Understanding the Basics of Bond Valuation

Yield to maturity (YTM) represents the total return an investor anticipates receiving from a bond if held until its maturity date. It’s a crucial metric for evaluating bond investments, as it considers not only the bond’s coupon payments but also any capital gain or loss realized at maturity. Grasping the relationship between a bond’s price, coupon rate, face value (par value), and time remaining until maturity is fundamental to understanding the necessity of calculating YTM. The bond’s coupon rate dictates the periodic interest payments, while the face value is the amount the bondholder receives upon maturity. The current market price reflects the present value of these future cash flows, discounted back to today. The time to maturity significantly influences the discounting effect; the longer the maturity, the greater the impact of discounting. These factors collectively determine the bond’s YTM. Learning how to solve for YTM allows investors to compare different bonds with varying characteristics on a level playing field. For example, a bond trading at a discount to its face value will have a YTM higher than its coupon rate, while a bond trading at a premium will have a lower YTM than its coupon rate. Understanding how to solve for YTM is therefore vital for assessing the true profitability of a bond investment. How to solve for YTM helps in the comparison of bonds.

The need to understand how to solve for YTM arises from the inherent complexity of bond valuation. Bonds are essentially a stream of future cash flows (coupon payments and face value) discounted back to the present. The YTM is the single discount rate that, when applied to these cash flows, equates their present value to the bond’s current market price. This calculation is not straightforward because it involves solving for a rate (YTM) within a present value equation. This contrasts with simply calculating the current yield, which only considers the annual coupon payment divided by the current price. Current yield ignores the potential capital gain or loss at maturity, making YTM a more comprehensive measure of return. Therefore, accurately determining how to solve for YTM requires considering all relevant factors and employing appropriate calculation methods. This is very important when comparing bonds. How to solve for YTM provides a more complete profitability analysis.

Different bonds have varied coupon rates, prices, and maturity dates; therefore, knowing how to solve for YTM enables investors to make informed comparisons. It provides a standardized measure of return that accounts for all the factors influencing a bond’s value. Without understanding how to solve for YTM, investors risk making suboptimal investment decisions based solely on coupon rates or current yields, potentially overlooking significant opportunities or risks. Therefore, mastering the techniques involved in how to solve for YTM is an essential skill for any bond investor seeking to maximize returns and manage risk effectively. Furthermore, understanding the concepts helps in comparing bonds with different ratings, and risks.

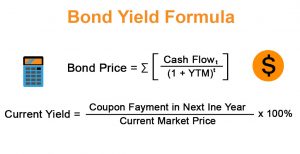

Unlocking the Formula for Bond Yield

The yield to maturity (YTM) formula is used to determine the total return expected on a bond held until it matures. Understanding how to solve for ytm requires grasping its core components. These include: the bond’s coupon payments, the face value (the amount the bondholder receives at maturity), the current market price of the bond, and the time remaining until maturity. The formula essentially calculates the discount rate that equates the present value of all future cash flows (coupon payments and face value) to the current market price of the bond.

It’s important to note that the YTM formula isn’t straightforward. It involves an iterative calculation due to the discounting effect of future cash flows. This means that finding the precise YTM usually involves trial and error or the use of specialized tools. The complexity arises from the fact that the YTM is embedded within a present value equation, and isolating it requires solving for a rate that satisfies the equation. Financial calculators and spreadsheet software are commonly employed to efficiently determine how to solve for ytm with accuracy, and avoid the cumbersome manual iterations.

While a precise solution requires these tools, understanding the underlying principle is crucial. The YTM represents the single discount rate that, when applied to all future cash flows, makes the present value of those cash flows equal to the bond’s current price. Therefore, effectively to know how to solve for ytm provides a comprehensive measure of a bond’s potential return, considering both the coupon income and the capital gain or loss realized at maturity. This makes it a valuable metric for comparing different bonds and evaluating their investment attractiveness. Keep in mind that an approximate calculation may be obtained, but the approximation trades accuracy for simplicity.

Estimating Yield to Maturity: A Simplified Approach

While the precise calculation of yield to maturity (YTM) often requires financial calculators or spreadsheet software, a simplified approximation formula can provide a reasonable estimate, especially for bonds with longer maturities. This method offers a balance between accuracy and ease of calculation, making it accessible for quick estimations. This simplified approach is useful to estimate how to solve for ytm without complex tools. The trade-off for simplicity is a slight reduction in precision, but it serves as a practical starting point.

