Understanding Accrued Interest

Accrued interest represents interest earned on an investment or owed on a debt but not yet received or paid. It’s a crucial concept in various financial areas, including bonds, loans, and savings accounts. Think of it like this: your savings account earns interest daily. This daily interest accumulates, becoming the accrued interest until the bank pays it out, usually monthly or quarterly. Similarly, if you have a credit card balance, you accrue interest charges daily until you pay off your balance. Learning how to compute accrued interest is essential for managing your finances effectively. This guide explains how to compute accrued interest in simple terms.

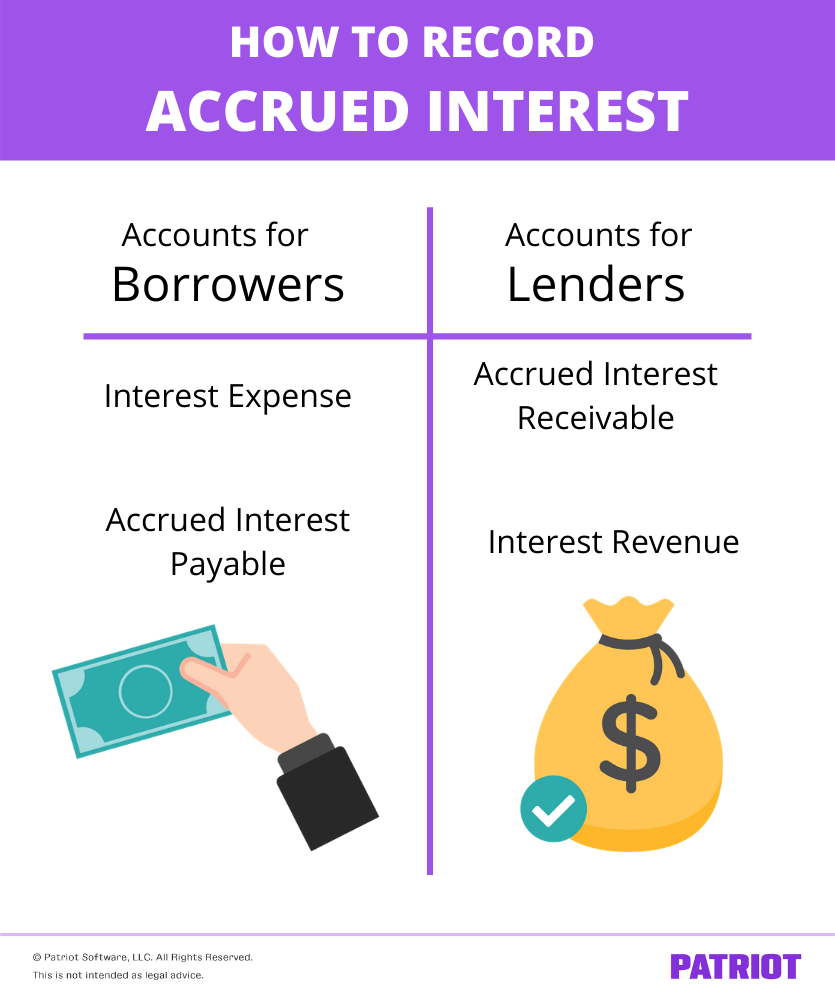

Accrued interest is important because it reflects the true cost of borrowing or the true return on an investment over a specific period. For borrowers, understanding accrued interest helps determine the total amount owed, including interest, at any given time. For investors, it shows the actual earnings generated by their investments. Knowing how to compute accrued interest empowers individuals to make informed financial decisions. Accurately calculating accrued interest ensures financial transparency and helps avoid unexpected expenses or missed earnings. Therefore, mastering how to compute accrued interest is a valuable skill for anyone managing personal finances or analyzing investment opportunities.

Many people wonder, “How to compute accrued interest?” The process varies depending on the financial instrument involved. However, the fundamental principles remain consistent. Understanding the basic components – principal amount, interest rate, and time period – is critical. This guide will equip you with the knowledge and tools to accurately calculate accrued interest in various scenarios. You’ll learn how to compute accrued interest on loans, savings accounts, and bonds, and avoid common mistakes that can lead to incorrect calculations. This will enable you to confidently navigate various financial situations and make informed decisions based on accurate financial data. This guide details exactly how to compute accrued interest.

Identifying the Key Variables to Compute Accrued Interest

To understand how to compute accrued interest, one must first identify three key variables: the principal amount, the interest rate, and the time period. The principal amount represents the initial sum of money upon which interest accrues. This could be the loan amount, the balance in a savings account, or the face value of a bond. It’s crucial to use the correct principal balance for accurate interest calculations. For example, when computing accrued interest on a loan, the principal will be the outstanding loan balance at the start of the accrual period.

