Gauging Investment Success: Understanding YTD Return

Year-to-Date (YTD) return is a vital metric for investors seeking to understand investment performance. It represents the percentage change in an investment’s value from the beginning of the current calendar year (January 1st) to the present date. Investors track YTD return to quickly gauge how their investments are performing relative to their expectations and market conditions. Understanding how to calculate YTD return provides a snapshot of an investment’s growth, allowing for timely adjustments to portfolio strategies. This measure offers a clear view of financial progress within the current year, making it an essential tool for informed decision-making.

The importance of YTD return lies in its simplicity and relevance. It provides a standardized way to assess investment performance across different asset classes and time periods. By focusing on the current year, YTD return offers a fresh perspective, unaffected by past gains or losses. Regular monitoring of YTD return can help investors identify trends, detect potential problems, and seize opportunities. Knowing how to calculate YTD return empowers individuals to actively manage their investments and stay aligned with their financial goals. This metric serves as a benchmark for evaluating the effectiveness of investment strategies and making necessary course corrections.

Furthermore, the ability to accurately assess investment performance through metrics such as understanding how to calculate YTD return is paramount for both novice and seasoned investors. It allows for a clear comparison against market benchmarks, such as the S&P 500, providing context to individual investment results. A positive YTD return indicates growth, while a negative return signals a decline in value. However, interpreting YTD return requires considering factors like risk tolerance and investment objectives. Ultimately, understanding and tracking YTD return is a crucial step toward achieving financial success and making well-informed investment decisions. This ongoing assessment ensures that investment strategies remain effective and aligned with long-term goals.

How to Calculate Your Year-to-Date Investment Growth

Understanding how to calculate YTD return is crucial for monitoring your investment performance. The formula itself is relatively straightforward, allowing you to quickly assess your gains or losses from the start of the year. It focuses on three key components: the Beginning Value, the Ending Value, and any Dividends or Distributions received.

To accurately calculate YTD return, you’ll need to know the Beginning Value of your investment. This is the value of your investment on January 1st of the current year. Next, determine the Ending Value, which represents the value of your investment on the current date. Finally, account for any Dividends or Distributions you’ve received throughout the year. These represent income generated by your investment and should be included in the calculation to provide a complete picture of your return.

The formula for how to calculate ytd return is as follows: YTD Return = [(Ending Value – Beginning Value + Dividends/Distributions) / Beginning Value] * 100. Let’s break this down further. First, subtract the Beginning Value from the Ending Value. Then, add any Dividends or Distributions received. This gives you the total change in value, including income. Divide this result by the Beginning Value to determine the rate of return. Finally, multiply by 100 to express the YTD return as a percentage. By following these steps, you can effectively assess how to calculate ytd return and the growth of your investments over the course of the year and helps you to understand how to calculate ytd return on your investments. Investors should understand how to calculate ytd return for any investment for measurement.

Calculating YTD Return: A Step-by-Step Walkthrough

To illustrate how to calculate YTD return, consider this example. Imagine you invested $10,000 on January 1st of the current year. As of today’s date, your investment is worth $11,000. During this period, you also received $200 in dividends. This section provides a step-by-step guide on how to calculate ytd return.

Step 1: Determine the Beginning Value. The beginning value of your investment is the value on January 1st. In this case, it’s $10,000. Step 2: Determine the Ending Value. The ending value is the current value of your investment. Here, it’s $11,000. Step 3: Account for Dividends/Distributions. Note any dividends or distributions received during the year. In our example, it’s $200. Step 4: Apply the YTD Return Formula. The formula is: YTD Return = ((Ending Value – Beginning Value + Dividends) / Beginning Value) * 100. Step 5: Perform the Calculation. ((11000 – 10000 + 200) / 10000) * 100. This simplifies to (1200 / 10000) * 100. Step 6: Calculate the Result. 0.12 * 100 = 12%. Therefore, your YTD return is 12%. This detailed example showed how to calculate ytd return.

Let’s break down how to calculate ytd return a bit further. Suppose another investor started the year with $5,000. Their investment grew to $5,300, and they received $50 in dividends. Using the same formula: ((5300 – 5000 + 50) / 5000) * 100. This equals (350 / 5000) * 100, resulting in a 7% YTD return. Remember to accurately track your beginning value, ending value, and any dividends received. These figures are crucial for an accurate YTD return calculation. This method will teach you how to calculate ytd return easily. These practical examples offer a clear understanding of how to calculate ytd return.

