Navigating Your Path into Quantitative Finance

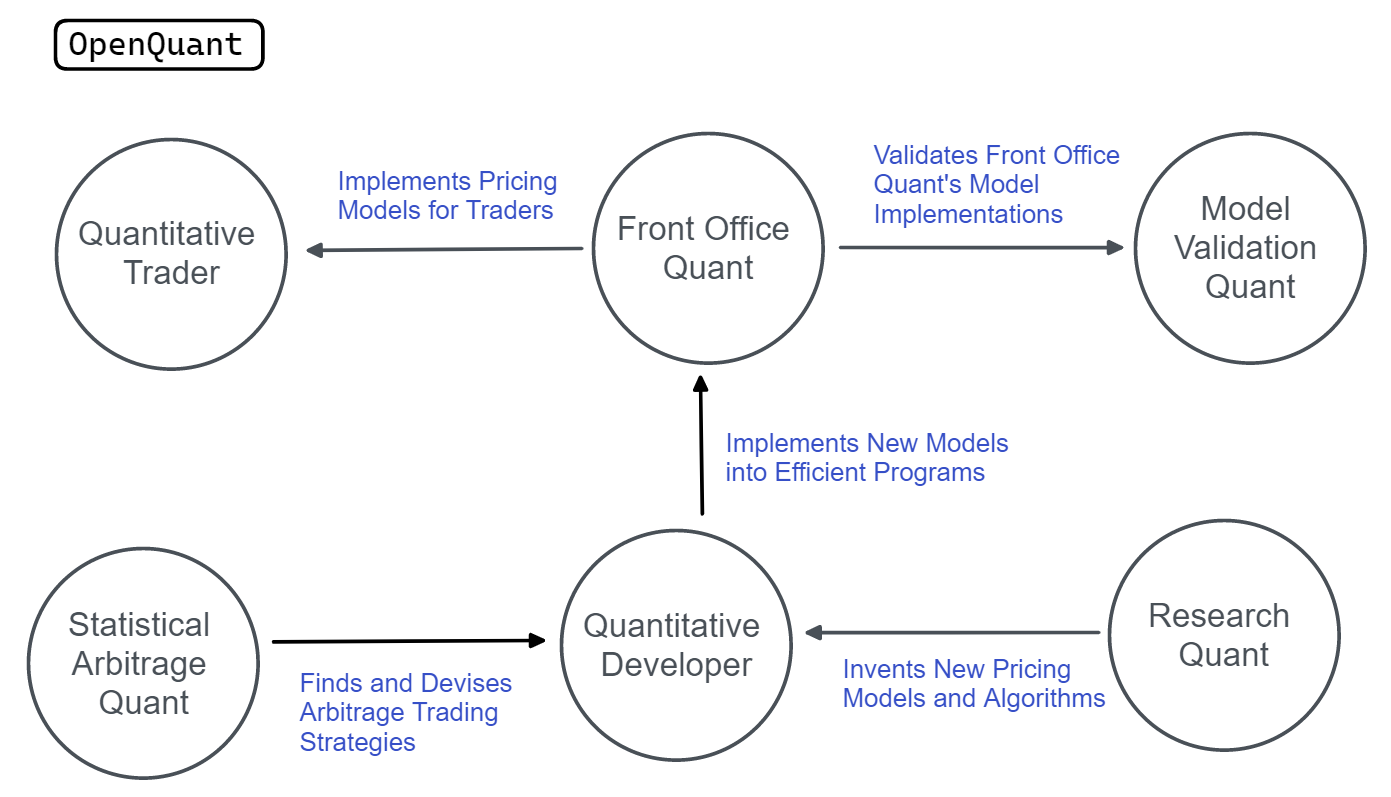

Quantitative finance, a field that blends advanced mathematics, statistics, and computer science, has emerged as a highly sought-after career path. The allure of quant finance stems from its intellectually stimulating challenges and the potential for significant financial rewards. The demand for skilled quantitative professionals continues to surge, fueled by the increasing sophistication of financial markets and the ever-evolving landscape of technology. Those interested in how to get into quantitative finance will discover a diverse range of opportunities. These opportunities include roles such as quantitative traders who develop and implement trading strategies, quantitative researchers who focus on creating and refining financial models, and quantitative developers who build the technological infrastructure that supports these processes. Each of these positions plays a vital role in the financial ecosystem, and while distinct, all require a blend of analytical rigor and practical skill. This guide will serve as a roadmap, providing a comprehensive overview of how to get into quantitative finance, outlining the necessary academic background, technical skills, practical experiences, networking strategies, and interview preparation that are essential for a successful transition into this dynamic industry. This exploration will empower individuals with the necessary insights to navigate their journey into the world of quantitative finance.

The appeal of quantitative finance lies in its ability to tackle real-world problems using cutting-edge techniques. It’s not just about numbers; it’s about understanding market dynamics, predicting trends, and managing risk with sophisticated mathematical models and algorithms. Furthermore, the diverse roles available offer varied paths based on interests and aptitudes. For example, a quant researcher might spend their days deeply involved in theoretical modeling and statistical analysis, while a quant developer may focus more on building robust and efficient software solutions. Understanding the nuances of these different roles is a crucial first step for anyone considering how to get into quantitative finance. The opportunities for career growth in quant finance are substantial, and professionals with the right skills and dedication can advance into leadership positions and specialize in areas that genuinely excite them. This field offers a unique combination of intellectual challenge and tangible impact, making it an attractive proposition for those with a passion for numbers and a keen interest in the financial markets. The journey into quant finance requires careful planning and consistent effort, but the rewards are well worth the commitment. Those seeking to understand how to get into quantitative finance are encouraged to explore these areas in detail.

