What is Tracking Error and Why Does It Matter?

Tracking error serves as a vital metric in portfolio management, quantifying the divergence between a portfolio’s returns and those of its benchmark index. Understanding tracking error is paramount for both investors and portfolio managers because it sheds light on the active risk undertaken to achieve specific investment objectives. A well-defined understanding of how to calculate tracking risk is essential for evaluating the effectiveness of active portfolio management strategies.

In essence, tracking error illustrates the degree to which a portfolio’s performance deviates from its intended benchmark. A lower tracking error signifies that the portfolio closely mirrors the benchmark’s performance, indicating a more passive management style. Conversely, a higher tracking error suggests a more active approach, with the portfolio manager making deliberate investment decisions that differ from the benchmark’s composition. These decisions aim to generate returns exceeding the benchmark, a concept known as alpha. However, this active management also introduces the potential for underperformance, highlighting the inherent trade-off between risk and reward.

Why is it crucial to understand how to calculate tracking risk and manage it effectively? Firstly, it allows investors to assess whether the portfolio manager’s active bets are adding value or detracting from performance. Secondly, tracking error provides insights into the consistency of a portfolio’s returns relative to its benchmark. A portfolio with a consistently low tracking error is generally more predictable, while one with a high and fluctuating tracking error may be more volatile and less aligned with investor expectations. Therefore, understanding and effectively managing tracking error is not merely a technical exercise, but a cornerstone of informed investment decision-making and sound portfolio governance. Investors need to understand how to calculate tracking risk for comprehensive portfolio oversight. Properly calculating tracking risk and using it to assess portfolio performance and risk are critical factors in the realm of portfolio management.

How to Determine Tracking Error: Choosing the Right Calculation Method

Selecting the appropriate method to calculate tracking error is crucial for accurately assessing portfolio performance relative to its benchmark. Several methods exist, each with its strengths and weaknesses. The most common approach involves calculating the standard deviation of the difference between the portfolio’s returns and the benchmark’s returns over a specific period. This method, while straightforward, provides a valuable measure of dispersion around the average difference in returns. Understanding how to calculate tracking risk using standard deviation is a fundamental skill for portfolio managers.

The standard deviation method’s simplicity makes it appealing, but it’s essential to consider its limitations. It assumes that the differences in returns are normally distributed, which may not always be the case in real-world scenarios. Furthermore, it doesn’t provide insights into the direction of the deviations, only their magnitude. An alternative approach involves calculating the Information Ratio, which divides the active return (the difference between the portfolio’s return and the benchmark’s return) by the tracking error. The Information Ratio offers a risk-adjusted measure of active management performance, indicating the return generated per unit of tracking risk. When considering how to calculate tracking risk, one must weigh the benefits of simplicity against the need for more nuanced insights.

Other methods, such as calculating tracking error using regression analysis, offer more sophisticated approaches. Regression analysis can help identify the sources of tracking error and quantify the portfolio’s sensitivity to various factors. However, these methods often require more data and computational resources. The choice of method depends on the specific needs of the analysis, the availability of data, and the desired level of detail. Ultimately, a thorough understanding of how to calculate tracking risk empowers investors and portfolio managers to make informed decisions about portfolio construction and risk management. Regardless of the chosen method, consistency in application and a clear understanding of the results are paramount.

Gathering the Necessary Data for Accurate Calculation

To accurately assess portfolio performance and understand its relationship to a chosen benchmark, gathering precise and consistent data is paramount. Calculating tracking error requires a reliable stream of historical portfolio returns and corresponding benchmark returns over a defined period. The frequency of these returns (daily, weekly, monthly) will influence the granularity of the tracking error calculation. It’s vital to ensure both datasets cover the same time frame to avoid skewing the results.