The approximation formula is as follows: YTM ≈ (Annual Interest Payment + (Face Value – Current Price) / Years to Maturity) / ((Face Value + Current Price) / 2). This formula essentially averages the income from the coupon payments with the capital gain or loss if the bond is held to maturity, and then divides it by the average of the face value and the current price. It gives a quick way to understand how to solve for ytm. For example, consider a bond with a face value of $1,000, a current price of $950, an annual coupon rate of 8% (meaning an $80 annual interest payment), and a maturity of 5 years. Applying the formula: YTM ≈ ($80 + ($1,000 – $950) / 5) / (($1,000 + $950) / 2) = ($80 + $10) / $975 = $90 / $975 ≈ 0.0923 or 9.23%. This provides an estimated YTM of 9.23%. Note that this is an approximation, and the actual YTM might be slightly different.

The accuracy of the approximation depends on several factors, including the size of the discount or premium relative to the face value and the time remaining until maturity. Bonds trading close to par value will yield more accurate results. Also, understanding how to solve for ytm using this estimation can be a valuable starting point before refining the number with the help of the more complex calculations with specialized financial software. While not a substitute for precise calculations, this simplified approach provides a valuable tool for quickly assessing the potential return of a bond investment.

How to Calculate YTM with Financial Calculators

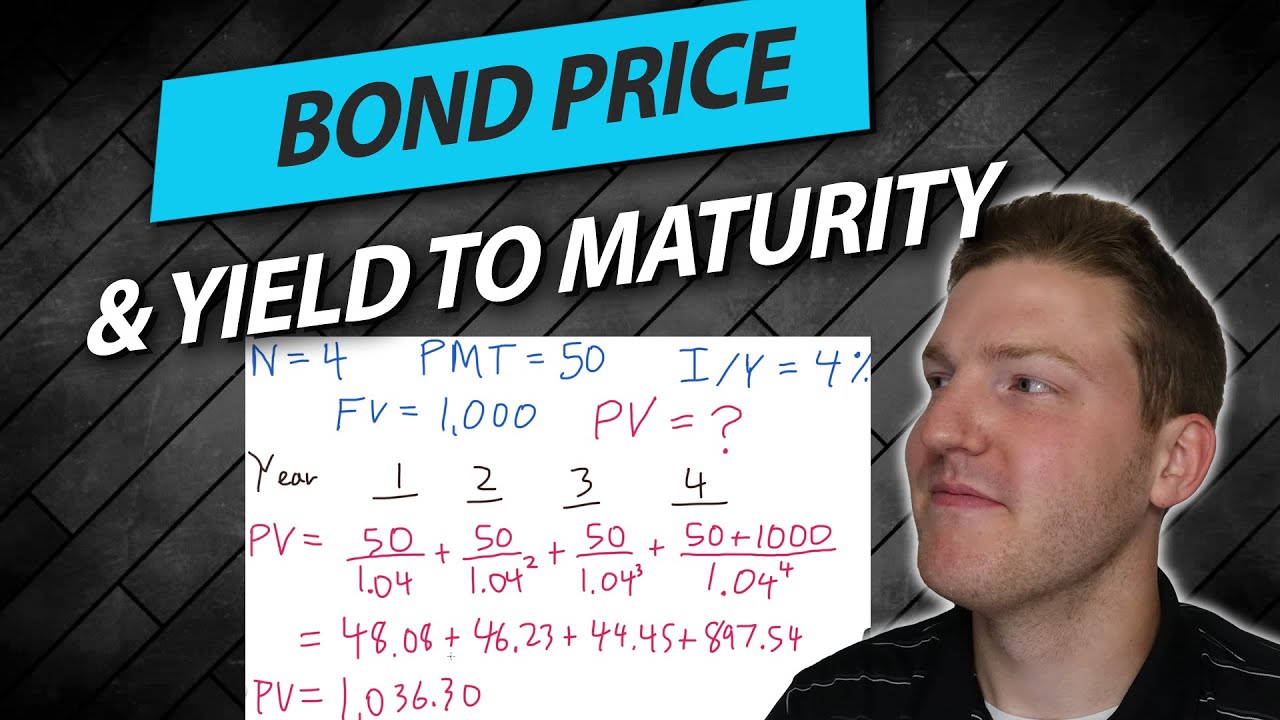

Financial calculators streamline the process of how to solve for YTM. These calculators efficiently handle the iterative calculations inherent in determining YTM. The Texas Instruments BA II Plus is a popular model frequently used by finance professionals. To calculate YTM using this calculator, follow these steps: First, input the number of periods (N) representing the bond’s time to maturity. Next, enter the interest rate per period (I/Y), typically half the annual coupon rate for semi-annual payments. Then, input the present value (PV), which is the current market price of the bond (enter this as a negative value). Input the payment (PMT) representing the periodic coupon payment. Finally, enter the future value (FV), which is the bond’s face value. Press the CPT (compute) button followed by I/Y to solve for the periodic yield. Multiply this result by two to obtain the annual YTM if semi-annual payments were used. Learning how to solve for YTM using a financial calculator significantly reduces calculation time and potential errors.

