Understanding the Fundamentals of Correlation Coefficients

In statistical analysis, correlation coefficients play a crucial role in measuring the strength and direction of the linear relationship between two variables. A correlation coefficient is a numerical value that ranges from -1 to 1, indicating the degree of correlation between two variables. A correlation coefficient of 1 indicates a perfect positive correlation, while a coefficient of -1 indicates a perfect negative correlation. A coefficient of 0 indicates no correlation between the variables.

There are different types of correlation coefficients, each with its own strengths and weaknesses. Pearson’s r, also known as the product-moment correlation coefficient, is the most commonly used correlation coefficient. It measures the linear relationship between two continuous variables. Spearman’s rank correlation coefficient, on the other hand, is used to measure the correlation between two ranked variables. Other types of correlation coefficients include Kendall’s tau and Goodman and Kruskal’s gamma.

Correlation coefficients are widely used in various fields, including finance, economics, and engineering. They help professionals identify patterns and trends in data, make predictions, and inform decision-making. However, to gain a deeper understanding of the relationship between variables, it’s essential to know how to get covariance from correlation, which will be discussed in the following sections.

The Limitations of Correlation: Why You Need Covariance

While correlation coefficients are useful in measuring the strength and direction of the linear relationship between two variables, they have significant limitations. One of the major drawbacks of correlation coefficients is their inability to provide information about the scale and units of the variables. This limitation can lead to misinterpretation of results, as correlation coefficients are unit-less and do not account for the magnitude of the variables.

Another limitation of correlation coefficients is that they do not provide a comprehensive understanding of the relationship between variables. Correlation coefficients only measure the linear relationship between two variables, ignoring other important aspects of the relationship, such as the scale and units of the variables. This is where covariance comes in, providing a more comprehensive measure of the relationship between two variables.

To gain a deeper understanding of the relationship between variables, it’s essential to know how to get covariance from correlation. Covariance takes into account the scale and units of the variables, providing a more accurate and comprehensive understanding of the relationship between variables. In the next section, we will provide a step-by-step guide on how to calculate covariance from correlation, highlighting the importance of understanding the units and scales of the variables.

