Understanding the Concept of Expected Market Return

When it comes to investing, understanding the concept of expected market return is crucial for making informed decisions. Expected market return refers to the anticipated return on investment based on historical data, market trends, and other factors. This concept is significant in investment decisions as it helps investors set realistic expectations and make strategic decisions. Expected market return differs from actual returns, which are the realized profits or losses from an investment. To achieve long-term investment goals, understanding how to find the expected market return is essential, as it enables investors to create a tailored investment strategy that aligns with their risk tolerance and financial objectives. By knowing how to find the expected market return, investors can make more accurate estimates, avoid costly mistakes, and ultimately achieve their investment goals. In essence, understanding how to find the expected market return is a crucial step in unlocking consistent investment returns, as it provides a foundation for informed decision-making and strategic portfolio management. By grasping this concept, investors can identify potential opportunities and threats, adjust their investment strategies accordingly, and stay ahead of the curve in a rapidly changing market. In fact, understanding how to find the expected market return is a critical component of successful investing, as it allows investors to make informed decisions and achieve their long-term financial goals. By understanding how to find the expected market return, investors can create a roadmap for their investment journey, navigate market volatility, and ultimately achieve consistent returns. Moreover, having a clear understanding of how to find the expected market return enables investors to make adjustments to their investment strategy, ensuring that their investment goals remain on track.

Historical Market Trends: A Key to Unlocking Future Returns

Analyzing historical market trends is a crucial step in estimating expected returns. By examining past market data, investors can identify patterns and trends that can inform their investment decisions. Historical data provides valuable insights into how different asset classes have performed over time, allowing investors to make more accurate estimates of future returns. For instance, analyzing historical data can help investors identify which asset classes tend to perform well during certain economic conditions, such as recessions or periods of high inflation. This information can be used to create a diversified portfolio that is better equipped to weather market fluctuations. Furthermore, historical data can help investors identify potential risks and opportunities, enabling them to adjust their investment strategy accordingly. For example, if historical data shows that a particular asset class has consistently underperformed during certain market conditions, investors may choose to allocate a smaller portion of their portfolio to that asset class. By understanding how to find the expected market return through historical data analysis, investors can make more informed decisions and increase their chances of achieving consistent returns. Additionally, historical data can be used to test different investment strategies and evaluate their effectiveness, allowing investors to refine their approach and improve their overall performance.

The Role of Asset Allocation in Expected Market Return

Asset allocation plays a crucial role in determining expected market returns. By diversifying a portfolio across different asset classes, investors can reduce risk and increase the potential for consistent returns. The key to successful asset allocation is understanding how different asset classes contribute to overall portfolio returns. For instance, stocks tend to offer higher potential returns over the long term, but they also come with higher volatility. Bonds, on the other hand, offer more stable returns, but with lower potential for growth. By allocating a portion of the portfolio to each asset class, investors can create a balanced portfolio that is better equipped to weather market fluctuations. To find the expected market return, investors must consider the expected returns of each asset class and how they interact with one another. This involves analyzing historical data, understanding the current market environment, and making informed decisions about asset allocation. By doing so, investors can create a portfolio that is tailored to their risk tolerance and investment goals, increasing their chances of achieving consistent returns. Furthermore, understanding how to find the expected market return through asset allocation enables investors to make adjustments to their portfolio as market conditions change, ensuring that their investment goals remain on track.

