The Power of Machine Learning in Trading Bot Optimization

Trading bot strategies have gained popularity in recent years due to their ability to automate trading processes, enabling users to take advantage of market opportunities around the clock. However, the performance of these bots can be significantly improved through the application of machine learning techniques. This advanced technology allows trading bots to adapt to changing market conditions, enhancing their accuracy, and efficiency.

Machine learning, a subset of artificial intelligence, involves training algorithms to learn patterns from data and make predictions or decisions based on that information. In the context of trading bot strategies, machine learning can be employed to analyze historical market data, identify trends, and make informed trading decisions. This approach not only improves the accuracy of trading bots but also reduces the need for manual intervention, making the trading process more efficient and less prone to human error.

Machine learning algorithms can be categorized into supervised, unsupervised, and reinforcement learning. Supervised learning involves training algorithms using labeled data, where the desired output is known. Unsupervised learning, on the other hand, deals with unlabeled data, and the algorithm identifies hidden patterns or structures within the data. Reinforcement learning, a more complex form of machine learning, involves training algorithms to make decisions based on feedback from the environment, allowing the bot to learn and adapt over time.

By incorporating machine learning into trading bot strategies, users can benefit from improved accuracy, adaptability, and efficiency. As market conditions change, machine learning algorithms can identify new trends and adjust trading strategies accordingly, ensuring that users stay ahead of the competition. Furthermore, machine learning-based trading bots can process vast amounts of data more quickly than human traders, enabling them to capitalize on market opportunities that might be missed otherwise.

