Understanding the Basics of Invested Capital

Invested capital represents the total funds a company has utilized to operate its business, encompassing both debt and equity financing. It is a critical metric in financial analysis that shows how a company is funded and, therefore, how efficiently it can generate returns. Knowing how to find total invested capital is essential for evaluating the financial health and performance of a company, since it acts as the denominator in several key performance indicators (KPIs). A solid understanding of invested capital allows investors and analysts to assess the efficacy of a company’s management in deploying its financial resources. This figure provides a baseline for assessing a company’s ability to generate profit with the funds available. It’s not just about how much profit is made, but also how that profit is achieved considering how much is invested. Understanding how to find total invested capital provides a view of the true picture of how much capital is deployed and hence how efficiently the invested capital is used to generate revenues and profits. Thus, learning how to find total invested capital is a fundamental step in understanding a company’s financial narrative.

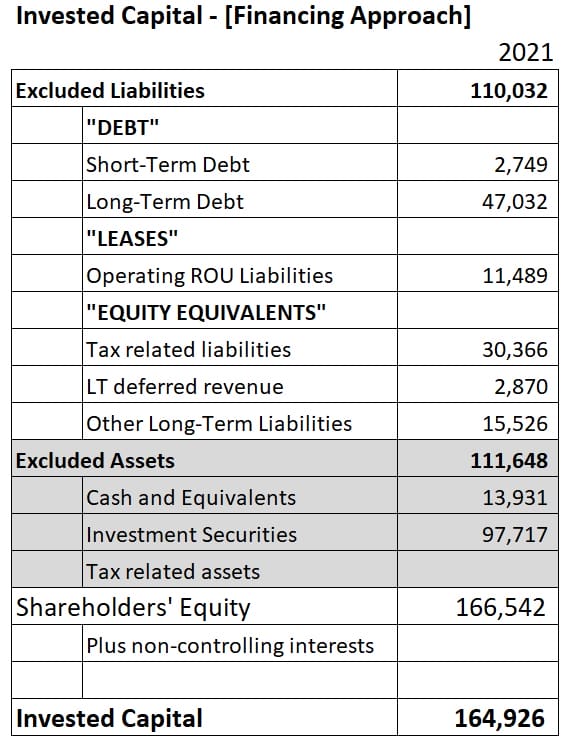

How to Calculate Total Invested Capital Using Balance Sheet Data

The primary method for determining how to find total invested capital involves a thorough analysis of a company’s balance sheet. This financial statement provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time, and it is the key to calculating invested capital. The two main components required are total debt and total shareholders’ equity. Total debt encompasses all interest-bearing obligations of the company, both short-term (due within one year) and long-term (due beyond one year). Examples of short-term debt might include bank overdrafts or the current portion of long-term loans, while long-term debt can include bonds payable, mortgages, or other long-term loans. Total shareholders’ equity represents the residual ownership interest in the company’s assets after deducting liabilities. This figure is composed of contributions from investors and the retained earnings generated by the business operations over time. These figures are not typically provided in total and must be calculated. The balance sheet will show each component of debt and equity and, you must sum them up yourself. Typically, the debt components are listed under ‘Liabilities’ and the equity components are listed under ‘Equity’ or ‘Shareholders’ Equity’ sections of the balance sheet. To understand how to find total invested capital, it is crucial to accurately identify and extract these figures.

To accurately calculate invested capital, the balance sheet must be examined with meticulous attention to detail. Within the ‘Liabilities’ section, you will need to carefully review short-term and long-term obligations, ensuring that all debt that incurs interest, such as commercial papers, bank loans, and bonds, is included. Some liabilities, like accounts payable, are non-interest-bearing and should be excluded from this calculation. Similarly, when looking at shareholders’ equity, the different components such as common stock, preferred stock, and accumulated retained earnings, must be located and correctly added. This information is usually presented in the ‘Equity’ section. Some statements might also include ‘accumulated other comprehensive income’ which might be included as a part of total equity if it is deemed to reflect the company’s operational performance. It is essential to sum up the total debt figure and the total equity figure separately, as these will be the two main components needed for the final calculation. Investors or analysts who want to learn how to find total invested capital need to meticulously aggregate these values from the appropriate sections of the balance sheet, to get an accurate picture of the capital employed in the business.

