Navigating the Yahoo Finance Interface: A Beginner’s Roadmap

Embarking on the journey of understanding financial markets often begins with familiarizing oneself with the tools that provide access to crucial data. Yahoo Finance serves as a popular platform for investors of all levels. This section provides a step-by-step introduction to navigating the Yahoo Finance website or app, ensuring a smooth and informative experience. Learning how to read Yahoo Finance effectively starts with understanding its layout.

The Yahoo Finance interface is generally structured into key sections. At the top, a search bar allows users to quickly locate specific companies or stock symbols. Simply type the company name (e.g., Apple) or its ticker symbol (e.g., AAPL) into the search bar and select the appropriate result. Below the search bar, users will typically find a navigation menu with options such as “Quotes,” “News,” “My Portfolio,” and “Markets.” The “Quotes” section displays real-time stock prices and related information. The “News” section aggregates financial news articles from various sources. “My Portfolio” allows users to track their investments (registration may be required). “Markets” provides an overview of major market indices and sector performance. Exploring these sections is the first step in learning how to read Yahoo Finance.

The homepage usually features a snapshot of market performance, including major indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. Scrolling down reveals trending news stories and popular stock quotes. The app interface mirrors the website, offering similar functionalities optimized for mobile devices. Take some time to explore each section and familiarize yourself with the location of key features. Pay attention to the layout of individual stock quote pages, which contain a wealth of information. Understanding how to read Yahoo Finance is a valuable skill for anyone interested in investing or tracking the financial markets. With practice, navigating the platform will become second nature, allowing you to efficiently access the information needed to make informed decisions. So, continue practicing how to read Yahoo Finance for better insights on markets performance and investment options.

Mastering Stock Quotes: Interpreting Key Financial Metrics

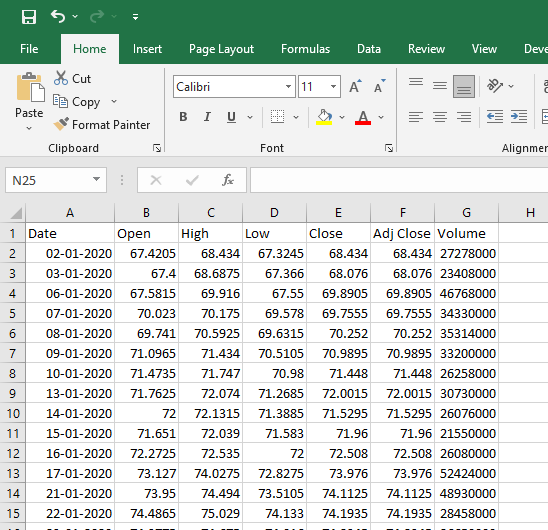

Understanding stock quotes is crucial for making informed investment decisions. Yahoo Finance provides a wealth of data points for each stock. Learning how to read Yahoo Finance stock quotes empowers investors. Key metrics displayed include the open, high, low, and close prices. The “open” represents the price at the beginning of the trading day. The “high” and “low” show the highest and lowest prices reached during the day, respectively. The “close” indicates the final trading price at the end of the day.

Volume, another essential metric, reflects the number of shares traded during the day. A high volume can signal strong interest in a stock. Market capitalization, often shortened to “market cap,” represents the total value of a company’s outstanding shares. It is calculated by multiplying the stock price by the number of shares outstanding. This metric classifies companies as small-cap, mid-cap, or large-cap. The price-to-earnings ratio (P/E ratio) is a valuation metric that compares a company’s stock price to its earnings per share (EPS). How to read Yahoo Finance using P/E ratios? A high P/E ratio may suggest that a stock is overvalued. A low P/E ratio might indicate undervaluation, but this should be considered alongside other factors. EPS represents a company’s profit allocated to each outstanding share of common stock. It is a key indicator of profitability.

Dividend yield is the annual dividend payment per share, divided by the stock price. It indicates the return on investment from dividends alone. For example, a stock with a $1 dividend and a $20 share price has a 5% dividend yield. Investors use these metrics in various ways. Value investors may focus on stocks with low P/E ratios and high dividend yields. Growth investors might prioritize companies with high EPS growth. Day traders might focus on volume and intraday price movements. Learning how to read Yahoo Finance stock quotes helps understand a company’s financial health and potential. By combining these metrics with other research, investors improve decision-making and potentially increase their chances of success in the stock market. Understanding these metrics is fundamental to understanding how to read Yahoo Finance effectively.

