What is Par Value and Why is it Important?

In the realm of bond investing, par value plays a vital role in determining the bond’s price and yield. Also known as face value or nominal value, par value is the amount that the bond issuer borrows from the investor and promises to repay at maturity. It is the foundation of a bond’s pricing and valuation, and understanding how to find par value of a bond is crucial for making informed investment decisions. The par value of a bond affects its price and yield, as it serves as the basis for calculating the bond’s interest payments and return on investment. A bond’s par value can also impact its credit rating, interest rates, and maturity date, making it an essential concept for investors to grasp.

Understanding Bond Pricing: The Relationship Between Par Value and Market Value

In the bond market, understanding the distinction between par value and market value is crucial for investors. Par value, also known as face value or nominal value, is the amount that the bond issuer borrows from the investor and promises to repay at maturity. On the other hand, market value is the current price of the bond in the market, which can fluctuate based on various market forces. The market value of a bond can be higher or lower than its par value, depending on factors such as interest rates, credit rating, and economic conditions. For instance, if interest rates rise, the market value of a bond with a fixed coupon rate may decrease, causing it to trade below its par value. Conversely, if interest rates fall, the market value of the bond may increase, causing it to trade above its par value. Understanding how to find par value of a bond and its relationship with market value is essential for investors to make informed investment decisions and optimize their returns.

How to Find the Par Value of a Bond: A Step-by-Step Guide

Finding the par value of a bond is a straightforward process that requires understanding where to find the necessary information and how to calculate it. To determine the par value of a bond, follow these steps:

Step 1: Locate the Bond Certificate or Prospectus – The par value of a bond is typically stated on the bond certificate or prospectus. These documents provide essential information about the bond, including its face value, coupon rate, and maturity date.

Step 2: Identify the Face Value – The face value, also known as the par value or nominal value, is the amount that the bond issuer borrows from the investor and promises to repay at maturity. This value is usually stated in the bond certificate or prospectus.

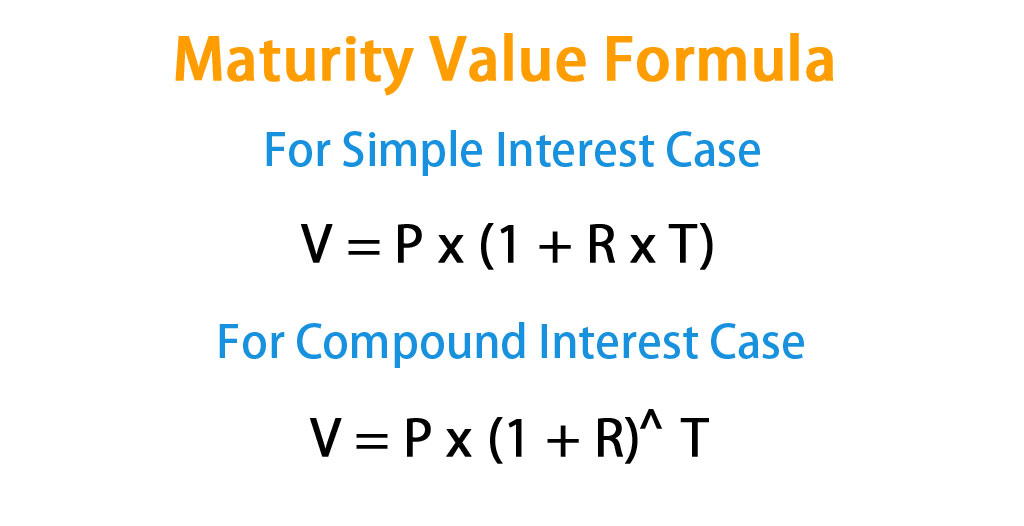

Step 3: Calculate the Par Value – In most cases, the par value is a fixed amount, such as $1,000 or $5,000. However, some bonds may have a variable par value, which is calculated based on a specific formula. To calculate the par value, investors can refer to the bond’s prospectus or consult with a financial advisor.

By following these steps, investors can easily find the par value of a bond and use this information to make informed investment decisions. Understanding how to find par value of a bond is essential for determining the bond’s price and yield, as well as its creditworthiness and risk profile.

