Understanding Stock Market Volatility: A Crucial Concept for Investors

Stock market volatility refers to how much a stock’s price fluctuates over time. A volatile stock experiences significant price swings, rising and falling sharply within short periods. Conversely, a non-volatile stock shows relatively stable price movements. Understanding how to determine volatility of a stock is essential for investors because it directly impacts risk. High volatility means higher potential returns, but also higher potential losses. For example, Tesla, known for its dramatic price changes, is a highly volatile stock. In contrast, Johnson & Johnson, a large, established company, typically exhibits lower volatility. This difference highlights the importance of assessing a stock’s volatility before investing. How to determine volatility of a stock is a key question for all investors. The relationship between risk and volatility is directly proportional: higher volatility equals higher risk, and vice-versa. Learning how to determine volatility of a stock will significantly improve investment decision making.

Investors need to learn how to determine volatility of a stock to make informed decisions. Volatility isn’t inherently good or bad; it depends on an investor’s risk tolerance and investment goals. A risk-averse investor might prefer less volatile stocks, prioritizing capital preservation. Conversely, a risk-tolerant investor might seek out more volatile stocks, aiming for higher potential returns. How to determine volatility of a stock is a fundamental skill for both types of investors. Successfully navigating the market requires understanding the various levels of risk associated with different stocks, and knowing how to determine volatility of a stock is paramount in this process. Different investment strategies, like hedging or day trading, will also necessitate a different approach to how to determine volatility of a stock.

Analyzing a stock’s historical price data provides valuable insights into its volatility. The price history reveals patterns and trends, helping investors assess the stock’s typical price fluctuations. This historical analysis is crucial for understanding how to determine volatility of a stock and for making predictions about future price behavior. However, it is essential to remember that past performance does not guarantee future results. How to determine volatility of a stock accurately often involves combining historical analysis with other metrics. Understanding this complexity is crucial for any successful investor. Therefore, learning how to determine volatility of a stock is a critical component of a successful investment strategy.

Analyzing Historical Stock Price Data: A Key Step in Determining Stock Volatility

Understanding how to determine volatility of a stock requires analyzing its historical price movements. This provides crucial insights into its past behavior and helps predict potential future fluctuations. Examining historical data allows investors to quantify the magnitude of these price swings. One of the most common ways to assess volatility is by studying the standard deviation of its price returns over various timeframes, such as daily, weekly, or monthly intervals. This method reveals the dispersion of returns around the average return, with a higher standard deviation indicating greater volatility and a lower standard deviation signifying less volatility. Analyzing historical stock data offers a quantitative approach to understand how to determine volatility of a stock.

To calculate the standard deviation of price returns, one first needs to obtain historical stock price data. This data is readily available from various financial websites and data providers. The next step involves calculating the daily, weekly, or monthly returns. This is achieved by using the formula: Return = (Current Price – Previous Price) / Previous Price. These returns are then used to compute the average return, which serves as the central tendency for the dataset. Next, one calculates the variance, which measures the average squared deviation of returns from the mean. The square root of the variance provides the standard deviation, a direct measure of volatility. By examining the standard deviation of stock returns over different time periods, investors gain a comprehensive understanding of how to determine volatility of a stock.

Visualizing this data using charts and graphs is highly beneficial. A simple line chart displaying historical stock prices, for instance, can offer a visual representation of volatility. Periods with steeper inclines and declines visually signify higher volatility, whereas flatter periods indicate lower volatility. However, such charts offer a qualitative assessment; quantitative analysis using standard deviation provides a precise, numerical measure of how to determine volatility of a stock. Combining visual representations with numerical calculations allows for a more comprehensive understanding of past price behavior and potential future fluctuations, improving an investor’s ability to make informed decisions. The selection of appropriate time periods for analysis is also critical. Shorter time periods, such as daily data, reflect short-term volatility, whereas longer time periods (monthly or yearly) reveal long-term volatility patterns. A comprehensive analysis of how to determine volatility of a stock considers various time horizons to get a complete picture.

How to Calculate Standard Deviation of Stock Returns

To determine the volatility of a stock, calculating the standard deviation of its returns is crucial. This statistical measure quantifies the dispersion of a stock’s returns around its average return. A higher standard deviation signifies greater volatility, meaning the stock price fluctuates more significantly. Conversely, a lower standard deviation suggests lower volatility and price stability. This process helps investors assess risk and make informed decisions. To learn how to determine volatility of a stock, follow these steps.

First, gather historical stock price data. Let’s use a hypothetical example. Suppose a stock’s closing prices for five consecutive days were: $10, $12, $11, $13, and $14. Calculate the daily returns. The formula for daily return is: (Today’s Price – Yesterday’s Price) / Yesterday’s Price. The returns are: 0.20 (20%), -0.083 (-8.3%), 0.182 (18.2%), and 0.077 (7.7%). Next, compute the average return. Add all the daily returns and divide by the number of returns. In this case, the average return is approximately 0.095 or 9.5%.

