What is a Discount Factor and Why is it Important?

In the world of finance, the concept of discount factor plays a crucial role in evaluating investment opportunities and determining the present value of future cash flows. Essentially, a discount factor is a numerical value that represents the rate at which future cash flows are discounted to their present value. This concept is vital in various financial calculations, including capital budgeting, investment analysis, and asset valuation.

The significance of discount factor lies in its ability to account for the time value of money. By understanding how to compute discount factor, financial analysts can quantify the difference in value between receiving money today versus receiving it in the future. This knowledge enables businesses and investors to make informed decisions about investments and resource allocation.

As we delve deeper into the world of discount factor, it’s essential to understand its applications and the factors that influence its calculation. In the following sections, we’ll explore the time value of money concept, how to compute discount factor, and its various applications in finance. By the end of this article, you’ll have a comprehensive understanding of how to compute discount factor and its significance in financial decision-making.

Understanding the Time Value of Money

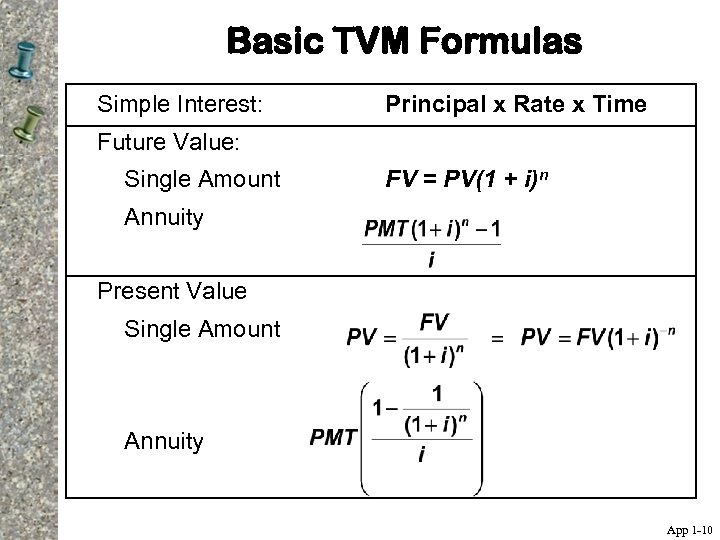

The concept of time value of money is a fundamental principle in finance that recognizes the idea that a dollar received today is worth more than a dollar received in the future. This concept is closely related to the discount factor, as it provides the basis for calculating the present value of future cash flows. The time value of money is influenced by various factors, including interest rates, inflation, and opportunity costs.

In real-world scenarios, the time value of money is applied in various ways. For instance, when evaluating investment opportunities, businesses and investors consider the potential returns on investment and the time it takes to realize those returns. By understanding the time value of money, they can make informed decisions about which investments to pursue and how to allocate resources.

The time value of money is also essential in capital budgeting, where companies evaluate different projects and determine which ones to pursue based on their potential returns and costs. By applying the concept of time value of money, companies can calculate the net present value of each project and make informed decisions about which projects to invest in.

As we move forward, understanding how to compute discount factor is crucial in applying the time value of money concept in various financial calculations. By grasping the relationship between discount factor and time value of money, financial analysts can make more accurate predictions about future cash flows and make informed decisions about investments and resource allocation.