Next, the interest rate dictates the percentage of the principal that accrues as interest over a specified period. Interest rates are typically expressed as annual percentages (e.g., 5% per year). However, depending on the context, you might encounter daily, monthly, or quarterly interest rates. To ensure accurate calculations, it is vital to convert all interest rates to a consistent time unit, usually annual. Loan agreements, bank statements, and bond prospectuses clearly state the applicable interest rate. Carefully examine these documents to obtain the correct rate. Understanding how to compute accrued interest necessitates precise identification of the interest rate.

Finally, the time period defines the duration over which interest accrues. This is usually expressed in years, but can also be given in months, days, or even fractions of a year. When calculating accrued interest, ensure consistency in the units of the interest rate and the time period. For instance, if using an annual interest rate, the time period must also be expressed in years, or a proportional fraction thereof. If the time period is given in months, one must convert it to years (e.g., 3 months = 3/12 = 0.25 years) before plugging it into the formula. Accurate determination of the time period is critical for computing accrued interest correctly.

Simple Interest Calculation: The Basic Formula

To understand how to compute accrued interest using the simplest method, we begin with the basic formula for simple interest: Interest = Principal x Rate x Time. The principal represents the initial amount of money invested or borrowed. The rate signifies the annual interest rate, usually expressed as a decimal (e.g., 5% is 0.05). Time represents the duration of the loan or investment, measured in years. Accurate calculation requires consistent units. For example, if the rate is an annual percentage, the time must also be in years. To compute accrued interest accurately, ensure that the units align perfectly. Using this formula provides a clear and straightforward approach to calculating simple interest. Let’s illustrate with an example: Suppose you invest $1,000 at a 5% annual interest rate for three years. The simple interest calculation would be: Interest = $1,000 x 0.05 x 3 = $150. In this scenario, the accrued interest after three years would be $150.

Computing accrued interest often involves converting time periods. For instance, if the time is given in months, divide the number of months by 12 to express it in years. Similarly, if the time is given in days, divide the number of days by 365 (or 360, depending on the convention used). Consistent units are essential for precise calculations. When you compute accrued interest using a simple interest approach, always check the consistency of your units to avoid errors. Consider this example: You borrow $500 at a monthly interest rate of 1% for six months. First, convert the monthly rate to an annual rate: 1% x 12 = 12%. Then, express the time in years: 6 months / 12 months/year = 0.5 years. Now compute accrued interest: Interest = $500 x 0.12 x 0.5 = $30. This illustrates how to compute accrued interest accurately by ensuring consistent units. Remember, proper unit conversion is critical for precision when using this simple formula.

Understanding how to compute accrued interest using the simple interest formula provides a foundational understanding of interest calculations. While simple interest provides a basic framework, it’s crucial to remember that many financial instruments utilize compound interest, which we will explore further. Mastering the simple interest calculation is a key step in grasping more complex financial computations. The method presented here demonstrates a practical and clear approach to compute accrued interest in straightforward scenarios. Always double-check your work and ensure the correct application of this formula to achieve accuracy in your calculations. Accurate computation of accrued interest is essential for financial planning and understanding your financial position.

Compound Interest Calculation: A More Realistic Approach

Compound interest differs significantly from simple interest. Simple interest calculates interest only on the principal amount. Compound interest, however, calculates interest on the principal plus any accumulated interest. This means your interest earns interest, leading to faster growth. To learn how to compute accrued interest accurately, understanding this difference is crucial. The formula for compound interest is A = P (1 + r/n)^(nt), where A is the future value of the investment/loan, including interest, P is the principal investment amount (the initial deposit or loan amount), r is the annual interest rate (decimal), n is the number of times that interest is compounded per year, and t is the number of years the money is invested or borrowed for. This formula provides a more accurate representation of how interest grows in most real-world financial situations.

Consider an example. Suppose you invest $1,000 at an annual interest rate of 5%, compounded annually for 3 years. Using the compound interest formula, the calculation is as follows: A = 1000 (1 + 0.05/1)^(1*3) = $1157.63. The total interest earned is $157.63. If this were simple interest, the calculation would be: Interest = 1000 x 0.05 x 3 = $150. The difference of $7.63 highlights the power of compounding. This shows how to compute accrued interest using the more realistic approach of compound interest. Over longer periods, the difference between simple and compound interest becomes even more substantial. When learning how to compute accrued interest for various financial instruments, using the compound interest formula will usually provide a more accurate result.

