Unlocking the Power of YTM in Bond Investing

In the world of bond investing, Yield to Maturity (YTM) is a crucial metric that helps investors evaluate the performance of their bond portfolios. It represents the total return an investor can expect to earn from a bond if it is held until maturity, taking into account the bond’s coupon rate, face value, and market price. By understanding YTM, investors can make informed investment decisions, compare the potential returns of different bonds, and optimize their portfolios. In this article, we will explore the ins and outs of YTM, including how to calculate it using a financial calculator, and uncover its practical applications in bond analysis. Whether you’re a seasoned investor or just starting out, mastering YTM calculations is essential for achieving your investment goals.

Understanding the Formula: Breaking Down YTM Calculation

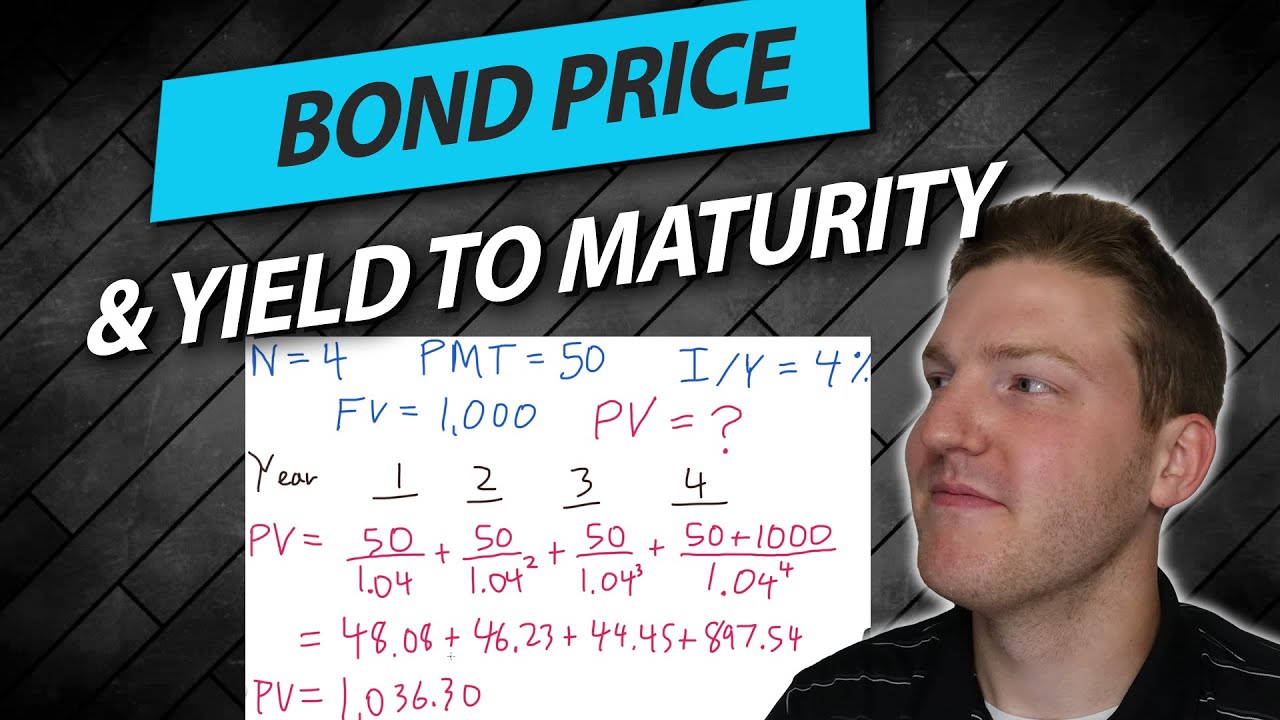

The Yield to Maturity (YTM) formula is a complex calculation that involves several variables, including the bond’s face value, coupon rate, market price, and time to maturity. The formula is as follows: YTM = (C + ((FV – PV) / years)) / ((FV + PV) / 2), where C is the coupon rate, FV is the face value, PV is the present value or market price, and years is the time to maturity. To break down this calculation, let’s examine each variable and how they interact to produce the yield. The coupon rate represents the periodic interest payments made by the bond issuer, while the face value is the bond’s principal amount. The market price, on the other hand, is the current value of the bond in the market. By understanding how these variables interact, investors can gain a deeper appreciation for the YTM calculation and its significance in bond investing. In the next section, we will explore how to calculate YTM using a financial calculator, providing a step-by-step guide on how to input these variables and produce an accurate yield.