Analyzing Financial News: Staying Informed About Market Trends

To effectively utilize the news section on Yahoo Finance, one must understand how to navigate and filter information. The news section is a valuable resource for staying abreast of market trends and company-specific events. Learning how to read Yahoo Finance news effectively involves understanding the filtering options available. Users can filter news by company ticker symbol or industry to focus on areas of particular interest. This allows for a tailored news feed, ensuring that relevant information is readily accessible.

Distinguishing between objective news reports and opinion pieces is crucial for informed decision-making. Objective news reports present factual information without bias, while opinion pieces reflect the author’s personal views. Look for reputable news sources and be wary of articles that seem overly promotional or sensationalized. Cross-referencing information from multiple sources is a best practice. By comparing reports from different news outlets, one can gain a more balanced perspective and identify potential biases. Understanding how to read Yahoo Finance news also entails recognizing the source’s credibility. Focus on established news organizations with a track record of accuracy.

The ability to critically evaluate financial news is paramount for investors. Pay attention to the details presented in the news articles, such as earnings reports, analyst ratings, and company announcements. Consider the potential impact of these events on stock prices and investment strategies. Staying informed about market trends and company-specific news is a continuous process. By regularly monitoring the news section on Yahoo Finance and cross-referencing information from various sources, investors can make more informed decisions. Understanding how to read Yahoo Finance news enables users to filter information efficiently, distinguish between objective reports and opinion pieces, and critically evaluate the potential impact of news events on their investments. Therefore, learning how to read Yahoo Finance is a very useful and important thing for investors.

Utilizing Charts and Graphs: Visualizing Stock Performance Over Time

Yahoo Finance provides robust charting tools that are essential for anyone learning how to read Yahoo Finance effectively. These tools allow users to visualize stock performance over different timeframes and identify potential trends. Understanding how to use these charts is a crucial aspect of financial analysis. Several chart types are available, with line charts and candlestick charts being the most commonly used. Line charts offer a simple view of price movement over time, while candlestick charts provide more detailed information, including the open, high, low, and closing prices for a specific period.

To effectively use Yahoo Finance’s charting tools, customization is key. Users can adjust the time period displayed on the chart, ranging from a single day to several years, or even the maximum available history. This allows for both short-term and long-term trend analysis. Furthermore, various technical indicators can be overlaid on the charts to provide additional insights. Common indicators include moving averages, which smooth out price data to identify trends; Relative Strength Index (RSI), which measures the magnitude of recent price changes to evaluate overbought or oversold conditions; and Moving Average Convergence Divergence (MACD), a trend-following momentum indicator that shows the relationship between two moving averages of prices. Learning how to read Yahoo Finance charts involves experimenting with these indicators and understanding their signals.

Identifying trends and patterns in stock prices is a primary goal when using charting tools. Uptrends are characterized by a series of higher highs and higher lows, while downtrends exhibit lower highs and lower lows. Sideways trends, or consolidation phases, occur when the price moves within a relatively narrow range. Candlestick patterns, such as dojis, engulfing patterns, and hammers, can also provide clues about potential future price movements. While Yahoo Finance’s charting tools are powerful, it’s important to remember that technical analysis is not foolproof. It should be used in conjunction with fundamental analysis and other research methods to make informed investment decisions. Practicing how to read Yahoo Finance charts regularly will improve your ability to interpret market data and identify potential investment opportunities. Recognizing these patterns is an essential skill when learning how to read Yahoo Finance effectively.

Exploring Company Profiles: Delving Deeper into Business Fundamentals

Understanding company profiles on Yahoo Finance is crucial for informed investment decisions. This section provides a detailed overview of a company’s operations and financial health, going beyond simple stock quotes. Learning how to read Yahoo Finance company profiles empowers users to conduct thorough due diligence before investing.

To access a company profile, first, search for the company’s stock ticker symbol. Once on the main stock page, navigate to the “Profile” tab. Here, one will find several key sections. The “Business Summary” offers a concise description of the company’s activities, industry, and competitive landscape. “Key Statistics” provides a snapshot of essential metrics like market capitalization, enterprise value, and valuation ratios. Paying attention to these statistics is part of learning how to read Yahoo Finance effectively.