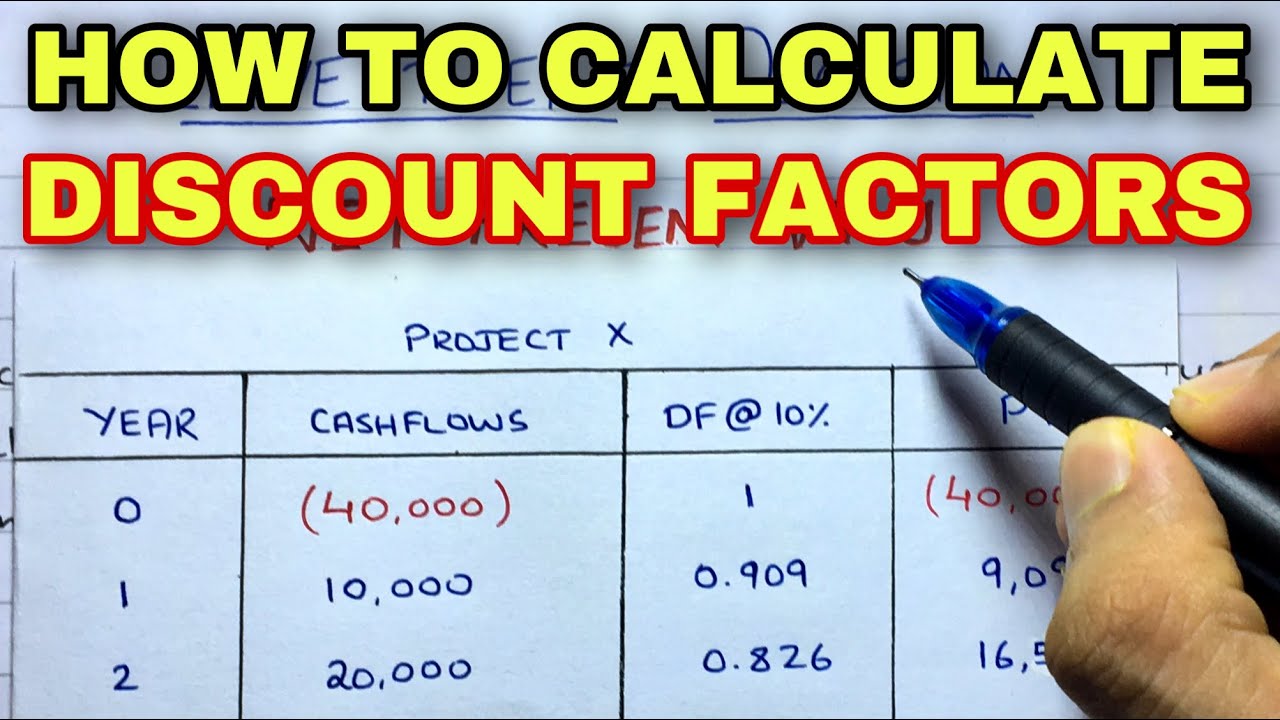

How to Compute Discount Factor: A Step-by-Step Guide

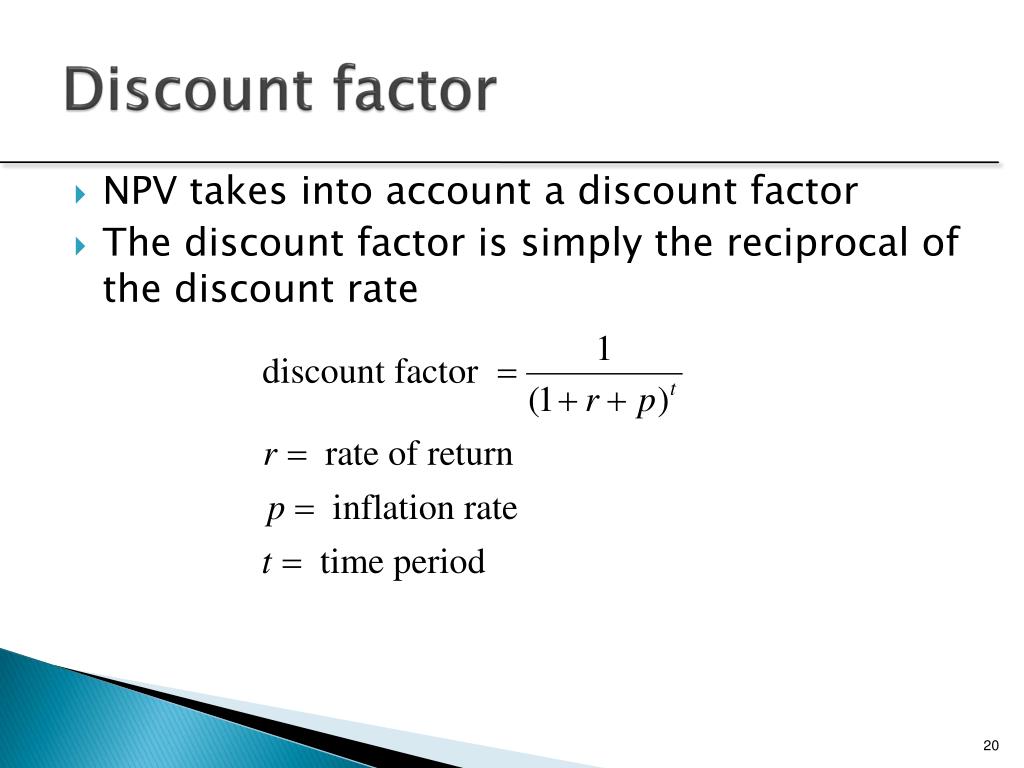

Computing the discount factor is a crucial step in determining the present value of future cash flows. The discount factor is a numerical value that represents the rate at which future cash flows are discounted to their present value. In this section, we will provide a detailed, step-by-step explanation of how to compute discount factor, including the formula and examples of how to apply it.

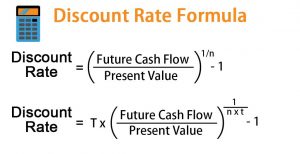

The formula to compute discount factor is as follows:

Discount Factor = 1 / (1 + r)^n

Where:

r = discount rate or interest rate

n = number of periods

To illustrate how to compute discount factor, let’s consider an example. Suppose we want to calculate the present value of a cash flow of $100 that will be received in 5 years, with a discount rate of 10%. Using the formula above, we can compute the discount factor as follows:

Discount Factor = 1 / (1 + 0.10)^5 = 0.683

Once we have computed the discount factor, we can use it to calculate the present value of the future cash flow. In this case, the present value would be:

Present Value = $100 x 0.683 = $68.30

By understanding how to compute discount factor, financial analysts can accurately determine the present value of future cash flows and make informed decisions about investments and resource allocation. In the next section, we will discuss the key factors that influence discount factor, including risk, time, and opportunity cost.

Factors Affecting Discount Factor: Risk, Time, and Opportunity Cost

The discount factor is influenced by several key factors, including risk, time, and opportunity cost. Understanding these factors is crucial in accurately calculating the discount factor and determining the present value of future cash flows.

