Understanding the Concept of Risk-Free Rate

In the world of finance, the risk-free rate is a fundamental concept that serves as a benchmark for investment decisions. It represents the rate of return an investor can expect from a completely risk-free investment, providing a basis for evaluating the performance of other investments. To effectively navigate the complex landscape of investments, it is essential to know how to determine the risk-free rate and its significance in finance. The risk-free rate is crucial in modern portfolio theory, as it helps investors determine the expected returns of their investments and make informed decisions about asset allocation. By grasping this concept, investors can better assess the potential risks and rewards of their investments, ultimately leading to more informed and strategic decision-making.

The Role of Government Bonds in Determining the Risk-Free Rate

Government bonds, particularly U.S. Treasury bonds, play a crucial role in estimating the risk-free rate. These bonds are considered to be virtually risk-free, as they are backed by the credit and taxing power of the U.S. government. As a result, they offer a reliable proxy for the risk-free rate. The characteristics that make government bonds an attractive proxy include their liquidity, low default risk, and lack of credit risk. Additionally, government bonds have a wide range of maturities, allowing investors to estimate the risk-free rate for different time horizons. By understanding how to determine the risk-free rate using government bonds, investors can gain valuable insights into the expected returns of their investments and make more informed decisions. In fact, learning how to determine the risk-free rate is essential for investors seeking to optimize their portfolios and minimize risk.

How to Calculate the Risk-Free Rate Using Yield Curves

Yield curves are a powerful tool for determining the risk-free rate, providing a graphical representation of the relationship between bond yields and maturities. To calculate the risk-free rate using yield curves, follow these steps: first, obtain a yield curve for a specific bond market, such as the U.S. Treasury bond market. Next, identify the shortest-term bond on the curve, typically a 3-month or 1-year bond, as this will serve as a proxy for the risk-free rate. Then, read the yield from the curve at the selected maturity, which represents the risk-free rate for that time horizon. For example, if the 1-year Treasury bond yield is 2.5%, this would be the risk-free rate for a 1-year investment horizon. By understanding how to determine the risk-free rate using yield curves, investors can gain a deeper understanding of the bond market and make more informed investment decisions. In fact, learning how to determine the risk-free rate is essential for investors seeking to optimize their portfolios and minimize risk. There are different types of yield curves, including the spot rate curve, forward rate curve, and par yield curve, each with its own applications and uses. By mastering the art of calculating the risk-free rate using yield curves, investors can unlock the secrets of risk-free investing and achieve their long-term financial goals.

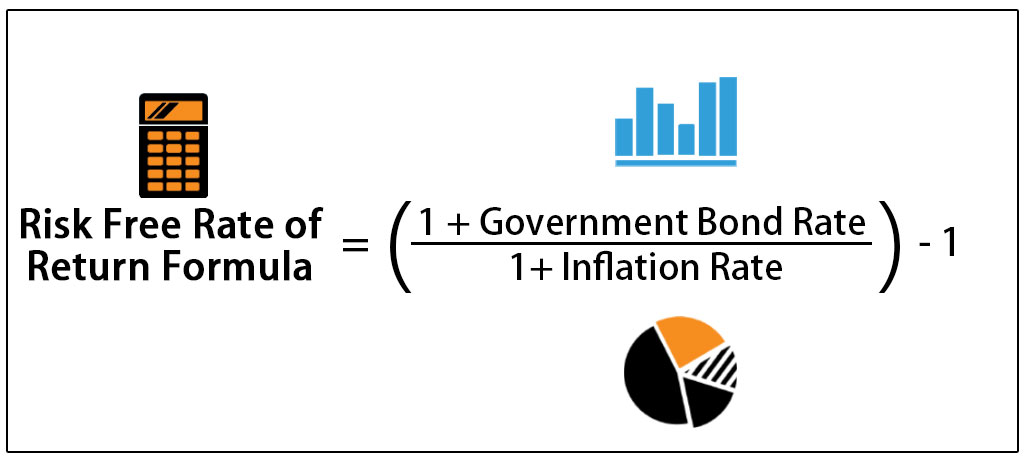

The Impact of Inflation on the Risk-Free Rate

Inflation plays a significant role in shaping the risk-free rate, as it affects the returns investors expect from their investments. When inflation expectations rise, bond yields also increase, as investors demand higher returns to compensate for the erosion of purchasing power. This, in turn, affects the risk-free rate, as it is typically estimated from the yields of government bonds. To adjust the risk-free rate for inflation, investors can use inflation-indexed bonds, such as Treasury Inflation-Protected Securities (TIPS), which provide a direct measure of the real risk-free rate. Alternatively, investors can use inflation expectations, such as those derived from inflation swaps or breakeven rates, to adjust the nominal risk-free rate for inflation. Understanding how to determine the risk-free rate in an inflationary environment is crucial, as it enables investors to make informed decisions about their investments and optimize their portfolios. By learning how to determine the risk-free rate and adjusting it for inflation, investors can better navigate the complexities of the bond market and achieve their long-term financial goals.