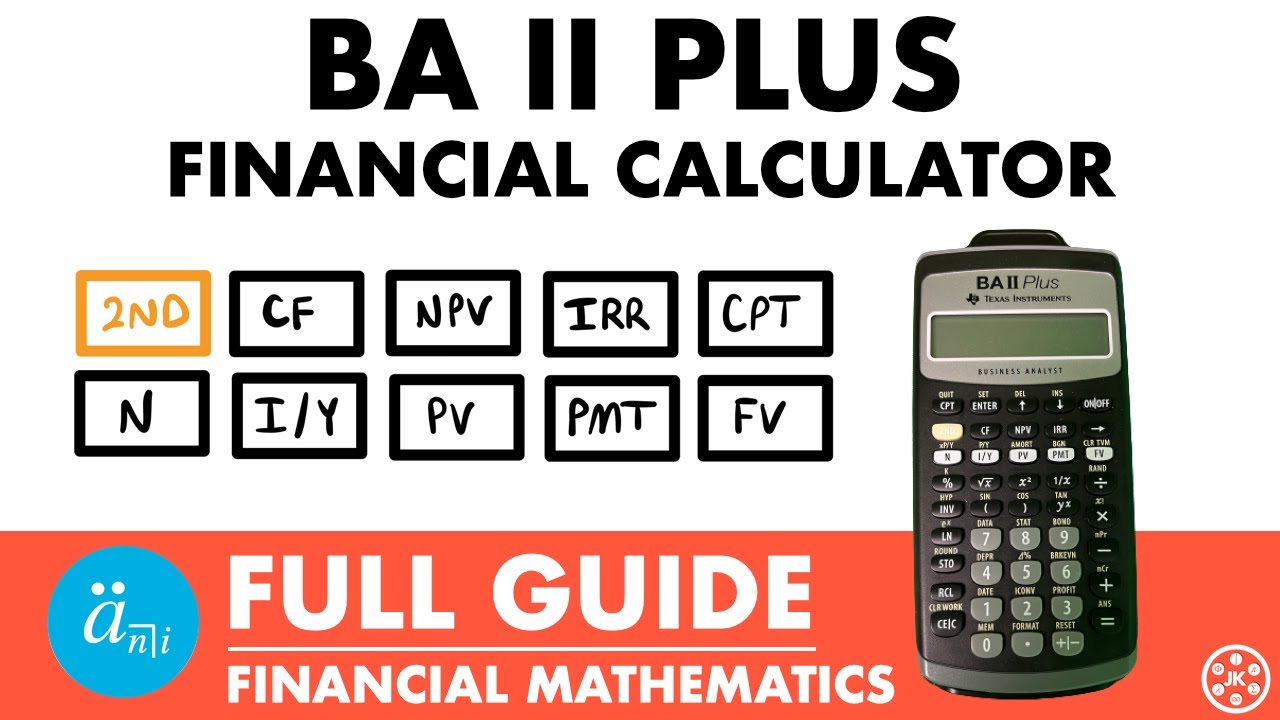

How to Calculate YTM on a Financial Calculator: A Step-by-Step Guide

Calculating Yield to Maturity (YTM) on a financial calculator is a straightforward process that requires a few simple steps. In this section, we will use the popular Texas Instruments BA II Plus financial calculator as an example. To calculate YTM on this calculator, follow these steps: First, enter the bond’s face value, coupon rate, and market price into the calculator using the following keys: CF (cash flow) for the face value, I/Y (interest rate) for the coupon rate, and PV (present value) for the market price. Next, enter the bond’s time to maturity using the N (number of periods) key. Then, press the CPT (compute) key and select the YTM function. The calculator will display the YTM, which represents the bond’s total return if held until maturity. For example, if the bond’s face value is $1,000, coupon rate is 5%, market price is $900, and time to maturity is 10 years, the YTM would be approximately 6.34%. By following these steps, investors can quickly and accurately calculate YTM using a financial calculator, enabling them to make informed investment decisions. Remember, mastering how to calculate YTM on a financial calculator is a crucial skill for any bond investor, and with practice, you can become proficient in no time.

Common Errors to Avoid When Calculating YTM

When calculating Yield to Maturity (YTM) using a financial calculator, it’s essential to avoid common mistakes that can lead to inaccurate results. One of the most frequent errors is entering incorrect input values, such as the bond’s face value, coupon rate, or market price. To avoid this, double-check the input values to ensure they are accurate and consistent with the bond’s terms. Another common mistake is misunderstanding the YTM formula or the calculator’s functions. For instance, some investors may confuse the YTM with the bond’s coupon rate or current yield. To avoid this, take the time to understand the YTM formula and the calculator’s functions, and practice calculating YTM with different scenarios. Additionally, failing to account for the bond’s compounding frequency can also lead to errors. Make sure to set the calculator to the correct compounding frequency, whether it’s annually, semi-annually, or quarterly. By being aware of these common errors and taking steps to avoid them, investors can ensure accurate YTM calculations and make informed investment decisions. Remember, accurately calculating YTM is crucial in bond investing, and attention to detail is key.