Breaking Down Debt Components in Invested Capital Calculation

To accurately calculate invested capital, a thorough understanding of the debt component is essential. When determining how to find total invested capital, it’s important to recognize that not all liabilities are included; specifically, only interest-bearing debt should be considered. This typically includes various forms of borrowing a company undertakes, such as bonds issued to the public, loans obtained from banks or other financial institutions, and other forms of notes payable that carry interest obligations. Each of these debt instruments represents capital that has been raised to finance the company’s operations or capital expenditures. The importance of this distinction lies in the fact that interest-bearing debt directly affects a company’s financing costs and its overall capital structure, which is why it forms an integral part of the invested capital calculation.

The meticulous summation of all interest-bearing debt is crucial for a proper calculation of invested capital. One must ensure that all relevant debt accounts are included, irrespective of their maturity period; this comprises both short-term and long-term liabilities which incur interest. Short-term debt may consist of short-term bank loans or the current portion of long-term debt, while long-term debt will typically include items such as bonds payable and long-term bank loans. It’s vital to differentiate these from non-interest bearing liabilities, such as accounts payable, accrued expenses, and deferred revenue which should be excluded when figuring out how to find total invested capital. Non-interest-bearing liabilities are a part of the operating cycle and do not represent capital raised in the same way as debt, so they don’t impact the invested capital. This meticulous approach ensures that the invested capital reflects the total capital obtained via debt that is actively used to fund the operations and growth of the company.

Analyzing Equity in the Total Invested Capital Calculation

To find total invested capital, a crucial component is shareholders’ equity. This represents the residual interest in the assets of an entity after deducting all its liabilities. Shareholders’ equity is readily available on a company’s balance sheet and is typically composed of several key elements. Common stock represents the initial investment made by shareholders when purchasing the company’s stock. Preferred stock, if issued, represents a class of stock with preferential rights, such as dividend payments or liquidation proceeds, over common stock. Retained earnings reflect the accumulated profits of the company that have not been distributed as dividends. These three components—common stock, preferred stock, and retained earnings—are fundamental in understanding how to find total invested capital through the equity portion of the calculation. Understanding these components is critical for accurately calculating total invested capital.

However, the calculation of shareholders’ equity can sometimes present complexities. One such complexity is the inclusion of accumulated other comprehensive income (AOCI). AOCI encompasses unrealized gains or losses on certain investments, foreign currency translations, and derivative instruments. While AOCI is part of the comprehensive income statement, it does not impact net income and traditionally is a separate component of shareholders’ equity. Therefore, whether to include AOCI in the invested capital calculation depends on the context of the analysis and the specific definition of invested capital being employed. In some instances, a more conservative approach might exclude AOCI to focus on realized gains and losses directly impacting the company’s profitability. To ascertain how to find total invested capital accurately, carefully review the balance sheet for the inclusion of AOCI and determine the most appropriate treatment depending on the analysis.

In summary, identifying and correctly utilizing total shareholders’ equity is paramount when determining how to find total invested capital. Understanding the composition of equity, including common stock, preferred stock, retained earnings, and the potential impact of AOCI, is essential for arriving at a precise figure for total invested capital. This understanding allows for a more accurate financial analysis and interpretation of a company’s performance, offering better insight into the relationship between invested capital and profitability. By meticulously examining the balance sheet and applying the correct accounting principles, one can confidently determine how to find total invested capital using the equity component.