Essential Academic Background for Quant Roles

A strong academic foundation is paramount when considering how to get into quantitative finance. The field demands a high degree of analytical rigor and problem-solving capability, qualities that are typically honed through specific academic disciplines. Degrees in mathematics, statistics, physics, computer science, and various engineering fields are highly valued by employers in the quantitative finance industry. These disciplines cultivate a structured way of thinking, an ability to approach complex problems systematically, and the capacity to understand and manipulate intricate models. A deep understanding of mathematical concepts like calculus, linear algebra, and differential equations provides the necessary framework for grasping advanced financial models. Similarly, expertise in statistics, probability, and stochastic calculus is critical for analyzing market data and understanding random processes inherent in financial markets. The focus on logical reasoning and quantitative methods within these programs makes them ideal preparation for the challenges presented by quantitative finance. A solid grasp of computer science, specifically with a focus on data structures, algorithms, and computational methods, is essential for developing and implementing trading algorithms, performing complex data analysis, and building software for financial applications. The ability to translate mathematical models into code is a core skill and a computer science degree can help you achieve proficiency in this. Furthermore, understanding the scientific method cultivated by physics and engineering programs becomes invaluable in model building and validation, in effect creating the required foundation to navigate the complex world of finance.

The rigorous coursework in these fields ensures that candidates possess a deep analytical mindset and a keen ability to break down complicated situations into manageable components. These academic programs not only impart specialized knowledge, but also foster the skills needed to independently learn and adapt to new technologies and methodologies within the rapidly evolving quantitative finance sector. It is not simply the degree itself, but the process of mastering such complex information, that indicates one’s capability to succeed in quantitative finance. The focus of these fields on analytical problem-solving is what makes them directly applicable to the various aspects of the industry. A background in these areas will provide you with the needed expertise on how to get into quantitative finance and the capacity to thrive in a high-pressure environment where critical decision-making is essential. In conclusion, while other academic routes are certainly possible, a background in math, statistics, computer science, physics or engineering will offer the most robust foundation when considering how to get into quantitative finance.