Understanding Trading Bot Components and Data

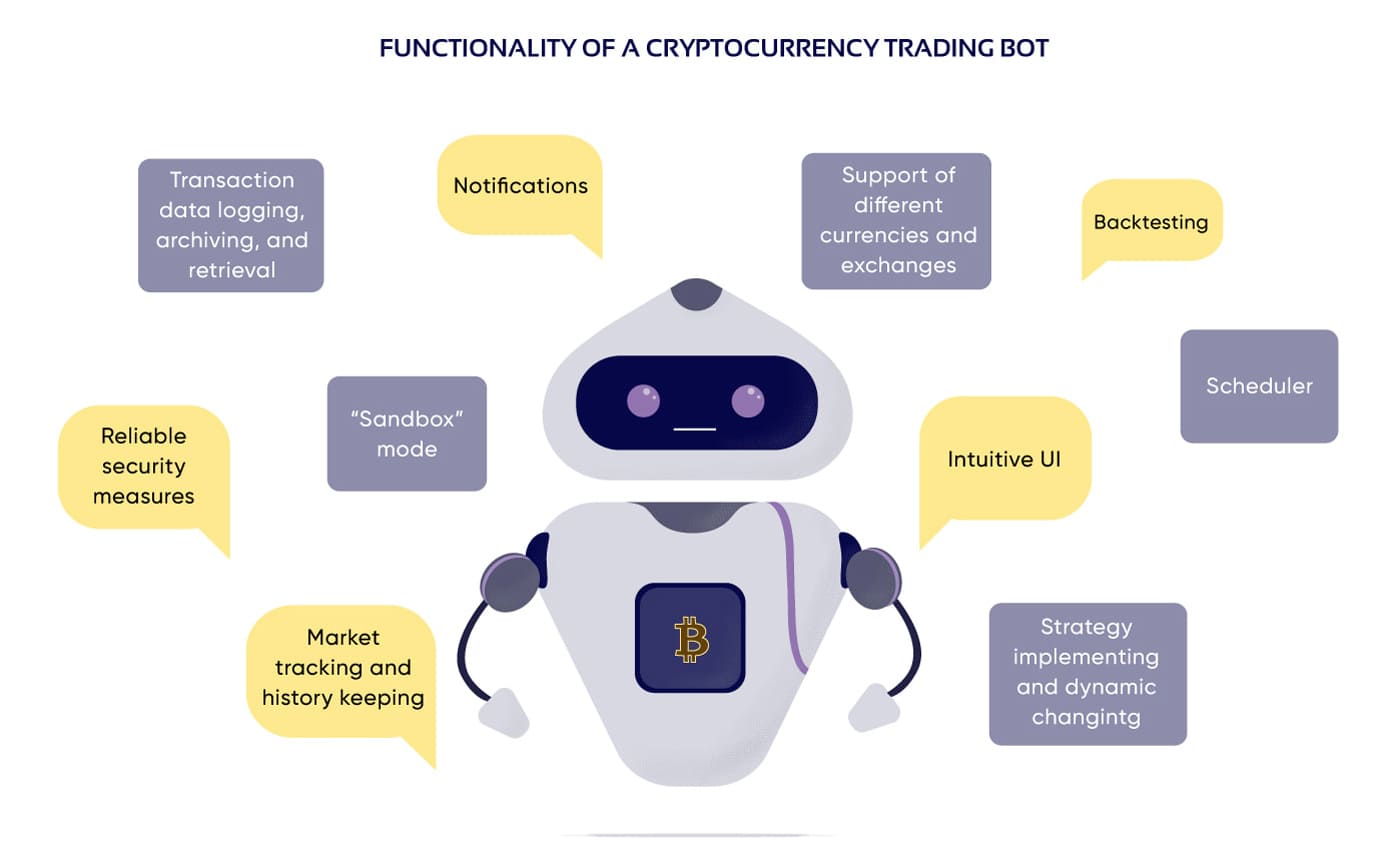

To effectively optimize trading bot strategies using machine learning, it is essential to understand the fundamental components of trading bots and the types of data used in their strategies. Trading bots typically consist of three main components: data feeds, trading algorithms, and brokerage interfaces. Data feeds provide the bot with market data, such as prices, volumes, and news. Trading algorithms analyze this data and generate trading signals based on predefined rules or machine learning models. Finally, brokerage interfaces facilitate the execution of trades through a connected brokerage account.

The types of data used in trading bot strategies can vary depending on the specific market and trading strategy. Common data sources include historical price data, volume data, financial reports, economic indicators, and news feeds. These data sources can be categorized into structured and unstructured data. Structured data, such as historical price and volume data, can be easily processed and analyzed using machine learning algorithms. In contrast, unstructured data, such as news feeds, requires preprocessing and feature engineering before it can be used in machine learning models.

Data preprocessing is a crucial step in developing machine learning-based trading bot strategies. This process involves cleaning and transforming raw data into a format suitable for machine learning algorithms. Techniques used in data preprocessing include missing value imputation, outlier detection, and normalization. Once the data has been preprocessed, feature selection is performed to identify the most relevant features for the machine learning model. This step helps reduce the dimensionality of the data, improve model performance, and reduce overfitting.

Model validation is another critical aspect of machine learning-based trading bot strategies. This process involves evaluating the performance of the machine learning model using a separate validation dataset. Various evaluation metrics, such as accuracy, precision, recall, and F1 score, can be used to assess the performance of the model. Cross-validation techniques, such as k-fold cross-validation, can also be employed to ensure that the model performs well on unseen data.

By understanding the essential components of trading bots and the importance of data preprocessing, feature selection, and model validation, users can develop more effective machine learning-based trading bot strategies. These strategies can help improve trading performance, reduce risk, and increase profitability in various financial markets.

Popular Machine Learning Algorithms for Trading Bot Optimization

Machine learning algorithms have become increasingly popular in trading bot optimization due to their ability to improve accuracy, adaptability, and efficiency. Various machine learning algorithms can be employed in trading bot strategies, each with its unique advantages and disadvantages. Here are some of the most popular machine learning algorithms used in trading bot optimization:

Linear Regression

Linear regression is a simple and widely used machine learning algorithm for predicting continuous outcomes. It is often used in trading bot strategies to predict future price movements based on historical data. The advantages of linear regression include its simplicity, interpretability, and ability to handle large datasets. However, it assumes a linear relationship between the dependent and independent variables, which may not always be the case in financial markets. Additionally, it may not perform well in the presence of outliers or non-linear relationships.

Decision Trees

Decision trees are a popular machine learning algorithm for classification and regression tasks. They are easy to interpret and can handle both numerical and categorical data. In trading bot strategies, decision trees can be used to predict binary outcomes, such as whether a stock price will go up or down. The advantages of decision trees include their ability to handle non-linear relationships and missing data. However, they may be prone to overfitting, especially when dealing with small datasets or complex decision rules.

Random Forests

Random forests are an ensemble machine learning algorithm that combines multiple decision trees to improve accuracy and reduce overfitting. They are widely used in trading bot strategies due to their ability to handle complex relationships and high-dimensional data. The advantages of random forests include their robustness to noise, outliers, and missing data. However, they may be computationally expensive and difficult to interpret compared to individual decision trees.