The integrity of the data directly impacts the reliability of the how to calculate tracking risk. Potential sources of error can arise from inaccurate record-keeping, currency fluctuations (if the portfolio and benchmark are denominated in different currencies), or inconsistencies in the calculation of returns themselves. For example, dividends may be treated differently in the portfolio versus the benchmark data. Mitigating these errors involves careful validation of the data, cross-referencing with multiple sources where possible, and ensuring a standardized approach to return calculation across both the portfolio and the benchmark. Investment professionals often rely on specialized tools like Bloomberg Terminal or FactSet to obtain and validate market data. These platforms offer features for data cleaning and reconciliation, improving accuracy in how to calculate tracking risk.

Effective data collection also includes establishing clear protocols for handling corporate actions (e.g., mergers, acquisitions, stock splits). These events can significantly impact returns and should be accounted for consistently in both the portfolio and benchmark data. Furthermore, it’s essential to document all data sources and any adjustments made to the raw data to maintain transparency and auditability. Neglecting data accuracy can lead to a misleading tracking error calculation, resulting in poor investment decisions. Ultimately, robust data management practices are essential to how to calculate tracking risk and gain meaningful insights into active portfolio management strategies.

Step-by-Step Guide: Calculating Tracking Error Using Standard Deviation

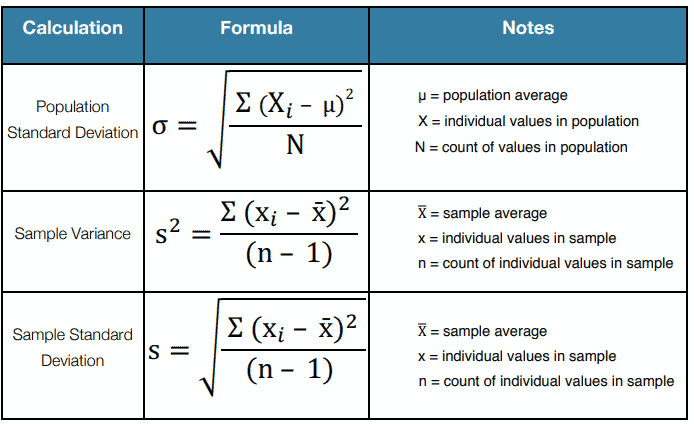

To understand how to calculate tracking risk effectively, a step-by-step guide using the standard deviation method is presented. This approach offers a clear and statistically sound way to quantify the divergence between a portfolio’s returns and its benchmark’s returns. The formula for tracking error, when calculated using standard deviation, is the standard deviation of the difference between the portfolio’s returns and the benchmark’s returns over a specific period.

Step 1 involves gathering the necessary data. Obtain historical returns for both the portfolio and its benchmark for the period under analysis. These returns should be calculated for the same time intervals (e.g., daily, weekly, or monthly). Consistency in the frequency of returns is paramount. Step 2 consists of calculating the difference in returns. For each period, subtract the benchmark’s return from the portfolio’s return. This difference represents the active return, or the excess return, generated by the portfolio relative to the benchmark for that specific period. Step 3 focuses on calculating the standard deviation of these differences. This standard deviation represents the tracking error. The formula is: Tracking Error = Standard Deviation (Portfolio Return – Benchmark Return). Use a spreadsheet program or statistical software to compute the standard deviation of the series of return differences. For example, consider a scenario where a portfolio and its benchmark have the following monthly returns (%): Month 1 (2, 1), Month 2 (3, 2), and Month 3 (1, 0). The return differences would be 1, 1, and 1. If you want to know how to calculate tracking risk, the standard deviation of these differences (1, 1, and 1) is 0, meaning there is no tracking error.

Several challenges may arise during the calculation process. One common pitfall is inconsistent data. Ensure that both portfolio and benchmark returns are calculated using the same methodology and time periods. Another challenge is dealing with missing data. Impute missing values using appropriate statistical techniques, or exclude periods with missing data if their impact is minimal. Understanding how to calculate tracking risk requires careful attention to data quality and consistency. Accurate tracking error calculation provides insights into the portfolio’s active management and risk profile, helping investors make informed decisions. Remember to annualize the tracking error by multiplying the monthly tracking error by the square root of 12 to get the annual tracking error, providing a more interpretable measure of risk.

