What is Yield to Maturity and Why Does it Matter?

Yield to Maturity (YTM) is a crucial concept in bond investing, as it helps investors evaluate bond performance and make informed investment decisions. In essence, YTM represents the total return an investor can expect to earn from a bond if they hold it until maturity. This metric takes into account the bond’s coupon rate, face value, and maturity date, providing a comprehensive picture of the bond’s potential performance. By understanding how to calculate YTM for bonds, investors can compare different bond offerings, assess risk, and optimize their investment portfolios. In today’s complex bond market, mastering YTM calculations is essential for making informed investment decisions and achieving long-term financial goals.

Understanding Bond Basics: Face Value, Coupon Rate, and Maturity Date

Before diving into the intricacies of yield to maturity (YTM) calculations, it’s essential to understand the fundamental components of a bond. These components include face value, coupon rate, and maturity date, which all play a critical role in determining a bond’s YTM. The face value, also known as the principal, is the amount borrowed by the issuer and repaid to the investor at maturity. The coupon rate, on the other hand, is the interest rate paid periodically to the investor, usually semi-annually or annually. Finally, the maturity date marks the end of the bond’s life, at which point the issuer repays the face value to the investor. Understanding these basic components is crucial for accurately calculating YTM and making informed investment decisions. By grasping how these elements interact, investors can better navigate the bond market and make informed decisions about how to calculate YTM for bonds.

How to Calculate Yield to Maturity: A Formula Breakdown

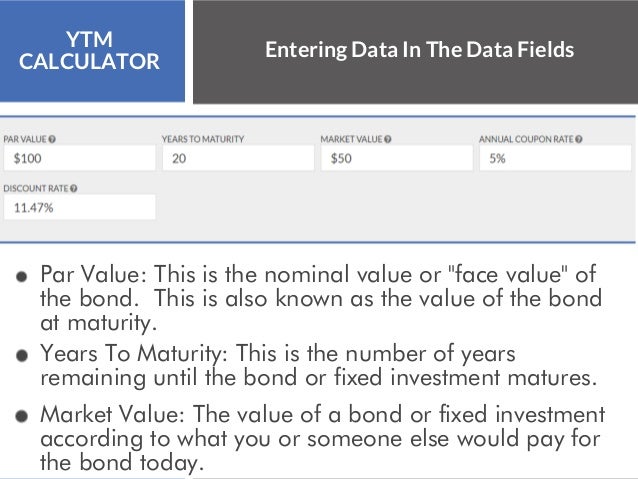

The yield to maturity (YTM) formula is a complex calculation that involves several variables. To accurately calculate YTM, investors need to understand the formula and how to plug in the correct numbers. The YTM formula is as follows: YTM = (Coupon Payment + (Face Value – Current Price) / Years to Maturity) / ((Face Value + Current Price) / 2). This formula takes into account the bond’s coupon payment, face value, current price, and years to maturity. By understanding how to calculate YTM for bonds using this formula, investors can gain a deeper understanding of a bond’s potential return and make more informed investment decisions. It’s essential to note that YTM calculations can be time-consuming and require a thorough understanding of the variables involved. However, by mastering this formula, investors can unlock the full potential of their bond investments and achieve their long-term financial goals.

