Understanding the Importance of Year-to-Date Returns in Investment Analysis

In the realm of investment analysis, accurately calculating year-to-date returns is crucial for evaluating portfolio performance and making informed investment decisions. Year-to-date returns provide a snapshot of an investment’s performance over a specific period, typically from the beginning of the year to the present date. This metric is essential for investors, as it helps them assess their investment’s progress, identify areas for improvement, and adjust their strategies accordingly. By grasping the concept of year-to-date returns, investors can gain valuable insights into their investment’s performance, enabling them to make data-driven decisions that drive long-term success. In fact, learning how to calculate year to date return is a fundamental skill for any investor seeking to optimize their portfolio’s performance. In this article, we will delve into the world of year-to-date returns, exploring the importance of this metric and providing a step-by-step guide on how to calculate it.

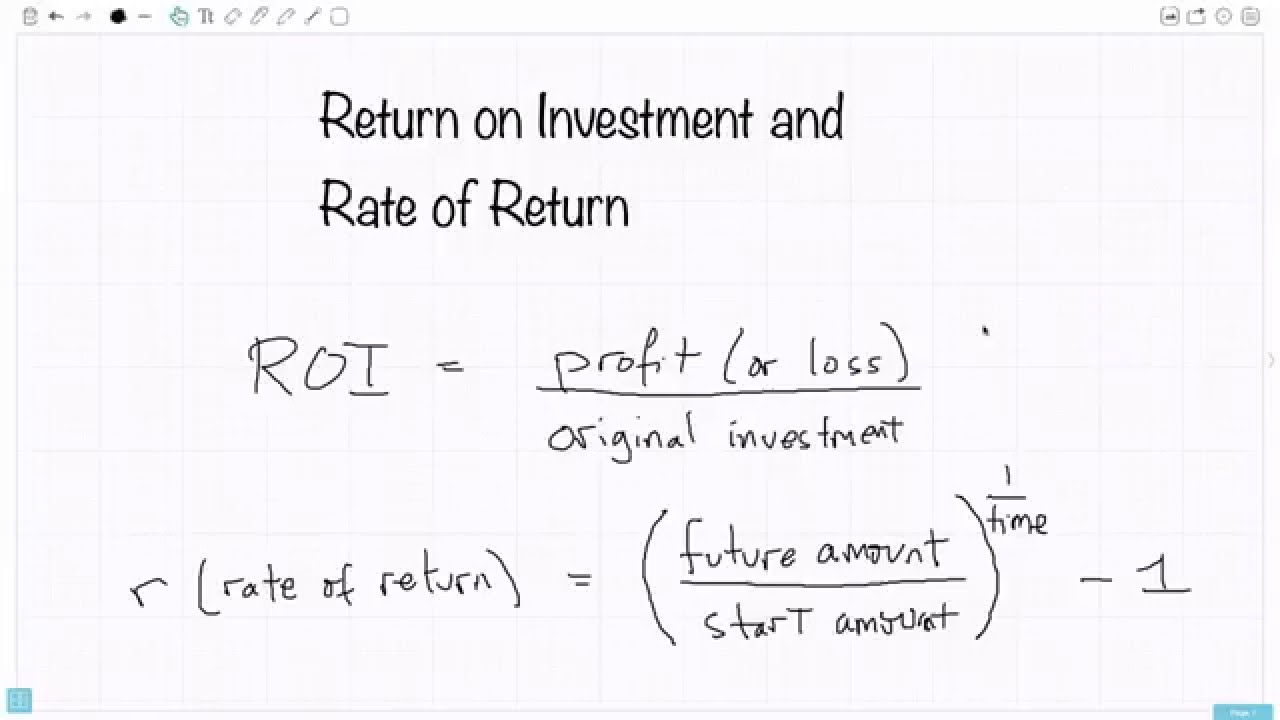

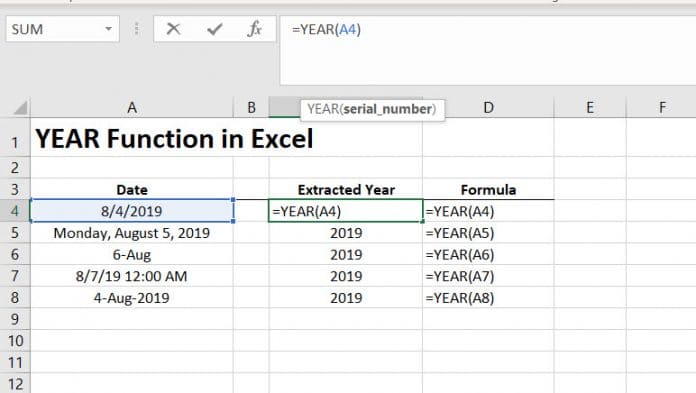

How to Calculate Year-to-Date Returns: A Simple Formula

The formula to calculate year-to-date returns is straightforward and involves a few key variables. The year-to-date return is calculated by dividing the total value of the investment at the end of the period by its initial value, and then subtracting 1. The formula can be expressed as: ((Current Value – Initial Value) / Initial Value) + 1. This formula takes into account any dividends, interest, or capital gains that have accrued over the period, providing a comprehensive picture of the investment’s performance. To accurately calculate year-to-date returns, it is essential to have precise data on the initial investment, any dividends or interest earned, and the current value of the investment. By mastering this simple formula, investors can learn how to calculate year to date return and gain valuable insights into their investment’s performance.

Breaking Down the Calculation: Understanding the Components of Year-to-Date Returns

