Understanding the Core of Return on Invested Capital

Return on Invested Capital (ROIC) stands as a pivotal metric for evaluating a company’s proficiency in allocating capital towards profitable ventures. It serves as a compass for both investors and business proprietors, offering insights into how effectively a company utilizes its invested capital to generate profits. ROIC distinguishes itself from other profitability ratios, such as Return on Investment (ROI), through its distinct emphasis on capital structure, providing a more granular view of financial performance. Understanding how to find return on invested capital involves assessing how well a company transforms investments into profits.

The significance of ROIC lies in its capacity to reveal a company’s ability to create value. While ROI offers a general overview of investment returns, ROIC delves deeper by focusing on the capital employed to generate those returns. This distinction is crucial for investors seeking to identify companies that not only generate profits but also manage their capital efficiently. ROIC considers a company’s debt and equity, offering a more comprehensive picture of its financial health. Learning how to find return on invested capital is essential for comparing companies with different capital structures.

Furthermore, ROIC is an invaluable tool for business owners aiming to optimize their capital allocation strategies. By understanding their ROIC, businesses can identify areas where capital is being deployed effectively and areas where improvements can be made. This insight enables informed decisions regarding investments, acquisitions, and divestitures, ultimately leading to enhanced profitability and shareholder value. A high ROIC signals that a company is adept at generating profits from its investments, while a low ROIC may indicate inefficiencies in capital allocation. Mastering how to find return on invested capital enables businesses to fine-tune their financial strategies and maximize their returns. Investors should understand how to find return on invested capital to better evaluate investment opportunities.

How to Calculate Return on Invested Capital: A Step-by-Step Breakdown

Understanding how to find return on invested capital (ROIC) involves a clear, step-by-step approach. The ROIC formula centers on evaluating a company’s efficiency in allocating capital. It consists of two primary components: Net Operating Profit After Tax (NOPAT) and Invested Capital. Mastering how to find return on invested capital relies on accurately determining these values. Let’s dissect the process.

First, calculating NOPAT requires examining the income statement. Begin with earnings before interest and taxes (EBIT). Adjust this figure for taxes. Specifically, NOPAT = EBIT * (1 – Tax Rate). The EBIT reveals operating profitability, and subtracting taxes provides the after-tax profit generated from core operations. Next, determine Invested Capital. This can be derived from the balance sheet. A common approach is to subtract non-interest-bearing current liabilities from total assets. Alternatively, Invested Capital can be calculated as the sum of debt and equity. Both methods should yield a similar result. This represents the total capital employed by the company to generate profits. Knowing how to find return on invested capital at this stage makes the process seamless.

Now, with both NOPAT and Invested Capital determined, the ROIC calculation is straightforward. The ROIC formula is: ROIC = NOPAT / Invested Capital. The resulting percentage indicates the return generated for every dollar of capital invested. For example, imagine a company with a NOPAT of $5 million and Invested Capital of $25 million. Its ROIC would be 20% ($5 million / $25 million = 0.20). This signifies that for every dollar invested, the company generates 20 cents in operating profit after tax. Grasping how to find return on invested capital through such calculations provides crucial insights into a company’s financial health and capital allocation prowess. Learning how to find return on invested capital is essential for investors and business owners.

Identifying NOPAT: Unveiling Operating Profitability

Calculating Net Operating Profit After Tax (NOPAT) is essential when learning how to find return on invested capital. NOPAT represents a company’s after-tax profit from its core operations, excluding the impact of financing. The starting point is typically Earnings Before Interest and Taxes (EBIT), which can be found on the income statement. However, adjustments are often needed to arrive at an accurate NOPAT figure. A key adjustment involves accounting for taxes. Since EBIT is pre-tax, it’s necessary to subtract the appropriate tax expense related to operating income. This isn’t always the total tax expense of the company, but rather the portion attributable to operating profits. Another common adjustment involves adding back non-cash charges like depreciation and amortization to EBIT. These expenses reduce earnings but don’t represent actual cash outflows, thus they are added back to reflect the true cash-generating ability of the operations. Understanding how to find return on invested capital relies on accurately determining NOPAT.

