What is Unlevered Beta and Why is it Important?

In the realm of finance, understanding risk is crucial for making informed investment decisions. One key metric used to measure risk is beta, which comes in two forms: levered and unlevered. Unlevered beta, in particular, plays a vital role in investment analysis and portfolio management.

Unlevered beta, also known as asset beta, is a measure of a company’s underlying business risk, excluding the impact of debt. It represents the volatility of a company’s assets, providing insights into its inherent risk profile. This metric is essential for investors and analysts, as it helps them understand a company’s potential returns and make informed investment decisions.

The importance of unlevered beta lies in its ability to provide a more accurate representation of a company’s business risk, unencumbered by the effects of debt. By understanding a company’s unlevered beta, investors can gain a better understanding of its true risk profile and make more informed decisions. This is particularly important for companies with high levels of debt, as their levered beta may not accurately reflect their underlying risk profile.

As investors and analysts, understanding how to calculate unlevered beta is crucial for making informed investment decisions. In the following sections, we will delve into the formula for calculating unlevered beta, walk through a step-by-step approach to calculating it, and discuss the role of debt in unlevered beta calculation.

Understanding the Formula: A Breakdown of the Unlevered Beta Calculation

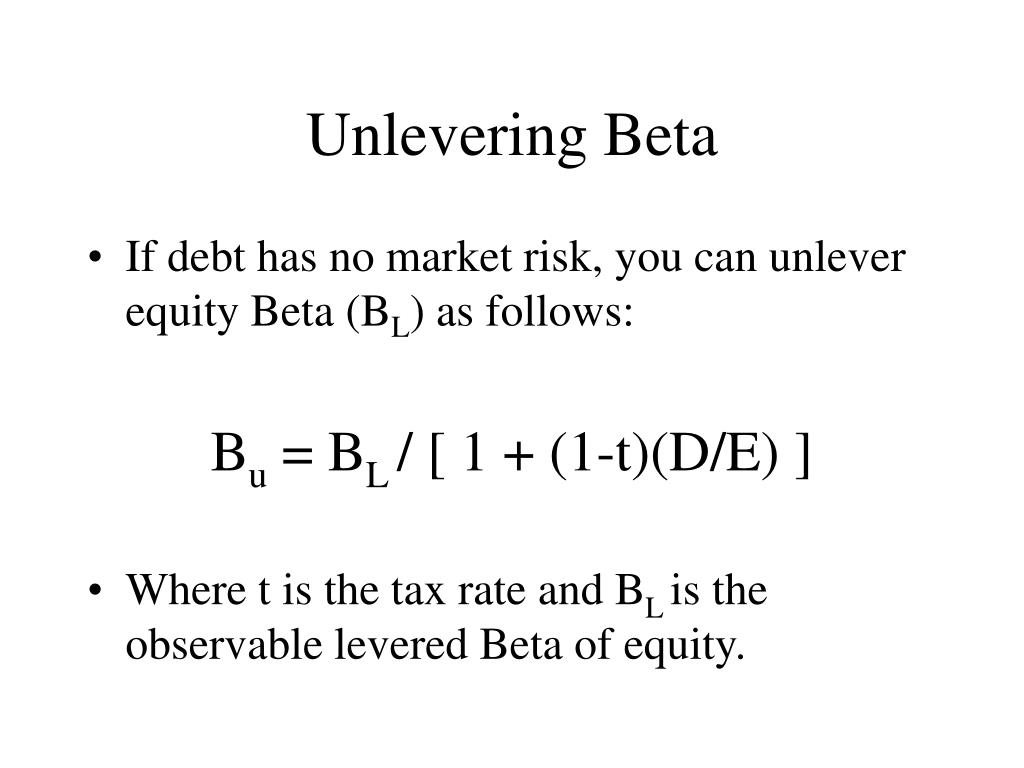

The formula for calculating unlevered beta is a crucial aspect of understanding how to calculate unlevered beta. The formula is as follows:

Unlevered Beta (βu) = Levered Beta (βl) / (1 + (1 – Tax Rate) * (Debt/Equity))

Let’s break down each component of the formula and understand their roles:

Levered Beta (βl): This is the beta of the company with debt, which can be obtained from financial databases or calculated using historical stock returns.