Developing Key Technical Skills for Quantitative Finance

A pivotal aspect of learning how to get into quantitative finance lies in acquiring a robust set of technical skills. Proficiency in programming is paramount, with languages like Python, C++, and R being highly sought after. Python’s versatility and extensive libraries make it ideal for data analysis, statistical modeling, and algorithm development. C++, known for its speed and efficiency, is often used in high-frequency trading and performance-critical applications. R is favored for statistical computing and graphics, offering a vast range of statistical packages. A deep understanding of mathematical concepts is equally crucial. This includes a strong foundation in calculus, which provides the tools to model and optimize complex systems; linear algebra, essential for understanding vector spaces, matrices, and transformations, critical for handling large datasets and sophisticated algorithms; probability theory, which is foundational to financial modeling and risk management; and stochastic calculus, used to model random processes in time, necessary for pricing derivatives and analyzing asset behavior. Mastery of statistical modeling techniques is also essential. These techniques allow for the extraction of meaningful insights from data and the building of predictive models. For example, time series analysis is used to forecast market movements, regression analysis to understand the relationships between variables, and machine learning to build advanced predictive models. These techniques are not just theoretical; they are applied every day in the practical settings of quantitative finance.

The application of these skills is varied and depends on the specific role within quantitative finance. For instance, a quant trader uses these skills to build algorithms for trading and risk management, requiring a solid grasp of stochastic calculus, programming for fast execution, and statistical modeling to identify market anomalies. A quant researcher, on the other hand, might focus more on developing new mathematical models and algorithms to price complex derivatives or optimize investment strategies, thus requiring mastery of advanced mathematics, stochastic calculus, statistical modeling, and proficiency in software development. A quant developer translates these models into efficient software solutions that are used by traders or researchers to implement their ideas in the market, requiring expert skills in programming with Python, C++ or similar languages, depending on the platform. The ability to effectively apply these technical skills in real-world scenarios is critical to learn how to get into quantitative finance and thrive in this competitive field. The knowledge must be coupled with the ability to adapt and solve complex issues that are unique to the world of financial markets.

Gaining Practical Experience in Quant Finance

Practical experience is paramount when considering how to get into quantitative finance, a highly competitive field where theoretical knowledge must be complemented by hands-on application. Securing internships within established financial institutions, such as hedge funds, trading firms, or investment banks, provides an invaluable opportunity to apply learned skills in a real-world setting. These internships offer a glimpse into the daily operations of a quant team, allowing aspiring professionals to understand the nuances of financial markets, risk management, and algorithmic trading strategies. Moreover, such opportunities enable the development of mentorship relationships with industry experts, which can be pivotal in shaping one’s career trajectory and enhancing their understanding of how to get into quantitative finance. Such a practical training is key to making a smooth transition from academic studies to a professional role.

While internships are highly beneficial, alternative paths also offer substantial practical experience. Participating in quantitative trading competitions, such as those frequently organized by universities or online platforms, provides a simulated environment to test skills in strategy development, risk management, and algorithm implementation. These competitions can be a valuable addition to your portfolio as they demonstrate an ability to apply quant skills under pressure and also show initiative to potential employers of how to get into quantitative finance. Similarly, pursuing personal projects that involve analyzing financial data, developing predictive models, or implementing trading algorithms can substantially boost one’s skill set and provide a compelling showcase of abilities when searching for a job. Such projects could include backtesting different trading strategies, researching market anomalies, or creating custom data visualization tools, all which exemplify a hands-on understanding of financial markets and an ability to independently develop quantitative models.

These forms of experience are critical in making the theoretical knowledge acquired in the classroom relevant in a competitive job market. Demonstrating a grasp of the real world applications of quantitative methods is as important as mastering the underlying mathematical concepts. These practical experiences collectively demonstrate a commitment to growth within the field of quantitative finance, highlighting proactivity and the dedication necessary to make it in a demanding field, ultimately showing how to get into quantitative finance.

Networking Strategies to Enter Quant Finance

Networking is a crucial, often underestimated, component of how to get into quantitative finance, especially considering that many opportunities are not publicly advertised. Building a strong professional network can significantly increase the chances of discovering hidden job openings and gaining invaluable insights into the industry. The approach to networking within the quantitative finance field should be strategic and focused on building genuine connections rather than just collecting contacts. One effective method is to attend industry-specific conferences and workshops. These events provide a platform to meet and interact with professionals actively working in quant finance, including traders, researchers, and developers. Engaging in conversations about their experiences and challenges can offer valuable perspectives and lead to mentorship opportunities. Furthermore, actively participate in the discussions and ask thoughtful questions. This shows that you are genuinely interested and capable of engaging at a professional level, enhancing your visibility and increasing your chances of being remembered. Another strategic way is to focus on building strong online professional presence on platforms such as LinkedIn. This is very important to highlight and showcase your skills and experience within the field, increasing the discoverability for recruiters. Consistently posting about relevant projects or insights demonstrates your expertise and also keeps you on the radar of professionals in quant finance.

