Understanding the Value of Options Price History

Tracking options price history is essential for making informed trading decisions. Analyzing historical data helps traders identify trends and patterns in price movements. This information can assist in predicting future price behavior, although predictions should always be treated with caution. Understanding how to see options price history is crucial for assessing risk. Historical data reveals past volatility, providing insights into potential price fluctuations. Knowing how to see options price history allows for the development of more robust trading strategies. This contrasts with real-time data, which only provides a snapshot of the current market. Real-time data is valuable, but historical data offers context and perspective, essential for effective long-term strategies. How to see options price history is the first step in building a foundation for success in options trading. The ability to analyze this historical data allows traders to contextualize current market conditions. By understanding how to see options price history, traders can formulate plans based on observable market behavior. This historical context is vital for mitigating risks and increasing the probability of successful trades. Understanding how to see options price history is a fundamental skill for any serious options trader.

Options price history offers a wealth of information. It allows traders to identify support and resistance levels. These levels represent areas where prices have historically struggled to break through. By understanding how to see options price history, traders can better anticipate future price movements, and plan accordingly. They can use this historical data to spot potential entry and exit points for trades. Furthermore, how to see options price history is crucial for backtesting different trading strategies. Backtesting allows traders to test strategies against historical data, evaluating potential profitability before risking actual capital. It is a vital process for strategy refinement. How to see options price history also plays a crucial role in understanding implied and historical volatility. This information helps traders assess risk and adjust their trading strategies appropriately. Understanding how to see options price history helps assess the effectiveness of various risk management techniques. Mastering the analysis of this data is a key component of successful options trading. Ultimately, understanding how to see options price history is a cornerstone of efficient and profitable trading.

The difference between using historical and real-time data is significant. Real-time data provides an immediate view of market conditions. However, without historical context, it lacks the depth needed for strategic decision-making. How to see options price history allows traders to compare current market trends with past behavior. This provides a more nuanced understanding of price movements. Combining historical data with real-time data enables more accurate predictions. This combined approach reduces reliance on speculative forecasting, favoring a data-driven method. It promotes more informed and rational trading strategies. Learning how to see options price history and interpret this data effectively is key to successful options trading. This enables traders to adapt to changing market conditions and make more profitable trades. Mastering this skill is vital for long-term success in this dynamic market.

Accessing Options Price Data Through Your Brokerage Platform

Locating options price history varies across brokerage platforms. Understanding how to see options price history on your chosen platform is crucial. Most platforms offer robust charting tools. These tools usually allow users to specify the date range and select the desired options contracts. For example, on TD Ameritrade’s Thinkorswim platform, users navigate to the “Chart” tab for a selected option. Then, they can adjust the time frame using the controls at the bottom of the chart. Interactive Brokers provides a similar interface, allowing users to select historical data directly from the option chain. Fidelity and Schwab also offer dedicated sections within their trading platforms dedicated to charting and historical data retrieval. These typically involve selecting an option contract and then specifying the desired timeframe for the historical price data. Remember to check your specific brokerage’s help documentation or tutorials for more detailed instructions on how to see options price history. Finding this information often involves searching keywords like “charting tools”, “historical data”, or “options price history” within the platform’s support section.

Platform-specific differences exist in terms of data presentation and available features. Some platforms might offer more advanced charting options or provide more detailed historical data. Others may have limitations in terms of the time range or the level of detail available. For instance, some platforms may only provide daily data, while others may offer intraday data at various intervals. Furthermore, understanding the limitations of how to see options price history on each platform is essential. This includes understanding data quality, potential delays in updating the data, or data limitations based on the option contract’s liquidity. Always review your platform’s terms of service and user agreements for details. Regularly checking for updates and new features related to charting and historical data is also advisable.

Before using any platform’s charting tools, familiarize yourself with its features. Learning how to effectively use the tools is key to maximizing the benefit of accessing this valuable information. Understanding how to customize the charts, select the appropriate indicators, and download the data for further analysis are all important aspects of mastering your chosen platform. Knowing how to see options price history correctly is only the first step. Effective analysis and interpretation of this data requires careful consideration and understanding of the platform’s capabilities and limitations. Practice using the tools to refine your ability to gather and interpret the data needed for informed decision-making. Remember, consistently refining your understanding of how to see options price history, and the data itself, is vital for successful options trading.

