Understanding the Concept of Covariance

Covariance is a statistical measure that reveals how two variables change together. In simpler terms, it indicates whether an increase in one variable tends to correspond with an increase or decrease in another. It’s a key tool in data analysis for understanding relationships between datasets. A positive covariance suggests that the two variables move in the same direction: as one increases, the other tends to increase as well, and vice versa. Conversely, a negative covariance indicates an inverse relationship, where an increase in one variable is typically associated with a decrease in the other. Understanding covariance is essential for various fields, from finance to marketing, allowing you to see how different factors might affect one another. For instance, analyzing stock prices and a market index often utilizes covariance to see how much a specific stock tends to move in tandem with the broader market. Similarly, when examining marketing campaigns, you might look at the covariance between advertising spend and sales to understand if increased advertising correlates with increased revenue. This exploration helps to make informed business decisions based on trends identified through covariance, which will be useful when learning how to find covariance in excel.

While covariance tells you the direction of a relationship (positive or negative), it doesn’t reveal the strength of the relationship in a simple, easily understood way. The value of covariance is affected by the scale of the variables, making it difficult to interpret on its own. That is why it is essential to know how to find covariance in excel to move forward with the data analysis. For example, a covariance of 1000 might seem large, but it’s meaningless without understanding the context of the data. Consider another real-world example, the relationship between study hours and exam scores. A positive covariance would suggest that as study hours increase, so do exam scores. However, the actual value of the covariance only represents the direction of the relationship and is not directly comparable to, say, the covariance between marketing expenses and sales. Hence, it is used in conjunction with other statistical measures to derive more insightful conclusions about the strength and nature of the associations between variables. Understanding these details and how to find covariance in excel will allow you to analyze data efficiently.

How to Prepare Your Data for Covariance Calculation in Excel

Before diving into the calculation of covariance, proper data preparation is crucial for accurate results. To effectively use Excel for this task, you’ll need to arrange your data into two distinct columns, each representing a variable you wish to analyze. These columns should contain numerical data only, as the covariance calculation requires quantitative inputs. When setting up your spreadsheet, ensure both columns have the same number of data points. This means if one column has 50 entries, the other should also have 50, with each row representing a corresponding pair of data points. This correspondence is essential, as covariance measures how these pairs of data points vary together. For instance, if you are analyzing the relationship between study hours and exam scores, each row would represent one student’s study hours and their corresponding exam score. The importance of this step in determining how to find covariance in excel cannot be overstated, as inconsistent data sets will lead to inaccurate results.

Data cleaning is another vital aspect of preparing your spreadsheet. Before calculating the covariance, examine your columns for any missing values or errors. Blank cells, text entries, or other non-numerical data can interfere with the calculation and cause Excel to return an error. It’s important to remove or correct these inconsistencies. If data is missing, consider whether it can be imputed reasonably or if those rows should be excluded from the calculation. For example, you might decide to average adjacent entries or exclude the data point entirely if it cannot be reasonably replaced. Furthermore, ensure that the numerical data is consistently formatted. Using a number format with a consistent number of decimals will enhance the readability and the accuracy of any further analysis. This attention to detail when preparing data is paramount for anyone seeking to understand how to find covariance in excel efficiently and reliably. This thorough preparation will ensure the subsequent calculation is accurate and meaningful for analyzing relationships between variables.

Utilizing the COVARIANCE.P Function in Excel

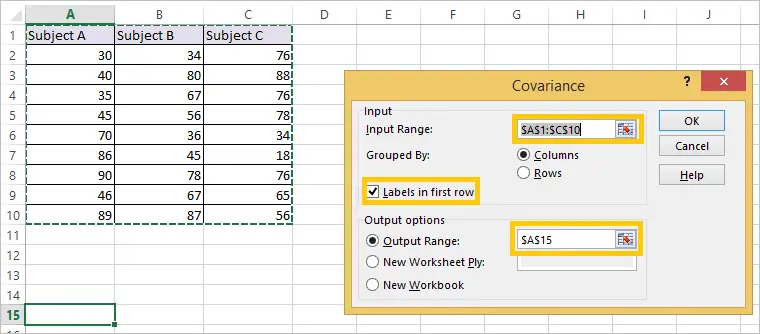

The COVARIANCE.P function in Excel is a powerful tool that calculates population covariance, an essential statistical measure for understanding how two variables change together. This function is particularly useful when you have access to data representing an entire population, rather than just a sample. To effectively use the COVARIANCE.P function and understand how to find covariance in excel, follow these steps: First, ensure your data is organized into two distinct columns in your Excel worksheet. These columns should contain the numerical values for the two variables you are analyzing. For instance, one column might list advertising expenses, while the other lists corresponding sales figures. To apply the COVARIANCE.P function, select a blank cell where you want the result to appear. Enter the formula =COVARIANCE.P( into the formula bar or directly into the cell. Next, you’ll need to specify the array parameters. These are the two data sets you will use to calculate covariance. Select the entire column of data for your first variable, followed by a comma, then select the entire column of data for your second variable. The formula will look something like =COVARIANCE.P(A1:A10,B1:B10) if your data spans from cell A1 to A10 in one column and B1 to B10 in the other. Close the parenthesis and press ‘Enter’. Excel will automatically calculate and display the population covariance. Below, you will see a screenshot of the function in use.

