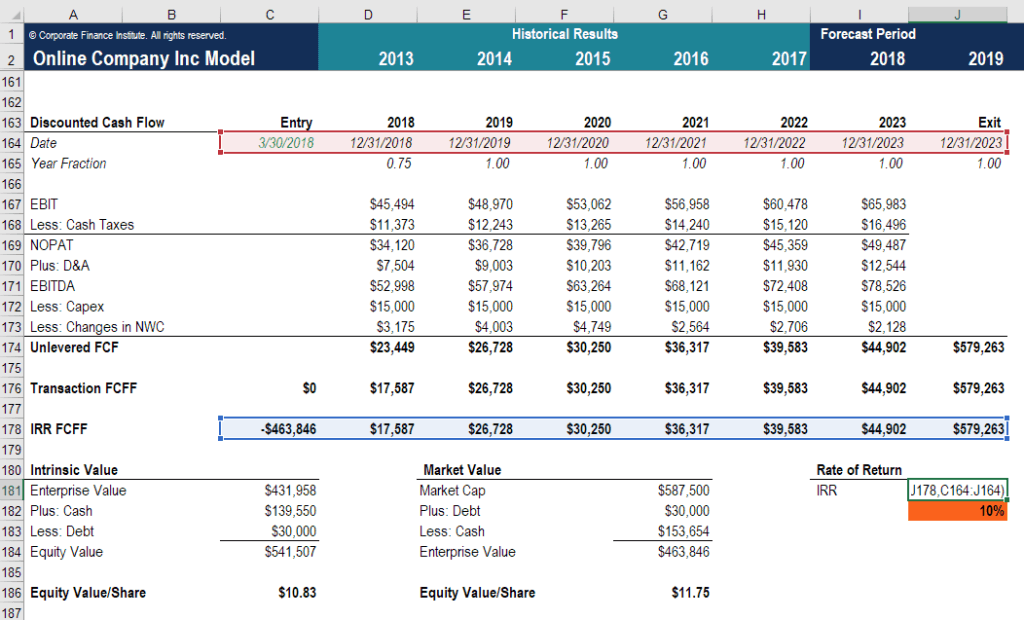

The Internal Rate of Return (IRR) represents the discount rate at which the net present value (NPV) of an investment equals zero. It is a vital metric for assessing the profitability of potential investments. Knowing how to use cash flow on financial calculator to determine IRR allows for informed investment choices.

To calculate IRR using a financial calculator, begin by clearing the cash flow register. Input the initial investment as a negative value (CF0), followed by subsequent cash inflows (CF1, CF2, etc.). The specific button sequence may vary depending on the calculator model (e.g., HP 12C, Texas Instruments BA II Plus), but the general procedure involves entering each cash flow amount and pressing the appropriate “CFj” key. Once all cash flows are entered, press the “IRR” key, often followed by “CPT” (compute) to display the calculated IRR value. It’s essential to carefully input the correct cash flow amounts and their corresponding periods for an accurate IRR calculation. Understanding how to use cash flow on financial calculator ensures the accurate calculation of the IRR.

A potential pitfall to consider is the possibility of multiple IRR values for certain cash flow patterns, particularly those with alternating positive and negative cash flows after the initial investment. In such cases, the calculator might display only one IRR, which might not accurately reflect the investment’s true profitability. It’s important to analyze the cash flow pattern and potentially use other methods, like NPV analysis, to validate the IRR result. Furthermore, the IRR should be interpreted in relation to the required rate of return (hurdle rate). If the IRR exceeds the hurdle rate, the investment is generally considered acceptable. However, it’s crucial to remember that IRR assumes reinvestment of cash flows at the IRR itself, which might not always be realistic. Mastering how to use cash flow on financial calculator for IRR calculation is a valuable skill, but it should be complemented with a thorough understanding of its limitations and proper interpretation.

Calculating Payback Period with a Financial Calculator

The payback period represents the time required for an investment to generate sufficient cash flow to cover its initial cost. It’s a straightforward metric useful in assessing the risk associated with an investment. A shorter payback period generally indicates a less risky investment. Understanding how to use cash flow on financial calculator to determine this period is crucial for quick investment evaluations.