Factors Affecting Par Value: Credit Rating, Interest Rates, and Maturity

Several factors can impact the par value of a bond, including credit rating, interest rates, and maturity date. Understanding how these factors affect par value is crucial for investors to make informed investment decisions.

Credit Rating: A bond’s credit rating is a measure of the issuer’s creditworthiness. A higher credit rating indicates a lower risk of default, which can result in a higher par value. Conversely, a lower credit rating may lead to a lower par value. Investors should consider the credit rating of a bond when determining its par value and potential return on investment.

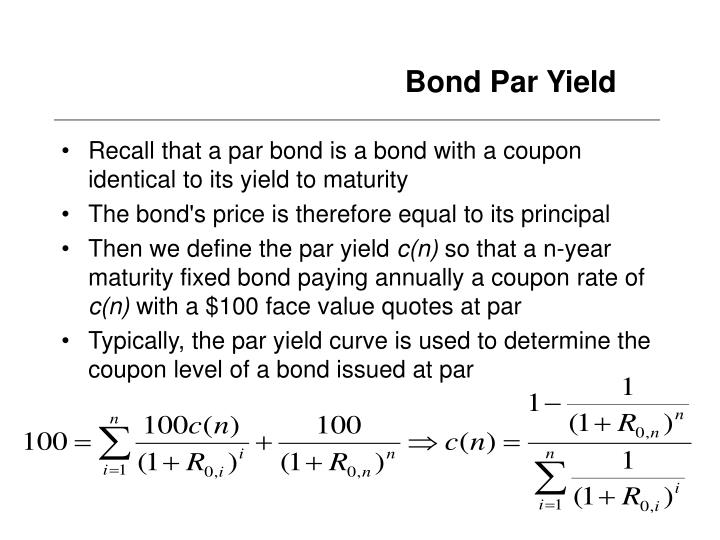

Interest Rates: Changes in interest rates can also affect the par value of a bond. When interest rates rise, the par value of existing bonds with lower coupon rates may decrease, causing their market value to fall. Conversely, when interest rates fall, the par value of existing bonds with higher coupon rates may increase, causing their market value to rise. Investors should consider the current interest rate environment when evaluating the par value of a bond.

Maturity Date: The maturity date of a bond is the date on which the bond issuer repays the face value of the bond to the investor. Bonds with shorter maturity dates typically have lower par values than those with longer maturity dates. This is because investors demand a higher return for tying up their capital for a longer period. Investors should consider the maturity date of a bond when determining its par value and potential return on investment.

By understanding how these factors affect the par value of a bond, investors can make more informed investment decisions and optimize their returns. It is essential to consider these factors when evaluating the par value of a bond and determining its potential return on investment.

Real-World Examples: Calculating Par Value for Different Types of Bonds

To illustrate the concept of par value in practice, let’s consider real-world examples of calculating par value for different types of bonds.

Government Bonds: U.S. Treasury bonds, such as the 10-year Treasury note, have a par value of $1,000. When investors purchase these bonds, they essentially lend the government $1,000, which is repaid at maturity with interest. The par value of government bonds is typically fixed and does not fluctuate with market conditions.

Corporate Bonds: Corporate bonds, issued by companies to raise capital, also have a par value. For example, a corporate bond with a face value of $5,000 and a coupon rate of 5% would pay $250 in annual interest to the investor. The par value of corporate bonds can fluctuate based on the company’s creditworthiness and market conditions.

Municipal Bonds: Municipal bonds, issued by local governments and municipalities to finance infrastructure projects, have a par value that varies depending on the issuer and the project. For example, a municipal bond with a face value of $10,000 and a coupon rate of 4% would pay $400 in annual interest to the investor. The par value of municipal bonds can be affected by the creditworthiness of the issuer and the project’s revenue-generating potential.

High-Yield Bonds: High-yield bonds, also known as junk bonds, have a higher par value due to their higher credit risk. For example, a high-yield bond with a face value of $20,000 and a coupon rate of 8% would pay $1,600 in annual interest to the investor. The par value of high-yield bonds can fluctuate significantly based on the issuer’s creditworthiness and market conditions.