Another common method to determine how to solve for YTM involves using other financial calculators. Many models offer similar functionalities. Consult your calculator’s manual for specific keystrokes and instructions. Remember to always double-check your inputs to ensure accuracy. Incorrect inputs can lead to inaccurate YTM calculations. Understanding the inputs for each variable is crucial for a correct result. The process of how to solve for YTM remains consistent across different calculator models, though the specific keystrokes may vary. Practice using your calculator with different examples to build proficiency and confidence in your calculations. Mastering this method is valuable for efficient bond valuation.

When using a financial calculator, it’s crucial to understand the inputs needed to accurately calculate the YTM. Pay close attention to the payment frequency (annual or semi-annual). This directly affects the number of periods and the interest rate. Always ensure that the signs of PV and FV are correctly entered. The PV should be negative since it represents an outflow of cash, while the FV is generally positive representing an inflow at maturity. Accurately inputting these values is vital for obtaining the correct YTM. Understanding how to solve for YTM using a financial calculator provides a quick and efficient method for bond valuation. This approach is widely used in the finance industry for its speed and accuracy compared to manual calculation methods. By practicing these steps, you’ll develop the skill to rapidly and accurately determine the YTM of bonds.

Leveraging Spreadsheet Software for Accurate YTM Calculation

Spreadsheet software offers a powerful and precise method to calculate yield to maturity (YTM). Microsoft Excel and Google Sheets provide built-in functions that simplify the process of solving for YTM, eliminating the need for iterative calculations. This allows for quick and accurate determination of the total return on a bond held to maturity. Users can easily input bond characteristics such as coupon rate, face value, market price, and maturity date to determine the YTM. This method is particularly useful for comparing multiple bonds simultaneously. Understanding how to solve for YTM using these tools is essential for effective bond analysis.

In Excel, the YIELD function is used. The function requires several arguments: settlement date, maturity date, rate (coupon rate), pr (price), redemption value (face value), and frequency (number of coupon payments per year). The settlement date represents the date the bond is purchased. The maturity date denotes the bond’s expiration. All dates should be entered using the appropriate date format of your spreadsheet program. Accurate input of all these values is crucial for a correct YTM calculation. Once the data is entered, the function returns the annual YTM as a decimal. This result can then be easily converted to a percentage for interpretation. Learning how to solve for YTM in Excel enables efficient analysis of a bond portfolio.

Google Sheets utilizes a similar function, also named YIELD. The arguments are identical to Excel’s YIELD function. This consistency between spreadsheet programs allows for easy transfer of calculation methods between platforms. The ability to easily manipulate inputs enables efficient sensitivity analysis—assessing how changes in bond price or interest rates affect the YTM. This is a crucial tool for how to solve for YTM under different market scenarios. Mastering the use of spreadsheet functions significantly improves the efficiency and accuracy of YTM calculations. The use of spreadsheet software is an invaluable tool for investors seeking to understand how to solve for YTM and make well-informed investment decisions. This method provides a flexible and efficient approach to understanding bond yields.

Factors Influencing Bond Yields and Market Dynamics

Yield to maturity (YTM) is not a static figure. It’s a dynamic metric influenced by a multitude of factors, reflecting the ever-changing landscape of the financial markets. Understanding these factors is crucial for interpreting YTM and making informed investment decisions. So, let’s explore how to solve for YTM considering some factors. One primary driver is the prevailing interest rate environment. When interest rates rise, newly issued bonds offer higher coupon rates to attract investors. Consequently, the prices of existing bonds with lower coupon rates fall, leading to an increase in their YTM to compensate for the lower coupon. Conversely, when interest rates decline, bond prices rise, and their YTM decreases.

Credit risk, the possibility that the issuer may default on its obligations, also significantly impacts YTM. Bonds issued by entities with higher credit risk typically offer higher YTMs to compensate investors for the increased risk of non-payment. Credit rating agencies, such as Moody’s and Standard & Poor’s, assess the creditworthiness of bond issuers, and their ratings directly influence the yields demanded by investors. Inflation expectations are another key factor. Investors demand higher yields on bonds when they anticipate higher inflation rates to preserve the real value of their investment. Inflation erodes the purchasing power of future coupon payments and principal, so YTM adjusts to reflect these expectations. How to solve for YTM considers factors like these: market sentiment, economic growth forecasts, and geopolitical events can also influence bond yields. A flight to safety during times of uncertainty can drive up demand for government bonds, pushing their yields down, while increased optimism about economic growth may lead to higher corporate bond yields. So, when considering how to solve for YTM, take this in consideration.