When calculating year-to-date returns, it’s essential to understand the components that make up this metric. The initial investment, dividends, and capital gains are the three primary components that determine the overall return. The initial investment refers to the principal amount invested at the beginning of the period. Dividends represent the income earned from the investment, such as interest or dividend payments. Capital gains, on the other hand, represent the profit or loss resulting from the sale of an investment. To accurately calculate year-to-date returns, investors must account for these components and their impact on the investment’s overall performance. For instance, if an investor receives dividend payments during the period, these payments will increase the total value of the investment, thereby affecting the year-to-date return. Similarly, capital gains or losses will also influence the overall return. By grasping the role of these components, investors can better understand how to calculate year to date return and make informed investment decisions.

Real-World Examples: Calculating Year-to-Date Returns for Different Investment Scenarios

To illustrate the practical application of the year-to-date return formula, let’s consider three real-world examples: stocks, bonds, and mutual funds. In each scenario, we’ll demonstrate how to calculate year-to-date returns and provide insights into the investment’s performance.

Example 1: Stocks – Suppose an investor purchased 100 shares of XYZ Inc. stock at the beginning of the year for $50 per share. By the end of the year, the stock price has risen to $60 per share, and the investor has received a $200 dividend. To calculate the year-to-date return, we would use the formula: ((6000 – 5000) / 5000) + 1 = 20%. This indicates that the investment has generated a 20% return over the year.

Example 2: Bonds – Consider a bond with a face value of $1,000 and a 5% annual coupon rate. At the end of the year, the bond’s market value has increased to $1,050. To calculate the year-to-date return, we would use the formula: ((1050 – 1000) / 1000) + 1 = 5%. This indicates that the bond has generated a 5% return over the year.

Example 3: Mutual Funds – Suppose an investor invested $10,000 in a mutual fund at the beginning of the year. By the end of the year, the fund’s net asset value (NAV) has increased to $11,200. To calculate the year-to-date return, we would use the formula: ((11200 – 10000) / 10000) + 1 = 12%. This indicates that the mutual fund has generated a 12% return over the year.

These examples demonstrate how to calculate year-to-date returns for different investment scenarios, providing investors with a clear understanding of their investment’s performance. By applying the formula to various investment types, investors can gain valuable insights into their portfolio’s performance and make informed investment decisions.