Defining ‘operating’ income requires careful consideration. It’s crucial to exclude non-operating items, such as gains or losses from investments or discontinued operations, as they can distort the true picture of operating performance. Unusual or one-time items should also be carefully scrutinized. For instance, a significant restructuring charge or a gain from the sale of an asset might be included in the income statement. These items are typically excluded or adjusted to arrive at a normalized NOPAT that reflects the company’s sustainable operating profitability. Consider a hypothetical manufacturing company. If the company reports EBIT of $1 million and a tax rate of 25%, the initial NOPAT calculation would be $1 million * (1 – 0.25) = $750,000. However, if the company also had a one-time gain of $100,000 from the sale of land, this gain should be excluded from the NOPAT calculation to accurately reflect operating performance. Learning how to find return on invested capital accurately is key to comparing various investment opportunities.

Analyzing real-world examples further clarifies the process. For example, a technology company might have significant stock-based compensation expense, which is a non-cash charge that should be added back to EBIT when calculating NOPAT. Similarly, a retail company might have significant operating lease expenses, which could be adjusted to reflect their true economic impact. Examining the company’s financial statements and understanding its specific accounting policies are essential for accurately calculating NOPAT. Furthermore, consistency is vital when calculating NOPAT over time. Using the same methodology each period ensures comparability and allows for meaningful trend analysis. Correctly identifying NOPAT is critical in understanding how to find return on invested capital, facilitating informed decisions about where to allocate capital and making appropriate investment choices.

Determining Invested Capital: Defining Capital at Work

Calculating Invested Capital accurately is crucial when learning how to find return on invested capital. It represents the total amount of capital employed to generate profits. There are several approaches to this calculation. One common method involves subtracting operating liabilities from total assets. Alternatively, one can sum debt and equity. Both methods should yield similar results. Understanding these approaches is vital for grasping how to find return on invested capital effectively.

The treatment of specific items within the Invested Capital calculation warrants careful consideration. Goodwill, arising from acquisitions, should be included as it represents a real investment made by the company. Deferred taxes, however, can be more complex. Some analysts include them, while others exclude them, depending on their nature and permanence. Operating leases, now often recognized on the balance sheet, should be included as leased assets represent capital employed in the business. Real-world examples clarify these different scenarios. For instance, a company with significant goodwill on its balance sheet due to past acquisitions will have a higher Invested Capital base. This impacts the ROIC calculation, making it essential to understand how to find return on invested capital when acquisitions are involved.

Acquisitions significantly impact the invested capital base. When a company acquires another, the purchase price, often exceeding the target’s book value, is added to the acquiring company’s assets. This increase in Invested Capital affects the ROIC. It is important to consider whether the acquired company’s earnings justify the increased capital base. If the acquisition doesn’t generate sufficient returns, the overall ROIC will decrease. Analyzing how acquisitions impact invested capital is a key part of understanding how to find return on invested capital and assessing a company’s capital allocation strategy. Investors should scrutinize deals to determine if they enhance or detract from shareholder value. Companies need to integrate acquisitions effectively to realize synergies and improve ROIC post-acquisition.

Interpreting ROIC: What Does the Number Really Tell You?

The calculated Return on Invested Capital (ROIC) figure requires careful interpretation to gauge a company’s performance effectively. Understanding benchmarks and industry standards is crucial. What constitutes a “good” ROIC varies considerably across different industries. For example, a software company might exhibit a significantly higher ROIC than a capital-intensive manufacturing firm. Therefore, direct comparisons must be made cautiously and within the same sector. To find how to find return on invested capital for a particular industry look for the average data.

A high ROIC generally indicates that a company is efficiently generating profits from its invested capital. It suggests strong management and effective capital allocation. Conversely, a low ROIC might signal inefficiencies, poor investment decisions, or a struggling business model. It is vital to compare the ROIC to the company’s cost of capital. If the ROIC exceeds the cost of capital, the company is creating value for its investors. If the ROIC is lower than the cost of capital, the company is destroying value. To find how to find return on invested capital being higher than cost of capital indicates good investment decisions.