Leveraging your existing academic connections is another important step on how to get into quantitative finance. Connecting with alumni from your university who are working in the quantitative finance field can provide an invaluable source of networking opportunities. Often, alumni are willing to share their experience and offer guidance to fellow graduates looking to break into the industry. Engage with alumni through platforms like LinkedIn, schedule informational interviews, and ask specific questions about their career journey within quant finance. These discussions provide first-hand insights into different firms, the day-to-day responsibilities, and the various skills required for success in the industry. By having alumni connections, you are also making an introduction within the firms where these alumni work, helping you in your networking process. Remember to focus on building relationships that are based on mutual interest and respect, and maintain consistent communication, so you remain on their radar. Also, take the initiative to stay informed about industry trends and recent developments, so that any discussion with professionals will show your interest and knowledge. These relationships are key to help you navigate the often complex process of entering a career in quantitative finance, where these connections can lead to significant professional advantages and access to specific opportunities.

Preparing for Quant Finance Interviews

The interview process for quantitative finance roles is notoriously challenging, requiring meticulous preparation and a strategic approach. Understanding the typical types of questions is crucial for success. Aspiring quants should expect to encounter a range of problem-solving scenarios, including probability puzzles designed to test logical reasoning under pressure, brain teasers that assess creative thinking and the ability to approach problems from multiple perspectives, and coding challenges that evaluate practical programming proficiency in languages like Python, C++, or R. Additionally, be prepared for behavioral questions aimed at understanding your motivations, teamwork skills, and how you handle setbacks. To effectively prepare for these diverse question types, it’s essential to practice extensively. Begin by reviewing fundamental concepts in probability, statistics, and calculus. Strengthen your coding skills through online platforms and personal projects. Mastering how to get into quantitative finance often hinges on how well one performs in these technical interviews. Practice coding specific algorithms, data structures, and common statistical models often used in financial analysis. A consistent practice is paramount, especially in solving probability related problems.

A structured approach to answering interview questions is just as vital as technical prowess. When faced with a problem, articulate your thought process clearly and methodically. Don’t jump immediately to a solution without explaining the reasoning behind each step. This demonstrates your understanding and analytical capabilities to the interviewer. Clearly state any assumptions you make and explain the logic that drives your chosen approach. In coding interviews, use the whiteboard to illustrate your solution and its complexity analysis and don’t be afraid to ask clarifying questions to ensure you fully understand the problem. It is also important to review your answers for errors and areas of improvement. Practicing common interview questions related to quantitative finance is a must. Consider mock interviews with peers or mentors who have experience in the field as well, since they can provide valuable feedback on your performance and help you build confidence. The interview stage for someone who wants to know how to get into quantitative finance requires showing strong problem-solving skills and a structured approach to difficult problems, alongside a mastery of the required technical skills. Remember, clear communication and logical reasoning are valued just as much as the correct answer.

Crafting a Standout Quant Finance Resume

Creating a compelling resume is crucial when exploring how to get into quantitative finance, as it often serves as the first impression for potential employers. A resume tailored specifically for quantitative finance roles should showcase quantifiable achievements, demonstrating a clear impact in previous experiences. The resume should prominently feature relevant coursework, such as advanced mathematics, statistics, and programming, which are essential in this field. Specific projects that highlight the application of these skills should also be detailed, illustrating practical experience alongside theoretical knowledge. In addition to this, technical proficiencies must be clearly articulated, such as expertise in Python, C++, R, and relevant financial libraries. To make the resume stand out, it should focus on using action verbs and quantify your achievements wherever possible. Instead of just stating “developed models,” one could say, “Developed and deployed quantitative models that improved trading efficiency by 15%.” Tailoring the resume to specific job descriptions by highlighting relevant skills and experiences from your background greatly increases the likelihood of catching a recruiter’s attention. Also, ensuring the resume is ATS (Applicant Tracking System) friendly will improve the chances of getting it to a hiring manager, which means using keywords from the job description, and using a simplified format, avoiding tables and images, all to make sure the resume passes through the initial automated screenings.

