Why Fair Value Matters in Investment Decisions

In the world of stock investing, determining the fair value of a stock is crucial for making informed investment decisions. Fair value represents the intrinsic worth of a stock, and it serves as a benchmark for investors to evaluate the stock’s market price. When investors fail to determine fair value, they risk overpaying or underpaying for a stock, which can have significant implications for their portfolio’s long-term performance. Overpaying for a stock can lead to losses if the stock price corrects to its fair value, while underpaying can result in missed opportunities for profit. By understanding how to determine fair value of a stock, investors can avoid these costly mistakes and make more informed investment decisions. In this article, we will delve into the various approaches for determining fair value, including the use of financial ratios, discounted cash flow analysis, and comparable company analysis.

Understanding the Basics of Stock Valuation

In the realm of stock investing, understanding the basics of stock valuation is essential for making informed investment decisions. At its core, stock valuation involves estimating the intrinsic value of a stock, which represents its true worth. This intrinsic value is often different from the stock’s market value, which is the price at which it is currently trading. The disparity between intrinsic value and market value creates opportunities for investors to buy undervalued stocks or sell overvalued ones. The concept of intrinsic value is rooted in the idea that a stock’s value is ultimately determined by its ability to generate cash flows. Market value, on the other hand, is influenced by a complex array of factors, including supply and demand, investor sentiment, and macroeconomic trends. By grasping the fundamental principles of stock valuation, investors can better navigate the complexities of the stock market and make more informed decisions about how to determine fair value of a stock.

How to Calculate Fair Value Using Financial Ratios

One of the most common approaches to determining fair value is through the use of financial ratios. These ratios provide a snapshot of a company’s financial performance and can be used to estimate its intrinsic value. Three of the most popular financial ratios used in fair value calculation are the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. The P/E ratio, for example, provides a measure of how much investors are willing to pay for each dollar of earnings. By comparing a company’s P/E ratio to that of its peers or the industry average, investors can determine if the stock is overvalued or undervalued. The P/B ratio, on the other hand, provides a measure of a company’s value relative to its book value. This ratio can be useful for investors looking to identify undervalued stocks with strong balance sheets. Finally, the dividend yield provides a measure of a company’s dividend payments relative to its stock price. By using these financial ratios, investors can estimate a stock’s fair value and make more informed investment decisions about how to determine fair value of a stock. However, it is essential to note that each ratio has its limitations and should be used in conjunction with other approaches to ensure a comprehensive understanding of a stock’s fair value.

