Decoding Investment Returns: What is Yield to Maturity?

Yield to Maturity (YTM) is a crucial metric for bond investors. It represents the total return anticipated on a bond if it is held until it matures. Understanding how to find yield to maturity is essential for comparing different bond investment opportunities. YTM considers not only the bond’s coupon payments but also the difference between its purchase price and its par value (face value). This makes it a more comprehensive measure of a bond’s profitability than simpler metrics like coupon yield or current yield.

Coupon yield, for example, only reflects the annual interest income relative to the par value of the bond. Current yield considers the annual interest income relative to the bond’s current market price. However, neither of these measures accounts for the potential gain or loss realized when the bond matures and the investor receives the par value. If a bond is purchased at a discount (below par value), the investor will receive a capital gain at maturity, increasing the overall return. Conversely, if a bond is purchased at a premium (above par value), the investor will experience a capital loss at maturity, decreasing the overall return. YTM incorporates these factors, providing a more accurate picture of the bond’s total return potential. Knowing how to find yield to maturity allows investors to make informed decisions about which bonds best align with their investment goals.

The significance of YTM lies in its ability to facilitate comparisons between bonds with different coupon rates, maturities, and market prices. By calculating the YTM for various bonds, an investor can assess their relative attractiveness on a level playing field. For instance, a bond with a high coupon rate but trading at a significant premium might have a lower YTM than a bond with a lower coupon rate trading at a discount. Understanding how to find yield to maturity helps investors avoid being misled by superficial characteristics and focus on the true potential return. Therefore, mastering the concept of YTM is a fundamental step in becoming a savvy bond investor and optimizing portfolio performance. It’s a cornerstone of fixed-income analysis, enabling investors to evaluate and compare bond investments effectively.

A Step-by-Step Overview: Estimating Bond’s True Return

Understanding how to find yield to maturity involves several key steps. This section provides a roadmap to estimate a bond’s true return. The process begins with gathering essential data about the bond. This includes its current market price, face value, coupon rate, and the time remaining until it matures. Next, a simplified formula is used to approximate the yield to maturity (YTM). This formula considers the annual interest payments, the difference between the face value and the current price, and the years to maturity. Keep in mind that this calculation offers an estimated YTM, and not the precise value. The exact YTM requires more complex calculations.

The approximation helps understand how to find yield to maturity but comes with limitations. This simplified approach assumes that coupon payments are reinvested at the YTM rate. This is often an unrealistic assumption. It also doesn’t account for callable bonds. Bonds with varying coupon rates are also excluded. To achieve a more accurate YTM, financial tools become essential. Excel’s RATE function and online YTM calculators provide precise results. These tools require the same key inputs. They use iterative calculations to determine the exact discount rate that equates the present value of future cash flows to the bond’s current price.

Interpreting the calculated YTM allows for informed investment decisions. The YTM represents the total return you can expect if you hold the bond until maturity. This return includes all coupon payments plus any gain or loss realized at maturity. By understanding how to find yield to maturity, investors can compare different bonds. The comparison helps assess their relative attractiveness. It’s important to note that YTM is closely linked to prevailing interest rates. When interest rates rise, bond prices typically fall, and YTM increases. Conversely, when interest rates fall, bond prices rise, and YTM decreases. Market conditions can significantly impact YTM, making it a dynamic measure of a bond’s potential return.

Gathering Crucial Data: Key Inputs for the Calculation

To accurately estimate how to find yield to maturity, several key pieces of information are essential. These inputs form the foundation of the calculation and directly influence the resulting yield. Understanding where to locate this data and how to interpret it is critical for making informed investment decisions. The primary inputs required are the bond’s current market price, its par value (or face value), the coupon rate, and the time remaining until maturity.

The current market price reflects the price at which the bond is currently trading in the market. This value fluctuates based on supply and demand, prevailing interest rates, and the bond’s creditworthiness. Bond quotes, readily available from financial websites, brokerage platforms, and financial news outlets, provide this information. The par value, also known as the face value, represents the amount the bond issuer will repay to the bondholder at maturity. This value is typically $1,000 for corporate bonds but can vary for other types of bonds. The par value is usually stated on the bond certificate or in the bond’s offering documents. The coupon rate is the annual interest rate the bond issuer pays to the bondholder, expressed as a percentage of the par value. For example, a bond with a par value of $1,000 and a coupon rate of 5% pays $50 in annual interest. This information can also be found on bond quotes or in the bond’s prospectus. Finally, the time to maturity represents the number of years remaining until the bond matures and the par value is repaid. This is calculated from the current date to the maturity date, which is also available on bond quotes and brokerage statements. Knowing how to find yield to maturity relies on these values.

Let’s consider an example to illustrate these concepts. Imagine a bond with the following characteristics: Current Market Price: $950, Par Value: $1,000, Coupon Rate: 6%, Time to Maturity: 5 years. In this scenario, the bond is trading at a discount (below par value). The bondholder receives $60 in annual interest (6% of $1,000), and the bond will mature in five years, at which point the bondholder will receive the $1,000 par value. These figures will be used in the simplified YTM formula to approximate the bond’s true return. Determining how to find yield to maturity starts with identifying these key data points. Using these inputs, an investor can begin to assess the potential profitability of the bond investment. The ability to accurately gather and interpret this data is a fundamental skill for any bond investor seeking to understand how to find yield to maturity.