Furthermore, the time to maturity of a bond affects its YTM. Generally, bonds with longer maturities tend to have higher yields than those with shorter maturities, reflecting the greater risk associated with longer-term investments. This relationship is known as the yield curve. The shape of the yield curve can provide insights into market expectations about future interest rates and economic conditions. Understanding how these factors interrelate and influence YTM is essential for assessing the attractiveness of bonds and making sound investment choices. It is also very important to know how to solve for YTM as it is a valuable tool for investors.

Interpreting Yield to Maturity: Making Informed Investment Decisions

Yield to maturity (YTM) is a critical metric for bond investors. It provides an estimated total return if the bond is held until maturity. It is a tool that can help investors understand how to solve for YTM and use this to compare bonds. YTM represents the bond’s internal rate of return (IRR). This assumes all coupon payments are reinvested at the same YTM rate. The higher the YTM, the greater the return on investment.

When comparing different bonds, YTM is valuable. It allows investors to assess their relative value. For example, consider two bonds with similar credit ratings and maturities. The bond with the higher YTM may appear more attractive. However, it is crucial to consider other factors beyond YTM alone. Credit rating agencies, such as Moody’s and Standard & Poor’s, provide ratings. These indicate the creditworthiness of the bond issuer. A lower credit rating means a higher risk of default. Investors often demand a higher YTM to compensate for this increased risk. Liquidity also plays a role. A less liquid bond, meaning it’s harder to sell quickly without a significant price reduction, might offer a higher YTM. Investors need to assess their risk tolerance and investment goals. This helps determine if the higher yield compensates for the added risks.

It’s vital to understand the limitations of YTM. It is just an estimate and not a guarantee of actual returns. Changes in interest rates can impact the bond’s price. This affects the actual return if the bond is sold before maturity. Reinvestment risk is another consideration. If interest rates decline, reinvesting coupon payments at the same YTM rate might not be possible. Furthermore, how to solve for YTM accurately requires careful attention. Investors should consider using financial calculators or spreadsheet software to determine YTM precisely. It is an important part of bond analysis. By understanding its calculation and limitations, investors can make well-informed decisions.

Practical Examples: Calculating YTM in Real-World Scenarios

This section provides several detailed examples of yield to maturity (YTM) calculations. These examples use different bond characteristics such as coupon rates, maturities, and prices. The goal is to reinforce the concepts and help readers apply their knowledge. These real-world situations consider premium bonds, discount bonds, and par bonds to make it comprehensive. Understanding how to solve for YTM is critical for bond investors.

Example 1: Par Bond Consider a bond with a face value of $1,000. It has a coupon rate of 5% paid annually and matures in 5 years. The bond is currently trading at $1,000. Since the bond is trading at par, the YTM is equal to the coupon rate, which is 5%. This illustrates a basic scenario. Here’s how to solve for YTM in this case: the current yield (5%) approximates the YTM because the bond price equals its face value.

Example 2: Discount Bond Imagine a bond with a face value of $1,000. It has a coupon rate of 6% paid annually and matures in 3 years. The bond is currently trading at $950. To estimate the YTM, one could use the approximation formula. Annual coupon payments are $60. The approximate YTM = (Annual Interest Payment + (Face Value – Current Price) / Years to Maturity) / ((Face Value + Current Price) / 2). Plugging in the values, YTM = ($60 + ($1000 – $950) / 3) / (($1000 + $950) / 2) = ($60 + $16.67) / $975 = 0.0787 or 7.87%. A financial calculator or spreadsheet would provide a more precise YTM, but this gives a reasonable estimate. Knowing how to solve for YTM helps you understand the potential return.

Example 3: Premium Bond Let’s examine a bond with a face value of $1,000. It has a coupon rate of 8% paid annually and matures in 2 years. The bond is currently trading at $1,050. Using the same approximation formula: YTM = ($80 + ($1000 – $1050) / 2) / (($1000 + $1050) / 2) = ($80 – $25) / $1025 = 0.0537 or 5.37%. In this scenario, the YTM is lower than the coupon rate. The premium paid reduces the overall return. Understanding how to solve for YTM shows the effect of the premium on the bond’s return. Accurate YTM calculation often necessitates a financial calculator.

These examples highlight the impact of bond price relative to face value and coupon rate. These examples also illustrate how to solve for YTM using an approximation. While the approximation formula provides a quick estimate, financial calculators and spreadsheet software offer more accurate results. Factors that can influence YTM calculations are interest rate changes, credit risk, and market sentiment. Understanding YTM helps investors make informed decisions.