It’s crucial to understand that COVARIANCE.P assumes that the data provided is the complete set of observations for the population you are analyzing. This distinction is important because using this function on a sample might not accurately represent the population covariance. Knowing how to find covariance in excel using the population method is a fundamental skill in statistical analysis. This function allows for an accurate assessment of how changes in one variable relate to changes in another when all data points are known. The resulting value, while not intuitive on its own, indicates the direction of the relationship. A positive value suggests that the variables tend to move in the same direction, whereas a negative value suggests they move in opposite directions. The magnitude of the value, however, is difficult to interpret without further analysis or context. When learning how to find covariance in excel, always be sure to choose the proper function, either COVARIANCE.P or COVARIANCE.S.

Employing the COVARIANCE.S Function in Excel

The COVARIANCE.S function is another vital tool in Excel for calculating covariance, specifically when dealing with a sample from a larger population. Unlike COVARIANCE.P, which calculates population covariance, COVARIANCE.S estimates the covariance of the population based on the sample data provided. Understanding when to use each function is crucial for accurate statistical analysis. The choice between COVARIANCE.P and COVARIANCE.S depends on whether your data represents the entire population or a sample. When you have a subset of data intended to represent a larger group, utilizing the COVARIANCE.S function is appropriate and necessary for correctly estimating the population’s covariance. It’s fundamental to grasp that the result from this function provides an estimate, not the exact population covariance. Now let’s delve into how to find covariance in excel using COVARIANCE.S.

To use the COVARIANCE.S function, follow these simple steps within your Excel spreadsheet. Begin by selecting the cell where you want the covariance result to appear. Type `=COVARIANCE.S(` into the cell. Next, you’ll need to input the two arrays, which are the columns of data you’re comparing. For array1, click and drag to select the first data column. Then, type a comma to move to the next array input. Click and drag to select the second data column for array2. Close the function with a closing parenthesis `)`. Press ‘Enter,’ and the cell will display the sample covariance of the two sets of data. For instance, if your data is in columns A and B, you might enter something like `=COVARIANCE.S(A1:A10,B1:B10)`. It’s also important to ensure that both array ranges are of the same length to avoid errors. The following image shows an example with two datasets in columns A and B. The formula calculates how to find covariance in excel using =COVARIANCE.S(A1:A7,B1:B7). The cell with the formula returns the value -1.73.

The main difference between COVARIANCE.P and COVARIANCE.S is the divisor used in the calculation. While COVARIANCE.P divides by the number of data points (N), COVARIANCE.S divides by (N-1). This slight adjustment makes COVARIANCE.S an unbiased estimator of population covariance when working with samples. Therefore, selecting the correct function is paramount to obtaining the right results. Knowing how to find covariance in excel with COVARIANCE.S is essential for researchers and data analysts who often work with samples rather than entire populations, and it allows for more accurate generalization about the relationship between variables.

Interpreting the Covariance Result

The covariance result, once calculated, provides insight into the relationship between two variables. A positive covariance indicates that as one variable increases, the other tends to increase as well, and vice-versa. Conversely, a negative covariance suggests an inverse relationship; as one variable rises, the other tends to fall. To understand how to find covariance in excel, it’s important to remember that a positive result suggests variables move in the same direction, whereas a negative value indicates an opposing trend. If the covariance is near zero, it implies a weak or virtually no linear relationship between the variables. For example, if analyzing advertising spend and sales, a positive covariance would imply that increased advertising spending tends to correspond with higher sales figures. Conversely, when evaluating the relationship between interest rates and bond prices, a negative covariance is expected, because when interest rates go up bond prices tend to decline. A covariance of or near zero between the amount of rain on one day and the daily stock price indicates no linear relationship between these two variables.

