Understanding Market Returns: What They Mean and Why They Matter

Market return is the profit or loss on an investment over a period. It reflects how much an investment has grown or shrunk. Understanding market return is vital for investors. It reveals the growth of the principal investment. It shows the potential for income generation. It is essential for achieving financial goals. Market returns come in various forms. Capital appreciation is one type. It is the increase in an investment’s value. Dividends are another. These are payments made by companies to shareholders. Knowing how to find return on market helps you make sound investment choices. It allows you to compare different opportunities. Ultimately, it empowers you to manage your money wisely.

Investors often ask: how to find return on market accurately? It’s more than just seeing a number go up or down. Understanding the components is crucial. For instance, a stock’s return includes both price changes and dividends. A bond’s return includes interest payments and any change in its market value. Real estate returns involve rental income and property appreciation. Considering these different sources is essential for a complete picture. Market return is crucial because it directly impacts financial planning. It influences decisions about retirement savings, education funds, and other long-term goals. A higher return means faster progress toward those goals. Lower returns might require adjusting strategies.

How to find return on market also requires understanding benchmarks. Comparing your investment returns to a market index is useful. For example, comparing stock returns to the S&P 500. This helps you gauge how your investments are performing relative to the broader market. Remember, market return isn’t guaranteed. It is subject to fluctuations due to various factors. Economic conditions, industry trends, and company performance all play a role. By understanding these influences, investors can better navigate the market. They can make more informed decisions about where to allocate their capital. It’s essential to stay informed and adapt your strategies as needed.

How to Calculate Your Portfolio’s Return

Understanding how to find return on market is crucial for evaluating investment performance. A straightforward method involves calculating simple return, which is the profit or loss divided by the initial investment. For instance, if an investment of $1,000 grows to $1,100, the simple return is ($1,100 – $1,000) / $1,000 = 10%. However, this doesn’t account for the time value of money or compounding.

Compounded return offers a more accurate picture, especially over longer periods. It reflects the effect of earning returns on prior returns. To illustrate, consider an investment that yields 5% in year one and 10% in year two. The compounded return isn’t simply 15%. Instead, you calculate it by multiplying the returns for each period: (1 + 0.05) * (1 + 0.10) = 1.155, indicating a 15.5% compounded return. This demonstrates how to find return on market with reinvested earnings boosting overall gains. Visually, a chart plotting investment growth over time can clearly show the difference between simple and compounded returns, with the compounded return curve rising more steeply as time progresses.

Furthermore, investors often need to calculate Return on Investment (ROI) and annualized return. ROI is similar to simple return, providing a percentage measure of profitability. Annualized return, on the other hand, translates returns into a yearly figure, allowing for easier comparison across different investment durations. For example, if an investment doubles in five years, calculating the annualized return involves finding the annual rate that would achieve the same growth. The formula for annualized return is: [(Ending Value / Beginning Value)^(1 / Number of Years)] – 1. These calculations reveal a more precise understanding of how to find return on market, enabling investors to make informed decisions and assess the true profitability of their investments.

Analyzing Different Investment Vehicles: Stocks, Bonds, and More

Understanding the return potential of various asset classes is crucial for informed investment decisions. Stocks, often associated with higher growth potential, also carry a greater degree of risk compared to bonds. Bonds, representing debt instruments, generally offer more stable, but typically lower, returns. Real estate can provide returns through rental income and property appreciation, but it also involves factors like property management and market fluctuations. The relationship between risk and return is fundamental: higher potential returns usually come with higher risks, and vice versa. Considering historical performance is valuable; however, past performance doesn’t guarantee future results. It’s important to understand how to find return on market for each asset class before investing.

Diversification is key to managing risk and optimizing returns. Spreading investments across different asset classes can help mitigate losses in one area by gains in another. For example, a portfolio might include a mix of stocks for growth, bonds for stability, and real estate for diversification. Each asset class responds differently to economic conditions and market events. Therefore, a diversified portfolio is designed to weather market volatility more effectively. Investors should research and understand how to find return on market for different assets to make well-informed choices.