Many financial instruments, including savings accounts, bonds, and most loans, utilize compound interest. The compounding frequency (n) varies depending on the specific instrument. Some accounts compound daily, monthly, or quarterly. The more frequent the compounding, the faster the growth of your investment or the faster the accumulation of debt for a loan. Understanding how to compute accrued interest using compound interest is vital for making informed financial decisions, whether it’s maximizing returns on savings or effectively managing loan repayments. The formula allows for precise calculation, providing a clear picture of financial growth or debt accumulation over time. Remember to always convert your interest rate to a decimal and ensure consistent units for time to accurately calculate accrued interest.

Calculating Accrued Interest on Loans: A Step-by-Step Guide

Accurately computing accrued interest on loans requires understanding the loan terms and applying the appropriate formula. Loan statements typically provide the necessary information: the principal balance, the annual interest rate, and the payment schedule. To compute accrued interest for a specific period, such as a month or a quarter, one must first determine the daily periodic interest rate. This involves dividing the annual interest rate by 365 (or 360, depending on the loan agreement). Then, multiply this daily rate by the number of days in the period for which you’re calculating the accrued interest. Finally, multiply the result by the principal balance to arrive at the accrued interest figure. This method directly addresses how to compute accrued interest for a given period.

Let’s illustrate how to compute accrued interest with an example. Suppose a loan has a principal balance of $10,000, an annual interest rate of 6%, and a monthly payment schedule. To calculate the accrued interest for one month (assuming 30 days), we first find the daily interest rate: 6% / 365 ≈ 0.0164%. Next, we multiply this by the number of days in the month: 0.000164 x 30 ≈ 0.00492. Finally, we multiply this by the principal balance: 0.00492 x $10,000 ≈ $49.20. Therefore, the accrued interest for that month is approximately $49.20. This simple calculation shows how to compute accrued interest on a fixed-rate loan. Variable-rate loans require using the applicable interest rate for each period to compute accrued interest accurately. Understanding how to compute accrued interest is crucial for managing loan repayment effectively.

Different loan types have nuances in how to compute accrued interest. For instance, fixed-rate loans use a consistent interest rate throughout the loan term, simplifying the calculation. Variable-rate loans, however, involve a fluctuating interest rate, requiring the calculation to be performed using the rate applicable to each period. Moreover, some loans might use different day-count conventions (e.g., 360 days versus 365 days). It’s essential to consult the loan agreement to identify the correct method for how to compute accrued interest accurately. Careful attention to these details ensures correct calculation and avoids potential discrepancies in loan accounting. Using a spreadsheet or financial calculator can significantly aid in managing these calculations, especially for loans with complex terms or variable interest rates. Knowing how to compute accrued interest empowers borrowers to monitor their loan balances and interest charges effectively.

Calculating Accrued Interest on Savings Accounts

Savings accounts offer a straightforward way to earn interest on deposited funds. To compute accrued interest on a savings account, understanding the interest rate and compounding frequency is crucial. Interest rates are usually expressed as an Annual Percentage Yield (APY), representing the total amount of interest earned in a year, considering the effect of compounding. This APY helps determine how to compute accrued interest, accurately reflecting the growth of your savings. The compounding frequency (daily, monthly, or annually) determines how often interest is calculated and added to your principal balance. More frequent compounding leads to slightly higher returns due to the effect of earning interest on interest.

How to compute accrued interest accurately involves using the appropriate formula based on the compounding frequency. For daily compounding, interest is calculated daily and added to the principal. For monthly compounding, it’s calculated monthly. Annual compounding, the simplest method for how to compute accrued interest, calculates interest only once a year. The formula for simple interest (Interest = Principal x Rate x Time) can be adapted. For instance, with daily compounding, the rate is the APY divided by 365, and the time is the number of days. This daily rate then gets applied repeatedly. Calculating the accrued interest for a specific period, like a quarter or a year, is straightforward once the compounding frequency is known. One can easily calculate interest earned over various timeframes using this approach. Tools like spreadsheets or financial calculators can streamline these calculations, allowing for quicker and more efficient determination of accrued interest.

Let’s illustrate how to compute accrued interest with an example. Suppose you have $1,000 in a savings account with a 5% annual percentage yield (APY), compounded monthly. To calculate the interest earned after six months, you would divide the APY by 12 (5%/12 = 0.004167) to get the monthly interest rate. The accrued interest is then computed using this rate for six months. The formula would be similar to the compound interest formula adapted to reflect monthly compounding. Accurate calculation of interest highlights the importance of understanding compounding frequency when managing savings and evaluating investment options. Learning how to compute accrued interest allows you to make informed financial decisions and fully realize the potential of your savings. Remember to always check with your financial institution for their precise calculation methods.