The “Financials” section is arguably the most important part of the company profile. It contains the income statement, balance sheet, and cash flow statement, presented in an easily accessible format. The income statement reveals the company’s revenues, expenses, and profitability over a specific period. The balance sheet provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. The cash flow statement shows the movement of cash both into and out of the company. Analyzing these statements provides insights into a company’s financial stability and performance. Furthermore, the “Competitors” section lists other companies in the same industry, allowing for comparisons. Reviewing competitors is integral to how to read Yahoo Finance company data for relative analysis. By learning how to read Yahoo Finance and interpret these sections, investors can gain a deeper understanding of a company’s strengths, weaknesses, and potential risks, facilitating more informed investment choices.

Creating and Managing Watchlists: Tracking Your Favorite Investments

Watchlists on Yahoo Finance are a powerful tool for monitoring potential investments and tracking the performance of securities you already own. This section will guide you on how to create and effectively manage watchlists to enhance your investment strategy. Understanding how to read Yahoo Finance data within a watchlist context is crucial for informed decision-making. This is a useful feature to learn how to read Yahoo Finance.

To begin, navigate to the “My Portfolio” section on Yahoo Finance. From there, you should find an option to create a new watchlist. Give your watchlist a descriptive name, such as “Tech Stocks,” “Retirement Portfolio,” or “High-Yield Dividends.” Once the watchlist is created, you can begin adding securities. To add a stock, ETF, mutual fund, or other security, simply search for its ticker symbol in the search bar and then click the “+ Add to Watchlist” button. You can add the same security to multiple watchlists if desired. Customization is key to effective watchlist management. Yahoo Finance allows you to customize the columns displayed in your watchlist view. Consider including essential data points such as: Last Price, Change (in price and percentage), Volume, Market Cap, and any other metrics relevant to your investment strategy. Knowing how to read Yahoo Finance data allows customization of watchlist views. Regularly review and update your watchlists to ensure they reflect your current investment interests and goals. Remove securities that are no longer relevant and add new ones as you identify potential opportunities. Pay close attention to news and analysis related to the securities on your watchlists. Yahoo Finance provides a news feed for each security, allowing you to stay informed about important developments. By effectively utilizing watchlists, you can streamline your investment research, monitor portfolio performance, and make more informed decisions. Learning how to read Yahoo Finance becomes much easier when you organize stocks into watchlists, where you can quickly view and compare key data. It’s a skill that significantly enhances how to read Yahoo Finance for investment purposes.

Watchlists provide a focused view of your selected securities, facilitating quick performance assessment and informed decision-making. They also enable you to quickly grasp how to read Yahoo Finance data. Understanding how to read Yahoo Finance is essential to investing. Take advantage of this tool to enhance your overall investment process.

Understanding Market Data and Indices: Gauging Overall Market Performance

To effectively learn how to read Yahoo Finance, understanding market data and indices is crucial. Yahoo Finance provides easy access to information on major market indices, serving as valuable benchmarks for gauging overall market performance. Key indices to monitor include the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. These indices represent a broad spectrum of the stock market, reflecting the performance of large, medium, and small-cap companies.

The S&P 500 tracks the performance of 500 of the largest publicly traded companies in the United States. It is widely considered a benchmark for the overall health of the US stock market. The Dow Jones Industrial Average (DJIA) is a price-weighted index that tracks 30 large, publicly owned companies trading in the United States. While it includes fewer companies than the S&P 500, it still provides insights into the performance of major industrial players. The Nasdaq Composite is a market-capitalization-weighted index of all stocks listed on the Nasdaq stock exchange. It is heavily weighted towards technology companies and is often used as an indicator of the technology sector’s performance. Learning how to read Yahoo Finance and interpret these indices allows investors to quickly assess the general direction of the stock market. A rising index generally indicates a positive market sentiment, while a declining index suggests a negative outlook.