An Alternate Approach: Calculating Invested Capital from Operating Assets

An alternative method to how to find total invested capital involves using a company’s operating assets and operating liabilities. This approach shifts the focus from financing sources to the resources a company uses in its daily operations. Operating assets are those assets directly employed in generating revenue, such as cash, accounts receivable, inventory, and property, plant, and equipment (PP&E). These are the resources the company uses for its core business activities. On the other hand, operating liabilities are the obligations incurred in the course of day-to-day operations. Examples include accounts payable, accrued expenses, and deferred revenue. This method of determining how to find total invested capital focuses on the net investment in the company’s operations, rather than on how it is financed.

To calculate invested capital using this method, you would subtract total operating liabilities from total operating assets. The result represents the net assets deployed in the company’s core operations. This can be a more appropriate measure when you want to evaluate the efficiency of asset utilization within a company. For example, a company with high debt levels might show a large invested capital figure using the debt and equity approach, but its operational efficiency might be better reflected by this operating asset method if there are also many operating liabilities. Understanding how to find total invested capital from operating assets provides an essential alternative viewpoint. This alternate approach is especially useful when comparing firms with different capital structures or those whose financing activities are complex, offering a clearer lens to assess the actual resources at work.

The operating asset approach also allows for a more granular analysis of a company’s core business performance by excluding non-operating assets or liabilities, which can sometimes skew the results of the standard debt and equity calculation. This method also gives an accurate view on how much capital is tied up in day-to-day business, offering a more operationally focused perspective on how to find total invested capital. When analyzing companies, the choice between the two approaches often depends on the specific analytical needs and the type of company being evaluated. This alternative method can reveal insights into the efficiency of a company’s resource allocation.

Practical Example: Calculating Invested Capital Step-by-Step

To illustrate how to find total invested capital, let’s consider a hypothetical company, “Tech Solutions Inc.” Assume that, based on its most recent balance sheet, Tech Solutions Inc. has the following financial data: Total short-term debt of $5 million, total long-term debt of $20 million, and total shareholders’ equity of $75 million. The first step in determining the total invested capital is to sum all interest-bearing debts. This means adding the short-term debt ($5 million) and long-term debt ($20 million) together, which results in $25 million for total debt. Next, identify the total shareholders’ equity, which in this case is given as $75 million. Finally, add the total debt and total shareholders’ equity together to obtain the total invested capital. For Tech Solutions Inc., this calculation would be $25 million (total debt) + $75 million (total equity) = $100 million. Therefore, Tech Solutions Inc.’s total invested capital is $100 million. This example showcases a clear and straightforward approach for anyone looking into how to find total invested capital.

Now, let’s explore this concept further, using the same figures of Tech Solutions Inc., where the debt components could be further broken down. Suppose that of the $5 million short-term debt, $2 million is from bank overdrafts and $3 million from short-term loans. Additionally, the $20 million long-term debt consists of $10 million in bonds and $10 million in long-term bank loans. When calculating the total debt to find total invested capital, we sum all these interest-bearing debts, whether they are short-term or long-term, resulting in the same total debt of $25 million. For the equity section, assuming that the $75 million consists of $20 million in common stock, $10 million in preferred stock and $45 million in retained earnings. We still arrive to the total equity of $75 million. Adding together the total debt and equity ($25 million + $75 million) confirms that the total invested capital for Tech Solutions Inc. remains at $100 million. This additional breakdown helps understand where all the company’s financing comes from and reinforces the correct methodology to accurately calculate the total invested capital.

This step-by-step approach is crucial to accurately determining a company’s total invested capital. It is important to meticulously review the balance sheet, identify all interest-bearing debt and all the components of the shareholders’ equity to ensure no elements are overlooked. As presented by Tech Solutions Inc., this practice of carefully summing the components is key to ensuring a precise calculation of how to find total invested capital, allowing analysts and investors to utilize this key figure in their financial analysis for better strategic decisions.

