Understanding Expected Utility: A Practical Guide to How to Find Expected Utility

Expected utility represents the average value of an outcome, considering its probability. It’s a crucial tool for making smart decisions when facing uncertainty. Understanding how to find expected utility allows individuals to weigh potential gains against potential losses, leading to more rational choices. A simple example illustrates this: Imagine two job offers. Job A offers a guaranteed salary of $60,000 per year. Job B offers a salary of $80,000 per year but with a 50% chance of being downsized after one year, reverting to a salary of $40,000. The higher potential earnings of Job B are offset by the considerable risk. Calculating expected utility helps determine which job is truly the better option, based on an individual’s risk tolerance and financial situation. This method lets people analyze and quantify the impact of uncertainty on their decisions.

To effectively use this technique to find expected utility, one must properly weigh risks and rewards. The calculation incorporates both the potential value of an outcome and its likelihood. For instance, a lottery ticket with a small chance of winning a large sum may appear attractive. However, the low probability diminishes the overall expected utility. Conversely, a lower-paying, stable job might have higher expected utility than a high-paying, high-risk job. The decision-making process becomes less about gut feelings and more about objective assessment. How to find expected utility becomes an exercise in assigning numerical values to uncertain situations, enabling people to make informed decisions.

The process of how to find expected utility involves several key steps. First, one identifies all possible outcomes and assigns probabilities to each. The accuracy of these probability assessments is paramount. Then, one assigns a utility value to each outcome, reflecting its personal worth. This value is subjective; the utility of an extra $10,000 differs vastly for someone with limited funds versus someone already wealthy. Finally, the expected utility for each option is calculated by multiplying each outcome’s probability by its utility and summing the results. The option with the highest expected utility is the rational choice. This systematic approach clarifies decisions under uncertainty. Learning how to find expected utility offers a powerful framework for rational decision-making, considering both the potential rewards and the associated risks.

Identifying Possible Outcomes and Their Probabilities: A Crucial Step in Learning How to Find Expected Utility

To understand how to find expected utility, one must first identify all possible outcomes of a given decision. Consider a simple coin flip: the outcomes are heads or tails. Each outcome has an associated probability. In a fair coin flip, the probability of heads is 0.5, and the probability of tails is also 0.5. More complex decisions involve more outcomes and probabilities. For example, investing in a stock involves various potential returns (profits or losses) with different likelihoods. These probabilities are often estimated using historical data, market analysis, or expert opinions. Accurately assessing probabilities is vital for calculating expected utility. The process of how to find expected utility relies heavily on this accuracy. Inaccurate probabilities lead to inaccurate expected utility calculations, potentially resulting in poor decision-making.

Determining probabilities can be challenging. For some scenarios, probabilities are relatively easy to ascertain. The probability of drawing a specific card from a deck is straightforward. However, assigning probabilities to more complex events requires more sophisticated methods. Predicting the success of a new product launch involves market research and forecasting. Evaluating the likelihood of a natural disaster necessitates considering historical data and scientific models. These scenarios highlight the importance of using appropriate methods and data sources. To accurately calculate expected utility, one must carefully consider all the data, and how to find expected utility requires a well-considered probabilistic foundation. The reliability of your expected utility calculation depends entirely on how well you assess probabilities.

Illustrating how to find expected utility with a career choice example: Imagine choosing between two job offers. Job A offers a guaranteed salary of $60,000 per year. Job B offers a salary of $80,000 per year with a 70% probability of success, but a 30% chance of failure (resulting in no income). To use the principles of how to find expected utility, we need to assign probabilities to each possible outcome. The next step in learning how to find expected utility involves assigning utility values to each outcome which will then allow calculation of the expected utility for each job, enabling a comparison to determine the optimal choice.

Assigning Utility Values to Each Outcome

Understanding how to find expected utility requires grasping the concept of utility. Utility represents the subjective value an individual assigns to a particular outcome. It’s crucial to differentiate between monetary value and utility. While $10,000 might seem equally valuable to everyone, its utility varies greatly depending on individual circumstances. For a wealthy individual, an extra $10,000 holds less significance than for someone struggling financially. The utility reflects the personal satisfaction or benefit derived from the outcome, not just its monetary worth. This is a key element in how to find expected utility.

Quantifying utility can be achieved through various methods. A simple approach involves using a rating scale, such as a scale of 1 to 10, where 1 represents the least desirable outcome and 10 represents the most desirable. Individuals assign a numerical value to each potential outcome based on their personal preferences and circumstances. More sophisticated methods involve creating utility functions, mathematical formulas that express the relationship between an outcome’s monetary value and its subjective utility. These functions often incorporate factors like risk aversion and diminishing marginal utility – the idea that the additional utility gained from each extra unit of something decreases as you accumulate more. Understanding how to find expected utility involves selecting an appropriate method for quantifying utility that matches the complexity of the decision.