How to Interpret Options Price Charts and Graphs

Understanding how to see options price history visually is key to effective trading. Options price charts, typically displayed as line graphs or candlestick charts, present historical data. Line graphs show price changes over time. Candlestick charts offer a richer view, incorporating open, high, low, and closing prices for each period (e.g., daily, hourly). Learning how to see options price history in this format allows traders to quickly identify trends and potential turning points. For example, a consistently upward-trending line suggests increasing demand, while a series of bearish candles might indicate a potential price drop. Knowing how to see options price history through these visual representations is a fundamental skill. Remember, understanding the time frame of the chart (daily, weekly, monthly) is crucial for accurate interpretation. How to see options price history efficiently relies on understanding these chart types.

Beyond the price itself, volume and open interest provide valuable context. Volume indicates the number of contracts traded during a specific period. High volume accompanying price changes suggests strong conviction behind the move. Open interest represents the total number of outstanding contracts. A rising open interest alongside increasing prices often indicates sustained bullish momentum. Conversely, a falling open interest with rising prices might suggest a weakening trend, potentially indicating a price reversal. How to see options price history effectively involves analyzing these metrics alongside the price itself. Mastering this provides significant insight into market sentiment and potential future price movements. Visual aids and practice are essential to improve the skill of how to see options price history data and interpreting this information.

Candlestick patterns, while not foolproof, can offer additional insights. Patterns like bullish engulfing patterns or bearish hammers can signal potential shifts in momentum. However, it is important to remember that candlestick patterns should be used in conjunction with other indicators and a comprehensive understanding of how to see options price history, rather than as standalone predictive tools. Overreliance on any single indicator can be risky. The ability to effectively analyze charts and graphs, considering both price and volume, remains paramount. Understanding how to see options price history through a combination of visual analysis and understanding supplementary data is a critical skill for successful options trading. The process of learning how to see options price history requires dedicated practice and continuous learning.

Utilizing Third-Party Data Providers for Options Price History

Beyond brokerage platforms, several third-party data providers offer comprehensive options price history. These services often provide more advanced features and historical depth than what brokerage accounts typically offer. Understanding how to see options price history through these providers is crucial for serious options traders. They often compile data from multiple exchanges, ensuring a more complete picture. This allows for more robust analysis and backtesting, enhancing the understanding of market behavior and improving decision-making.

However, using these services often involves subscription fees. Costs vary depending on the level of access and data detail required. It is essential to carefully evaluate the pricing plans against the potential benefits. Data reliability is another critical factor to consider. Reputable providers employ stringent quality control measures, minimizing errors and ensuring data integrity. This is crucial when using the data for sophisticated analyses and backtesting, where accuracy is paramount to getting trustworthy results. How to see options price history accurately is a key consideration when choosing a provider. The features provided also vary significantly. Some providers offer real-time data feeds, advanced charting tools, and customizable data exports. Others may focus on specific market segments or offer specialized analytical tools. Traders should choose a provider that best suits their needs and technical expertise.

When researching how to see options price history from third-party sources, carefully consider factors like cost, data quality, features, and user-friendliness. Exploring the websites of these providers allows for direct comparison. Remember that even with third-party data, understanding how to interpret the information remains vital. The data itself does not provide trading strategies, but it provides the raw material for informed decision-making. Proper understanding of data interpretation is key to maximizing the value of any options price history resource. Accurate historical options pricing data is a vital component for successful options trading. Knowing how to see options price history effectively unlocks significant advantages.

Analyzing Historical Volatility and Implied Volatility

Understanding volatility is crucial when working with options. Historical volatility measures past price fluctuations. It reflects the actual price swings of the underlying asset over a specific period. To see how to see options price history and calculate historical volatility, one typically uses statistical methods on past price data. This data is readily available through brokerage platforms and data providers. Many platforms will directly calculate and display historical volatility, simplifying the process. However, it is useful to understand the calculation so you can compare different methodologies and data sources.