Alternative Approaches to Determining the Risk-Free Rate

Beyond government bonds, there are alternative methods for determining the risk-free rate, each with its own advantages and limitations. One approach is to use the London Interbank Offered Rate (LIBOR), which represents the rate at which banks lend to each other. LIBOR can be used as a proxy for the risk-free rate, especially for short-term investments. Another approach is to use commercial paper rates, which are the rates at which companies borrow money from the market. Commercial paper rates can provide a more accurate estimate of the risk-free rate for shorter maturities. Additionally, some investors use the rate on certificates of deposit (CDs) or the federal funds rate as alternative measures of the risk-free rate. When learning how to determine the risk-free rate, it’s essential to understand the strengths and weaknesses of each approach and choose the one that best suits the investment strategy. By exploring alternative methods, investors can gain a more comprehensive understanding of the risk-free rate and make more informed investment decisions. In fact, understanding how to determine the risk-free rate using alternative approaches can help investors optimize their portfolios and achieve their long-term financial goals.

Common Pitfalls to Avoid When Determining the Risk-Free Rate

When learning how to determine the risk-free rate, it’s essential to be aware of common mistakes that can lead to inaccurate estimates. One common pitfall is using historical data to estimate the risk-free rate, which can be misleading due to changes in market conditions and interest rates over time. Another mistake is ignoring credit risk, which can result in underestimating the risk-free rate. Additionally, failing to adjust for inflation or using an incorrect yield curve can also lead to errors. Furthermore, some investors may rely too heavily on a single method or data source, neglecting the importance of diversification and robustness in estimating the risk-free rate. By being aware of these common pitfalls, investors can avoid making costly mistakes and ensure a more accurate determination of the risk-free rate. This, in turn, can lead to better investment decisions and more effective portfolio management. In fact, understanding how to determine the risk-free rate while avoiding common pitfalls is crucial for achieving long-term financial goals and maximizing returns.

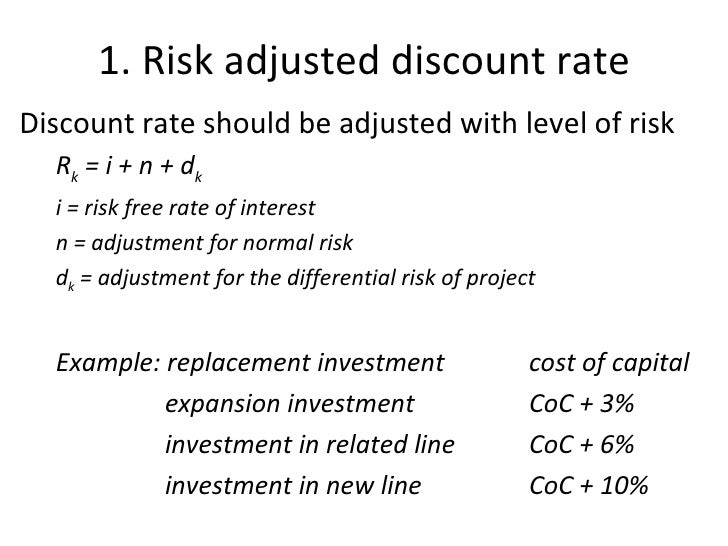

Practical Applications of the Risk-Free Rate in Portfolio Management

In portfolio management, the risk-free rate plays a crucial role in calculating expected returns, determining asset allocation, and evaluating investment performance. By understanding how to determine the risk-free rate, investors can make more informed decisions about their investments. For instance, the risk-free rate serves as a benchmark for evaluating the performance of a portfolio, allowing investors to assess whether their investments are generating sufficient returns. Additionally, the risk-free rate is used to calculate the expected returns of different asset classes, such as stocks and bonds, which helps investors determine the optimal asset allocation for their portfolio. Furthermore, the risk-free rate is a key input in capital asset pricing models (CAPM), which are used to estimate the expected returns of individual securities. By accurately determining the risk-free rate, investors can refine their investment strategies and make more effective decisions. In fact, mastering how to determine the risk-free rate is essential for achieving long-term financial goals and maximizing returns in portfolio management.

Conclusion: Mastering the Art of Determining the Risk-Free Rate

In conclusion, determining the risk-free rate is a crucial step in investment decisions, and understanding how to determine the risk-free rate is essential for achieving long-term financial goals. By grasping the concepts outlined in this guide, investors can avoid common pitfalls and make more informed decisions about their investments. Remember, accurately determining the risk-free rate is critical in portfolio management, as it serves as a benchmark for evaluating investment performance and calculating expected returns. By mastering the art of determining the risk-free rate, investors can refine their investment strategies, optimize their portfolios, and ultimately achieve greater returns. Whether you’re a seasoned investor or just starting out, understanding how to determine the risk-free rate is a vital skill that can help you navigate the complex world of finance with confidence.