For example, when choosing between two job offers, one with a higher salary but longer hours and the other with lower pay but more flexible work arrangements, the utility assigned to each outcome should reflect the individual’s preferences regarding income versus leisure time. Someone who prioritizes work-life balance might assign a higher utility to the job with lower pay and more flexible hours, even if the monetary value is lower. This illustrates how to find expected utility: it’s not just about the numbers but also the personal weight individuals assign to different aspects of each outcome. Accurate utility assignment is critical for calculating expected utility and making informed decisions. This process demonstrates how to find expected utility effectively.

Calculating Expected Utility: A Step-by-Step Guide

To find expected utility, begin by listing all possible outcomes for each decision option. Assign a probability to each outcome. Probabilities represent the likelihood of each outcome occurring, ranging from 0 (impossible) to 1 (certain). These probabilities should sum to 1 for each option. Next, assign a utility value to each outcome. Utility reflects the subjective value or satisfaction derived from each outcome. This is not always equivalent to monetary value; the utility of an extra $1,000 is greater for someone with low income than for a high-income earner. Use a scale (e.g., 1 to 10) or a more complex utility function to quantify these values. How to find expected utility involves understanding this crucial step of assigning appropriate utility values.

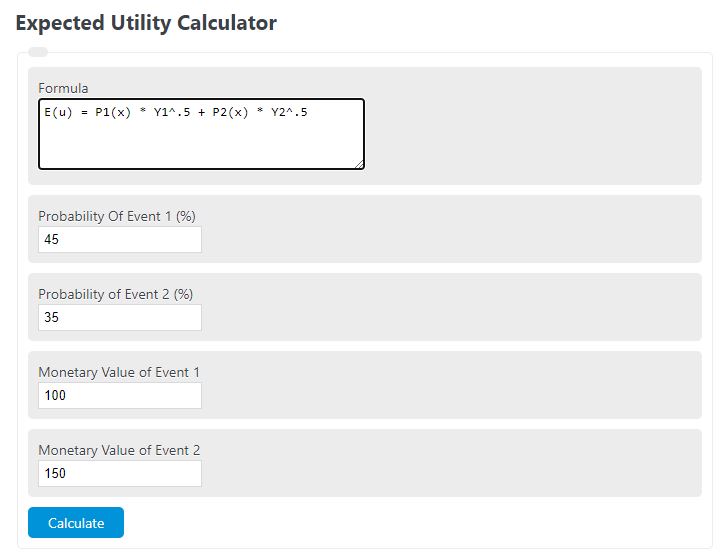

The formula for calculating expected utility for a single option is: Expected Utility = Σ [Probability (i) * Utility (i)], where Σ denotes the sum across all possible outcomes (i). To illustrate, consider an investment opportunity. Suppose there is a 60% chance of a $10,000 profit (utility 8 on a 1-10 scale), a 30% chance of breaking even (utility 5), and a 10% chance of a $5,000 loss (utility 2). The expected utility is calculated as: (0.6 * 8) + (0.3 * 5) + (0.1 * 2) = 6.5. Repeat this calculation for each available option. How to find expected utility becomes clearer with practice and varied examples.

Once the expected utility is calculated for each option, compare the results. The option with the highest expected utility is the preferred choice based on this decision-making model. Note that an option with a lower potential monetary gain might still have a higher expected utility if its probability of success is significantly higher or if it carries less risk. This highlights that understanding how to find expected utility is key to informed decision-making. Remember that this method relies on accurate probability assessments and utility assignments. The accuracy of the expected utility calculation depends heavily on the accuracy of these inputs. Therefore, careful consideration of these elements is vital when employing this methodology.

Comparing Expected Utilities: Making Informed Decisions

After calculating the expected utility for each option, comparing them reveals the optimal choice. The option with the highest expected utility represents the preferred choice, according to the theory. This process helps make informed decisions, even when dealing with uncertainty. Understanding how to find expected utility is crucial for effective decision-making. This approach allows for a rational evaluation of different choices, considering both potential gains and losses.

Consider a scenario where one investment option offers a high potential return but also carries substantial risk, while another offers a lower, more certain return. By calculating the expected utility for each, one can determine which option is truly preferable. This involves assigning utility values that reflect individual risk tolerance. For example, a risk-averse individual might favor the lower-risk, lower-return option, even if its expected monetary value is less. This highlights the importance of incorporating personal preferences into the calculations. How to find expected utility accurately often requires thoughtful consideration of personal risk tolerance.

Numerous real-world applications benefit from this approach. In business, comparing the expected utility of different marketing strategies or product development pathways allows for data-driven decisions. Similarly, individuals can use this framework to evaluate job offers, college choices, or even everyday purchases. Mastering how to find expected utility enables individuals and organizations to make rational choices that maximize their overall well-being, given their unique circumstances and preferences. The process of finding expected utility clarifies the decision-making process by quantifying both the potential benefits and risks associated with each possible outcome.