Implied volatility, conversely, represents the market’s expectation of future price swings. It’s derived from current option prices, reflecting the market’s collective sentiment about the potential for future price changes. How to see options price history for implied volatility involves looking at the option chain. Implied volatility is often expressed as a percentage. A higher implied volatility indicates greater expected price fluctuations, implying higher option premiums. Conversely, lower implied volatility suggests less expected movement and lower premiums. Both historical and implied volatility are essential for assessing risk. A trader can compare historical volatility to implied volatility to gauge whether the market is over or underestimating the future price swings of the underlying asset. This comparison informs decisions on which options strategies might be most appropriate. Analyzing both provides a more complete picture of risk and potential profit or loss. How to see options price history data for these metrics depends on your platform or data provider; some display them directly while others may require calculation.

Successfully employing options strategies relies heavily on understanding volatility. Analyzing historical volatility provides a baseline for comparison. The difference between historical and implied volatility helps gauge market sentiment and potential opportunities. Accessing this information often involves understanding how to see options price history within your brokerage account or through third-party data providers. Remember that volatility is not perfectly predictable. These metrics provide valuable insights, but they don’t guarantee future price movements. Always consider other market factors and use proper risk management techniques. Understanding how to see options price history for volatility data empowers traders to make more informed decisions, potentially improving trading outcomes.

Identifying Key Price Points and Support/Resistance Levels

Understanding how to see options price history is crucial for identifying key price points that acted as support or resistance in the past. Support levels represent price points where buying pressure overwhelmed selling pressure, preventing further price declines. Conversely, resistance levels mark points where selling pressure dominated, halting upward price movements. By examining historical options price charts, traders can pinpoint these significant levels. This analysis helps anticipate potential future price reactions. One effective method involves using candlestick charts, which visually represent price movements over time. Candlestick patterns, such as hammer formations or engulfing patterns near previous support or resistance levels, may indicate potential future price reversals. Learning how to see options price history effectively allows for better identification of these patterns.

Analyzing past price action around support and resistance levels is not about precise prediction. Instead, it provides context for current market behavior. For example, if the price approaches a previously strong support level, it might indicate a potential buying opportunity. Conversely, approaching a strong resistance level could suggest a potential selling opportunity. However, remember that markets are dynamic. Past support can become resistance, and vice versa. Therefore, traders should always use other technical and fundamental indicators along with historical data for informed decision-making. Knowing how to see options price history is only one piece of the puzzle.

To effectively identify these key price points and levels, traders should utilize charting tools provided by their brokerage platforms or third-party data providers. These tools usually allow for easy visualization of price data, drawing of trendlines, and identification of support and resistance zones. Remember, interpreting this historical data involves understanding the context of the market at the time the support and resistance levels were established. Economic events, news announcements, and overall market sentiment can all influence price action. Therefore, a holistic approach that combines the technical analysis of how to see options price history with a thorough understanding of market fundamentals is needed for the most effective trading strategies. Combining this knowledge allows for a clearer view of potential future price movements, but never guarantees accurate predictions.