Tax Rate: This is the company’s effective tax rate, which can be found in the company’s financial statements.

Debt/Equity: This is the company’s debt-to-equity ratio, which can be calculated by dividing the company’s total debt by its total equity.

The formula adjusts the levered beta by removing the effect of debt, providing a more accurate representation of the company’s underlying business risk. By understanding each component of the formula, investors and analysts can gain a deeper understanding of how to calculate unlevered beta and make more informed investment decisions.

In the next section, we will walk through a step-by-step approach to calculating unlevered beta, providing examples to illustrate the process.

How to Calculate Unlevered Beta: A Step-by-Step Approach

To calculate unlevered beta, follow these steps:

Step 1: Gather the necessary data

Collect the company’s levered beta, tax rate, debt, and equity values. These values can be found in the company’s financial statements or obtained from financial databases.

Step 2: Calculate the debt-to-equity ratio

Divide the company’s total debt by its total equity to obtain the debt-to-equity ratio.

Step 3: Calculate the unlevered beta

Plug the values into the formula: Unlevered Beta (βu) = Levered Beta (βl) / (1 + (1 – Tax Rate) * (Debt/Equity)).

Step 4: Interpret the results

The resulting unlevered beta value represents the company’s underlying business risk, excluding the impact of debt. This value can be used to evaluate investment opportunities and make informed decisions.

Example:

Let’s say we want to calculate the unlevered beta of a company with a levered beta of 1.2, a tax rate of 25%, and a debt-to-equity ratio of 0.5. Plugging these values into the formula, we get:

Unlevered Beta (βu) = 1.2 / (1 + (1 – 0.25) * 0.5) = 0.96

In this example, the company’s unlevered beta is 0.96, indicating a relatively low level of business risk.

By following these steps and understanding how to calculate unlevered beta, investors and analysts can gain a deeper understanding of a company’s risk profile and make more informed investment decisions.

The Role of Debt in Unlevered Beta Calculation

Debt plays a crucial role in the calculation of unlevered beta, as it affects the company’s risk profile and capital structure. The debt-to-equity ratio, in particular, is a key component of the unlevered beta formula, as it represents the proportion of debt financing used by the company.

The impact of debt on unlevered beta can be significant. When a company takes on more debt, its levered beta increases, reflecting the added risk of debt financing. However, when calculating unlevered beta, the debt effect is removed, providing a more accurate representation of the company’s underlying business risk.

To account for debt in the formula, the debt-to-equity ratio is used to adjust the levered beta. This adjustment is necessary because debt financing increases the company’s risk, which is not reflected in the unlevered beta calculation. By incorporating the debt-to-equity ratio, the formula provides a more accurate representation of the company’s risk profile.

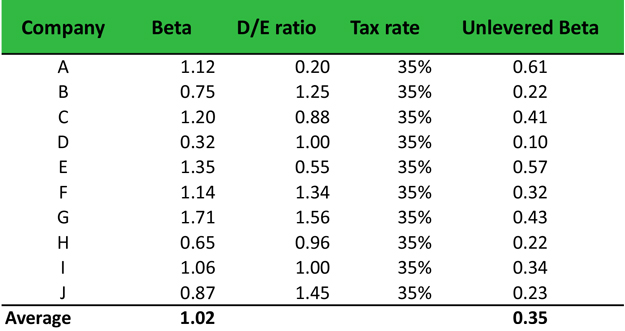

For example, let’s consider two companies with identical business risk profiles but different capital structures. Company A has a debt-to-equity ratio of 0.5, while Company B has a debt-to-equity ratio of 1.0. If both companies have a levered beta of 1.2, the unlevered beta calculation would yield different results due to the differing debt levels.

In this example, Company A’s unlevered beta would be lower than Company B’s, reflecting the lower level of debt financing. This highlights the importance of considering debt when calculating unlevered beta, as it can significantly impact the outcome.

By understanding the role of debt in unlevered beta calculation, investors and analysts can gain a more accurate understanding of a company’s risk profile and make more informed investment decisions. In the next section, we will discuss common mistakes to avoid when calculating unlevered beta.