Using Invested Capital to Measure Financial Performance

Investors and analysts calculate invested capital to gain critical insights into a company’s financial health and efficiency. Knowing how to find total invested capital allows stakeholders to assess how effectively a company uses its invested funds to generate profits. This figure is not just an isolated metric; it is a fundamental component of key financial ratios that are crucial for evaluation. One such vital ratio is the Return on Invested Capital (ROIC), which calculates the percentage return a company achieves on its total invested capital. To calculate ROIC, a company’s net operating profit after tax (NOPAT) is divided by its total invested capital. The resulting percentage indicates how well a company uses its capital to generate profit and create value for its investors. An important part of understanding profitability is knowing how to find total invested capital and is essential for making sound investment decisions and is used to compare a company’s operational performance against others in its industry. For example, a higher ROIC often suggests that a company is more efficient and effective at using the capital invested in its operations, which is attractive to investors seeking profitable ventures.

The ability to measure financial performance using invested capital is invaluable in determining the true profitability and operational efficiency of an organization. Understanding how to find total invested capital is crucial, as it goes beyond basic profitability metrics such as net income. A high net income might be appealing, but it may be skewed by inefficient capital allocation. Investors and analysts use the total invested capital figure to assess the underlying efficiency of the company’s core operations. For example, by knowing how to find total invested capital and calculating the ROIC, comparisons can be made over time to understand trends in a company’s performance, as well as benchmarked against competitors. A company that shows a higher ROIC relative to competitors, while consistently maintaining that ROIC, is likely creating more value per dollar invested. The use of invested capital in performance analysis enables deeper understanding into how a company’s management makes decisions regarding allocating their capital resources. This provides a critical layer of scrutiny and assists stakeholders in evaluating investment choices, making invested capital a practical and effective measuring tool.

Important Considerations When Calculating Invested Capital

When calculating invested capital, it’s crucial to be aware of several nuances that can affect the accuracy and comparability of the figure. One primary concern is consistency in reporting periods. Ensure that when comparing invested capital across different periods or companies, you use financial statements from the same point in time (e.g., all annual reports). Variations in the timing of financial statements can introduce inaccuracies, skewing any analysis that uses invested capital. For instance, a company with a different fiscal year-end compared to its competitors might show misleading invested capital if not accounted for. Another consideration involves the impact of significant corporate actions such as acquisitions and divestitures. If a company acquires another, its balance sheet will change drastically, which will affect total invested capital, hence, proper adjustments should be made to reflect the new combined entity’s financial position. Similarly, if assets or business lines are divested, these should be subtracted to maintain accurate calculations of invested capital that are comparable across periods. It is essential to trace the timeline of changes, and how to find total invested capital, in these kinds of events. For the sake of accurate analysis, meticulous tracking of these changes is advised. Moreover, the treatment of minority interests can also require attention. These interests in subsidiary companies can be included in the equity portion and it is important to analyze whether it should be part of total invested capital.

Furthermore, it’s important to acknowledge the potential impact of non-operating assets and liabilities on the alternate calculation method using operating assets minus operating liabilities. Non-operating items such as investments not directly involved in day-to-day activities, are generally excluded from this calculation. The focus of this method is to show the capital actively working in the company’s main operations. For instance, long term marketable securities are not core operating assets and should be excluded. Understanding and how to find total invested capital effectively, requires a clear distinction between assets and liabilities directly related to the business’s core operations versus those that are not. This provides a more detailed view of how much capital is deployed directly for the day-to-day business. When calculating invested capital, always verify the inclusion of all types of debt including leases and finance obligations that may be accounted for differently in financial statements. These debt types, while sometimes presented under different headings, are often part of the firm’s capital structure and should be accounted for as part of the debt. Paying close attention to the way debts are presented in the balance sheet of a company will help avoid miscalculations when determining total invested capital. Inconsistencies in this area can lead to skewed or incorrect analysis. Finally, different accounting methods can influence the values of both equity and debt and hence, the resulting total invested capital. This requires the analyst to be aware of differences in accounting practices when comparing companies or historical financial data.