Interpreting Tracking Error Results: What Does the Number Mean?

Tracking error, expressed as a percentage, quantifies the divergence between a portfolio’s returns and its benchmark’s returns. Understanding how to interpret this value is crucial for evaluating investment performance and risk. A lower tracking error signifies that the portfolio closely mirrors the benchmark, indicating a more passive investment strategy. Conversely, a higher tracking error suggests a more active approach, potentially leading to greater outperformance or underperformance. How to calculate tracking risk is related to the level of risk a portfolio manager is willing to take to beat the benchmark. An investor must understand how to calculate tracking risk and the implications of different tracking error values. Investment strategy is linked on how to calculate tracking risk and to the degree of active management.

The magnitude of acceptable tracking error is subjective and depends heavily on the investor’s objectives and risk tolerance. A conservative investor seeking to replicate benchmark performance might prefer a low tracking error, typically below 2%. An aggressive investor aiming for substantial outperformance might accept a higher tracking error, potentially exceeding 5%. Several factors can influence tracking error, including the investment strategy, portfolio construction techniques, and prevailing market conditions. A concentrated portfolio with significant active bets will generally exhibit a higher tracking error than a well-diversified portfolio that closely resembles the benchmark. Furthermore, volatile market conditions can amplify tracking error as active positions experience greater fluctuations in value.

Contextually, tracking error should be evaluated in conjunction with other performance metrics, such as the information ratio and alpha. The information ratio measures the portfolio’s excess return per unit of tracking error, providing a risk-adjusted measure of active management skill. Alpha represents the portfolio’s excess return relative to the benchmark, independent of market movements. By analyzing tracking error alongside these metrics, investors can gain a more comprehensive understanding of the portfolio’s performance and the effectiveness of the investment strategy. A high tracking error without a correspondingly high information ratio or alpha might indicate excessive risk-taking without commensurate rewards. Ultimately, interpreting tracking error requires careful consideration of the investment objectives, risk tolerance, and the specific characteristics of the portfolio and its benchmark. It’s crucial to know how to calculate tracking risk to manage portfolio performance effectively. Understanding how to calculate tracking risk helps assess if the active management is generating sufficient returns for the risk taken.

Factors Influencing Tracking Error: Understanding the Drivers

Tracking error, the divergence between a portfolio’s returns and its benchmark, is influenced by several interconnected factors. Understanding these drivers is crucial for portfolio managers aiming to manage and control this risk metric. Active bets, representing intentional deviations from the benchmark’s composition, are primary contributors. These bets can involve overweighting or underweighting specific sectors, industries, or individual securities. The magnitude and success of these active bets directly impact the observed tracking error.

Sector allocation decisions also play a significant role in determining tracking error. If a portfolio manager strategically overweights a particular sector that subsequently underperforms the benchmark, the portfolio will likely experience negative tracking error. Conversely, successful sector allocation can lead to positive tracking error. Security selection, the process of choosing individual securities within a given sector or asset class, also contributes. Superior security selection, where the portfolio manager identifies and invests in securities that outperform their peers, can generate positive tracking error. Conversely, poor security selection can detract from performance and increase tracking error. How to calculate tracking risk involves understanding these allocation impacts.

Trading costs, often overlooked, can erode returns and contribute to tracking error. Frequent trading, while potentially aimed at capturing short-term opportunities, incurs transaction costs that can negatively impact performance, especially if the trades are not profitable. Furthermore, diversification, or lack thereof, influences tracking error. A poorly diversified portfolio, heavily concentrated in a few securities or sectors, is more likely to deviate significantly from its benchmark. Unforeseen events impacting those specific holdings can have a pronounced effect on the portfolio’s overall performance, leading to higher tracking error. How to calculate tracking risk effectively includes considering the impact of diversification. For example, a portfolio heavily invested in technology stocks will exhibit a higher tracking error compared to a broad market index than a more diversified portfolio. By understanding these factors and their interplay, portfolio managers can proactively manage and control tracking error to align with investment objectives.