Backtesting Options Strategies with Historical Data

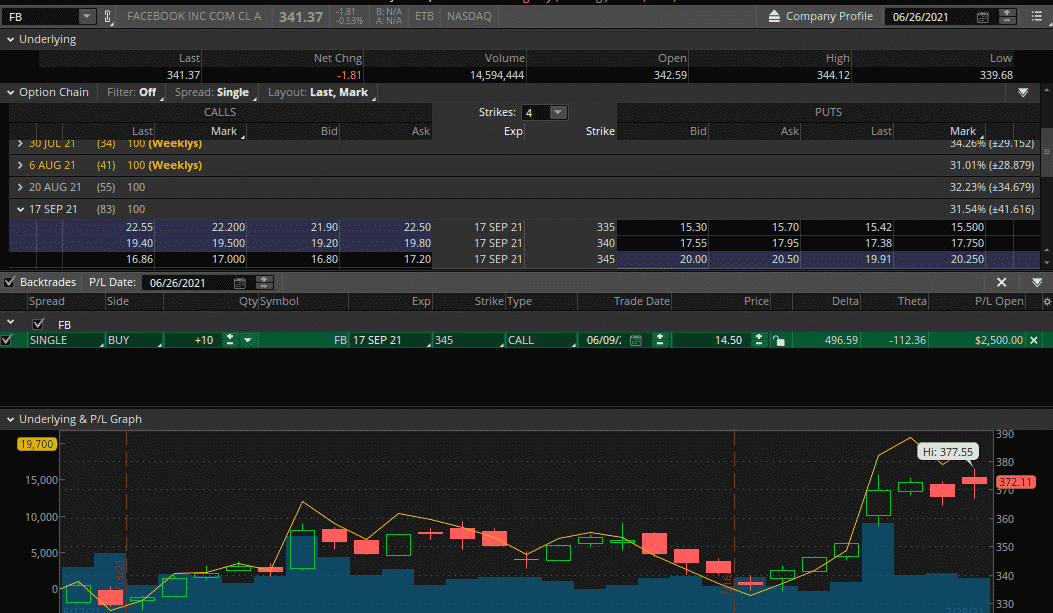

Understanding how to see options price history is fundamental to effective backtesting. Backtesting allows traders to evaluate the performance of various options strategies using historical price data before risking real capital. This process involves simulating trades using past market data to assess potential profitability and risk. It helps refine trading strategies, identify weaknesses, and optimize parameters for improved results. To begin, traders need access to comprehensive historical options data, which can be obtained through brokerage platforms or third-party data providers. This data should include price, volume, and open interest for a sufficient period to accurately reflect market conditions. Properly understanding how to see options price history in your chosen data source is crucial for accurate backtesting.

The backtesting process typically involves selecting a specific options strategy, defining entry and exit rules, and then applying these rules to the historical data. Software tools or programming languages like Python can automate this process, facilitating the analysis of large datasets and the rapid evaluation of multiple strategies. Traders should carefully document their backtesting process, including the parameters used, data sources, and the results obtained. This documentation aids in reproducibility and allows for future comparisons. It’s important to note that backtesting results do not guarantee future performance. Market conditions constantly evolve, and past performance is not indicative of future results. Therefore, backtesting should be used as a tool to improve trading strategies, not as a predictor of future success. Knowing how to see options price history is only one part of the process; interpreting the data correctly is just as crucial.

Limitations of backtesting include the inherent challenges of accounting for unforeseen events, such as market crashes or significant geopolitical shifts. Historical data may not accurately represent future volatility or market sentiment. Furthermore, transaction costs, slippage, and commissions are often not fully incorporated into backtests, potentially leading to overly optimistic results. To mitigate these limitations, traders should incorporate realistic assumptions into their backtests and use multiple data sets to validate their findings. Backtesting, though not a perfect predictive tool, significantly enhances the ability to refine strategies and manage risk. The ability to effectively utilize how to see options price history is a valuable skill for any options trader aiming for successful and informed trading decisions. By meticulously analyzing historical data, traders can build a stronger foundation for future trading success.

Advanced Techniques: Using Options Price History for Option Greeks Analysis

Understanding option Greeks—delta, gamma, theta, and vega—is crucial for advanced options trading. These metrics quantify the sensitivity of an option’s price to changes in underlying asset price, time decay, volatility, and other factors. Historical options price data allows traders to observe how these Greeks change over time. Analyzing this historical data can provide insights into how different strategies perform under various market conditions. For example, observing how delta changes with price movements helps refine hedging strategies. How to see options price history is essential for this analysis.

By plotting historical option price data against changes in the underlying asset’s price, traders can visually assess the delta of an option. Similarly, the rate of change in delta—the gamma—can be studied over time to understand the option’s sensitivity to price fluctuations. Historical data reveals how theta, the time decay, affects option value as expiration approaches. This is vital for understanding the potential profit erosion over time. Analyzing historical volatility alongside vega (the sensitivity to volatility changes) helps estimate the impact of shifts in market volatility on option pricing. How to see options price history efficiently is key to accessing this information.

It is important to remember that while historical data offers valuable insights, it does not predict the future. Market conditions are constantly evolving. Therefore, analyzing historical option Greeks should be used in conjunction with current market analysis. Effective use of historical data requires a deep understanding of options pricing models and the factors that influence them. How to see options price history is only the first step in mastering this advanced technique. Successful application depends on combining this historical information with a comprehensive understanding of current market dynamics and sound risk management practices.