The specific allocation of assets should align with an investor’s individual risk tolerance, financial goals, and time horizon. A younger investor with a longer time horizon might opt for a higher allocation to stocks, while an investor nearing retirement might prefer a more conservative approach with a larger allocation to bonds. Understanding how to find return on market in different scenarios is part of creating a successful strategy. It is important to acknowledge fees and taxes that can significantly impact the return on investment. By understanding the potential returns and risks of different asset classes, investors can build a well-diversified portfolio that aligns with their individual circumstances and increases their chances of achieving their financial goals.

Factors Influencing Market Returns: Economic Indicators and Market Sentiment

Market returns are not simply random occurrences; they are influenced by a complex interplay of economic indicators and market sentiment. Understanding these factors is crucial for investors seeking to navigate the financial landscape and learn how to find return on market trends. Economic indicators provide insights into the overall health and direction of the economy. Interest rates, for instance, play a significant role. When interest rates are low, borrowing becomes cheaper, encouraging investment and potentially boosting market returns. Conversely, high interest rates can dampen economic activity and negatively impact returns. Inflation, another key indicator, erodes the purchasing power of money and can impact corporate earnings, ultimately affecting stock prices. Strong economic growth, characterized by rising GDP and employment, typically fuels investor optimism and drives market returns higher. Geopolitical events, such as political instability, trade wars, or global crises, can also trigger significant market fluctuations, introducing uncertainty and volatility. Savvy investors closely monitor these macroeconomic factors to anticipate potential shifts in market conditions and adjust their strategies accordingly. It’s important to grasp how to find return on market signals amidst the economic noise.

Beyond the hard data of economic indicators, market sentiment – the overall attitude and feeling of investors – profoundly affects market returns. Investor confidence, driven by factors like positive news, strong corporate earnings, or a sense of economic stability, can lead to increased buying pressure and rising prices. Conversely, fear and uncertainty, fueled by negative news, economic concerns, or geopolitical risks, can trigger sell-offs and market downturns. Market sentiment can be influenced by a variety of psychological factors, including herd behavior (the tendency to follow the crowd), optimism bias (the tendency to overestimate positive outcomes), and loss aversion (the tendency to feel the pain of a loss more strongly than the pleasure of a gain). These psychological biases can lead to irrational investment decisions and amplify market swings. Learning how to find return on market assets requires considering these sentiment-driven forces.

History offers numerous examples of how economic indicators and market sentiment have shaped investment outcomes. The dot-com bubble of the late 1990s, for instance, was fueled by excessive investor exuberance and a disregard for fundamental valuations, ultimately leading to a market crash. The 2008 financial crisis was triggered by a combination of factors, including lax lending standards, a housing bubble, and a loss of confidence in the financial system. The COVID-19 pandemic in 2020 caused significant market volatility as investors grappled with the economic impact of lockdowns and uncertainty about the future. These events underscore the importance of understanding the interplay between economic realities and investor psychology. Investors need to understand how to find return on market while being aware of these market dynamics, maintaining a long-term perspective, and avoiding emotional decision-making.

Developing a Long-Term Investment Strategy: Diversification and Asset Allocation

Creating a robust, long-term investment strategy is crucial for achieving financial goals. This involves two key elements: diversification and asset allocation. Diversification means spreading investments across various asset classes. Asset allocation involves strategically distributing investments based on risk tolerance and financial objectives. Understanding how to find return on market informs these decisions.

Diversification helps mitigate risk. By investing in a mix of stocks, bonds, and other asset classes like real estate, the impact of any single investment’s poor performance is reduced. For example, a portfolio solely focused on technology stocks is highly susceptible to fluctuations in that sector. A diversified portfolio, however, would include stocks from different industries, bonds, and perhaps real estate, providing a buffer against sector-specific downturns. Proper asset allocation depends heavily on understanding how to find return on market for different asset classes, so that wise decisions are made.