Dealing with Uncertainty and Risk Aversion

In the real world, precisely determining probabilities for various outcomes is often impossible. Instead, one works with estimates. This inherent uncertainty significantly impacts decision-making when calculating how to find expected utility. The accuracy of the probability assessments directly affects the final expected utility calculation. Using overly optimistic or pessimistic probabilities will skew the results, leading to potentially suboptimal choices. Therefore, refining probability estimates through various methods, like sensitivity analysis or Bayesian updating, is crucial for a robust decision-making process. How to find expected utility under uncertainty requires careful consideration of these limitations.

Risk aversion plays a substantial role in how individuals react to uncertainty when learning how to find expected utility. Risk-averse individuals prioritize certainty and will often forgo higher expected utility options if they involve greater risk. Conversely, risk-seeking individuals are more comfortable with uncertainty and may accept higher-risk options with potentially higher payoffs. Risk-neutral individuals base their decisions solely on the expected utility, without considering the level of risk involved. To accurately reflect these preferences, utility functions should be tailored to an individual’s risk profile. A risk-averse individual might assign a lower utility value to a high-risk, high-reward outcome than a risk-seeking individual would, even if the expected monetary value is the same. Understanding and incorporating risk preferences into the expected utility calculation is paramount for making informed decisions.

Different approaches exist for dealing with uncertainty in how to find expected utility. One method involves using ranges of probabilities rather than single point estimates for each outcome. This approach helps visualize the impact of uncertainty on the expected utility calculation, highlighting the potential range of outcomes. Another technique is to incorporate the cost of acquiring more information. For example, before making an investment decision, it might be beneficial to commission an independent assessment, thus reducing uncertainty and potentially improving the final how to find expected utility calculation. The value of this additional information can be assessed using the concept of the expected value of perfect information. This helps to determine if the cost of acquiring more information is justified by the potential increase in expected utility.

Beyond Simple Calculations: Advanced Techniques for Determining How to Find Expected Utility

While the basic expected utility calculation provides a strong foundation for decision-making, more sophisticated techniques exist for handling complex scenarios. Decision trees, for instance, visually represent multiple stages of decision-making under uncertainty. These trees help to break down complex problems into smaller, more manageable parts. Each branch represents a possible outcome, allowing for the calculation of expected utility at each stage. This iterative process clarifies the optimal path to maximize overall expected utility. Understanding how to find expected utility using decision trees is invaluable for strategic planning.

Another advanced concept is the expected value of perfect information (EVPI). This technique quantifies the potential benefit of obtaining additional information before making a decision. By estimating the expected utility with and without perfect information, one can determine how much it is worth to invest in acquiring better data or insights. This is particularly useful in situations where the cost of acquiring information is substantial, allowing for a cost-benefit analysis of data acquisition. Learning how to find expected utility using EVPI enables more informed resource allocation.

For those seeking a deeper understanding of these advanced techniques and their applications, numerous resources are available. Exploring these methods allows for a more nuanced and comprehensive approach to decision-making, enabling one to more accurately predict and manage risks. Mastering these techniques provides a significant advantage in navigating complex scenarios where the basic calculation of how to find expected utility might be insufficient. Further exploration into these advanced methods will reveal more tools to refine decision making.

Applying Expected Utility in Real-Life Scenarios

Understanding how to find expected utility unlocks powerful decision-making tools across various life aspects. Consider an investment decision: Should you invest in a high-risk, high-reward startup or a safer, lower-return bond? By assigning probabilities to potential outcomes (startup success/failure, bond yield) and assigning utility values reflecting your risk tolerance and financial goals, you can calculate the expected utility of each option. The option with the higher expected utility, even if it seems less profitable on the surface, becomes the rational choice given your personal preferences. This process helps clarify financial choices. How to find expected utility in this context is key to informed investment decisions.

Career choices also benefit from this framework. Imagine choosing between a high-paying but stressful job and a lower-paying but more fulfilling role. Assessing probabilities of success and job satisfaction in each scenario and assigning utilities based on your priorities (income versus work-life balance) allows for a quantitative comparison. The higher expected utility identifies the path best aligning with your personal values. Learning how to find expected utility simplifies navigating the complexities of career planning, enabling more informed choices and less regret. The method offers a structured approach to compare options objectively.

Even seemingly trivial daily choices benefit from this approach. Suppose you’re deciding between buying a lottery ticket or saving the money. The low probability of winning the lottery (low probability) versus the certainty of saving (high probability), combined with the utility you assign to potential winnings versus the utility of saving, informs your choice. How to find expected utility in this scenario is straightforward: It involves weighing the small chance of a huge gain against the sure benefit of accumulating savings. By calculating expected utility, everyday decisions become more rational and aligned with individual preferences, highlighting the universal applicability of this concept.

:max_bytes(150000):strip_icc()/expectedutility.asp-final-4ed3e56bbda54625894e1f2c666bba1a.png)