Beyond these key indices, Yahoo Finance offers additional market data, including sector performance and economic indicators. Sector performance data allows investors to identify which sectors of the economy are performing well or underperforming. This information can be used to make informed investment decisions about how to read Yahoo Finance data and sector rotations. Economic indicators, such as inflation rates, unemployment figures, and GDP growth, provide insights into the overall health of the economy. These indicators can influence market sentiment and stock prices. By monitoring these indicators on Yahoo Finance, investors can gain a more comprehensive understanding of the factors driving market performance and improving their ability to how to read Yahoo Finance for informed decisions.

Leveraging Portfolio Tools: Monitoring and Analyzing Your Investments

Many investors seek efficient ways to monitor and analyze their investments. While Yahoo Finance’s direct portfolio tracking capabilities may be limited or point to external resources, understanding the principles of portfolio monitoring is crucial. This section outlines how to approach tracking your investments, even if it involves using separate tools or spreadsheets, and touches on features that Yahoo Finance might integrate or link to.

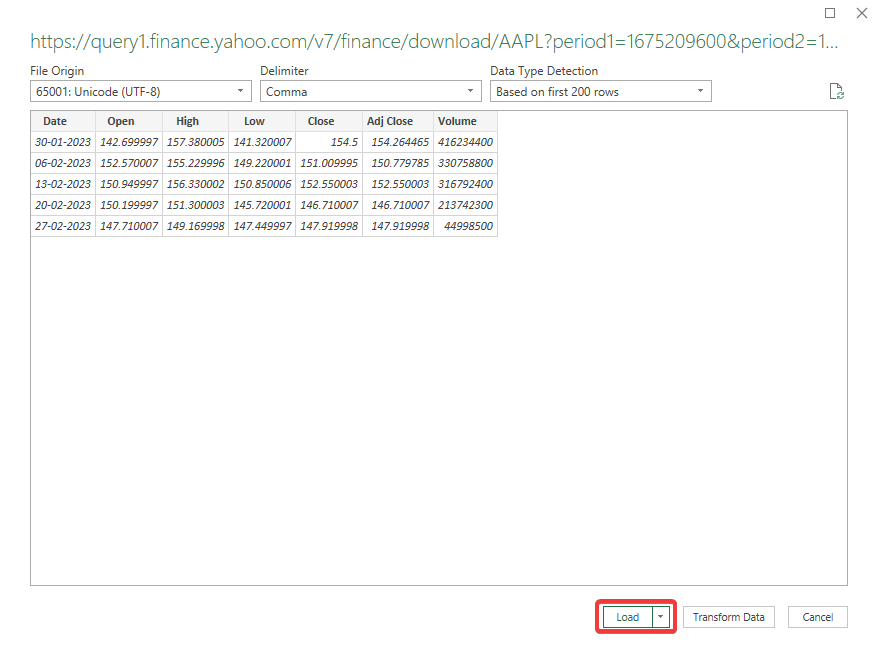

The core of portfolio tracking involves recording your holdings. This includes the security’s name or ticker symbol, the number of shares owned, the purchase price, and the date of purchase. Whether you use a dedicated portfolio tracking tool (potentially linked from Yahoo Finance), a spreadsheet, or another method, accurate record-keeping is essential. Once your holdings are entered, you can track gains and losses by comparing the current market value of each security (easily obtained from Yahoo Finance stock quotes) to your purchase price. Regularly updating this information provides a clear picture of your portfolio’s performance. One aspect of learning how to read Yahoo Finance is knowing where to find the current price of your stocks to keep your external portfolio information updated. Analyzing asset allocation involves determining the percentage of your portfolio invested in different asset classes, such as stocks, bonds, and real estate. This analysis helps ensure that your portfolio aligns with your risk tolerance and investment goals.

The benefits of portfolio tracking are numerous. It allows you to monitor the overall performance of your investments, identify underperforming assets, and make informed decisions about buying or selling securities. It also facilitates tax planning by providing a record of your capital gains and losses. Keep in mind that even if Yahoo Finance offers portfolio tracking features, it’s important to understand any associated costs or limitations. Some tools may offer advanced features such as automatic dividend tracking, tax reporting, or integration with brokerage accounts, but these may come at a premium. As a beginner, focusing on the fundamentals of portfolio tracking – accurate record-keeping, regular monitoring, and asset allocation analysis – will provide a solid foundation for managing your investments effectively. Knowing how to read Yahoo Finance for stock information and incorporating that into your portfolio tracking is a crucial skill.