Now, calculate the variance. Variance measures how spread out the returns are from the average. Subtract the average return from each daily return. Square each of these differences. Then add up these squared differences. Finally, divide this sum by the number of returns minus one (this is called the sample variance). In our example, the variance is approximately 0.008. The standard deviation is simply the square root of the variance. Therefore, the standard deviation of our hypothetical stock’s returns is approximately 0.09, or 9%. This indicates the typical deviation of daily returns from the average return. Understanding how to determine volatility of a stock empowers investors to gauge risk associated with their investments. A larger standard deviation suggests a riskier stock, while a smaller one indicates a less risky stock. Remember, this is a simplified example. For more accurate estimations, use a longer period of historical data, and consider using software for more complex calculations. This method of how to determine volatility of a stock provides a fundamental understanding of measuring stock price fluctuations.

Interpreting Volatility Measures: What the Numbers Mean

Understanding how to determine volatility of a stock involves interpreting the standard deviation of its returns. A higher standard deviation signifies greater volatility, meaning the stock’s price fluctuates more dramatically over time. Conversely, a lower standard deviation indicates less price fluctuation and therefore lower volatility. This crucial metric helps investors assess risk. A stock with high volatility presents a higher risk but also potentially higher returns. Conversely, a low-volatility stock offers greater stability but may yield lower returns. This is a key factor in investment strategy and risk management.

The practical implications of different volatility levels are significant for investment decisions. Investors with a high-risk tolerance might favor volatile stocks, seeking potentially larger gains. Conversely, those with a lower risk tolerance might opt for less volatile stocks, prioritizing capital preservation and stability. The standard deviation, therefore, is a valuable tool for gauging risk and aligning investments with individual risk profiles. By analyzing a stock’s volatility using this measure, investors can make more informed choices about whether or not to include that stock in their portfolio.

It’s important to note that standard deviation alone doesn’t provide a complete picture of a stock’s risk. Other factors, such as the overall market conditions and the stock’s correlation with other assets in a portfolio, also influence the overall risk. However, understanding how to determine volatility of a stock using the standard deviation of its returns is an essential first step in effective risk management and portfolio construction. Remember that volatility is not inherently good or bad; it’s simply a measure of price fluctuation, and its significance depends entirely on an investor’s individual financial goals and risk appetite. Understanding this helps tailor investment strategies to achieve optimal results.

Beyond Standard Deviation: Other Volatility Indicators

While standard deviation provides a fundamental measure of how to determine volatility of a stock, other indicators offer additional insights. Beta, for instance, gauges a stock’s price fluctuations relative to the overall market. A beta above 1 suggests higher volatility than the market average; below 1, lower volatility. Understanding beta is crucial for portfolio diversification, helping investors balance risk and return. How to determine volatility of a stock using beta involves comparing its historical returns against a market benchmark index like the S&P 500.

The Average True Range (ATR) focuses on price range fluctuations. It measures the average true range over a specified period, providing insights into the typical daily price movement. Unlike standard deviation which uses closing prices, ATR considers the high-low range, giving a more comprehensive view of volatility. Investors use ATR to set stop-loss orders or gauge potential price swings. Learning how to determine volatility of a stock with ATR improves trading strategies, especially for short-term traders concerned with intraday price changes. A higher ATR suggests greater price volatility.

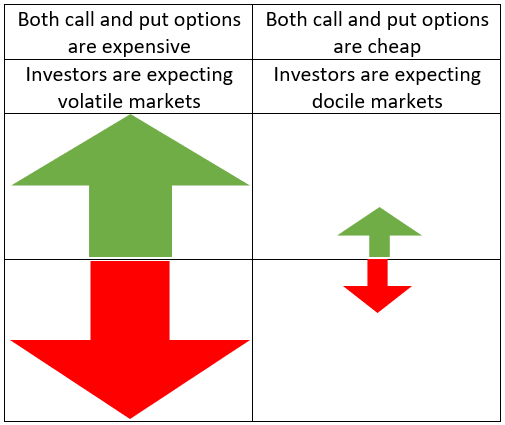

Implied volatility, derived from options prices, reflects market participants’ expectations of future price fluctuations. It’s not a direct measure of past volatility like standard deviation or ATR, but rather a forward-looking prediction. Options traders use implied volatility to price options contracts, while stock investors can use it as an indicator of market sentiment and potential future price swings. Higher implied volatility suggests greater uncertainty and expected volatility. This offers another dimension to understanding how to determine volatility of a stock, providing insight into future price movements. It’s important to note that implied volatility can differ from realized volatility (the actual volatility observed).