Asset allocation should align with an investor’s risk tolerance and financial goals. A young investor with a long time horizon might allocate a larger portion of their portfolio to stocks, which generally offer higher potential returns but also carry greater risk. As the investor approaches retirement, a shift towards a more conservative allocation with a higher percentage of bonds may be appropriate to preserve capital. Consider two hypothetical portfolios. Portfolio A, designed for a risk-averse investor, may consist of 70% bonds and 30% stocks. Portfolio B, for a more aggressive investor, may be 70% stocks and 30% bonds. Understanding how to find return on market for each scenario is crucial for choosing the appropriate asset mix. The key is to maintain a long-term perspective, understanding that short-term market fluctuations are normal and should not derail the overall strategy. Therefore, how to find return on market is very important for your investment stratergy. Regularly reviewing and adjusting the allocation as needed ensures that the portfolio remains aligned with the investor’s goals and risk profile.

Tracking Your Investment Performance: Monitoring and Adjustment

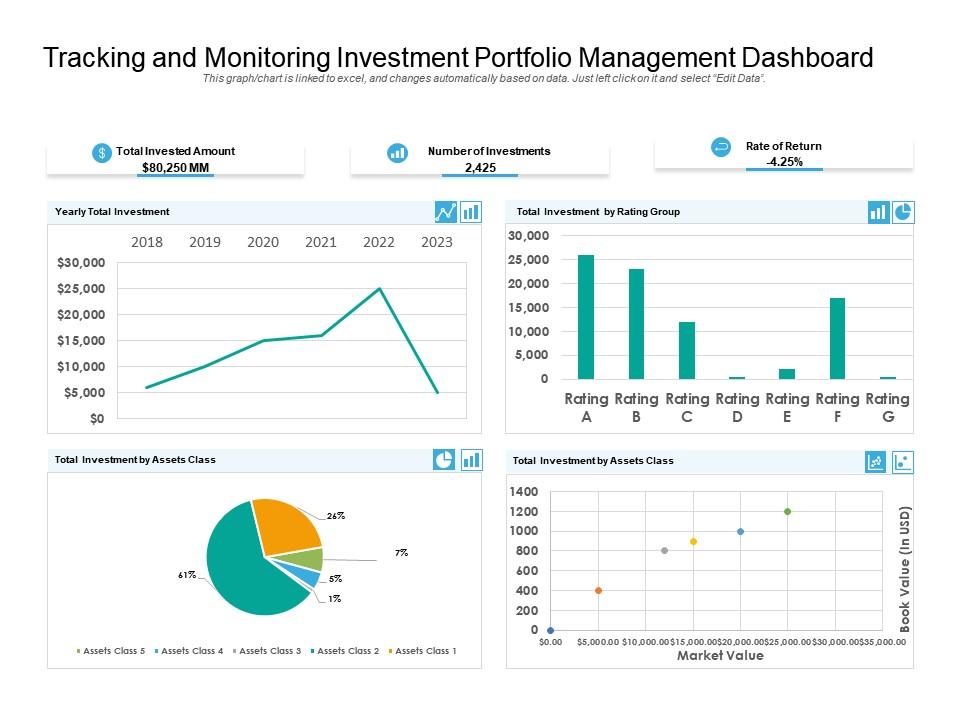

Regularly monitoring investment performance is crucial for successful investing. Investors can utilize various methods to track their returns. Online brokerage accounts often provide comprehensive portfolio tracking tools. These tools automatically calculate returns, showing both overall portfolio performance and the performance of individual holdings. Understanding how to find return on market is simplified through these platforms. Many investors also find spreadsheets helpful for manually tracking investments and calculating returns. Spreadsheets allow for customization and detailed analysis of investment performance over time. This meticulous approach facilitates a clear understanding of progress towards financial goals.

<p>Effective portfolio tracking involves more than just calculating returns. Investors should regularly review their asset allocation to ensure it remains aligned with their risk tolerance and financial goals. Market conditions change. Therefore, periodic adjustments to the investment strategy may be necessary. For example, if a specific investment underperforms consistently, it may be prudent to consider reallocating funds to better-performing assets. How to find return on market is only one aspect of successful investing. A deeper understanding of risk management and asset allocation is also essential. Investors may want to consult a financial advisor for personalized guidance on portfolio adjustments.