Common Pitfalls to Avoid When Calculating Year-to-Date Returns

When calculating year-to-date returns, it’s essential to avoid common mistakes that can lead to inaccurate results and misguided investment decisions. Here are some common pitfalls to watch out for:

Incorrect Data: One of the most critical errors is using incorrect or outdated data. Ensure that the initial investment, dividends, and capital gains are accurate and up-to-date. A small mistake in data can significantly impact the year-to-date return calculation.

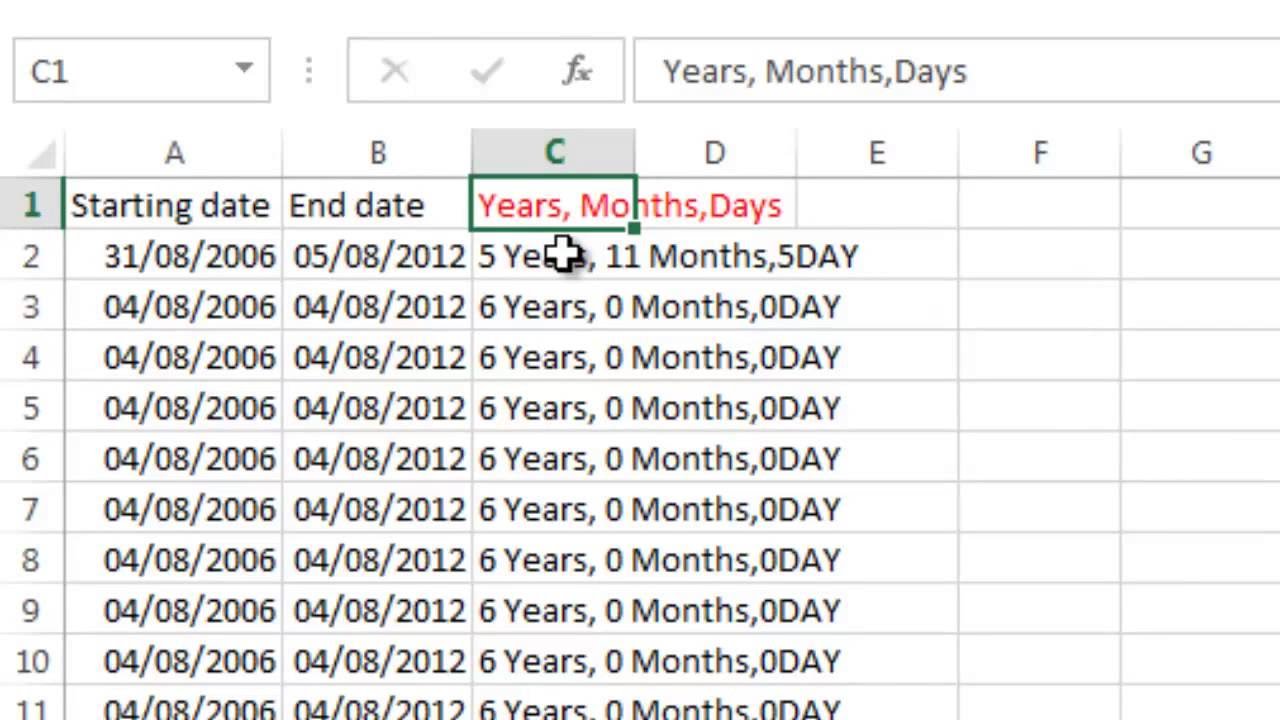

Inconsistent Time Periods: Another common mistake is using inconsistent time periods. When calculating year-to-date returns, it’s essential to use a consistent time period, such as a calendar year or a fiscal year. Inconsistent time periods can lead to inaccurate comparisons and misguided investment decisions.

Neglecting Compounding Effects: Failing to account for compounding effects can also lead to inaccurate year-to-date returns. Compounding occurs when returns are reinvested, generating additional returns. Neglecting compounding effects can result in underestimating or overestimating the true return on investment.