To calculate the payback period using a financial calculator, first, input the initial investment as a negative cash flow (CF0). Subsequently, enter the expected cash inflows for each period (CF1, CF2, CF3, and so on). The specific keystrokes will vary depending on the calculator model (e.g., HP 12C, Texas Instruments BA II Plus), but the general process involves using the cash flow (CF) function. It is important to keep in mind that, without a dedicated function, some financial calculators don’t directly compute the payback period. Therefore, understanding how to use cash flow on financial calculator for this calculation often involves manually tracking cumulative cash flow. Sum the cash flows period by period until the cumulative value equals or exceeds the initial investment. The payback period is then determined by the number of periods it took to reach this point. For instance, if an investment of $1,000 generates cash flows of $300, $400, and $500 in the first three years, the payback period is three years. If the $500 cash flow was instead $300, the payback would be between three and four years, requiring interpolation for a more precise calculation.

While the payback period offers a simple measure of investment risk, it has limitations. It does not account for the time value of money, meaning it treats cash flows received later the same as those received sooner. Nor does it consider cash flows generated after the payback period. For example, two projects might both have a three-year payback period, but one might generate significantly more cash flow in years four and five. Therefore, the payback period should not be used as the sole criterion for investment decisions. It is best used in conjunction with other methods like Net Present Value (NPV) and Internal Rate of Return (IRR) to gain a more comprehensive understanding of an investment’s potential. Mastering how to use cash flow on financial calculator to compute the payback period provides a valuable, though incomplete, perspective on investment viability. Properly understanding how to use cash flow on financial calculator is an important skill.

Analyzing Uneven Cash Flows for Real Estate Investments

Real estate investments often present a challenge: uneven cash flows. Unlike investments with consistent returns, real estate can have variable rental income, vacancy periods, and significant expenses. Understanding how to use cash flow on financial calculator to handle these irregularities is key for accurate analysis. This section will demonstrate how to effectively input these varying cash flows into your financial calculator.

The key to analyzing uneven cash flows lies in organizing your data. First, create a timeline of expected cash flows. This should include initial investment (a negative value), projected rental income for each period, estimated expenses (also negative values), and any anticipated cash flows from sale at the end of the investment horizon. When inputting this data into your financial calculator, each cash flow must be entered separately with its corresponding period. For example, if you expect $10,000 in rental income in year one, -$2,000 in expenses, and $12,000 in year two, you would enter these as distinct cash flows. Your financial calculator’s cash flow register (often labeled CF0, CF1, CF2, etc.) is designed for this purpose. Remember the importance of correct sign conventions; outflows (expenses, investments) must be negative, and inflows (income, sales) must be positive. Correctly understanding how to use cash flow on financial calculator can become simple with practice.

Consider this real-world scenario: You’re evaluating a rental property. The initial investment is $200,000. You project $25,000 in rental income the first year, $27,000 the second, and $30,000 the third. Property taxes and maintenance costs average $5,000 per year. In year three, you anticipate selling the property for $250,000. Using your financial calculator, CF0 would be -$200,000. CF1 would be $20,000 ($25,000 – $5,000). CF2 would be $22,000 ($27,000 – $5,000). CF3 would be $275,000 ($30,000 – $5,000 + $250,000). Once you have these cash flows entered, you can calculate the NPV or IRR, using the appropriate discount rate, to determine the investment’s viability. The ability to manage these calculations effectively demonstrates how to use cash flow on financial calculator for complex investment analyses.

Troubleshooting Common Cash Flow Calculation Errors

Calculating cash flows on a financial calculator can be prone to errors if caution is not exercised. One frequent mistake is related to sign conventions. Cash inflows should typically be entered as positive values, while cash outflows, like initial investments, must be negative. Failure to adhere to this can drastically skew NPV and IRR calculations. Remembering that money coming into your pocket is positive and money leaving is negative is key when considering how to use cash flow on financial calculator.

Another common pitfall is incorrect discounting. Ensure the discount rate entered reflects the appropriate period (annual, monthly, etc.) matching the cash flow frequency. An annual discount rate should be used with annual cash flows, and a monthly rate with monthly cash flows. If there is a mismatch, the resulting NPV, IRR and payback period will be wrong. Data entry errors also frequently lead to miscalculations. Double-check all entered cash flows and the discount rate before computing the results. Many financial calculators have a review function; make use of it. Understanding how to use cash flow on financial calculator correctly, requires careful attention to detail.