While covariance reveals the direction of the relationship, it’s crucial to understand its limitations. The covariance value itself is not standardized, meaning its magnitude is difficult to interpret without context. A high covariance value does not necessarily mean a strong relationship; it could simply be a result of the scale of the variables. Therefore, covariance alone cannot tell us how strong the relationship between variables is; it only gives the direction of their movement. This is why, when exploring how to find covariance in excel, it’s essential to consider additional metrics, such as correlation, that provides a standardized measure of association. Covariance is highly sensitive to the scale of the data, which can make comparisons across different datasets difficult. It’s a very helpful, but is limited as a standalone measure. When analyzing data, be aware that the direction of change is shown by the sign, but the scale of change is not provided by covariance.

To further clarify, the interpretation of covariance is nuanced. A covariance of 10 between one pair of variables and 100 between another pair does not automatically mean the second relationship is stronger, which is why standardizing the results through correlation can be useful. For example, when looking at data in excel, understanding how to find covariance is the first step, and it is critical to consider the units being analyzed. When analyzing very big numbers, a covariance of 1000 can still mean a very weak relationship, while a covariance of 10 for very small numbers, can be a strong one. Also, the units of the covariance will be the product of the units of the two variables, which is why interpretation is hard without standardization. Therefore, interpreting covariance requires context and should often be complemented by other measures.

Covariance vs. Correlation: Understanding the Difference

While understanding how to find covariance in excel is a crucial step in data analysis, it’s equally important to differentiate it from correlation. Covariance, as previously discussed, measures the degree to which two variables change together. However, it’s expressed in the units of the variables, which can make it difficult to interpret. A high covariance value in one set of data might not mean the same as a high value in another set due to differing scales. This is where correlation comes in, offering a standardized measure of the linear relationship between two variables. Correlation, unlike covariance, produces a value that ranges from -1 to +1. A correlation of +1 indicates a perfect positive linear relationship, -1 a perfect negative linear relationship, and 0 suggests no linear relationship. The standardization provided by correlation allows for easier comparison across different datasets and provides insight into the strength of the relationship.

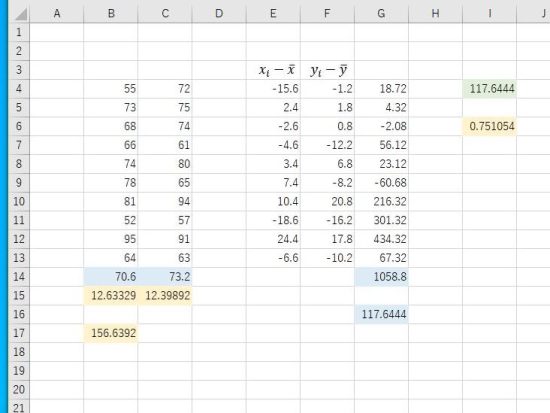

The key distinction lies in how each measure is calculated. Covariance is calculated by determining the extent to which each variable deviates from its mean, multiplying these deviations for each data point, and then averaging those results. This provides a sense of how the variables move relative to each other but is hard to use as an absolute measure of strength. Correlation on the other hand, normalizes the covariance by dividing it by the product of the standard deviations of the two variables. This normalization is what produces the -1 to +1 range that makes it easier to compare the strength of a relationship. For anyone learning how to find covariance in excel, it’s essential to understand that covariance is a precursor to correlation. While covariance shows the direction of a relationship (positive or negative), correlation provides a clear, standardized assessment of the strength and direction. This standardization is key to making data analysis more accessible. In practical terms, while covariance can inform that two variables tend to move together, correlation quantifies just how closely this movement occurs, which is invaluable for drawing data driven insights.

In short, both covariance and correlation are valuable tools in data analysis, especially when used in conjunction. Covariance serves as a foundation, demonstrating if variables tend to increase or decrease together, but can be hard to interpret in terms of strength of relationship. Correlation builds upon covariance by providing a normalized, easy-to-understand measure of relationship strength, making it easier to compare relationships across varied datasets and allowing for more sophisticated analysis. The process on how to find covariance in excel, is therefore often a step that leads to a broader understanding of data through correlation analysis, and both are key for statistical analysis and informed decision-making.

Step-by-Step Guide to Calculate Covariance in Excel

To effectively understand how to find covariance in excel, follow these steps, combining the preparation and function usage detailed previously. First, ensure your data is organized correctly. Prepare your Excel sheet with two columns of numerical data representing the two variables you want to analyze. Ensure that each column contains the same number of data points, with no missing values or errors. Data cleaning is crucial for accurate results, so verify that your data is clean of any non-numerical entries, empty cells, or inconsistencies. For calculating covariance, it is important to have your data prepared accurately. Next, determine whether you’re working with population data or a sample. If you have the entire population dataset, you will use the COVARIANCE.P function, and if you have sample data, use COVARIANCE.S. To use the COVARIANCE.P function, select an empty cell where you want the result to appear. Type “=COVARIANCE.P(” and then select your first data column as ‘array1’ by clicking and dragging the mouse over the values in the first column. Add a comma “,” and then select the second data column as ‘array2’ in the same manner, close the parenthesis “)”, and press enter. This calculates the population covariance for your data. If you have sample data, you will instead use the COVARIANCE.S function. The process for the COVARIANCE.S function is the same as described above: in an empty cell, type “=COVARIANCE.S(”, select the first data column, add a comma, select the second data column, close the parenthesis, and press enter. By following these steps you will calculate the covariance of your data in excel.