How to Calculate Covariance from Correlation: A Step-by-Step Guide

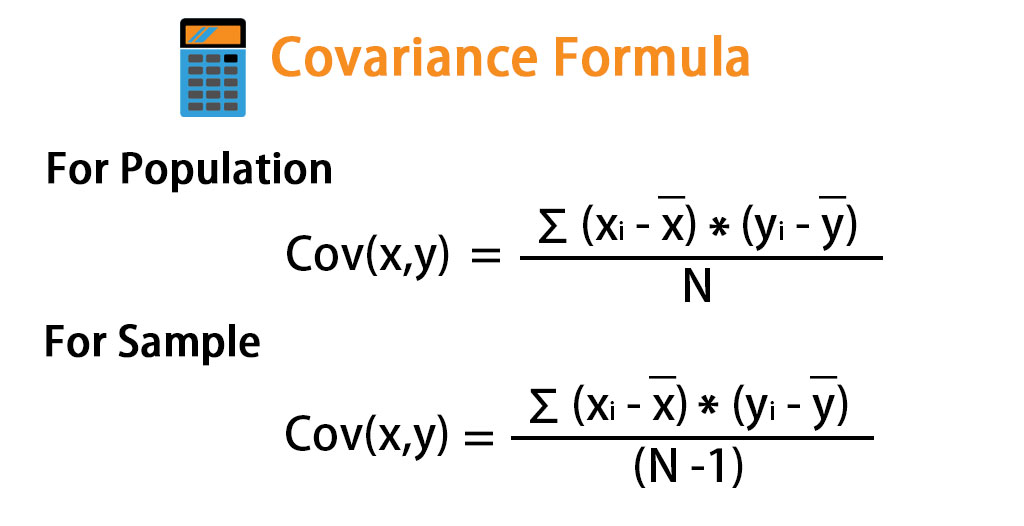

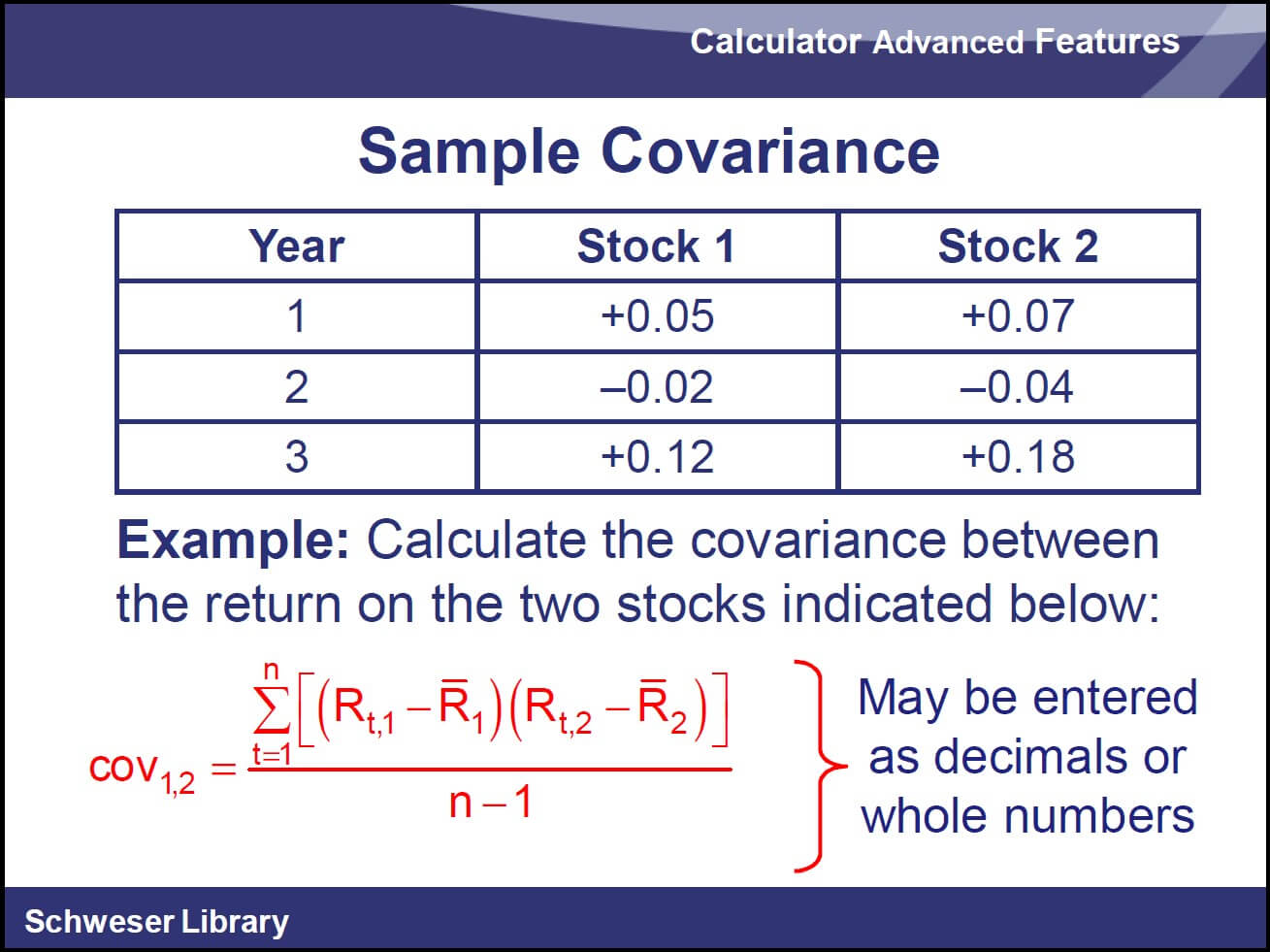

To calculate covariance from correlation, it’s essential to understand the formulas and steps involved in the process. The covariance between two variables X and Y can be calculated using the following formula:

cov(X, Y) = σ(X, Y) = E((X – E(X)) * (Y – E(Y)))

where E(X) and E(Y) are the means of X and Y, respectively, and E((X – E(X)) * (Y – E(Y))) is the expected value of the product of the deviations of X and Y from their means.

However, in practice, it’s more common to calculate covariance from correlation using the following formula:

cov(X, Y) = ρ(X, Y) * σ(X) * σ(Y)

where ρ(X, Y) is the correlation coefficient between X and Y, and σ(X) and σ(Y) are the standard deviations of X and Y, respectively.