Neural Networks

Neural networks are a class of machine learning algorithms inspired by the structure and function of the human brain. They are highly versatile and can handle complex relationships and high-dimensional data. In trading bot strategies, neural networks can be used for prediction, classification, and feature learning tasks. The advantages of neural networks include their ability to learn from large datasets and adapt to changing market conditions. However, they may be computationally expensive and difficult to interpret compared to other machine learning algorithms.

When selecting a machine learning algorithm for trading bot optimization, it is essential to consider the specific requirements and constraints of the trading strategy. Factors such as data availability, computational resources, interpretability, and model complexity should be taken into account. By selecting the appropriate machine learning algorithm and optimizing its hyperparameters, users can develop more effective and profitable trading bot strategies.

Designing and Implementing a Machine Learning-Based Trading Bot Strategy

To optimize trading bot strategies with machine learning, it is essential to follow a systematic approach to designing and implementing a machine learning-based trading bot strategy. Here is a step-by-step guide to help you get started:

Step 1: Define the Trading Strategy

The first step in designing a machine learning-based trading bot strategy is to define the trading strategy. This involves identifying the financial instruments to trade, the investment horizon, and the risk management parameters. It is crucial to have a clear understanding of the trading strategy before selecting the appropriate machine learning algorithm.

Step 2: Data Preprocessing

Data preprocessing is an essential step in developing a machine learning-based trading bot strategy. This involves cleaning and transforming the raw data into a format suitable for machine learning algorithms. Data preprocessing techniques include missing value imputation, outlier detection, and normalization. It is essential to ensure that the data is free from bias and noise to improve the accuracy and robustness of the machine learning model.

Step 3: Feature Engineering

Feature engineering is the process of selecting and transforming the input variables to improve the performance of the machine learning algorithm. In the context of trading bot strategies, feature engineering involves selecting the relevant financial indicators and transforming them into a format suitable for machine learning algorithms. Some of the commonly used financial indicators include moving averages, relative strength index (RSI), and Bollinger bands.

Step 4: Model Training

Model training involves selecting the appropriate machine learning algorithm and optimizing its hyperparameters to improve the performance of the trading bot strategy. It is essential to evaluate the performance of the machine learning model using appropriate metrics such as accuracy, precision, recall, and F1 score. It is also crucial to ensure that the machine learning model is not overfitting or underfitting the training data.

Step 5: Model Evaluation

Model evaluation involves testing the machine learning model on a separate dataset to assess its performance. It is essential to ensure that the evaluation dataset is representative of the real-world data that the trading bot strategy will encounter. Model evaluation techniques include cross-validation, walk-forward optimization, and backtesting.

Step 6: Model Deployment

Model deployment involves integrating the machine learning model into the trading bot strategy and deploying it in a live trading environment. It is crucial to ensure that the trading bot strategy is robust and can handle real-world scenarios such as market volatility, slippage, and transaction costs.

In conclusion, optimizing trading bot strategies with machine learning requires a systematic approach to designing and implementing a machine learning-based trading bot strategy. By following the steps outlined above, users can develop more effective and profitable trading bot strategies. It is essential to ensure that the machine learning model is transparent, interpretable, and fair to avoid regulatory and ethical issues in algorithmic trading.

Backtesting and Validating Trading Bot Strategies

Once a machine learning-based trading bot strategy has been designed and implemented, it is crucial to backtest and validate the strategy to ensure its robustness and effectiveness. Backtesting involves testing the strategy on historical data to evaluate its performance, while validation involves assessing the model’s ability to generalize to new, unseen data.

The Importance of Backtesting

Backtesting is an essential step in developing a machine learning-based trading bot strategy. It allows traders to evaluate the strategy’s performance on historical data and assess its strengths and weaknesses. Backtesting can help identify potential issues with the strategy, such as overfitting, underfitting, or bias, and provide insights into the strategy’s profitability and risk management.

Walk-Forward Optimization

Walk-forward optimization is a technique used to improve the robustness of machine learning models in trading bot strategies. It involves dividing the historical data into in-sample and out-of-sample periods. The machine learning model is trained on the in-sample data and then tested on the out-of-sample data. The process is repeated with overlapping out-of-sample periods to evaluate the model’s performance over time.

Walk-forward optimization can help identify potential issues with the machine learning model, such as overfitting or underfitting, and provide insights into the model’s ability to generalize to new, unseen data. It can also help traders evaluate the strategy’s performance over different market conditions and identify potential weaknesses or vulnerabilities.