Ignoring Fees and Expenses: Investors should also consider fees and expenses when calculating year-to-date returns. Fees and expenses can significantly impact the overall return on investment, and ignoring them can lead to inaccurate results.

By being aware of these common pitfalls, investors can ensure accurate year-to-date return calculations and make informed investment decisions. Remember, accurately calculating year-to-date returns is crucial for evaluating portfolio performance and driving investment success.

Using Year-to-Date Returns to Inform Investment Decisions

Accurately calculating year-to-date returns is only the first step in unlocking investment insights. The true value of year-to-date returns lies in their ability to inform investment decisions and drive portfolio performance. Here are some ways to interpret year-to-date returns and use them to make informed investment decisions:

Rebalancing Portfolios: Year-to-date returns can help identify areas of the portfolio that require rebalancing. By comparing the returns of different asset classes, investors can adjust their portfolio allocations to maintain an optimal risk-return profile.

Adjusting Asset Allocations: Year-to-date returns can also inform decisions about asset allocation. For example, if a particular asset class has underperformed, investors may consider reallocating funds to a more promising investment opportunity.

Evaluating Investment Strategies: Year-to-date returns provide a valuable benchmark for evaluating the effectiveness of investment strategies. By comparing returns across different strategies, investors can identify areas for improvement and optimize their investment approach.

Identifying Trends and Patterns: Year-to-date returns can help identify trends and patterns in the market, allowing investors to make more informed decisions about their investments. By analyzing returns over time, investors can identify areas of strength and weakness in their portfolio.

By using year-to-date returns to inform investment decisions, investors can optimize their portfolio performance, minimize risk, and maximize returns. Remember, accurately calculating year-to-date returns is crucial for making informed investment decisions and driving long-term investment success.

Year-to-Date Returns in the Context of Overall Portfolio Performance

Year-to-date returns are a crucial component of evaluating overall portfolio performance. However, they should not be viewed in isolation. To gain a comprehensive understanding of portfolio performance, it’s essential to consider year-to-date returns in conjunction with other metrics.

One such metric is the Sharpe ratio, which measures the excess return of an investment over the risk-free rate, relative to its volatility. By combining year-to-date returns with the Sharpe ratio, investors can gain a better understanding of the risk-adjusted performance of their portfolio.

Another important metric is standard deviation, which measures the volatility of an investment. By analyzing year-to-date returns in conjunction with standard deviation, investors can identify areas of their portfolio that may be too risky or too conservative.

Additionally, year-to-date returns can be used to evaluate the performance of different asset classes within a portfolio. By comparing the year-to-date returns of different asset classes, investors can identify areas of strength and weakness, and make informed decisions about asset allocation.

Ultimately, year-to-date returns are a powerful tool for evaluating portfolio performance and making informed investment decisions. By combining them with other metrics and considering them in the context of overall portfolio performance, investors can optimize their investment strategy and drive long-term success.

Conclusion: Mastering the Art of Calculating Year-to-Date Returns for Investment Success

In conclusion, accurately calculating year-to-date returns is a crucial step in unlocking investment insights and driving informed investment decisions. By understanding the importance of year-to-date returns, mastering the simple formula, and avoiding common pitfalls, investors can gain a deeper understanding of their portfolio’s performance.

By applying the concepts outlined in this article, investors can learn how to calculate year to date return and use it to inform investment decisions, such as rebalancing portfolios, adjusting asset allocations, and evaluating investment strategies. Additionally, by considering year-to-date returns in the context of overall portfolio performance, investors can optimize their investment strategy and drive long-term success.

Remember, accurately calculating year-to-date returns is not a one-time task, but rather an ongoing process that requires regular monitoring and analysis. By committing to mastering the art of calculating year-to-date returns, investors can unlock the full potential of their investments and achieve their financial goals.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-02-6e3072bd99d74ee4a0492e799e21560b.jpg)