To illustrate the process, let’s consider an example. Suppose we have two variables, X and Y, with a correlation coefficient of 0.8, and standard deviations of 2 and 3, respectively. To calculate the covariance between X and Y, we can plug in the values as follows:

cov(X, Y) = 0.8 * 2 * 3 = 4.8

Therefore, the covariance between X and Y is 4.8. This value indicates the strength and direction of the linear relationship between X and Y, taking into account the scale and units of the variables.

It’s essential to note that understanding the units and scales of the variables is crucial when calculating covariance from correlation. This is because covariance is sensitive to the units of measurement, and incorrect units can lead to misleading results. By following these steps and formulas, you can accurately calculate covariance from correlation and gain a deeper understanding of the relationship between variables.

Interpreting Covariance: What the Numbers Really Mean

Once you’ve calculated the covariance between two variables, it’s essential to understand what the numbers really mean. Covariance values can be positive, negative, or zero, each with its own implications.

A positive covariance indicates that the two variables tend to increase or decrease together. For example, if the covariance between stock prices and trading volume is positive, it means that as stock prices increase, trading volume also tends to increase. This information can be useful in finance, where understanding the relationship between stock prices and trading volume can help investors make informed decisions.

A negative covariance, on the other hand, indicates that the two variables tend to move in opposite directions. For instance, if the covariance between temperature and ice cream sales is negative, it means that as temperature increases, ice cream sales tend to decrease. This information can be useful in business, where understanding the relationship between temperature and ice cream sales can help companies optimize their marketing strategies.

A zero covariance indicates that the two variables are unrelated, meaning that changes in one variable do not affect the other variable. For example, if the covariance between the number of hours studied and the number of hours slept is zero, it means that the amount of time spent studying does not affect the amount of time spent sleeping.

In addition to understanding the sign of the covariance, it’s also important to consider the magnitude of the covariance value. A large covariance value indicates a strong relationship between the variables, while a small covariance value indicates a weak relationship.

In real-world applications, covariance is used in a variety of fields, including finance, engineering, and economics. For example, in finance, covariance is used to calculate the risk of a portfolio of assets. In engineering, covariance is used to analyze the relationship between different variables in complex systems. In economics, covariance is used to understand the relationship between economic indicators, such as GDP and inflation rate.

By understanding how to interpret covariance values, you can unlock the power of statistical analysis and make informed decisions in a variety of fields.

Common Mistakes to Avoid When Calculating Covariance

When calculating covariance, it’s essential to avoid common mistakes that can lead to incorrect results and misinterpretation of data. Here are some common mistakes to watch out for:

Error in Data Preparation: One of the most critical steps in calculating covariance is preparing the data. Make sure to check for missing values, outliers, and errors in data entry. Failing to do so can lead to inaccurate covariance values.

Incorrect Formula Application: The formula for calculating covariance from correlation is cov(X, Y) = ρ(X, Y) * σ(X) * σ(Y). Make sure to apply the formula correctly, and avoid mixing up the variables or using the wrong standard deviations.

Misinterpretation of Results: Covariance values can be positive, negative, or zero. Misinterpreting the results can lead to incorrect conclusions about the relationship between the variables. For example, a positive covariance does not necessarily mean that one variable causes the other to increase.

Ignoring the Units and Scales of the Variables: Covariance is sensitive to the units and scales of the variables. Failing to consider the units and scales can lead to incorrect covariance values and misinterpretation of results.

Not Considering the Assumptions of Covariance: Covariance assumes that the data is normally distributed and that the relationship between the variables is linear. Failing to check these assumptions can lead to incorrect covariance values and misinterpretation of results.

By avoiding these common mistakes, you can ensure that your covariance calculations are accurate and reliable. Remember to always check your data, apply the formula correctly, and interpret the results carefully to get the most out of your covariance calculations.

Real-World Applications of Covariance: From Finance to Engineering

Covariance is a powerful statistical tool that has far-reaching applications in various fields. By understanding the covariance between variables, professionals can make informed decisions, predict outcomes, and optimize processes. Here are some examples of how covariance is used in real-world applications:

Finance: In finance, covariance is used to calculate the risk of a portfolio of assets. By understanding the covariance between different assets, investors can diversify their portfolios and minimize risk. Covariance is also used to calculate the beta of a stock, which measures its volatility relative to the market.