The frequency of monitoring and adjustment depends on individual circumstances and investment goals. For long-term investors with a buy-and-hold strategy, less frequent monitoring may suffice. However, investors with shorter time horizons or higher risk tolerance may need to monitor their portfolios more closely. Regardless of the frequency, consistent review and analysis of investment performance are key to making informed decisions and achieving long-term financial success. By actively tracking progress and making timely adjustments, investors can significantly improve their chances of meeting their investment goals. Mastering how to find return on market is one important step. However, consistent monitoring and adaptation are crucial for overall investment success.

The Role of Fees and Taxes on Investment Returns

Understanding how fees and taxes impact investment returns is crucial for maximizing your portfolio’s growth. Various fees can eat into your profits, significantly affecting your overall return. Brokerage fees, charged for buying and selling investments, vary depending on the brokerage and the type of trade. Management fees are common in mutual funds and actively managed accounts. These fees represent a percentage of your assets under management. Knowing how to find return on market, net of these expenses, is essential. High fees can dramatically reduce your net returns over time, even offsetting potential gains. For example, a 2% annual management fee on a $100,000 portfolio means a $2,000 annual expense, regardless of market performance. This highlights the importance of comparing fee structures before investing. To calculate your net return, subtract all fees from your gross return. This will show your true investment gains.

Taxes further reduce your investment returns. Capital gains taxes apply to profits earned from selling assets like stocks or bonds. Dividend income is also taxable. The tax rate depends on your income bracket and the holding period of the investment. Long-term capital gains (investments held for more than one year) generally have lower tax rates than short-term gains. Understanding the tax implications of various investment strategies is vital for optimizing returns. Tax-advantaged accounts, such as 401(k)s and IRAs, can significantly reduce your tax burden and help improve your overall return on market investments. Investors should consult with a tax professional to strategize tax-efficient investment approaches, minimizing tax liabilities and maximizing net returns. How to find return on market after taxes is another key aspect investors must grasp.

Effective cost management is essential for long-term investment success. Analyze expense ratios carefully when selecting mutual funds or ETFs. Negotiate brokerage fees, if possible, and explore low-cost investment options. Understanding the combined impact of fees and taxes allows investors to make informed decisions that protect their hard-earned money. This leads to better outcomes by improving how to find return on market, ultimately contributing to the achievement of financial objectives. Regularly reviewing your investment statements allows you to track your fees and taxes, ensuring transparency and control over your investment costs. This practice helps in maximizing returns over the long term. Understanding how these factors affect how to find return on market empowers investors to make sound financial decisions.

Staying Informed and Adapting to Market Changes: Continuous Learning

Successfully navigating the investment landscape requires a commitment to ongoing learning. Understanding how to find return on market involves more than just initial calculations; it demands consistent monitoring and adaptation. Regularly review reputable financial news sources for economic updates and market trends. These sources provide insights into shifts in interest rates, inflation levels, and geopolitical events – all factors that influence market returns. Staying abreast of these changes allows investors to make informed decisions and adjust their strategies as needed. Learning how to find return on market is a dynamic process, not a one-time event. Utilize various resources to enhance your understanding of investment vehicles and their associated risks and rewards.

Consider diversifying information sources to avoid bias. Compare perspectives from different financial analysts and economists. This holistic approach mitigates the risk of making decisions based on incomplete or skewed information. Remember that successful investing is a marathon, not a sprint. Patience and discipline are essential. Avoid impulsive reactions to short-term market volatility. Instead, focus on your long-term financial goals and maintain a consistent investment strategy aligned with your risk tolerance. How to find return on market effectively is a skill honed over time through experience and continuous education.

Professional financial advice can be invaluable, particularly when dealing with complex investment decisions. A qualified advisor can provide personalized guidance tailored to your individual circumstances and financial objectives. They can help you refine your investment strategy, ensuring it remains aligned with your evolving goals. Remember, how to find return on market involves both analytical skills and a strategic, long-term outlook. By combining consistent learning with disciplined execution, investors can significantly improve their chances of achieving their financial aspirations. The path to mastering market returns is paved with continuous learning, adaptable strategies, and a commitment to long-term growth.