Improper compounding is a less obvious error that can significantly affect results. Some calculators offer options for compounding periods (e.g., daily, monthly, annually). Ensure the compounding period aligns with the payment frequency. If the payment frequency is monthly, then the compounding should also be monthly. When using a financial calculator, ensure you clear the calculator’s memory or reset all values before starting a new calculation. Persisting data from a previous calculation can lead to inaccurate results. Also, be aware of the calculator’s limitations. Some models have a maximum number of cash flow entries they can handle. For very long projects, you may need to group cash flows or use spreadsheet software. A solid grasp of these potential errors and how to avoid them will ensure accurate and reliable cash flow analysis, enhancing your financial decision-making capabilities when considering how to use cash flow on financial calculator.

Advanced Techniques: Sensitivity Analysis and Scenario Planning

Sensitivity analysis and scenario planning are powerful tools for stress-testing cash flow projections. Sensitivity analysis involves changing one key input variable, such as sales growth or discount rate, while holding others constant, to observe the impact on NPV or IRR. Scenario planning takes a broader approach by creating multiple plausible scenarios (e.g., best-case, worst-case, most likely) and assessing the cash flow implications of each. Understanding how to use cash flow on financial calculator, by implementing these techniques allows for a more comprehensive risk assessment.

To perform sensitivity analysis using a financial calculator, first, calculate the baseline NPV or IRR using the initial assumptions. Next, modify the input variable of interest (e.g., increase the discount rate by 1%) and recalculate the NPV or IRR. The difference between the baseline and recalculated values reveals the sensitivity of the investment to that particular variable. Repeat this process for other key variables to identify the most critical drivers of investment performance. While a financial calculator can handle these recalculations, a spreadsheet program often provides a more efficient way to organize and visualize the results of sensitivity analysis.

Scenario planning involves creating distinct sets of assumptions for different possible future states. For example, in a real estate investment, scenarios might include high occupancy rates, moderate occupancy rates, and low occupancy rates. Each scenario will have its own set of cash flows. How to use cash flow on financial calculator in this context involves calculating the NPV or IRR for each scenario individually. This provides a range of potential outcomes and helps in understanding the potential upside and downside of the investment. Although the financial calculator can perform the calculations for each scenario, a spreadsheet’s data table and scenario manager functionalities are exceptionally useful for organizing and comparing scenario results. Combining the precision of a financial calculator for individual calculations with the organizational power of a spreadsheet offers a robust approach to advanced cash flow analysis. The ability to quickly assess how changes impact financial outcomes enhances decision-making and provides a deeper understanding of investment risks and opportunities. This integrated approach is invaluable for mastering how to use cash flow on financial calculator to make informed financial choices.

Maximizing Your Financial Calculator’s Cash Flow Capabilities

The journey to mastering financial analysis hinges on a solid understanding of cash flow principles and the skillful application of tools like your financial calculator. This article has armed you with the knowledge to confidently tackle Net Present Value (NPV), Internal Rate of Return (IRR), and payback period calculations. Remember that consistent practice is the key to truly internalizing these concepts and improving your proficiency. Mastering how to use cash flow on financial calculator empowers you to make sound financial decisions.

Embrace the power of sensitivity analysis and scenario planning to stress-test your financial models. These techniques allow you to assess the impact of varying assumptions on your investment outcomes. While your financial calculator provides a robust platform for these calculations, don’t hesitate to leverage spreadsheet software for more complex scenarios. By combining the strengths of both tools, you can gain a comprehensive understanding of your financial landscape. Proficiency in how to use cash flow on financial calculator will significantly enhance your investment acumen.

In conclusion, understanding how to use cash flow on financial calculator is more than just pressing buttons; it’s about grasping the underlying principles that drive financial value. By diligently applying the techniques outlined in this article and continuously honing your skills, you’ll be well-equipped to navigate the complexities of financial decision-making. The ability to accurately analyze cash flows is an invaluable asset in both personal and professional financial contexts. So, take the time to practice, explore, and unlock the full potential of your financial calculator.

.jpg)