What is Implied Volatility and Why Does it Matter?

In the world of finance, understanding implied volatility is essential for investors and traders seeking to navigate the complexities of options trading. Implied volatility is a forward-looking measure of the market’s expected volatility of a security’s price, and it plays a critical role in options pricing models. Unlike historical volatility, which is based on past price movements, implied volatility provides a snapshot of the market’s expectations for future price fluctuations. This makes it a vital tool for traders and investors seeking to manage risk, optimize portfolios, and capitalize on market opportunities. To successfully trade options, it’s crucial to know how to compute implied volatility, as it directly impacts the pricing of options contracts. By grasping the concept of implied volatility, market participants can make more informed investment decisions and gain a competitive edge in the markets.

Understanding the Options Pricing Model

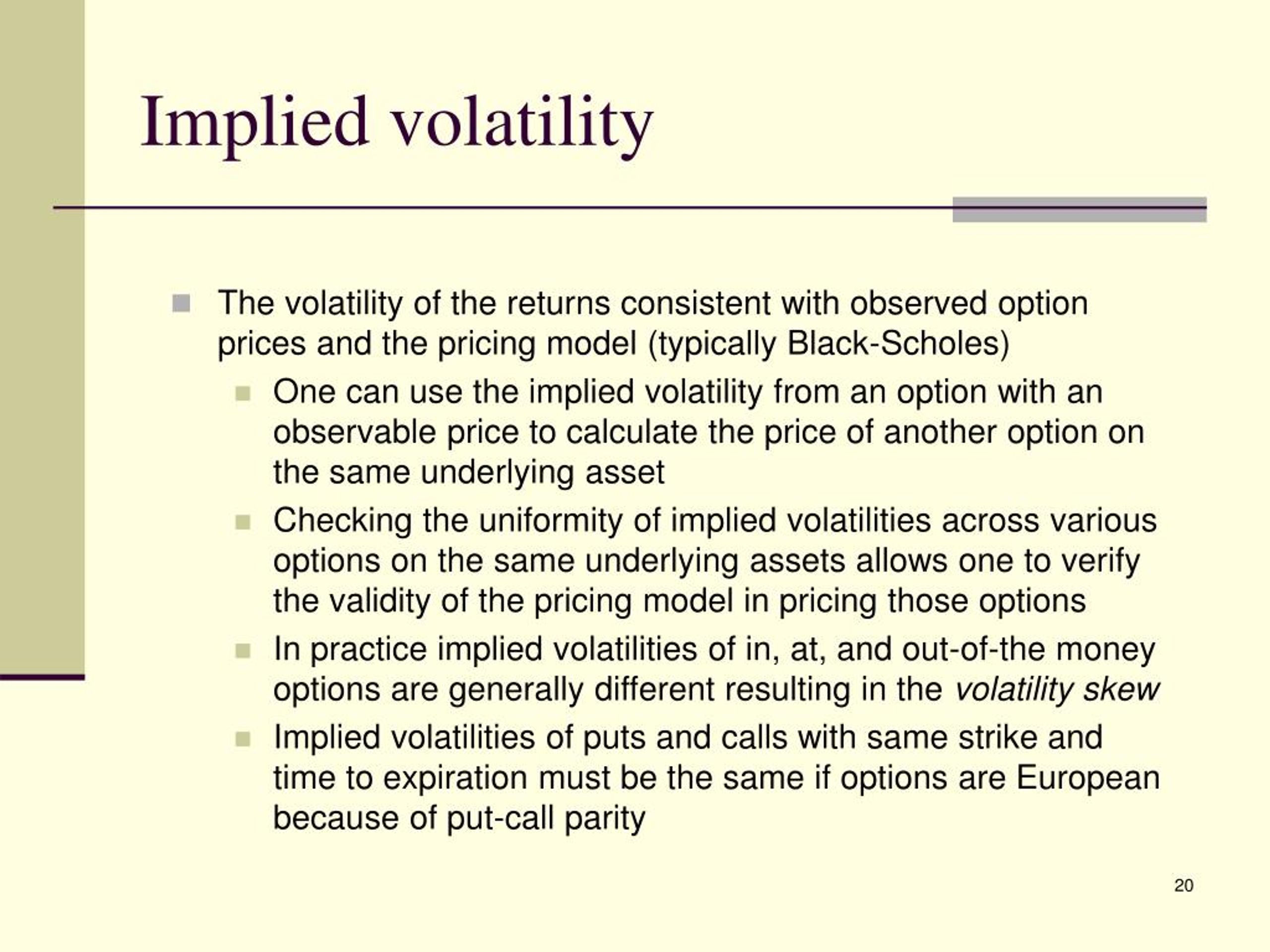

The options pricing model is a mathematical framework used to estimate the value of an option contract. One of the most widely used options pricing models is the Black-Scholes model, which was developed in the 1970s by Fischer Black and Myron Scholes. This model assumes that the underlying asset’s price follows a geometric Brownian motion and that there are no transaction costs or dividends. The Black-Scholes model requires five inputs: the underlying asset’s price, the strike price, the time to expiration, the risk-free interest rate, and the implied volatility. Implied volatility is a critical component of the Black-Scholes model, as it represents the market’s expected volatility of the underlying asset’s price. To accurately price options, it’s essential to understand how to compute implied volatility using the Black-Scholes model. By doing so, investors and traders can gain a deeper understanding of the options market and make more informed investment decisions. In the next section, we will delve into the step-by-step process of how to calculate implied volatility using the Black-Scholes model.

How to Calculate Implied Volatility Using the Black-Scholes Model