Simplified Formula: Approximating Your Bond’s Return

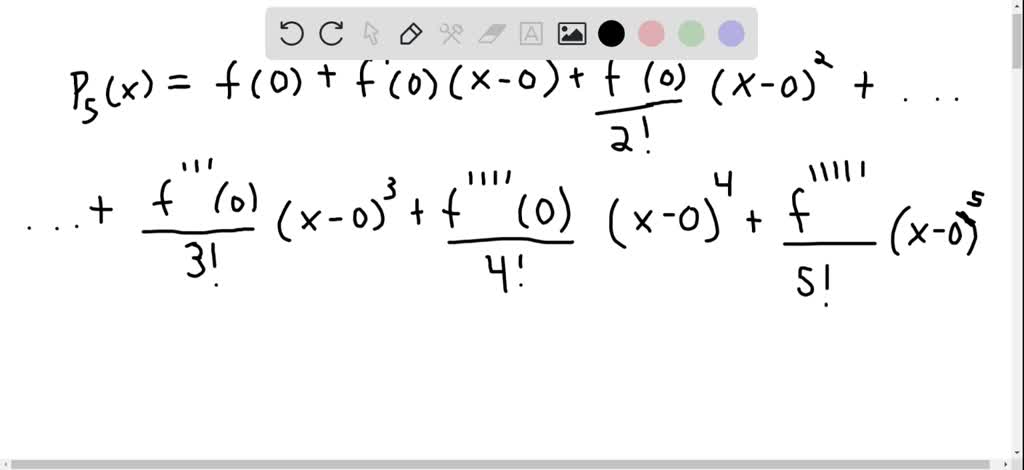

A simplified formula can estimate a bond’s Yield to Maturity (YTM). This calculation offers a practical understanding of how to find yield to maturity without complex financial modeling. It’s important to remember that this result is an approximation, not the precise YTM. The formula incorporates several key components: the annual interest payment, the difference between the bond’s face value and its current market price, and the years remaining until maturity. Understanding how to find yield to maturity using this formula can provide a quick assessment of a bond’s potential return.

The simplified YTM formula is expressed as: YTM ≈ (Annual Interest Payment + (Face Value – Current Price) / Years to Maturity) / ((Face Value + Current Price) / 2). Let’s break down each part. The “Annual Interest Payment” is the total interest income the bond pays each year, calculated by multiplying the coupon rate by the face value. “Face Value” is the amount the bond will be worth at maturity. “Current Price” is what the bond currently costs in the market. “Years to Maturity” is the time remaining until the bond matures and repays its face value. How to find yield to maturity becomes clearer when you understand these components.

Consider a bond with a face value of $1,000, a current price of $950, a coupon rate of 6% (meaning an annual interest payment of $60), and 5 years to maturity. Plugging these values into the formula: YTM ≈ ($60 + ($1000 – $950) / 5) / (($1000 + $950) / 2). This simplifies to: YTM ≈ ($60 + $10) / $975, resulting in an approximate YTM of 7.18%. Remember, this 7.18% is an estimated YTM. To accurately find yield to maturity, especially for critical financial decisions, it is best to use more precise methods, such as financial calculators or software. This simplified calculation is intended as an educational tool to understand the factors influencing a bond’s potential return and how to find yield to maturity in an easier way.

Navigating the Limitations: When the Approximation Falls Short

The simplified formula for estimating yield to maturity (YTM) offers a convenient way to gauge a bond’s potential return. However, it’s crucial to understand its limitations to avoid inaccurate investment assessments. One significant assumption is that coupon payments are reinvested at the calculated YTM rate throughout the bond’s life. In reality, reinvestment rates fluctuate with market conditions. Securing the same YTM rate for all coupon payments is highly improbable, potentially skewing the actual return. Accurately determining how to find yield to maturity involves acknowledging these constraints.

Furthermore, the simplified YTM formula doesn’t account for callable bonds. These bonds give the issuer the right to redeem the bond before its maturity date. If a bond is called, the investor receives the par value plus any accrued interest. This alters the actual investment timeline and return, making the simplified YTM calculation misleading. Similarly, bonds with varying coupon rates, such as step-up bonds or floating-rate notes, are not accurately reflected by this formula. These bonds have coupon payments that change over time, invalidating the assumption of a constant annual interest payment. Therefore, it is important to know how to find yield to maturity precisely.

The simplified formula provides an estimated YTM. It should not be considered a definitive measure of a bond’s return. For a more precise calculation, especially for callable bonds or bonds with variable coupon rates, employing more sophisticated methods or specialized calculators is essential. Remember that while the simplified formula offers a quick approximation, understanding its shortcomings is key to making informed investment decisions. Knowing how to find yield to maturity accurately requires a deeper dive into more complex calculations or the use of technology. It is important to acknowledge that this formula has some shortcomings.