Risk is a critical factor that affects the discount factor. The higher the risk associated with a future cash flow, the higher the discount rate and the lower the present value. This is because investors demand a higher return for taking on greater risk. For example, a company investing in a high-risk project may use a higher discount rate to reflect the increased uncertainty of the cash flows.

Time is another important factor that influences the discount factor. The longer the time period until the cash flow is received, the lower the present value. This is because money received today is worth more than money received in the future due to the potential for earning interest or returns on investment. For instance, a cash flow received in 10 years may have a lower present value than a cash flow received in 5 years, assuming the same discount rate.

Opportunity cost is also a significant factor that affects the discount factor. Opportunity cost refers to the potential return on investment that is forgone by choosing one investment over another. A higher opportunity cost implies a higher discount rate, as investors could potentially earn a higher return on their investment elsewhere. For example, if an investor can earn a 10% return on a low-risk investment, they may use a higher discount rate to evaluate a higher-risk investment.

In addition to these factors, other considerations such as inflation, liquidity, and market conditions can also impact the discount factor. By understanding how these factors influence the discount factor, financial analysts can make more accurate calculations and informed decisions about investments and resource allocation.

In the next section, we will explore the common applications of discount factor in finance, including capital budgeting, investment analysis, and valuation of assets.

Common Applications of Discount Factor in Finance

The discount factor has a wide range of applications in finance, including capital budgeting, investment analysis, and valuation of assets. In this section, we will explore these applications in more detail.