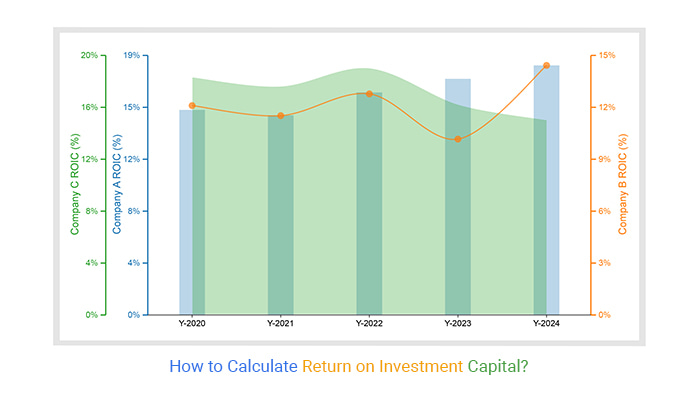

Consider these examples: Company A, a technology firm, boasts an ROIC of 25%, while Company B, a utility company, has an ROIC of 8%. On the surface, Company A appears to be the better investment. However, the utility sector typically requires substantial capital investments. An 8% ROIC might be considered healthy within that industry. Conversely, if the average ROIC for technology companies is 15%, Company A’s 25% ROIC would be considered exceptional. Always consider industry-specific benchmarks and the company’s cost of capital when interpreting the ROIC. To find how to find return on invested capital and make informed decisions, analyze trends of companies within similar sectors over multiple years. Furthermore, consider the company’s competitive advantages and future growth prospects in conjunction with its ROIC.

Leveraging ROIC for Investment Decisions: Making Informed Choices

Investors can significantly enhance their decision-making process by incorporating Return on Invested Capital (ROIC) analysis. When considering investments, it’s crucial to understand how to find return on invested capital and then compare this metric across different companies within the same industry. This comparison provides valuable insights into which companies are most efficiently utilizing their capital to generate profits. A higher ROIC generally indicates superior capital allocation and potentially greater long-term value creation.

Beyond a single snapshot, examining the trend of ROIC over time is essential. A consistently increasing ROIC suggests that the company is becoming more effective at deploying capital, while a declining ROIC may signal deteriorating efficiency or poor investment decisions. This longitudinal analysis helps investors assess the sustainability of a company’s performance and identify potential red flags. Understanding how to find return on invested capital and tracking its movement offer a deeper understanding of a company’s operational effectiveness. Investors should also consider industry-specific factors that might influence ROIC trends, such as technological disruptions or changes in competitive dynamics.

ROIC serves as a powerful tool for evaluating the quality of management’s capital allocation decisions. By analyzing ROIC, investors can gain insights into whether management is making sound investments that generate attractive returns. A high ROIC indicates that management is effectively deploying capital into profitable projects, while a low ROIC may suggest that capital is being misallocated or that the company is investing in projects with inadequate returns. Understanding how to find return on invested capital and then linking it to management’s actions can help investors assess the effectiveness and alignment of management’s interests with shareholder value creation. This includes evaluating decisions related to acquisitions, capital expenditures, and research and development investments. Ultimately, ROIC provides a critical lens through which investors can assess the quality of management and their ability to drive long-term value.

Enhancing Business Performance: Improving Your ROIC

Businesses seeking to elevate their financial standing should prioritize improving their Return on Invested Capital (ROIC). A higher ROIC signifies more efficient capital allocation and stronger profitability. To achieve this, a two-pronged approach is essential: boosting profitability and optimizing capital utilization. One aspect of how to find return on invested capital involves identifying areas to improve ROIC, starting with revenue generation. Sales increases, achieved through effective marketing and product development, directly contribute to higher profits. Simultaneously, businesses should aggressively pursue cost reduction strategies. Streamlining operations, negotiating better supplier terms, and minimizing waste are crucial steps. Effective cost management has a direct impact on how to find return on invested capital by improving the profit margin.