To compute implied volatility using the Black-Scholes model, it’s essential to understand the underlying formulas and calculations. The Black-Scholes model is based on the following equation: C = SN(d1) – Ke^(-rt)N(d2), where C is the call option price, S is the underlying asset’s price, K is the strike price, r is the risk-free interest rate, t is the time to expiration, and N(d1) and N(d2) are cumulative distribution functions. To calculate implied volatility, we need to rearrange this equation to solve for σ (implied volatility). The process involves a series of iterative calculations, which can be time-consuming and complex. Fortunately, there are various tools and software available that can simplify the process, such as option pricing calculators and programming languages like Python. When learning how to compute implied volatility, it’s crucial to understand the inputs required for the Black-Scholes model, including the underlying asset’s price, strike price, time to expiration, risk-free interest rate, and implied volatility. By mastering the step-by-step process of calculating implied volatility, investors and traders can gain a deeper understanding of options pricing and make more informed investment decisions. In the next section, we will explore alternative methods for computing implied volatility, including the binomial model and finite difference methods.

Alternative Methods for Computing Implied Volatility

Beyond the Black-Scholes model, there are alternative methods for calculating implied volatility that can provide more accurate results in certain scenarios. One such approach is the binomial model, which assumes that the underlying asset’s price can move up or down by a certain amount over a specific time period. This model is more flexible than the Black-Scholes model and can handle more complex option pricing scenarios. Another approach is the finite difference method, which uses numerical methods to solve the option pricing equation. This method is particularly useful for handling American-style options, which can be exercised at any time before expiration. When learning how to compute implied volatility, it’s essential to understand the advantages and disadvantages of each alternative method. For instance, the binomial model can be more computationally intensive than the Black-Scholes model, while the finite difference method can be more sensitive to input parameters. By understanding the strengths and weaknesses of each approach, investors and traders can choose the most appropriate method for their specific needs and improve their overall options trading strategy. In the next section, we will explore how to interpret the results of implied volatility calculations and how to use them to inform investment decisions.