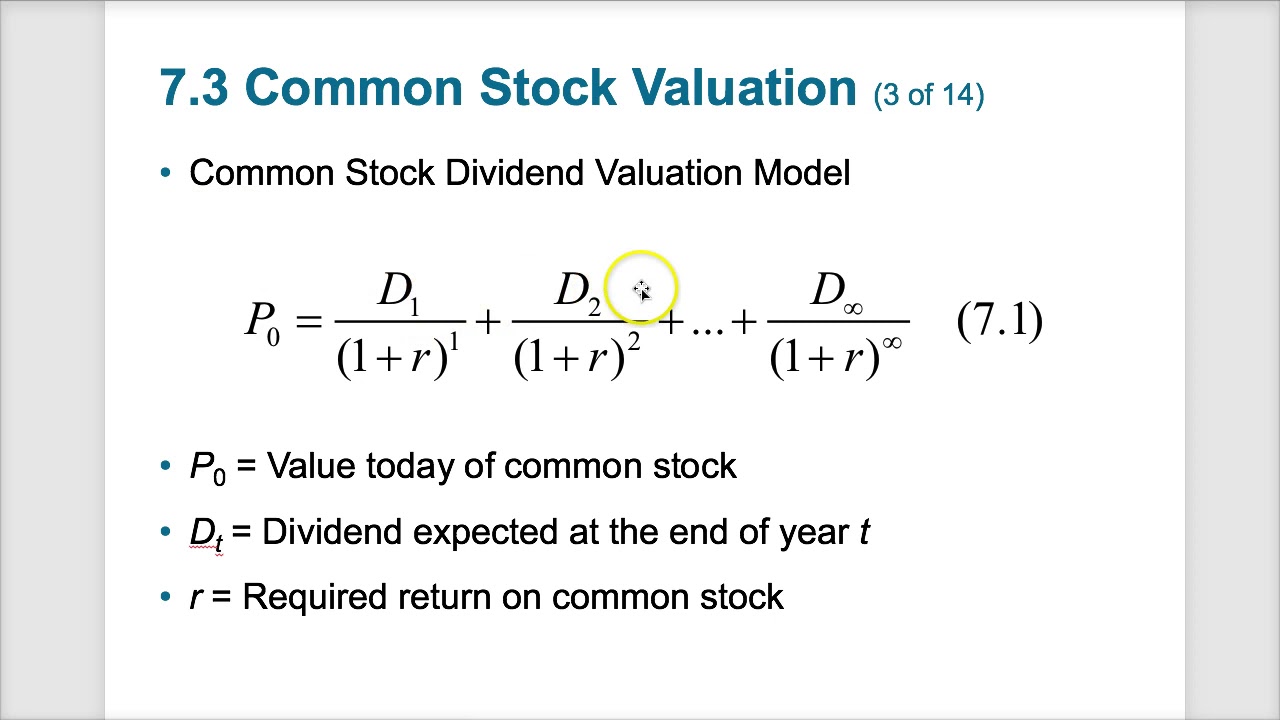

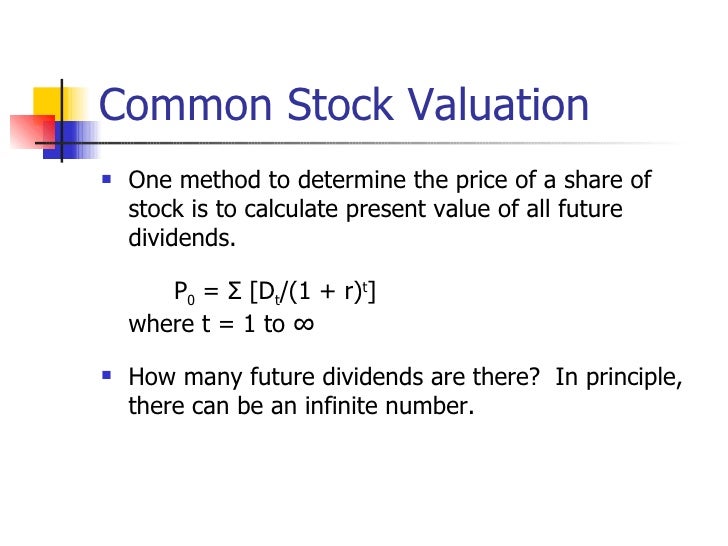

The Role of Discounted Cash Flow Analysis in Fair Value Calculation

Discounted cash flow (DCF) analysis is a powerful tool for estimating the fair value of a stock. This approach involves forecasting a company’s future cash flows and discounting them back to their present value using a discount rate. The resulting value represents the company’s intrinsic value, which can be compared to its market value to determine if the stock is overvalued or undervalued. The key to successful DCF analysis is accurately forecasting future cash flows, which requires a deep understanding of the company’s business model, industry trends, and competitive landscape. Additionally, selecting an appropriate discount rate is crucial, as it reflects the risk associated with the investment. By using DCF analysis, investors can gain a more comprehensive understanding of a company’s value and make more informed decisions about how to determine fair value of a stock. For example, a company with a high growth rate may require a higher discount rate to reflect the increased risk, while a company with a stable cash flow stream may require a lower discount rate. By carefully considering these factors, investors can use DCF analysis to estimate a stock’s fair value and make more informed investment decisions.

Using Comparable Company Analysis to Determine Fair Value

Comparable company analysis is a widely used approach to estimate the fair value of a stock. This method involves identifying companies that are similar in terms of their business model, industry, size, and growth prospects, and using their valuation multiples to estimate the fair value of the target company. The key to successful comparable company analysis is selecting companies that are truly comparable, and adjusting for differences in their financial performance, growth prospects, and risk profiles. By analyzing the valuation multiples of these comparable companies, such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and enterprise value-to-EBITDA (EV/EBITDA) ratio, investors can estimate the fair value of the target company and determine if it is overvalued or undervalued. For example, if a company’s P/E ratio is significantly higher than that of its peers, it may indicate that the stock is overvalued and due for a correction. On the other hand, if the company’s P/E ratio is lower than that of its peers, it may indicate that the stock is undervalued and presents a buying opportunity. By using comparable company analysis, investors can gain a better understanding of how to determine fair value of a stock and make more informed investment decisions.