Optimizing capital utilization is equally important. This involves maximizing the efficiency with which assets are deployed. Reducing inventory levels through improved demand forecasting and supply chain management frees up capital. Similarly, improving working capital management, such as shortening the cash conversion cycle, enhances cash flow and reduces the need for external financing. Strategic investments play a vital role. Businesses should prioritize projects with the highest expected returns, carefully evaluating the potential ROIC of each investment opportunity. Thorough due diligence and realistic projections are critical for making informed investment decisions. Understanding how to find return on invested capital helps in these situations.

Resource allocation should be strategically aligned to maximize ROIC. Departments and projects that consistently deliver high returns should receive adequate funding, while underperforming areas should be reevaluated. This may involve restructuring operations, divesting underperforming assets, or reallocating resources to more promising ventures. Supply chain management plays a crucial role in ROIC improvement. Optimizing the supply chain can reduce costs, improve efficiency, and free up capital tied up in inventory. Cost-cutting initiatives should be implemented thoughtfully, focusing on areas that do not compromise product quality or customer satisfaction. Businesses should continuously monitor their ROIC and track the impact of improvement initiatives. Regular reviews of financial performance, combined with a deep understanding of how to find return on invested capital, allow businesses to adapt their strategies and optimize their capital allocation decisions for sustainable growth and profitability.

ROIC vs. Other Financial Metrics: A Comparative Analysis

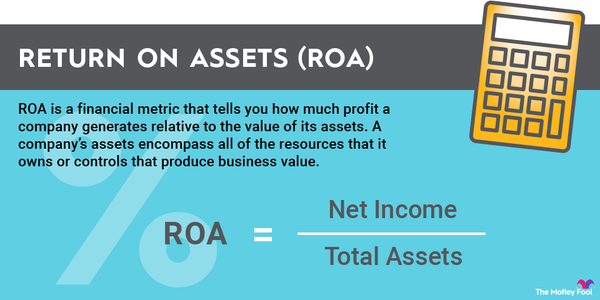

Return on Invested Capital (ROIC) stands as a pivotal metric, but understanding its relationship with other financial indicators, such as Return on Equity (ROE) and Return on Assets (ROA), is crucial for a holistic financial assessment. While all three metrics gauge profitability, they differ in their focus and application. Investors who want to know more about how to find return on invested capital, have to look at the differences with ROE and ROA.

Return on Equity (ROE) measures a company’s profitability relative to shareholder equity. It reveals how much profit a company generates for each dollar of shareholder investment. ROE is influenced by financial leverage, meaning that a company can artificially inflate its ROE by taking on more debt. This can make a company appear more profitable than it actually is. ROA, on the other hand, assesses how efficiently a company utilizes its assets to generate earnings, irrespective of its capital structure. While ROA provides insights into asset management effectiveness, it doesn’t specifically highlight the impact of debt financing like ROIC does when figuring out how to find return on invested capital. ROIC is a more rigorous assessment tool that isolates the returns generated from invested capital, providing a clearer picture of operational efficiency. It is vital to grasp how to find return on invested capital and differentiate it from other measures. Understanding how to find return on invested capital is enhanced by comparing it to other profitability metrics.

The strength of ROIC lies in its focus on capital allocation efficiency. It reveals how effectively a company is using its invested capital to generate profits, offering a more granular view than ROE or ROA. A high ROIC suggests that a company is adept at deploying capital to profitable ventures, while a low ROIC may signal inefficient capital allocation. Each metric is best suited for different analytical purposes. ROE is useful for evaluating shareholder returns. ROA is helpful for assessing asset utilization. ROIC provides a deeper understanding of how well a company is managing its capital investments. Savvy investors use all three metrics in conjunction to gain a comprehensive understanding of a company’s financial performance and make well-informed investment decisions, specially when figuring out how to find return on invested capital and use it.