Interpreting Implied Volatility Results

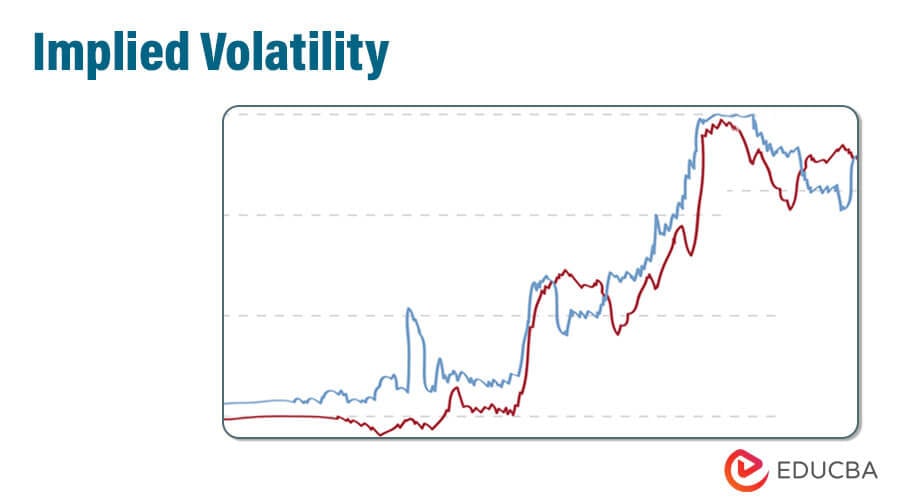

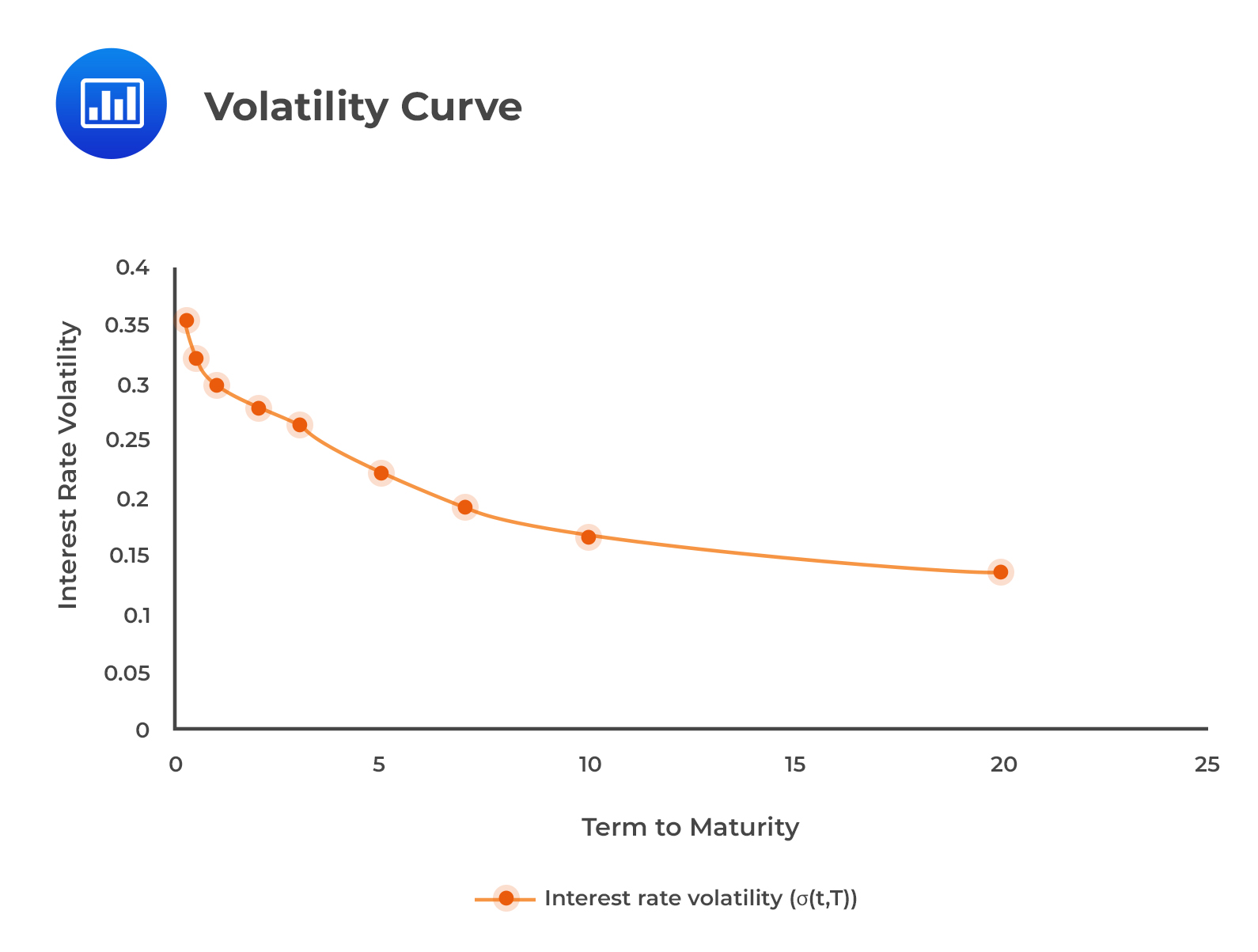

Once implied volatility is calculated, it’s essential to understand what the results mean and how to use them to inform investment decisions. Implied volatility is expressed as a percentage and represents the market’s expected volatility of the underlying asset over a specific time period. A higher implied volatility indicates that the market expects the underlying asset’s price to fluctuate more widely, while a lower implied volatility suggests that the market expects the price to remain relatively stable. When learning how to compute implied volatility, it’s crucial to understand how to interpret the results in the context of options trading. For instance, a high implied volatility may indicate that options premiums are high, making it a good time to sell options. On the other hand, a low implied volatility may suggest that options premiums are low, making it a good time to buy options. By understanding how to interpret implied volatility results, investors and traders can make more informed investment decisions and develop a more effective options trading strategy. In the next section, we will discuss common pitfalls and challenges that arise when computing implied volatility, such as dealing with dividend-paying stocks and handling volatility skew.

Common Pitfalls and Challenges in Computing Implied Volatility

When learning how to compute implied volatility, it’s essential to be aware of common pitfalls and challenges that can arise. One common mistake is failing to account for dividend-paying stocks, which can significantly impact implied volatility calculations. Another challenge is handling volatility skew, which occurs when the implied volatility of an option changes as the underlying asset’s price changes. This can lead to inaccurate implied volatility calculations if not properly addressed. Additionally, using incorrect or outdated data can also lead to inaccurate results. Furthermore, selecting the wrong options pricing model or failing to consider the underlying asset’s characteristics can also lead to errors. By understanding these common pitfalls and challenges, investors and traders can take steps to mitigate them and ensure more accurate implied volatility calculations. For instance, using a model that accounts for dividends and volatility skew can help to improve the accuracy of implied volatility calculations. By being aware of these potential pitfalls and challenges, investors and traders can develop a more effective options trading strategy and make more informed investment decisions.

Real-World Applications of Implied Volatility