How to Adjust for Industry and Market Factors in Fair Value Calculation

Industry and market factors can have a significant impact on a stock’s fair value. Macroeconomic trends, industry cycles, and regulatory changes can all influence a company’s financial performance and growth prospects, and therefore its fair value. For example, a company operating in a cyclical industry may have a higher fair value during periods of economic growth, while a company operating in a defensive industry may have a higher fair value during periods of economic downturn. Similarly, changes in regulatory policies can affect a company’s profitability and growth prospects, and therefore its fair value. To accurately determine the fair value of a stock, it is essential to adjust for these industry and market factors. This can be done by analyzing the company’s historical performance and growth prospects in relation to its industry and the broader market, and by considering the potential impact of macroeconomic trends, industry cycles, and regulatory changes on the company’s future cash flows. By adjusting for these factors, investors can gain a more accurate estimate of a stock’s fair value and make more informed investment decisions. For instance, when determining how to determine fair value of a stock, it is crucial to consider the company’s position within its industry and the broader market, as well as the potential impact of external factors on its financial performance and growth prospects. By doing so, investors can avoid overpaying or underpaying for a stock and achieve their long-term investment goals.

Common Pitfalls to Avoid in Fair Value Calculation

When calculating the fair value of a stock, it is essential to avoid common pitfalls that can lead to inaccurate estimates and poor investment decisions. One common mistake is using outdated data, which can result in a fair value estimate that is not reflective of the company’s current financial performance and growth prospects. Another pitfall is ignoring qualitative factors, such as management quality, industry trends, and competitive advantages, which can have a significant impact on a company’s fair value. Failing to consider alternative valuation approaches is also a common mistake, as it can lead to a narrow and incomplete view of a company’s fair value. Additionally, relying too heavily on a single valuation approach or metric, such as the price-to-earnings ratio, can also lead to inaccurate estimates. Furthermore, failing to adjust for industry and market factors, such as macroeconomic trends and regulatory changes, can also result in inaccurate fair value estimates. By being aware of these common pitfalls, investors can avoid making costly mistakes and ensure that their fair value estimates are accurate and reliable. For instance, when determining how to determine fair value of a stock, it is crucial to consider multiple valuation approaches and metrics, and to adjust for industry and market factors to ensure a comprehensive and accurate estimate. By doing so, investors can make more informed investment decisions and achieve their long-term investment goals.

Putting it all Together: A Step-by-Step Guide to Fair Value Calculation

To illustrate how to determine fair value of a stock, let’s consider a comprehensive example that combines the approaches discussed earlier. Suppose we want to estimate the fair value of a company in the technology sector, XYZ Inc. The company has a strong track record of revenue growth and a solid financial position. We will use a combination of financial ratios, discounted cash flow analysis, and comparable company analysis to estimate the fair value of XYZ Inc.

Step 1: Calculate Financial Ratios – We calculate the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield of XYZ Inc. using its historical financial data. The P/E ratio is 25, the P/B ratio is 3.5, and the dividend yield is 2.5%.

Step 2: Estimate Future Cash Flows – We forecast the future cash flows of XYZ Inc. using a discounted cash flow (DCF) model. We estimate the company’s revenue growth rate, operating margin, and capital expenditures to forecast its future cash flows.

Step 3: Select Comparable Companies – We identify comparable companies in the technology sector, such as ABC Inc. and DEF Inc., and calculate their valuation multiples, including the P/E ratio, P/B ratio, and dividend yield.

Step 4: Adjust for Industry and Market Factors – We adjust the fair value estimate for industry and market factors, including the impact of macroeconomic trends, industry cycles, and regulatory changes.

Step 5: Calculate Fair Value – We calculate the fair value of XYZ Inc. using a combination of the approaches discussed earlier. We use the financial ratios to estimate the fair value, and then adjust it using the DCF model and comparable company analysis. We also adjust for industry and market factors to arrive at a comprehensive fair value estimate.

By following these steps, we can estimate the fair value of XYZ Inc. to be around $50 per share. This estimate takes into account the company’s financial performance, growth prospects, and industry and market factors. By using a combination of approaches, we can arrive at a more accurate and reliable fair value estimate, which can help investors make informed investment decisions. When determining how to determine fair value of a stock, it is essential to consider multiple approaches and adjust for industry and market factors to ensure a comprehensive and accurate estimate.