After calculating covariance using either function, you need to understand what the result means. A positive covariance result indicates that the two variables tend to move in the same direction; as one increases, the other tends to increase as well. Conversely, a negative covariance indicates that the variables tend to move in opposite directions; as one variable increases, the other tends to decrease. A near-zero covariance suggests that there is little linear relationship between the two variables. Remember that covariance by itself does not tell you about the strength of the relationship, but only the direction. It’s crucial to also understand that, unlike correlation, covariance values are not standardized, making them hard to interpret in isolation or to compare across different datasets. Therefore, to better understand the strength of the relationship, covariance is often used in conjunction with other analysis such as correlation. Understanding how to find covariance in excel and interpret its result is a fundamental step in statistical analysis.

Understanding the differences between population and sample covariance is key. The choice between COVARIANCE.P and COVARIANCE.S depends on the nature of your data, COVARIANCE.P calculates population covariance, whereas COVARIANCE.S calculates the sample covariance, which is an unbiased estimate of the population covariance based on a sample. It is crucial to pick the right function to avoid errors. Once you have calculated the covariance, the result needs to be seen in the context of your data, to understand and extract the correct conclusions. To further enhance your analysis, remember that covariance is just one tool and should be used with other statistics tools. The ability to effectively calculate and interpret covariance is extremely helpful in various fields such as data analysis, finance and data mining. With this guide, you should now be able to understand and calculate how to find covariance in excel.

Practical Applications of Covariance with Example

Covariance is a versatile statistical tool with numerous real-world applications, particularly within financial analysis, statistical research, and data mining. In finance, understanding how to find covariance in excel is crucial for portfolio management. For instance, consider an investor analyzing two stocks: Stock A and Stock B. By calculating the covariance of their daily returns, one can ascertain how they tend to move relative to each other. A positive covariance suggests that Stock A and Stock B typically rise and fall together, indicating that they might both be sensitive to the same market factors. A negative covariance, on the other hand, would imply that when one stock increases, the other tends to decrease, which can be beneficial for diversification purposes as it may reduce overall portfolio risk. How to find covariance in excel here involves using the COVARIANCE.P or COVARIANCE.S function with the daily return data of these stocks, depending on whether we consider our data a full population or sample.

Within statistical analysis and research, covariance helps identify relationships between variables that would otherwise remain hidden. For example, an analyst might be studying the link between advertising spending and sales revenue. To achieve this, the analyst uses Excel and the functions COVARIANCE.P or COVARIANCE.S, depending if the advertising and sales data constitutes the full population or just a sample. A positive covariance would imply that as advertising spending increases, sales revenue also tends to increase, showing the effectiveness of the marketing efforts. In data mining, covariance can be utilized to uncover trends between different variables in a dataset. For instance, examining the covariance between customer demographics (like age or income) and purchase history. To demonstrate this practically, imagine an Excel spreadsheet. In column A we have “Advertising Spend (in USD)” with the following values: 1000, 1500, 1200, 1800, 2000 and in column B we have “Sales Revenue (in USD)” with the following values: 5000, 7000, 6000, 8000, 9000. Now we apply the `COVARIANCE.P` function using the formula `=COVARIANCE.P(A1:A5,B1:B5)` which will show the covariance between those variables. This example shows exactly how to find covariance in excel and how it uncovers hidden connections in real world examples, enabling companies to make informed decisions.

Furthermore, how to find covariance in excel can complement other statistical functions in Excel to perform comprehensive data analysis. The covariance value itself may not be enough, and thus, calculating correlation and standard deviation in Excel, alongside covariance can give more insights into the relationship between two variables, such as its strength and how the two variables are dispersed around their mean. By using other Excel functions such as `CORREL`, which calculates the correlation coefficient between two data sets, or `STDEV.P` which calculates the population standard deviation, one can get a full picture of how two variables relate. Continuing with our Advertising and Sales example, this data can be used to compute the correlation between advertising spending and sales to better determine the strength of their relationship. This approach demonstrates how covariance should not be seen as an isolated measure, but as a building block for more complex data analysis in Excel.