Capital Budgeting: The discount factor is used to evaluate investment opportunities and determine whether they are worth pursuing. By calculating the present value of future cash flows, companies can compare the expected returns of different projects and make informed decisions about resource allocation.

Investment Analysis: The discount factor is also used in investment analysis to evaluate the potential returns of different investments. By calculating the present value of future cash flows, investors can compare the expected returns of different investments and make informed decisions about where to allocate their capital.

Valuation of Assets: The discount factor is used to value assets such as stocks, bonds, and real estate. By calculating the present value of future cash flows, investors can determine the intrinsic value of an asset and make informed decisions about buying or selling.

In addition to these applications, the discount factor is also used in other areas of finance, such as risk management, portfolio optimization, and performance measurement. By understanding how to compute discount factor and its applications, financial analysts can make more accurate calculations and informed decisions about investments and resource allocation.

For example, a company may use the discount factor to evaluate a potential investment opportunity. By calculating the present value of the expected future cash flows, the company can determine whether the investment is worth pursuing. Similarly, an investor may use the discount factor to evaluate the potential returns of a stock or bond, and make informed decisions about whether to buy or sell.

In the next section, we will clarify the distinction between discount factor and interest rate, and how they’re used in different financial contexts.

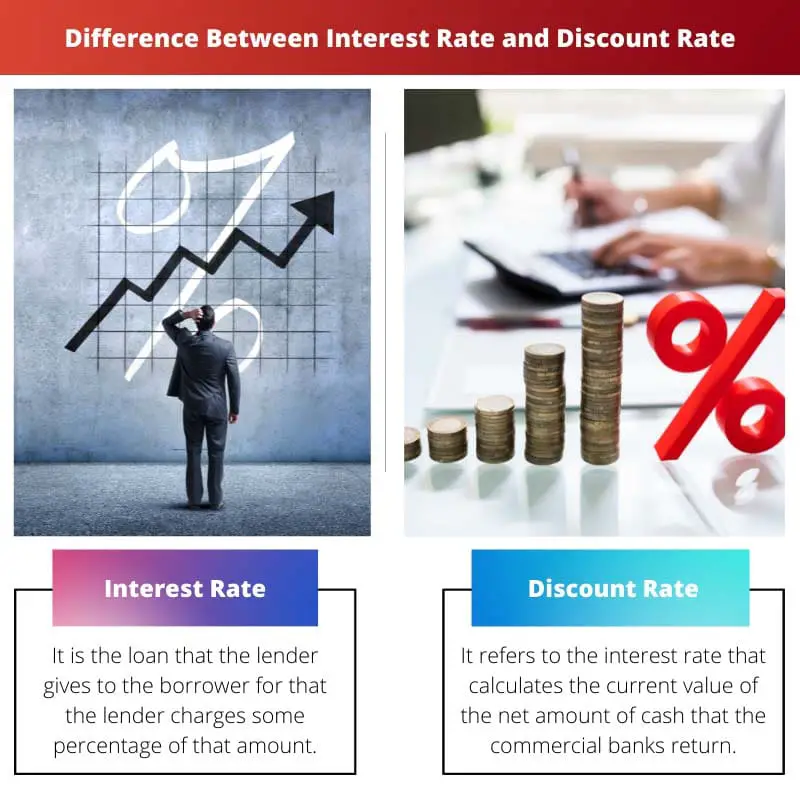

Discount Factor vs. Interest Rate: What’s the Difference?

When it comes to finance, two concepts are often confused with each other: discount factor and interest rate. While they are related, they serve different purposes and are used in different financial contexts.

A discount factor is a multiplier used to calculate the present value of future cash flows. It takes into account the time value of money, risk, and opportunity cost to determine the present value of a future cash flow. On the other hand, an interest rate is the rate at which borrowed money is repaid, typically expressed as a percentage.