Tools and Resources for Simplified YTD Calculations

Calculating YTD return can be simplified with various tools and resources. Investors no longer need to perform manual calculations. Several options are available to automate the process and enhance accuracy. Understanding how to calculate YTD return is easier than ever.

Brokerage account statements are a primary resource. These statements routinely provide YTD return information for investment accounts. The data is readily available and eliminates the need for manual tracking. These statements often include detailed breakdowns of gains, losses, and dividend payments. This feature makes it simple to assess investment performance. Online YTD calculators also offer a quick and easy way to determine YTD return. These calculators typically require inputting the beginning value, ending value, and any dividends or distributions received. They then automatically compute the YTD return. Many financial websites provide these calculators free of charge.

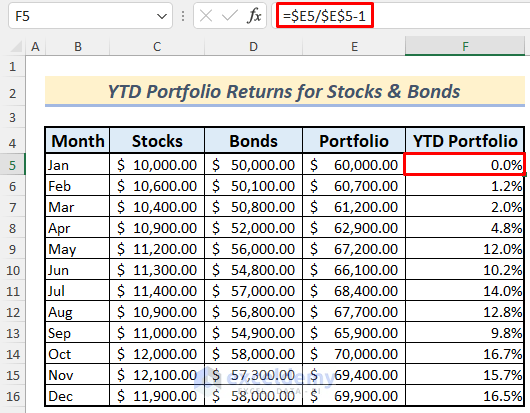

Spreadsheet templates represent another useful tool for calculating YTD return. Programs like Microsoft Excel and Google Sheets can be customized. Investors can create their own YTD return trackers. These templates allow for detailed tracking of investments, dividends, and other relevant data. Users can input formulas to automate the calculation process. The templates can be tailored to specific investment portfolios. They provide flexibility and control over performance tracking. The convenience and accuracy of these tools and resources cannot be overstated. They save investors time and effort while providing reliable YTD return data. Knowing how to calculate YTD return is valuable. However, these resources make the process far more efficient. Investors can focus on analyzing their performance. They can also make informed investment decisions. Rather than spending time on tedious calculations.

Beyond Simple Returns: Interpreting Your YTD Performance

Interpreting your Year-to-Date (YTD) performance is crucial for understanding investment success. However, there’s no universally “good” or “bad” YTD return. Assessing performance requires context, as it’s relative to several factors. These factors include the specific asset class, prevailing market conditions, and your individual investment goals. Knowing how to calculate ytd return is only the first step; understanding what it means is equally important.

A YTD return of 10% might seem impressive. But, if the stock market, as measured by the S&P 500 index, has risen by 15% during the same period, your investment has underperformed relative to the benchmark. Conversely, a YTD return of 3% could be considered strong if you’re invested in a low-risk bond fund during a period of economic uncertainty. Therefore, establishing a benchmark is essential. Benchmarking involves comparing your investment’s performance against a relevant market index or a similar investment. For stock portfolios, the S&P 500 or the Nasdaq Composite are common benchmarks. For bond portfolios, look to appropriate bond indexes. Understanding how to calculate ytd return in relation to these benchmarks provides a more realistic view of your investment’s effectiveness.

Furthermore, your investment objectives and risk tolerance play a significant role in interpreting YTD performance. If you are a conservative investor seeking capital preservation, a lower YTD return might be acceptable. Especially, if it means avoiding substantial losses during market downturns. On the other hand, an aggressive investor pursuing high growth would likely expect a higher YTD return. They should be willing to accept greater volatility. Before concluding whether your YTD return is satisfactory, carefully consider your personal financial situation, investment timeline, and risk appetite. Learning how to calculate ytd return and putting it into the proper perspective is key to making sound financial decisions. Remember that past performance is not indicative of future results.

Factors Influencing Your Year-to-Date Investment Results

Numerous external factors can significantly impact your year-to-date (YTD) investment returns. Understanding these influences is crucial when evaluating performance and making informed investment decisions. Market volatility, economic news, and interest rate changes are some of the most prominent drivers. These elements can create both opportunities and risks for investors seeking how to calculate ytd return effectively.