To further strengthen a quantitative finance resume, it is essential to include specifics related to mathematical knowledge, such as experience with calculus, linear algebra, probability, and stochastic calculus. For candidates looking at how to get into quantitative finance, highlighting any statistical modelling techniques you are familiar with is vital. These could include regression analysis, time series analysis, or machine learning. It is useful to show that you have worked with real financial data, demonstrating a keen interest and aptitude in the field. Examples of this would be personal projects involving backtesting strategies or analyzing market data, which can be highly beneficial to include in a portfolio or resume. If you have participated in quantitative finance competitions, such as those focused on trading, this is a clear indication of an understanding and passion for the industry. The resume should clearly indicate your abilities and how they align with the specific needs of the role. If possible, any previous internships, research, or volunteer experience should be tailored to demonstrate a direct relevance to quantitative finance; all to demonstrate the skills and dedication it takes for how to get into quantitative finance. By crafting a resume that is both comprehensive and targeted, you are substantially increasing your chances of gaining an interview and ultimately securing a role.

Long Term Career Development in Quantitative Finance

The journey into quantitative finance is not merely about securing an initial role, but also about cultivating a long-term and fulfilling career path. Opportunities for advancement within this field are substantial, often leading to specialized roles with increasing responsibility and compensation. After gaining experience as a quant trader, researcher, or developer, individuals may progress into leadership positions, such as leading a team, managing a portfolio, or heading a research division. Specialization is a common path as well; with time, quants often develop expertise in specific asset classes, trading strategies, or quantitative techniques. The dynamic nature of quantitative finance demands continuous learning and skill enhancement. The field is in constant evolution, with new technologies, models, and financial instruments emerging frequently. Professionals aiming for sustained success must be committed to staying abreast of these developments. One crucial aspect of “how to get into quantitative finance” and excel is to embrace lifelong learning. This involves not just keeping up with the academic literature but also actively participating in workshops, conferences, and online courses to broaden one’s skillset. This continuous development not only ensures professional growth but also maintains relevance in a competitive environment.

The career progression within quantitative finance is also marked by the potential to specialize in niche areas. For example, a quant may initially focus on equity derivatives trading and later specialize in high-frequency trading or machine learning based trading strategies. This capacity for specialization allows professionals to hone their skills and become experts in a specific facet of quant finance. Furthermore, the “how to get into quantitative finance” journey also involves the active pursuit of mentorship opportunities. Gaining insights from experienced professionals can offer valuable guidance on career choices and advancement strategies. In addition, networking remains crucial throughout one’s career. Maintaining connections with peers and senior professionals can open doors to new opportunities and collaborations. Financial rewards in quantitative finance are attractive, with salaries reflecting the specialized skills and high demand. Job growth in this field is projected to be strong as financial firms increasingly rely on quantitative strategies to gain an edge in the market. The potential for both professional growth and high earnings makes quantitative finance a compelling long-term career option for individuals with the necessary aptitude and dedication.

The long-term career path of “how to get into quantitative finance” includes the potential to make significant impacts within the industry. Advanced quants contribute to new financial models, design cutting-edge trading systems, and develop innovative risk management techniques. This role is not static; continuous adaptation to the changing market landscape is essential for long-term success. The emphasis on continuous learning should also extend beyond the technical aspects, encompassing a deeper understanding of financial markets and macroeconomics, contributing to better decision-making. Success in this career path depends on not only being at the forefront of technological developments, but also maintaining a genuine interest in learning, adapting and contributing to a field that is constantly evolving. The long-term opportunities are limitless for individuals who embrace continuous learning and strategic career planning.