Managing and Controlling Tracking Error: Strategies for Portfolio Optimization

Effective management of tracking error is crucial for aligning portfolio performance with investment objectives. One of the primary strategies involves setting explicit tracking error limits. These limits define the acceptable range of deviation from the benchmark, providing a clear framework for portfolio construction and risk management. Diversification plays a pivotal role in controlling tracking error. By spreading investments across various asset classes, sectors, and geographic regions, portfolio managers can reduce the impact of individual security movements on overall portfolio performance, thus keeping it closely aligned with the benchmark.

Another important strategy is the use of risk management tools. These tools help to monitor and analyze the sources of tracking error, enabling portfolio managers to make informed decisions about portfolio adjustments. Scenario analysis can be employed to assess the potential impact of different market conditions on tracking error, allowing for proactive risk mitigation. There are trade-offs between active management, tracking error, and investment costs. Pursuing higher returns through active strategies often leads to increased tracking error and higher management fees. A careful balance must be struck to ensure that the potential benefits of active management outweigh the associated costs and risks. Understanding how to calculate tracking risk is paramount when applying these strategies.

Portfolio optimization techniques can be used to achieve desired risk and return objectives while controlling tracking error. These techniques involve constructing portfolios that maximize expected returns for a given level of tracking error, or minimize tracking error for a given level of expected return. This often involves strategic asset allocation and security selection decisions designed to enhance portfolio efficiency. Regularly monitoring and rebalancing the portfolio is also essential. Periodic rebalancing helps to maintain the desired asset allocation and risk profile, preventing tracking error from drifting outside acceptable limits. By carefully implementing these strategies, portfolio managers can effectively manage and control tracking error, improving the likelihood of achieving investment goals. Learning how to calculate tracking risk and applying it consistently is important for maintaining investment strategy.

Tools and Technologies for Tracking Error Analysis: Streamlining the Process

The analysis of tracking error, a critical component of portfolio management, can be significantly streamlined through the use of specialized tools and technologies. These resources enhance efficiency and accuracy in understanding how to calculate tracking risk, allowing portfolio managers to make more informed decisions. The availability of robust software solutions empowers investment professionals to gain deeper insights into portfolio performance relative to benchmarks.

Portfolio management software often incorporates features specifically designed for tracking error calculation and analysis. These platforms typically provide automated data feeds, minimizing manual data entry and reducing the risk of errors. They also offer a range of analytical tools, such as risk dashboards and reporting capabilities, which facilitate the monitoring of tracking error over time. Furthermore, many platforms allow for scenario analysis, enabling users to assess the potential impact of different investment strategies on tracking error. Risk analytics platforms provide advanced statistical modeling and simulation capabilities. These tools enable a more sophisticated understanding of portfolio risk, including the drivers of tracking error. By using these platforms, portfolio managers can gain a more granular view of their portfolio’s sensitivity to various market factors and make adjustments to optimize risk-adjusted returns and understand how to calculate tracking risk efficiently.

Spreadsheet templates, while less sophisticated than dedicated software platforms, can also be valuable tools for tracking error analysis. Pre-built templates offer a structured framework for organizing data and performing calculations, making the process more efficient. However, it’s crucial to ensure the accuracy of formulas and data inputs when using spreadsheets. The choice of tool depends on the complexity of the portfolio, the level of analysis required, and the resources available. Whether using sophisticated software or simple spreadsheet templates, the goal remains the same: to gain a clear and accurate understanding of how to calculate tracking risk and its implications for portfolio performance. Understanding how to calculate tracking risk with accuracy will help portfolio managers to refine their investment strategies.