Factors Affecting Yield to Maturity: Credit Risk, Interest Rates, and Time

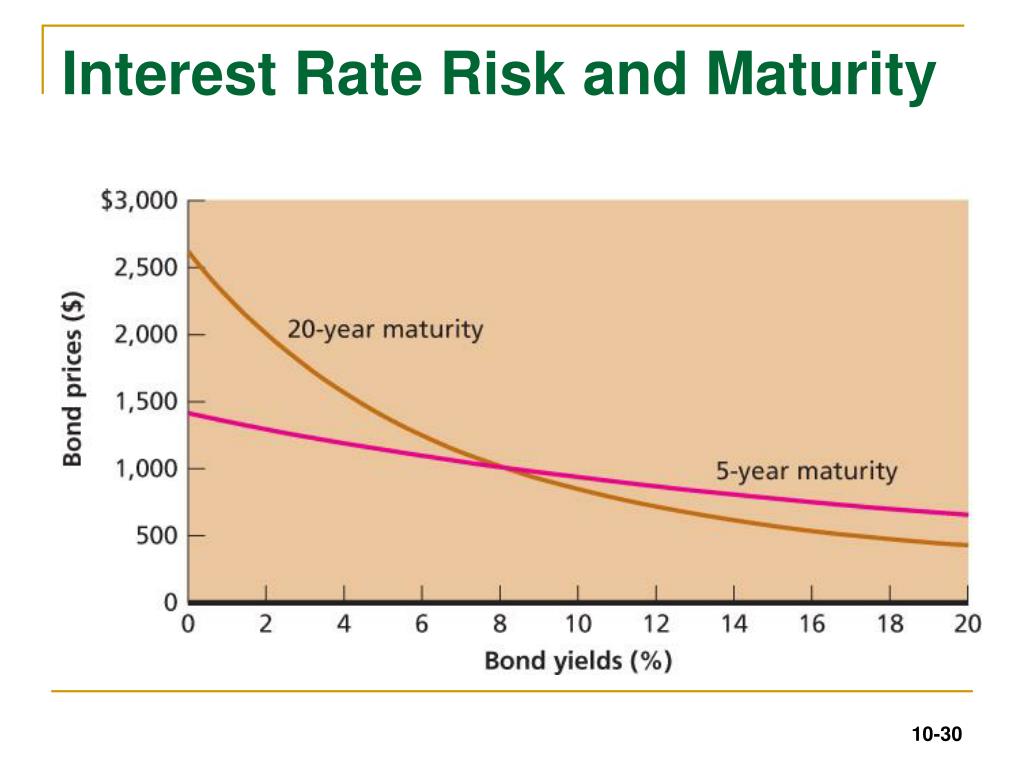

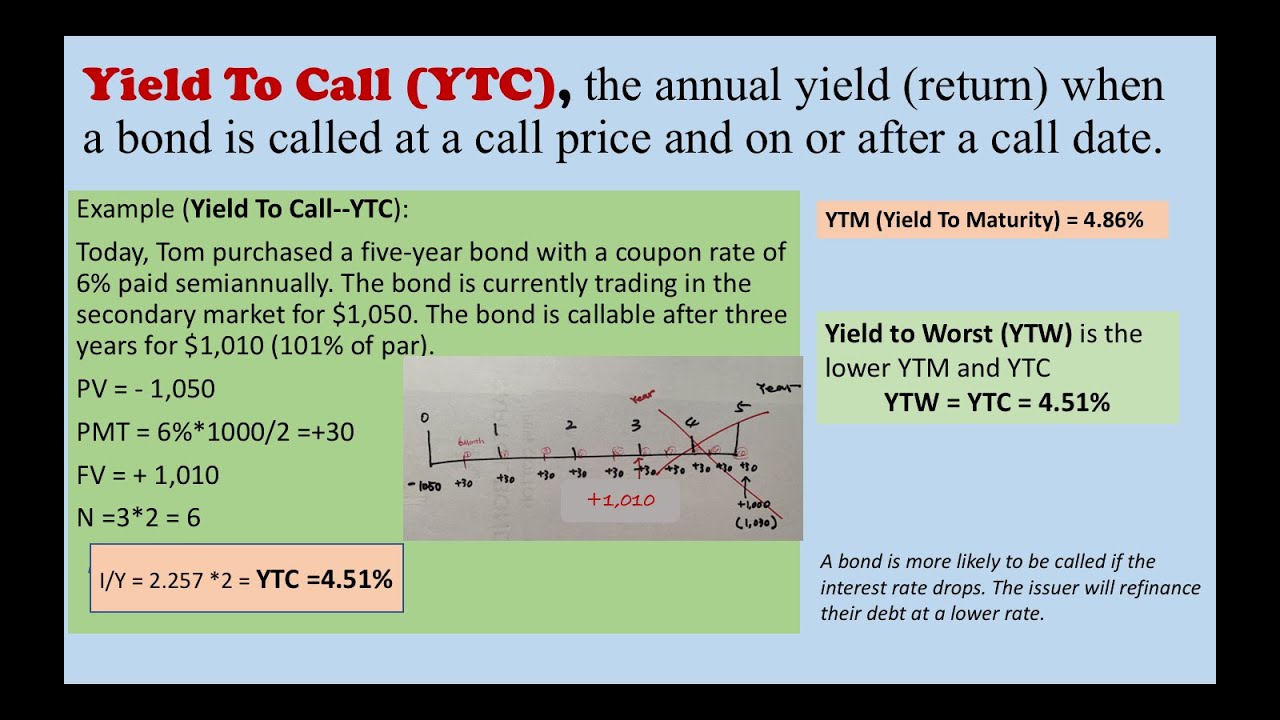

When learning how to calculate YTM for bonds, it’s essential to understand the key factors that influence this critical metric. Yield to maturity is not a fixed value, but rather a dynamic calculation that is affected by various market and economic conditions. Three primary factors impact YTM: credit risk, interest rates, and time to maturity. Credit risk refers to the likelihood of the bond issuer defaulting on their debt obligations, which can significantly impact YTM. Interest rates, on the other hand, have an inverse relationship with bond prices, meaning that when interest rates rise, bond prices fall, and YTM increases. Finally, time to maturity plays a crucial role in YTM calculations, as bonds with longer maturities typically offer higher yields to compensate investors for the increased risk. By understanding how these factors interact and impact YTM, investors can make more informed decisions about their bond investments and optimize their portfolios for maximum returns.

Real-World Examples: Calculating YTM for Different Bond Scenarios

To illustrate how to calculate YTM for bonds in practice, let’s consider three real-world examples: a government bond, a corporate bond, and a high-yield bond. In each scenario, we’ll walk through the YTM calculation process, highlighting the unique characteristics of each bond type and how they impact the YTM result.