Real-World Applications of YTM in Bond Analysis

In the world of bond investing, Yield to Maturity (YTM) is a powerful tool that helps investors evaluate bond performance, assess credit risk, and make informed investment decisions. One of the most significant applications of YTM is in comparing the performance of different bonds. By calculating the YTM of multiple bonds, investors can determine which bond offers the highest return, given the same level of risk. This enables investors to make more informed decisions about which bonds to buy or sell. Additionally, YTM can be used to evaluate credit risk by comparing the yield of a bond to its credit rating. A bond with a higher YTM than its credit rating suggests may be a higher-risk investment, while a bond with a lower YTM may be a safer bet. Furthermore, YTM can be used to inform investment decisions by helping investors determine the optimal bond portfolio. For instance, an investor may use YTM to determine the optimal mix of short-term and long-term bonds to achieve their investment goals. By understanding the real-world applications of YTM, investors can unlock the full potential of this powerful tool and make more informed investment decisions. Whether you’re a seasoned investor or just starting out, mastering how to calculate YTM on a financial calculator is an essential skill that can help you achieve your investment goals.

Using YTM to Evaluate Bond Performance: A Case Study

Let’s consider a real-world example of how YTM can be used to evaluate the performance of a specific bond. Suppose we have a 10-year bond with a face value of $1,000, a coupon rate of 4%, and a market price of $950. Using a financial calculator, we can calculate the YTM of this bond to be approximately 4.53%. This means that if we were to hold the bond until maturity, we could expect to earn a return of 4.53% per year. But how does this compare to other bonds in the market? By calculating the YTM of similar bonds, we can determine which bond offers the highest return for a given level of risk. For instance, if we compare our bond to a similar bond with a YTM of 4.20%, we can see that our bond offers a higher return, making it a more attractive investment opportunity. Furthermore, by analyzing the YTM of our bond over time, we can identify trends and patterns that may indicate changes in the bond’s credit risk or market conditions. For example, if the YTM of our bond increases over time, it may indicate that the market is becoming more risk-averse, and investors are demanding higher returns for their investments. By understanding how to calculate YTM on a financial calculator and applying it to real-world scenarios, investors can gain valuable insights into bond performance and make more informed investment decisions.

Advanced YTM Concepts: Understanding Duration and Convexity

While Yield to Maturity (YTM) provides a comprehensive measure of a bond’s return, it’s essential to understand two additional concepts that can significantly impact bond performance: duration and convexity. Duration measures the sensitivity of a bond’s price to changes in interest rates, while convexity measures the curvature of the bond’s price-yield relationship. Both duration and convexity are critical in bond analysis, as they can help investors anticipate how a bond’s price will respond to changes in market conditions. For instance, a bond with a higher duration is more sensitive to interest rate changes, meaning its price will fluctuate more significantly in response to rate changes. On the other hand, a bond with higher convexity will exhibit a more pronounced curvature in its price-yield relationship, making it more sensitive to large changes in interest rates. By understanding duration and convexity, investors can better navigate the complexities of bond investing and make more informed decisions. For example, an investor seeking to minimize interest rate risk may opt for a bond with a lower duration, while an investor seeking to maximize returns may opt for a bond with higher convexity. By incorporating these advanced YTM concepts into their investment strategy, investors can gain a deeper understanding of bond performance and make more informed decisions. When learning how to calculate YTM on a financial calculator, it’s essential to consider these advanced concepts to gain a more comprehensive understanding of bond investing.

Conclusion: Mastering YTM Calculations for Informed Investing

In conclusion, accurately calculating Yield to Maturity (YTM) is a crucial step in bond investing, providing investors with a comprehensive measure of a bond’s return. By understanding how to calculate YTM on a financial calculator and incorporating advanced concepts such as duration and convexity, investors can gain a deeper understanding of bond performance and make more informed investment decisions. To ensure accurate YTM calculations, it’s essential to avoid common errors, such as incorrect input values or misunderstanding the formula. By following the step-by-step guide outlined in this article, investors can confidently calculate YTM and unlock the power of YTM in bond investing. Remember, mastering YTM calculations is key to evaluating bond performance, comparing bond returns, and making informed investment decisions. By incorporating YTM into their investment strategy, investors can optimize their portfolio and achieve their long-term financial goals. With practice and patience, investors can become proficient in calculating YTM and unlock the full potential of bond investing.