Calculating Accrued Interest on Bonds

Bonds represent a loan made to a borrower, typically a corporation or government. To understand how to compute accrued interest on bonds, one must grasp the concept of coupon payments. These are periodic interest payments made to the bondholder. The coupon rate determines the annual interest payment as a percentage of the bond’s face value. The accrued interest represents the interest earned from the last coupon payment date up to a specific settlement date (the date the bond is bought or sold). How to compute accrued interest in this context involves determining the fraction of the year elapsed since the last coupon payment and multiplying this by the total annual coupon payment. For example, if a bond has a coupon rate of 5% and a face value of $1,000, the annual coupon payment is $50 ($1,000 x 0.05). If the bond was purchased six months after the last coupon payment, the accrued interest would be $25 ($50 x 6/12). This calculation shows how to compute accrued interest for a simple scenario. More complex scenarios may require more detailed calculations.

Accrued interest calculations for bonds often involve determining the number of days between the last coupon payment date and the settlement date. This is then divided by the total number of days in the coupon period to obtain the fraction of the coupon period that has elapsed. This fraction is then multiplied by the next upcoming coupon payment. This method ensures accurate calculations, particularly when dealing with bonds with different coupon payment frequencies (e.g., semi-annual, quarterly). The specific day-count conventions used can vary depending on the type of bond and the relevant market conventions. Understanding these conventions is crucial for accurate bond pricing and interest calculations. How to compute accrued interest accurately requires careful attention to these details. Using specialized financial software or calculators can streamline this process, minimizing errors associated with manual calculations. Bond interest calculations often involve more detailed day-count conventions and may differ from simple interest computations.

Several factors influence how to compute accrued interest on bonds. These include the bond’s coupon rate, the face value, the last coupon payment date, and the settlement date. The timing of the purchase relative to the coupon payment schedule directly affects the accrued interest amount. Investors should be aware of the accrued interest when buying or selling bonds, as this amount is added to the bond’s price. Understanding how to compute accrued interest is vital for accurate valuation and investment decision-making in the bond market. The precise method used for calculating accrued interest on bonds may vary depending on market conventions and the type of bond involved. This highlights the importance of consulting relevant documentation or using specialized financial tools to ensure accuracy.

Troubleshooting Common Calculation Errors When Computing Accrued Interest

Accurately computing accrued interest requires precision and attention to detail. One common mistake involves incorrect unit conversions. Interest rates are often expressed annually, while the time period might be given in months or days. Failing to convert these units consistently leads to inaccurate results. Always ensure that the interest rate and time period use the same units (e.g., annual rate and years, monthly rate and months). To learn how to compute accrued interest correctly, always double-check your unit conversions. For example, converting a monthly interest rate to an annual rate involves multiplying by 12. Conversely, converting an annual interest rate to a monthly rate involves dividing by 12. When computing accrued interest, paying close attention to these small details is crucial. Misinterpreting the interest rate itself is another frequent error. Understanding whether the rate is simple or compound is critical. Simple interest calculations only consider the principal amount. However, compound interest calculations incorporate the accumulated interest. Using the wrong formula for the type of interest will lead to significant discrepancies in the final calculation. Always carefully examine the context and the nature of the interest being calculated to choose the correct method for how to compute accrued interest.

Another area where errors can arise is in the application of the formulas themselves. Simple mistakes in arithmetic, like misplacing decimal points or using an incorrect order of operations, can drastically alter the outcome. Independent verification of the calculations is extremely helpful. Performing the computation twice, using a different method if possible, can help catch errors. Consider using financial calculators or spreadsheet software like Microsoft Excel or Google Sheets to improve accuracy. These tools help automate computations, reduce manual errors, and provide a clear record of your calculations. Understanding how to compute accrued interest using technology is a valuable skill. Many spreadsheet programs have built-in functions for compound interest calculations, which eliminates the potential for manual formula errors. Always double-check your input values – principal, interest rate, and time period – before running any calculations, as small input errors propagate throughout the calculations.

Finally, remember that the method for how to compute accrued interest varies depending on the financial instrument. Loans, savings accounts, and bonds all have unique characteristics that affect the calculation. For instance, loans often involve regular payments, while savings accounts might compound interest daily, monthly, or annually. Bonds have specific coupon payment dates, necessitating a different approach to calculating the accrued interest. To fully understand how to compute accrued interest for different scenarios, consult the relevant documentation or seek professional financial advice if necessary. Always familiarize yourself with the specific terms and conditions of the financial instrument before attempting any calculations. A thorough understanding of the nuances is essential for calculating accrued interest accurately and avoiding mistakes.