Example 1: Government Bond – Suppose we have a 10-year U.S. Treasury bond with a face value of $1,000, a coupon rate of 2%, and a current price of $950. Using the YTM formula, we can calculate the YTM to be approximately 2.35%. This result indicates that the bond’s total return, including coupon payments and capital gains, is expected to be 2.35% per annum.

Example 2: Corporate Bond – Consider a 5-year corporate bond with a face value of $1,000, a coupon rate of 4%, and a current price of $1,050. In this scenario, the YTM calculation yields a result of approximately 3.75%. This higher YTM reflects the increased credit risk associated with corporate bonds compared to government bonds.

Example 3: High-Yield Bond – Let’s examine a 7-year high-yield bond with a face value of $1,000, a coupon rate of 6%, and a current price of $900. The YTM calculation for this bond yields a result of approximately 7.25%. This higher YTM reflects the increased credit risk and higher return potential associated with high-yield bonds.

By working through these examples, investors can gain a deeper understanding of how to calculate YTM for bonds in different scenarios, ultimately enabling them to make more informed investment decisions and optimize their bond portfolios for maximum returns.

Common Mistakes to Avoid When Calculating Yield to Maturity

When learning how to calculate YTM for bonds, it’s essential to avoid common mistakes that can lead to inaccurate results and misguided investment decisions. Here are some common errors to watch out for:

1. Incorrectly inputting bond data: Ensure that the face value, coupon rate, maturity date, and current price are accurate and up-to-date. A single mistake can significantly impact the YTM calculation.

2. Failing to account for compounding: YTM calculations assume compounding, so it’s crucial to consider the frequency of compounding when plugging in the numbers.

3. Ignoring credit risk: Credit risk can significantly impact YTM, so it’s essential to consider the bond issuer’s creditworthiness when calculating YTM.

4. Misunderstanding the YTM formula: Take the time to thoroughly understand the YTM formula and its variables to avoid mistakes in the calculation process.

5. Not considering the bond’s tax implications: Tax implications can impact the bond’s total return, so it’s essential to consider these factors when calculating YTM.

By being aware of these common mistakes, investors can ensure accurate YTM calculations and make informed investment decisions. Remember, understanding how to calculate YTM for bonds is crucial for optimizing bond portfolios and achieving long-term investment goals.

YTM vs. Current Yield: Understanding the Difference

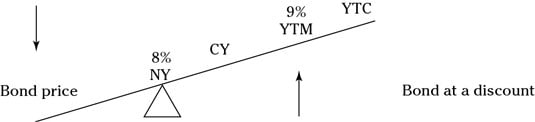

When evaluating bond performance, investors often rely on two key metrics: Yield to Maturity (YTM) and current yield. While both metrics provide insights into a bond’s return, they serve distinct purposes and offer different perspectives on a bond’s performance.

Current yield, also known as coupon yield, represents the bond’s annual coupon payment as a percentage of its current market price. It provides a snapshot of the bond’s current income generation, but it doesn’t account for the bond’s total return, including capital gains or losses.

In contrast, YTM takes into account the bond’s total return, including coupon payments, capital gains or losses, and the return of principal at maturity. YTM provides a more comprehensive picture of a bond’s performance, enabling investors to evaluate its potential for long-term returns.

To illustrate the difference, consider a 10-year bond with a face value of $1,000, a coupon rate of 4%, and a current price of $900. The current yield would be approximately 4.44% (4% coupon rate / $900 current price), while the YTM would be around 5.25%, taking into account the bond’s total return.

When deciding how to calculate YTM for bonds, it’s essential to understand the distinction between YTM and current yield. By using both metrics in tandem, investors can gain a more nuanced understanding of a bond’s performance and make informed investment decisions.

Putting it All Together: A Comprehensive YTM Calculation Example

Now that we’ve covered the fundamentals of Yield to Maturity (YTM) and how to calculate it, let’s walk through a comprehensive example to illustrate the entire process.

Suppose we want to calculate the YTM for a 10-year corporate bond with a face value of $1,000, a coupon rate of 5%, and a current price of $920. The bond makes semiannual coupon payments, and we want to determine its YTM.

Step 1: Gather Data

We’ve already been given the necessary data: face value ($1,000), coupon rate (5%), current price ($920), and maturity date (10 years). We’ll also need to assume a compounding frequency, which in this case is semiannual.

Step 2: Determine the Bond’s Cash Flows

The bond’s cash flows consist of semiannual coupon payments of $25 (5% of $1,000 / 2) and the return of principal at maturity ($1,000). We can create a cash flow table to visualize the bond’s payments:

| Period | Cash Flow |

|---|---|

| 1-19 | $25 |

| 20 | $1,025 |

Step 3: Calculate the YTM

Using the YTM formula, we can plug in the numbers to arrive at an accurate calculation. After calculating the YTM, we get a result of approximately 5.75%.

Step 4: Interpret the Results

The calculated YTM of 5.75% indicates that the bond’s total return, including coupon payments and capital gains or losses, is 5.75% per annum. This information can help investors evaluate the bond’s performance and make informed investment decisions.

By following these steps and understanding how to calculate YTM for bonds, investors can unlock the full potential of their bond portfolios and achieve their long-term investment goals.