Common Mistakes to Avoid When Calculating Unlevered Beta

When calculating unlevered beta, it’s essential to avoid common mistakes that can lead to inaccurate results. These errors can have significant consequences, influencing investment decisions and portfolio management. Here are some common mistakes to watch out for:

Incorrectly estimating the debt-to-equity ratio: This ratio is a critical component of the unlevered beta formula. Ensure that the debt and equity values are accurate and up-to-date to avoid errors.

Failing to account for tax rates: The tax rate affects the unlevered beta calculation, so it’s crucial to use the correct tax rate for the company. Ignoring or misestimating tax rates can lead to inaccurate results.

Using incorrect or outdated data: Ensure that the data used for the calculation is current and accurate. Outdated or incorrect data can lead to misleading results.

Not considering the company’s capital structure: The capital structure of the company, including the debt-to-equity ratio, affects the unlevered beta calculation. Failing to consider this can lead to inaccurate results.

Not understanding the differences between levered and unlevered beta: It’s essential to understand the differences between levered and unlevered beta and when to use each. Misusing these metrics can lead to incorrect investment decisions.

To avoid these mistakes, it’s crucial to carefully gather and review the necessary data, understand the formula and its components, and double-check calculations. By doing so, investors and analysts can ensure accurate unlevered beta calculations and make informed investment decisions.

By being aware of these common mistakes, investors and analysts can take steps to avoid them and ensure accurate calculations. In the next section, we will explore real-world applications of unlevered beta and how it is used in investment analysis and portfolio management.

Real-World Applications of Unlevered Beta: Case Studies and Examples

Unlevered beta is a powerful tool in investment analysis and portfolio management. It provides a more accurate representation of a company’s underlying business risk, allowing investors and analysts to make informed decisions. Here are some real-world examples of how unlevered beta is used:

Case Study 1: Evaluating Investment Opportunities

A portfolio manager is considering investing in two companies, Company A and Company B, both in the same industry. By calculating the unlevered beta of each company, the manager can compare their underlying business risk and make a more informed decision. If Company A has a lower unlevered beta, it may be considered a safer investment opportunity.

Case Study 2: Portfolio Optimization

An investment firm is looking to optimize its portfolio by minimizing risk while maximizing returns. By calculating the unlevered beta of each stock in the portfolio, the firm can identify areas of high risk and adjust the portfolio accordingly. This can help to reduce overall portfolio risk and improve returns.

Example: Using Unlevered Beta to Evaluate Mergers and Acquisitions

When evaluating a potential merger or acquisition, unlevered beta can be used to assess the underlying business risk of the target company. This can help to identify potential risks and opportunities, and inform the investment decision.

In each of these examples, unlevered beta provides a more accurate representation of a company’s underlying business risk, allowing investors and analysts to make informed decisions. By understanding how to calculate unlevered beta and its applications, investors can gain a competitive edge in the market.

In the next section, we will explore the differences between unlevered beta and levered beta, and discuss when to use each.

Unlevered Beta vs. Levered Beta: What’s the Difference?