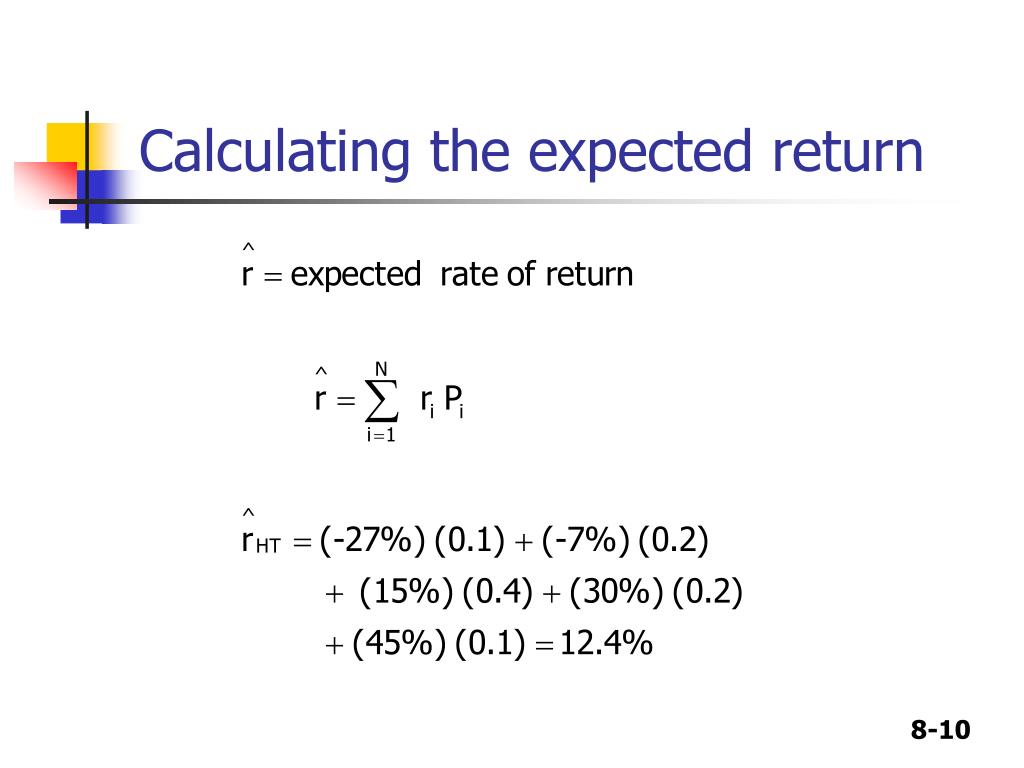

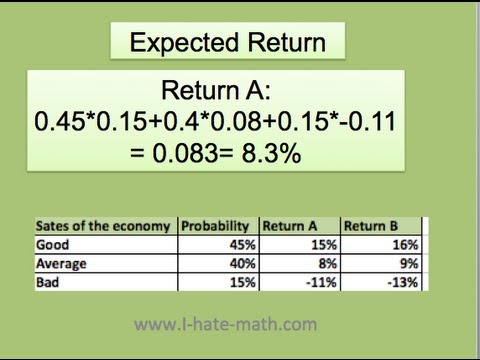

Using Financial Models to Estimate Expected Returns

Financial models are essential tools for investors seeking to estimate expected returns. By using these models, investors can make more accurate predictions about future market performance and make informed investment decisions. Two common financial models used to estimate expected returns are the Capital Asset Pricing Model (CAPM) and the Dividend Discount Model (DDM). The CAPM model estimates expected returns based on the relationship between risk and return, taking into account the market return, risk-free rate, and beta. The DDM model, on the other hand, estimates expected returns based on the present value of future dividends. Both models have their strengths and limitations, and investors should understand how to apply them effectively to find the expected market return. For instance, the CAPM model is useful for estimating expected returns for stocks, but it assumes that investors are rational and that markets are efficient, which may not always be the case. The DDM model, on the other hand, is useful for estimating expected returns for dividend-paying stocks, but it assumes that dividend payments will continue indefinitely, which may not always be the case. By understanding the strengths and limitations of these models, investors can use them to make more accurate estimates of expected returns and achieve consistent investment returns. Furthermore, combining these models with other approaches, such as analyzing historical market trends and adjusting for risk and inflation, can provide a more comprehensive understanding of how to find the expected market return.

How to Adjust for Risk and Inflation

When estimating expected returns, it’s essential to adjust for risk and inflation to ensure that the estimates are accurate and reliable. Risk is a critical factor in investment decisions, as it can significantly impact the potential returns of an investment. One way to adjust for risk is to use metrics such as beta, which measures the volatility of an investment relative to the overall market. By understanding the beta of an investment, investors can better assess the level of risk and adjust their expected returns accordingly. Inflation is another important factor to consider when estimating expected returns. Inflation can erode the purchasing power of returns, making it essential to adjust expected returns for inflation. The Consumer Price Index (CPI) is a commonly used metric to measure inflation, and investors can use it to adjust their expected returns for inflation. For instance, if the expected return of an investment is 8%, and the inflation rate is 2%, the real expected return would be 6%. By adjusting for risk and inflation, investors can get a more accurate estimate of how to find the expected market return and make more informed investment decisions. Additionally, understanding how to adjust for risk and inflation can help investors to better manage their portfolios and achieve consistent returns over the long term.

Practical Strategies for Achieving Consistent Returns

Achieving consistent returns requires a combination of effective investment strategies and a deep understanding of how to find the expected market return. One practical strategy for achieving consistent returns is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This approach helps to reduce the impact of market volatility and timing risks, allowing investors to benefit from the power of compounding over the long term. Another important strategy is regular portfolio rebalancing, which involves periodically reviewing and adjusting the asset allocation of a portfolio to ensure that it remains aligned with the investor’s goals and risk tolerance. This approach helps to manage risk and maintain a consistent return profile over time. Tax-efficient investing is also a key strategy for achieving consistent returns, as it involves minimizing tax liabilities and maximizing after-tax returns. By using tax-loss harvesting and other tax-efficient strategies, investors can reduce their tax burden and achieve higher returns over the long term. By combining these practical strategies with a deep understanding of how to find the expected market return, investors can increase their chances of achieving consistent returns and achieving their long-term investment goals.

Common Pitfalls to Avoid in Expected Return Estimation

When it comes to estimating expected returns, investors often make mistakes that can lead to inaccurate estimates and poor investment decisions. One common pitfall is relying on past performance, which is not always a reliable indicator of future returns. Another mistake is ignoring risk factors, such as volatility and inflation, which can significantly impact expected returns. Additionally, investors may fail to consider the impact of fees and taxes on their returns, leading to overly optimistic estimates. To avoid these pitfalls, investors should focus on understanding the underlying drivers of expected returns, such as the company’s financials, industry trends, and macroeconomic conditions. By taking a more nuanced approach to estimating expected returns, investors can avoid common mistakes and make more informed investment decisions. Furthermore, understanding how to find the expected market return requires a deep understanding of the market and its underlying dynamics. By avoiding common pitfalls and taking a more thoughtful approach to expected return estimation, investors can increase their chances of achieving their long-term investment goals.

Staying Ahead of the Curve: Monitoring and Adjusting Expected Returns

To ensure that investment goals remain on track, it is essential to regularly monitor and adjust expected returns. This involves staying informed about market changes, such as shifts in interest rates, economic indicators, and geopolitical events, which can impact expected returns. By continuously monitoring market conditions, investors can identify potential risks and opportunities, and adapt their investment strategies accordingly. For instance, if interest rates rise, investors may need to adjust their expected returns to reflect the increased cost of borrowing. Similarly, if economic indicators suggest a slowdown, investors may need to reduce their expected returns to reflect the decreased growth prospects. By staying ahead of the curve and adjusting expected returns in response to market changes, investors can increase their chances of achieving consistent returns and achieving their long-term investment goals. Furthermore, understanding how to find the expected market return requires ongoing monitoring and adaptation to changing market conditions. By staying informed and adapting to market changes, investors can refine their estimates of expected returns and make more informed investment decisions.