Implied volatility has numerous real-world applications in finance, particularly in options trading, risk management, and portfolio optimization. In options trading, implied volatility is used to determine the fair value of an option, allowing traders to make informed decisions about buying or selling options. For instance, a trader may use implied volatility to identify mispriced options and capitalize on arbitrage opportunities. In risk management, implied volatility is used to assess the potential risk of a portfolio and make adjustments to mitigate that risk. By understanding how to compute implied volatility, investors and traders can better manage their risk exposure and optimize their portfolios. Additionally, implied volatility is used in portfolio optimization to identify the optimal asset allocation and maximize returns. For example, a portfolio manager may use implied volatility to identify the most volatile assets in a portfolio and adjust the allocation accordingly. By understanding the real-world applications of implied volatility, investors and traders can gain a competitive edge in the markets and make more informed investment decisions.

Best Practices for Accurate Implied Volatility Calculations

To ensure accurate implied volatility calculations, it’s essential to follow best practices and guidelines. One key consideration is data quality, as inaccurate or outdated data can lead to incorrect implied volatility calculations. Therefore, it’s crucial to use reliable and up-to-date data sources. Another important factor is model selection, as different models are suited to different market conditions and underlying assets. For instance, the Black-Scholes model may be suitable for European options, while the binomial model may be more appropriate for American options. Additionally, sensitivity analysis is critical to understanding how changes in input parameters affect implied volatility calculations. By conducting sensitivity analysis, investors and traders can identify the most critical inputs and adjust their calculations accordingly. Furthermore, it’s essential to understand the limitations of each model and to be aware of potential pitfalls, such as dealing with dividend-paying stocks and handling volatility skew. By following these best practices and guidelines, investors and traders can ensure accurate implied volatility calculations and make more informed investment decisions. For example, by using high-quality data and selecting the appropriate model, investors can accurately compute implied volatility and identify profitable trading opportunities. By understanding how to compute implied volatility and following best practices, investors and traders can gain a competitive edge in the markets.

:max_bytes(150000):strip_icc()/volatilitysmile-5c64696846e0fb00011066e4.jpg)