By understanding how to calculate par value for different types of bonds, investors can make informed investment decisions and optimize their returns. Whether investing in government, corporate, municipal, or high-yield bonds, knowing how to find the par value of a bond is essential for achieving financial goals.

Common Mistakes to Avoid When Calculating Par Value

When calculating par value, investors often make mistakes that can lead to inaccurate investment decisions. To avoid these mistakes, it’s essential to understand the common pitfalls and take steps to mitigate them.

Confusing Par Value with Market Value: One of the most common mistakes is confusing par value with market value. Par value is the face value of the bond, while market value is the current price of the bond in the market. Investors should not assume that the market value is the same as the par value, as market forces can cause the bond’s price to fluctuate.

Ignoring the Impact of Interest Rates: Another mistake is ignoring the impact of interest rates on par value. Changes in interest rates can affect the bond’s yield and, subsequently, its par value. Investors should consider the current interest rate environment when calculating par value.

Failing to Consider Credit Rating: Credit rating is a critical factor in determining par value. Investors should not overlook the credit rating of the issuer, as it can significantly impact the bond’s par value. A lower credit rating can result in a lower par value, while a higher credit rating can lead to a higher par value.

Not Accounting for Maturity Date: The maturity date of a bond is crucial in determining its par value. Investors should not forget to consider the maturity date, as it can affect the bond’s yield and par value.

To avoid these mistakes, investors should carefully review the bond’s prospectus or certificate, consider the current market conditions, and calculate the par value accurately. By doing so, investors can make informed investment decisions and optimize their returns.

The Role of Par Value in Bond Portfolio Management

In bond portfolio management, par value plays a crucial role in helping investors diversify their portfolio, manage risk, and optimize returns. By understanding the par value of individual bonds, investors can make informed decisions about their bond holdings and create a well-balanced portfolio.

One way par value is used in bond portfolio management is to determine the overall value of the portfolio. By calculating the par value of each bond, investors can determine the total value of their portfolio and make adjustments as needed. This helps investors to maintain a target asset allocation and ensure that their portfolio remains aligned with their investment objectives.

Par value also helps investors to manage risk by identifying bonds with higher credit risk or lower liquidity. By analyzing the par value of individual bonds, investors can identify potential risks and take steps to mitigate them. For example, if an investor holds a bond with a lower credit rating, they may choose to sell it and replace it with a bond from a more creditworthy issuer.

In addition, par value is used to optimize returns by identifying bonds with higher yields or better liquidity. By analyzing the par value of individual bonds, investors can identify opportunities to earn higher returns or improve the liquidity of their portfolio. For instance, if an investor holds a bond with a lower yield, they may choose to sell it and replace it with a bond from a similar issuer with a higher yield.

Furthermore, par value is used in bond indexing and benchmarking. Bond indexes, such as the Bloomberg Barclays Aggregate Bond Index, use par value to calculate the total return of the index. This helps investors to track the performance of their bond portfolio against a benchmark and make adjustments as needed.

In conclusion, par value plays a vital role in bond portfolio management by helping investors to diversify their portfolio, manage risk, and optimize returns. By understanding how to find the par value of a bond, investors can make informed investment decisions and achieve their financial goals.

Conclusion: The Importance of Understanding Par Value in Bond Investing

In conclusion, understanding par value is crucial in bond investing as it provides a foundation for making informed investment decisions. By grasping the concept of par value, investors can better navigate the complexities of bond investing and achieve their financial goals. Whether it’s determining the face value of a bond, understanding the relationship between par value and market value, or using par value in bond portfolio management, this concept plays a vital role in bond investing.

By following the step-by-step guide on how to find the par value of a bond, investors can avoid common mistakes and make informed decisions about their bond holdings. Furthermore, understanding the factors that affect par value, such as credit rating, interest rates, and maturity date, can help investors optimize their returns and manage risk.

In today’s complex bond market, understanding par value is more important than ever. With the ability to make informed investment decisions, investors can navigate the bond market with confidence and achieve their financial objectives. Remember, understanding how to find the par value of a bond is a critical step in successful bond investing, and by doing so, investors can unlock the full potential of their bond portfolio.