Using Beta to Compare Stock Volatility to the Market

Beta is a crucial metric for assessing a stock’s volatility relative to the overall market. It quantifies how much a stock’s price tends to move in relation to the market as a whole. A beta of 1 indicates that the stock’s price will move in line with the market. If the market rises by 10%, a stock with a beta of 1 is also expected to rise by approximately 10%. Conversely, a market decline of 10% would likely lead to a 10% drop in the stock’s price. Understanding how to determine volatility of a stock using beta is essential for investors.

A beta greater than 1 suggests that the stock is more volatile than the market. For instance, a stock with a beta of 1.5 is expected to move 1.5 times more than the market. So, a 10% market increase could translate to a 15% increase in the stock’s price, while a 10% market decrease could result in a 15% decline. Conversely, a beta less than 1 signifies that the stock is less volatile than the market. A stock with a beta of 0.5, for example, will typically move half as much as the market. How to determine volatility of a stock accurately requires considering multiple factors, including beta.

Beta’s significance lies in its implications for portfolio diversification. Investors seeking to reduce overall portfolio risk often incorporate stocks with different betas. Combining high-beta stocks (more volatile) with low-beta stocks (less volatile) can help to balance risk and return. Understanding how to determine volatility of a stock using beta is crucial for building a well-diversified portfolio and managing risk effectively. Analyzing a stock’s beta alongside other volatility measures provides a comprehensive view, facilitating better investment decisions. Remember that beta is a historical measure and may not perfectly predict future volatility.

Factors Influencing Stock Volatility

Numerous factors influence a stock’s price fluctuations, making understanding how to determine volatility of a stock crucial for investors. Economic news, such as changes in interest rates or inflation reports, significantly impacts market sentiment and, consequently, stock prices. Positive economic indicators often lead to increased investor confidence and higher valuations, while negative news can trigger sell-offs and increased volatility. Industry trends also play a vital role. Technological advancements, shifts in consumer preferences, and regulatory changes can all dramatically affect the performance of companies within specific sectors. For example, the rise of e-commerce significantly impacted the volatility of brick-and-mortar retailers’ stocks.

Company-specific announcements are another major driver of volatility. Earnings reports, which reveal a company’s financial performance, often cause significant price swings. Positive surprises usually result in price increases, while disappointing results can lead to sharp declines. Mergers, acquisitions, and other corporate actions also introduce uncertainty and can increase volatility. A proposed merger, for instance, might create excitement and price increases initially, but any complications or regulatory hurdles could lead to significant price drops. Geopolitical events are another major source of market uncertainty and volatility. International conflicts, political instability, and changes in trade policies can all significantly impact investor sentiment and stock prices worldwide. How to determine volatility of a stock becomes even more challenging during periods of global uncertainty, requiring careful analysis and diversified investment strategies.

Understanding these factors is essential for investors seeking to manage risk and make informed decisions. By analyzing economic indicators, industry trends, company news, and geopolitical events, investors can better anticipate potential price fluctuations and adjust their portfolios accordingly. Recognizing these influences is a key aspect of learning how to determine volatility of a stock and a crucial element of effective investment planning. Investors should always remain informed and adapt their strategies based on the evolving market landscape. The ability to anticipate and react to these factors contributes significantly to successful investing.

Putting It All Together: Making Informed Investment Decisions

Understanding how to determine volatility of a stock is crucial for successful investing. This guide has explored several methods, from calculating standard deviation of historical returns to utilizing indicators like Beta and the Average True Range (ATR). Remember, no single metric provides a complete picture. Investors should employ a multifaceted approach, combining historical data analysis with an understanding of current market conditions and company-specific factors. Successfully gauging a stock’s volatility requires a holistic view, integrating quantitative analysis with qualitative insights. How to determine volatility of a stock effectively involves considering various factors, from past performance to future prospects.

The relationship between volatility, risk, and investment strategy is paramount. Higher volatility generally implies higher risk. Conservative investors with lower risk tolerance might prefer less volatile stocks, while those with a higher risk tolerance may be comfortable with more volatile investments, potentially seeking higher returns. Diversification is a key strategy for managing portfolio volatility. By spreading investments across different asset classes and sectors, investors can reduce the overall impact of individual stock fluctuations. How to determine volatility of a stock, therefore, is inherently linked to an investor’s overall investment goals and risk profile. A well-informed investor makes decisions based on a comprehensive understanding of risk and potential reward.

This exploration of how to determine volatility of a stock provides a foundation for further learning. Continuous research and staying updated on market trends are essential for effective investment management. By mastering these techniques, investors can improve their ability to analyze stock performance, predict potential risks, and construct portfolios aligned with their financial objectives. Remember that investing involves inherent risks, and no method guarantees perfect prediction of future stock price movements. However, a thorough understanding of volatility and its various measures empowers investors to make more informed decisions and navigate the market with greater confidence.