Validation Techniques

Validation techniques are used to assess the machine learning model’s ability to generalize to new, unseen data. Common validation techniques include cross-validation, bootstrapping, and holdout validation. Cross-validation involves dividing the data into k-folds and training and testing the model on each fold. Bootstrapping involves randomly sampling the data with replacement and evaluating the model’s performance on the resampled data. Holdout validation involves dividing the data into training and testing sets and evaluating the model’s performance on the testing set.

Validation techniques can help traders assess the machine learning model’s performance and identify potential issues, such as overfitting or underfitting. They can also provide insights into the model’s ability to generalize to new, unseen data and its robustness to different market conditions.

Best Practices for Backtesting and Validation

To ensure the robustness and effectiveness of a machine learning-based trading bot strategy, it is essential to follow best practices for backtesting and validation. These practices include:

- Using high-quality, representative data for backtesting and validation.

- Avoiding data snooping and overfitting by using appropriate validation techniques and cross-validation.

- Evaluating the strategy’s performance over different market conditions and time periods.

- Assessing the strategy’s risk management and position sizing parameters.

- Monitoring the strategy’s performance and updating it as needed based on new data and market conditions.

By following best practices for backtesting and validation, traders can develop more robust and effective machine learning-based trading bot strategies that can adapt to changing market conditions and generate consistent profits over time.

Monitoring and Updating Trading Bot Strategies

Continuous monitoring and updating of trading bot strategies are crucial to maintaining their effectiveness and profitability. As market conditions change, machine learning models may become outdated or less accurate, leading to decreased performance. By implementing techniques for detecting model drift and strategies for re-training and fine-tuning machine learning models, traders can ensure that their trading bot strategies remain optimized and adapt to changing market conditions.

Detecting Model Drift

Model drift occurs when the performance of a machine learning model decreases over time due to changes in the underlying data or market conditions. To detect model drift, traders can monitor the model’s performance metrics, such as accuracy, precision, recall, and F1 score. If the performance metrics decrease significantly, it may indicate that the model is no longer accurate and needs to be updated.

Another technique for detecting model drift is to use statistical tests, such as the Kolmogorov-Smirnov test or the Chi-Square test, to compare the distribution of the input data to the distribution of the training data. If the distributions are significantly different, it may indicate that the model is no longer applicable to the current market conditions.

Re-Training and Fine-Tuning Machine Learning Models

Once model drift has been detected, traders can re-train and fine-tune the machine learning model to improve its performance. Re-training involves training the model on a new dataset that reflects the current market conditions. Fine-tuning involves adjusting the model’s hyperparameters, such as learning rate, batch size, and number of epochs, to optimize its performance.

To ensure that the machine learning model remains up-to-date, traders can implement a schedule for re-training and fine-tuning the model. For example, the model can be re-trained and fine-tuned monthly, quarterly, or annually, depending on the market conditions and the model’s performance.

Best Practices for Monitoring and Updating Trading Bot Strategies

To ensure the effectiveness and profitability of a machine learning-based trading bot strategy, it is essential to follow best practices for monitoring and updating the strategy. These practices include:

- Continuously monitoring the machine learning model’s performance metrics and detecting model drift.

- Re-training and fine-tuning the machine learning model regularly to adapt to changing market conditions.

- Implementing a schedule for re-training and fine-tuning the machine learning model.

- Documenting the changes made to the machine learning model and the reasons for those changes.

- Testing the updated machine learning model on historical data to ensure its effectiveness and profitability.

By following best practices for monitoring and updating a machine learning-based trading bot strategy, traders can ensure that the strategy remains optimized and adaptive to changing market conditions, leading to consistent profits over time.

Real-World Applications and Success Stories

Machine learning has been increasingly adopted in the financial industry to optimize trading bot strategies, leading to significant improvements in accuracy, adaptability, and efficiency. The following examples and success stories highlight the achievements and lessons learned from implementing machine learning in trading bots.

Example 1: QuantConnect’s Machine Learning Competition

QuantConnect, a cloud-based algorithmic trading platform, hosts an annual machine learning competition that challenges participants to develop a trading algorithm that outperforms the market. The competition attracts data scientists, quants, and traders from around the world, who compete for cash prizes and recognition. In the 2021 competition, the top-performing algorithm achieved a return on investment (ROI) of 241.55%, demonstrating the potential of machine learning in trading bot optimization.