Employing Technology: Leveraging Excel and Online Calculators

For a more precise calculation of how to find yield to maturity, technology offers efficient solutions. Excel’s RATE function and online YTM calculators can provide accurate results, eliminating the manual complexities. This section details how to use these tools effectively.

To calculate how to find yield to maturity using Excel, utilize the RATE function. This function requires several inputs: Nper (number of periods), PMT (periodic payment), PV (present value or current bond price), FV (future value or par value), and Type (0 for payment at the end of the period, 1 for the beginning). For instance, if a bond has 10 years to maturity, pays $60 annually, is priced at $950, and has a par value of $1000, the formula in Excel would be “=RATE(10,60,-950,1000,0)”. The result, expressed as a decimal, represents the yield to maturity. Multiplying this decimal by 100 converts it to a percentage. Ensure that the inputs are accurate to get a reliable YTM. The RATE function considers the time value of money, providing a more accurate figure than the simplified formula. Using Excel is a practical method for investors needing a precise calculation.

Alternatively, numerous online YTM calculators are available. These tools typically require the same inputs as the Excel RATE function: current bond price, par value, coupon rate, and years to maturity. Input the bond’s details into the calculator, and it will instantly display the yield to maturity. Reputable online calculators often include disclaimers about the accuracy of their calculations and the assumptions they make. Examples of reliable online calculators can be found on financial websites like Investopedia or Calculator.net. These resources offer a quick and convenient way to estimate how to find yield to maturity, particularly for those less familiar with Excel functions. Always cross-verify the results with another source or calculation to ensure accuracy. Leveraging these technological tools simplifies how to find yield to maturity, providing investors with the data needed for informed decisions.

Interpreting the Results: What Does the YTM Tell You?

The calculated Yield to Maturity (YTM) provides a valuable metric for evaluating bonds. It represents the total return an investor can anticipate receiving if the bond is held until maturity. This return encompasses both the periodic coupon payments and any difference between the purchase price and the bond’s face value. Understanding how to find yield to maturity and interpreting it correctly is crucial for making informed investment decisions. A higher YTM generally indicates a more attractive investment, assuming all other factors are equal, as it suggests a greater potential return on investment. However, it’s essential to consider the risks associated with the bond before making any decisions.

YTM serves as a useful tool for comparing different bonds. When evaluating multiple bonds, compare their YTMs to assess their relative attractiveness. For instance, if two bonds have similar credit ratings and maturities, the bond with the higher YTM offers a better potential return. Moreover, YTM is closely linked to prevailing interest rates. When interest rates rise, the YTM of existing bonds typically increases to remain competitive with newly issued bonds offering higher coupon rates. Conversely, when interest rates fall, the YTM of existing bonds tends to decrease. This inverse relationship is a fundamental principle of bond investing. Monitoring changes in market conditions and their potential impact on YTM is vital for bondholders. Knowing how to find yield to maturity is the first step, understanding how market dynamics influence it is the next.

Changes in market conditions, such as shifts in interest rates or changes in the issuer’s creditworthiness, can significantly affect a bond’s YTM. If a bond’s price declines due to rising interest rates, its YTM will increase to compensate investors for the lower price. Similarly, if the issuer’s credit rating is downgraded, the bond’s price may fall, leading to a higher YTM to reflect the increased risk of default. Understanding how to find yield to maturity in a changing market helps investors make timely adjustments to their portfolios. Actively monitoring these factors is crucial for making informed decisions about buying, selling, or holding bonds. Remember that YTM is a dynamic measure that reflects the current market perception of a bond’s value and risk.

Beyond the Numbers: Considering Additional Factors for Bond Investing

While understanding how to find yield to maturity is crucial, it is only one piece of the puzzle when evaluating bond investments. Investors must also consider factors beyond the calculated YTM to make informed decisions. Credit risk, liquidity, and tax implications significantly impact the overall attractiveness and suitability of a bond for a particular investment strategy. It’s important to remember that knowing how to find yield to maturity provides a valuable metric, but a holistic approach to bond investing is always recommended.

Credit risk, often assessed through bond ratings provided by agencies like Moody’s and Standard & Poor’s, reflects the issuer’s ability to repay the principal and interest. Higher-rated bonds generally offer lower yields due to their perceived safety, while lower-rated, or “junk” bonds, offer higher yields to compensate for the increased risk of default. Liquidity refers to the ease with which a bond can be bought or sold in the market without significantly impacting its price. Bonds with high trading volumes are generally more liquid. Illiquid bonds may be difficult to sell quickly or at a fair price. How to find yield to maturity does not reflect these risks. This is why it is important to consider these risks separately.

Tax implications also play a vital role in bond investing. The interest income from bonds is typically subject to federal, state, and sometimes local taxes. Municipal bonds, issued by state and local governments, often offer tax-exempt interest, making them attractive to investors in high tax brackets. Furthermore, capital gains taxes may apply if a bond is sold for a profit. Understanding how these taxes affect the overall return is essential for making informed investment decisions. Remember, determining how to find yield to maturity is a starting point. Diversifying bond investments across different maturities, credit qualities, and sectors can help mitigate risk and enhance portfolio stability. Consulting with a financial advisor can help tailor a bond investment strategy to individual circumstances and financial goals.