Market volatility, often measured by indexes like the VIX, reflects the degree of price fluctuations in the market. High volatility can lead to substantial swings in investment values, impacting YTD returns positively or negatively. Economic news, including reports on inflation, unemployment, and GDP growth, also plays a vital role. Positive economic data typically boosts investor confidence and market performance, while negative news can trigger sell-offs and declines. Interest rate changes, implemented by central banks, affect borrowing costs for companies and consumers. Rising interest rates can dampen economic activity and potentially lower investment returns. Conversely, falling rates can stimulate growth and increase asset values. How to calculate ytd return must consider the influence of these major market forces.

Other factors impacting YTD performance include geopolitical events, industry-specific trends, and even seasonal patterns. For example, unexpected political developments or shifts in government policies can create uncertainty and affect investor sentiment. Understanding these macroeconomic and microeconomic factors is essential for making informed investment decisions and interpreting YTD returns accurately. Successful investors consider these external influences and adjust their strategies accordingly. Paying attention to these factors, along with a clear understanding of how to calculate ytd return, helps investors navigate the complexities of the market and achieve their financial goals.

YTD Return vs. Other Performance Metrics: A Comparison

Understanding investment performance requires looking at various metrics. YTD return is just one piece of the puzzle. It’s important to compare it with other measures like annual return, total return, and ROI (Return on Investment) to get a complete picture. This section will explore the strengths and weaknesses of each, clarifying when each is most useful for investors seeking to understand how to calculate ytd return.

Annual return reflects the performance of an investment over a full year. It is useful for comparing returns across different years. Unlike YTD return, which only covers a portion of the year, the annual return provides a standardized measure. Total return, on the other hand, represents the entire return of an investment over its lifespan. It accounts for all capital gains, losses, dividends, and distributions. Total return offers a long-term perspective. It is especially valuable for investments held for several years. ROI (Return on Investment) is a broader measure of profitability. It assesses the efficiency of an investment relative to its cost. ROI is often expressed as a percentage. It’s calculated by dividing the net profit by the cost of the investment. While ROI is simple to understand, it doesn’t always account for the time value of money. This means that a higher ROI might not always be better if it takes significantly longer to achieve. When considering how to calculate ytd return, remember it’s a snapshot, not the whole story.

YTD return is most useful for tracking current-year performance. It allows investors to quickly assess how their investments are performing in the present market environment. This helps in making timely adjustments to their portfolios. However, YTD return can be misleading if viewed in isolation. For instance, a high YTD return early in the year might not be sustainable. Similarly, a low YTD return might recover later in the year. Annual return provides a more stable and comprehensive view. Total return is crucial for evaluating long-term investment success. It reveals the overall profitability of an investment from start to finish. ROI is helpful for comparing different investment opportunities. It helps in determining which investments offer the best return for the capital invested. By understanding the differences between these metrics, investors can make more informed decisions. They can better assess their investment performance and align their strategies with their financial goals. Knowing how to calculate ytd return offers valuable insight, but comparing it to other metrics is essential for a holistic understanding.

Using YTD Returns to Inform Investment Decisions

Year-to-date (YTD) return serves as a valuable data point when making investment decisions. It offers a snapshot of investment performance during the current calendar year. Investors can leverage this information to assess whether their investments are on track to meet their financial goals. Knowing how to calculate YTD return provides crucial insights.

However, it’s crucial to avoid making investment decisions based solely on YTD return. A single year’s performance does not paint the entire picture. Instead, consider it within the context of the overall investment strategy, risk tolerance, and long-term objectives. For instance, a lower-than-expected YTD return might prompt a review of asset allocation. It is an opportunity to ensure it aligns with the investor’s risk profile. Conversely, a high YTD return may indicate an opportunity to rebalance the portfolio and lock in gains. Understanding how to calculate YTD return empowers investors to manage their portfolios actively.

Furthermore, remember that external factors significantly influence investment performance. Market volatility, economic shifts, and changes in interest rates can all impact YTD returns. Therefore, consider these factors when interpreting investment results. It is recommended to consult with a qualified financial advisor. A financial advisor can provide personalized advice. They can consider individual circumstances and financial goals. While learning how to calculate YTD return is beneficial, professional guidance ensures well-informed and strategic investment decisions. Do not underestimate the power of understanding how to calculate ytd return, as it can significantly impact your investment journey.

:max_bytes(150000):strip_icc()/Investing-Tips-for-Better-Investment-Results-581b54fa3df78cc2e842a4d5.jpg)