The key difference between discount factor and interest rate lies in their application. Discount factor is used to calculate the present value of future cash flows, while interest rate is used to calculate the future value of a present amount. For example, if you want to know the present value of a $100 cash flow received in 5 years, you would use a discount factor. If you want to know the future value of a $100 investment made today, you would use an interest rate.

In addition, discount factor and interest rate are used in different financial contexts. Discount factor is commonly used in capital budgeting, investment analysis, and valuation of assets, while interest rate is used in lending and borrowing decisions.

For instance, a company may use a discount factor to evaluate a potential investment opportunity, while a bank may use an interest rate to determine the interest charged on a loan. Understanding the distinction between discount factor and interest rate is crucial in making informed financial decisions.

In the next section, we will provide concrete examples of how discount factor is used in real-world scenarios, such as evaluating investment opportunities or determining the present value of future cash flows.

Real-World Examples of Discount Factor in Action

Discount factor is a powerful tool used in various financial applications. In this section, we will explore real-world examples of how discount factor is used in practice.

Example 1: Evaluating Investment Opportunities

A company is considering two investment opportunities: Project A and Project B. Both projects have a expected cash flow of $100,000 in 5 years. However, Project A has a higher risk profile than Project B. To evaluate these opportunities, the company uses a discount factor of 0.8 for Project A and 0.9 for Project B. By applying the discount factor, the company determines that the present value of Project A is $64,000 and the present value of Project B is $81,000. Based on this analysis, the company decides to invest in Project B.

Example 2: Determining the Present Value of Future Cash Flows

An investor expects to receive a cash flow of $50,000 in 10 years from a bond investment. To determine the present value of this cash flow, the investor uses a discount factor of 0.7. By applying the discount factor, the investor determines that the present value of the cash flow is $29,400.

Example 3: Capital Budgeting

A company is evaluating a capital project that requires an initial investment of $1 million. The project is expected to generate cash flows of $200,000 per year for 5 years. To evaluate the project, the company uses a discount factor of 0.85. By applying the discount factor, the company determines that the present value of the cash flows is $741,000. Based on this analysis, the company decides to pursue the project.

These examples illustrate how discount factor is used in real-world scenarios to evaluate investment opportunities, determine the present value of future cash flows, and make informed capital budgeting decisions.

In the next section, we will offer tips and best practices for ensuring accurate discount factor calculations, including common pitfalls to avoid and how to handle complex scenarios.

Best Practices for Accurate Discount Factor Calculations

When it comes to calculating discount factor, accuracy is crucial to make informed financial decisions. In this section, we will provide tips and best practices for ensuring accurate discount factor calculations.

1. Understand the Formula: To compute discount factor accurately, it’s essential to understand the formula and its components. The formula for discount factor is 1 / (1 + r)^n, where r is the discount rate and n is the number of periods.

2. Choose the Right Discount Rate: The discount rate is a critical component of the discount factor formula. Choose a discount rate that reflects the risk and opportunity cost associated with the investment or project.

3. Consider the Time Horizon: The time horizon of the investment or project affects the discount factor calculation. Ensure that you use the correct time horizon to calculate the discount factor accurately.

4. Avoid Common Pitfalls: Common pitfalls to avoid when calculating discount factor include using the wrong discount rate, incorrect time horizon, and failing to consider the risk and opportunity cost associated with the investment or project.

5. Use Sensitivity Analysis: Sensitivity analysis is a useful tool to test the robustness of your discount factor calculation. It involves changing the input variables to see how they affect the output.

6. Consider Multiple Scenarios: When calculating discount factor, consider multiple scenarios to reflect different possible outcomes. This will help you make more informed financial decisions.

7. Use Discount Factor Tables or Calculators: Discount factor tables or calculators can simplify the calculation process and reduce errors. They are particularly useful when dealing with complex scenarios or multiple cash flows.

By following these best practices, you can ensure accurate discount factor calculations and make informed financial decisions. Remember to always consider the context and specific requirements of your project or investment when calculating discount factor.