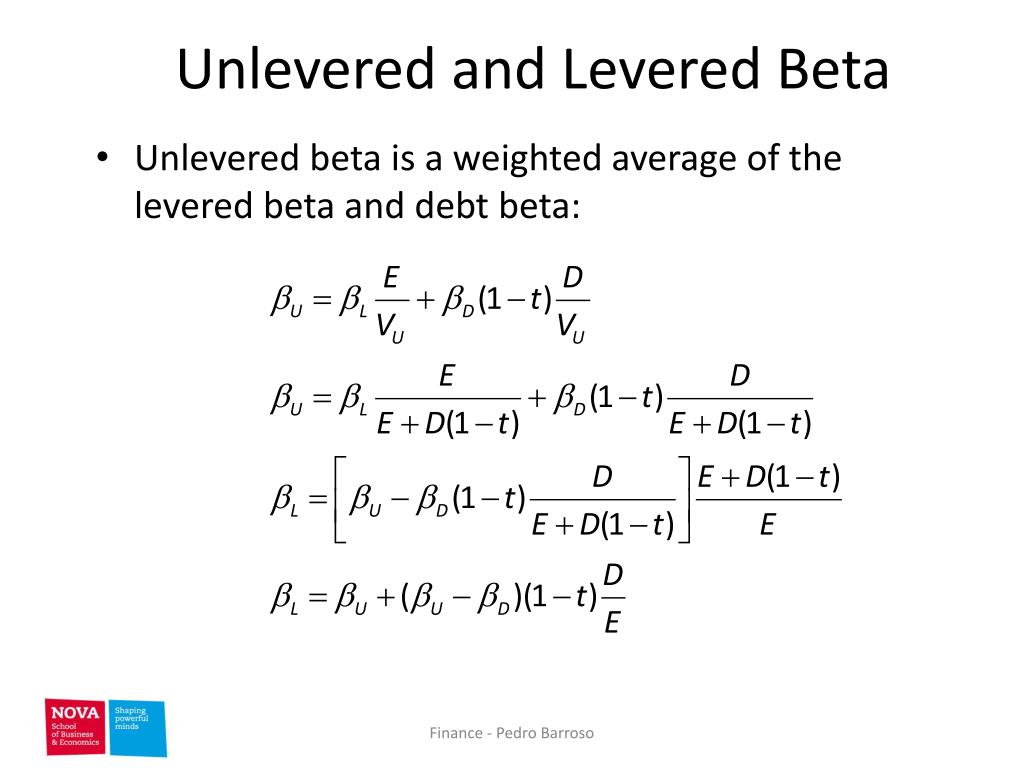

When it comes to calculating beta, there are two types: unlevered beta and levered beta. While both metrics measure a company’s risk, they differ in their calculation and application. Understanding the differences between unlevered beta and levered beta is crucial for investors and analysts to make informed decisions.

Levered beta, also known as equity beta, takes into account a company’s debt and equity structure. It measures the risk of a company’s stock, including the impact of debt on its volatility. Levered beta is commonly used by investors to evaluate the risk of a specific stock or portfolio.

Unlevered beta, on the other hand, removes the impact of debt from the calculation, providing a more accurate representation of a company’s underlying business risk. This metric is useful for comparing companies with different capital structures or for evaluating the risk of a company’s assets.

The key differences between unlevered beta and levered beta lie in their calculation and application:

– Calculation: Levered beta is calculated using the company’s debt and equity structure, while unlevered beta is calculated using the company’s asset beta and debt-to-equity ratio.

– Application: Levered beta is used to evaluate the risk of a specific stock or portfolio, while unlevered beta is used to compare companies with different capital structures or to evaluate the risk of a company’s assets.

When to use each:

– Use levered beta when evaluating the risk of a specific stock or portfolio.

– Use unlevered beta when comparing companies with different capital structures or evaluating the risk of a company’s assets.

By understanding the differences between unlevered beta and levered beta, investors and analysts can gain a more complete understanding of a company’s risk profile and make informed decisions. In the next section, we will summarize the key takeaways from this article and provide a final thought on the importance of accurately calculating unlevered beta.

Conclusion: Mastering the Art of Unlevered Beta Calculation

In conclusion, understanding how to calculate unlevered beta is a crucial skill for investors and analysts. By mastering this concept, individuals can gain a more accurate understanding of a company’s underlying business risk and make informed investment decisions.

Throughout this article, we have covered the importance of unlevered beta, its calculation, and its applications. We have also discussed the differences between unlevered beta and levered beta, and how to avoid common mistakes when calculating unlevered beta.

To recap, unlevered beta is a powerful tool that provides a more accurate representation of a company’s underlying business risk. By removing the impact of debt from the calculation, investors and analysts can gain a better understanding of a company’s assets and make more informed decisions.

Remember, accurately calculating unlevered beta is crucial for investment analysis and portfolio management. By following the steps outlined in this article, individuals can master the art of unlevered beta calculation and gain a competitive edge in the market.

As you continue to learn about unlevered beta, remember to practice calculating it using real-world examples. This will help you to reinforce your understanding of the concept and apply it to your investment decisions. With time and practice, you will become proficient in calculating unlevered beta and making informed investment decisions.

By mastering the art of unlevered beta calculation, you will be able to unlock the secrets of this powerful financial metric and make more informed investment decisions. So, start practicing today and take your investment analysis to the next level!