Example 2: Sentient Investment Management

Sentient Investment Management, a hedge fund manager, uses machine learning algorithms to analyze vast amounts of financial data and make trading decisions. The firm’s artificial intelligence (AI) system, called Sentient Trade, uses deep learning techniques to identify patterns and trends in the market, generating trading signals that are used to execute trades automatically. In 2017, Sentient Investment Management managed over $2.6 billion in assets, demonstrating the scalability and profitability of machine learning-based trading bots.

Example 3: Aidyia Limited

Aidyia Limited, a Hong Kong-based fintech company, uses machine learning algorithms to predict stock prices and generate trading signals. The company’s AI system, called Aidyia Sentiment Engine, analyzes news articles, social media posts, and other forms of unstructured data to identify sentiment and predict market trends. In 2016, Aidyia Limited’s AI system outperformed human traders in a simulated trading competition, achieving a return on investment (ROI) of 19.4% compared to human traders’ average ROI of 11.2%. The company’s success highlights the potential of machine learning in trading bot optimization and the advantages of using AI over human traders.

Lessons Learned

These examples and success stories demonstrate the potential of machine learning in trading bot optimization. However, they also highlight the importance of careful design, implementation, and monitoring of machine learning-based trading strategies. Key lessons learned include:

- The need for high-quality data and feature engineering to ensure accurate and reliable predictions.

- The importance of model validation and backtesting to ensure the robustness and generalizability of machine learning models.

- The significance of continuous monitoring and updating of trading bot strategies to adapt to changing market conditions.

- The potential risks and challenges associated with algorithmic trading, such as overfitting, model drift, and regulatory compliance.

By following best practices and incorporating machine learning techniques, traders can optimize their trading bot strategies and achieve consistent profits in the financial markets.

Navigating Regulatory and Ethical Considerations

As the use of machine learning in trading bot optimization becomes more widespread, it is crucial to address the regulatory and ethical considerations surrounding algorithmic trading. Ensuring transparency, fairness, and accountability in machine learning models is essential to maintaining the integrity of financial markets and protecting investors.

Transparency

Transparency in machine learning models refers to the ability to understand and explain how the model makes decisions. In the context of trading bot optimization, transparency is essential to ensure that traders can understand the reasoning behind the bot’s trading decisions and identify any potential biases or errors. Regulatory bodies may require traders to provide explanations for their trading strategies, including the use of machine learning models. Therefore, it is essential to use transparent machine learning algorithms and techniques that can be easily explained and interpreted.

Fairness

Fairness in machine learning models refers to the absence of discrimination or bias in the decision-making process. In the context of trading bot optimization, fairness is essential to ensure that all traders have equal access to the market and that the bot does not favor certain traders or assets over others. Regulatory bodies may require traders to demonstrate that their machine learning models do not discriminate against certain groups or assets. Therefore, it is essential to use fair machine learning algorithms and techniques that do not rely on biased data or discriminatory features.

Accountability

Accountability in machine learning models refers to the ability to hold the model and its developers responsible for the decisions made by the model. In the context of trading bot optimization, accountability is essential to ensure that traders can be held responsible for the bot’s trading decisions and any potential consequences. Regulatory bodies may require traders to demonstrate that they have taken appropriate measures to ensure the accountability of their machine learning models. Therefore, it is essential to implement appropriate governance and oversight mechanisms to monitor and control the bot’s trading decisions and ensure that they align with the trader’s objectives and risk tolerance.

Regulatory Compliance

Regulatory compliance is essential to ensure that trading bot strategies using machine learning are legal and ethical. Regulatory bodies may require traders to obtain licenses, register their bots, and comply with specific rules and regulations. Therefore, it is essential to stay informed about the latest regulatory requirements and ensure that the bot’s design, implementation, and operation comply with all relevant regulations.

Ethical Considerations

Ethical considerations refer to the moral and social implications of using machine learning in trading bot optimization. Traders have a responsibility to ensure that their bots do not harm other market participants, manipulate the market, or violate ethical norms. Therefore, it is essential to consider the potential consequences of the bot’s trading decisions and ensure that they align with ethical principles such as honesty, integrity, and respect for others.

In conclusion, navigating regulatory and ethical considerations is essential to optimize trading bot strategies with machine learning. By ensuring transparency, fairness, accountability, regulatory compliance, and ethical considerations, traders can build trust with regulatory bodies, investors, and other market participants, and maintain the integrity of financial markets.