Engineering: In engineering, covariance is used to analyze the relationship between different variables in complex systems. For example, in mechanical engineering, covariance is used to analyze the relationship between temperature, pressure, and flow rate in a pipeline. This information can be used to optimize the design of the pipeline and improve its efficiency.

Economics: In economics, covariance is used to analyze the relationship between economic indicators, such as GDP, inflation rate, and unemployment rate. By understanding the covariance between these variables, economists can predict economic trends and make informed policy decisions.

Quality Control: In quality control, covariance is used to analyze the relationship between different variables in a manufacturing process. By understanding the covariance between variables, manufacturers can identify areas for improvement and optimize their processes.

In addition to these examples, covariance has many other applications in fields such as biology, medicine, and social sciences. By understanding the covariance between variables, professionals can gain insights into complex systems and make informed decisions.

As we’ve seen, covariance is a powerful tool that has many real-world applications. By understanding how to calculate and interpret covariance, professionals can unlock new insights and make informed decisions. Whether you’re an investor, engineer, economist, or quality control specialist, covariance is an essential tool to have in your toolkit.

Covariance vs. Correlation: When to Use Each

When it comes to statistical analysis, both covariance and correlation are essential tools for understanding the relationship between variables. While they are related concepts, they serve different purposes and are used in different contexts. In this section, we’ll explore the differences between covariance and correlation, and provide guidance on when to use each.

Correlation: Correlation measures the strength and direction of the linear relationship between two variables. It provides a standardized measure of the relationship, ranging from -1 (perfect negative correlation) to 1 (perfect positive correlation). Correlation is useful for identifying patterns and trends in data, but it has limitations. For example, correlation does not provide information about the scale and units of the variables.

Covariance: Covariance, on the other hand, measures the linear relationship between two variables in terms of their units and scales. It provides a more comprehensive understanding of the relationship between variables, taking into account the magnitude and direction of the relationship. Covariance is particularly useful when working with variables that have different units or scales.

When to Use Each: So, when should you use correlation, and when should you use covariance? Here are some general guidelines:

Use correlation when:

- You want to identify patterns and trends in data.

- You want to compare the strength of relationships between different variables.

- You want to perform statistical tests, such as hypothesis testing.

Use covariance when:

- You want to understand the relationship between variables in terms of their units and scales.

- You want to analyze the relationship between variables with different units or scales.

- You want to perform advanced statistical analysis, such as principal component analysis.

In summary, correlation is a useful tool for identifying patterns and trends in data, while covariance provides a more comprehensive understanding of the relationship between variables. By understanding the strengths and weaknesses of each approach, you can choose the right tool for the job and unlock the power of statistical analysis.

Conclusion: Unlocking the Power of Covariance in Statistical Analysis

In conclusion, covariance is a powerful tool in statistical analysis that provides a more comprehensive understanding of the relationship between variables. By understanding how to calculate covariance from correlation, interpreting covariance values, and avoiding common mistakes, professionals can unlock new insights and make informed decisions. Whether in finance, engineering, or economics, covariance is an essential tool for predicting outcomes and optimizing processes.

Throughout this article, we’ve explored the limitations of correlation coefficients and the importance of covariance in providing a more nuanced understanding of the relationship between variables. We’ve also discussed how to calculate covariance from correlation, interpret covariance values, and avoid common mistakes. By applying these concepts to real-world problems, professionals can gain a competitive edge and drive success.

As we’ve seen, covariance is a versatile tool with far-reaching applications. By mastering covariance, professionals can unlock new insights, improve decision-making, and drive innovation. Whether you’re a seasoned statistician or just starting out, understanding covariance is essential for unlocking the power of statistical analysis.

So, how can you get started with covariance? Begin by applying the concepts discussed in this article to your own data. Practice calculating covariance from correlation, interpreting covariance values, and avoiding common mistakes. As you become more comfortable with covariance, explore its applications in your field and discover new ways to drive success.

Remember, covariance is a powerful tool that can help you unlock new insights and drive success. By mastering covariance, you can take your statistical analysis to the next level and achieve your goals.