Understanding the Basics of Bond Yield

In the world of bond investing, understanding the concept of bond yield is crucial for making informed investment decisions. Bond yield represents the total return on investment, encompassing the interest earned and any capital gains or losses. There are several types of bond yields, each serving a distinct purpose in the investment process. Two of the most critical yields are yield to maturity and yield to call, which are often confused or used interchangeably. Yield to maturity represents the total return on investment if the bond is held until maturity, while yield to call represents the total return on investment if the bond is called prior to maturity. Understanding the differences between these two yields is vital for investors seeking to maximize their returns. In this article, we will explore the concept of yield to call and provide a step-by-step guide on how to calculate the yield to call, a critical metric for investors seeking to optimize their bond portfolios.

What is Yield to Call and Why Does it Matter?

Yield to call is a critical concept in bond investing that represents the total return on investment if a bond is called prior to maturity. It’s essential for investors to understand yield to call because it provides a more accurate picture of a bond’s potential return, especially for callable bonds. Unlike yield to maturity, which assumes the bond will be held until maturity, yield to call takes into account the possibility of the bond being called, which can significantly impact the investor’s returns. By understanding how to calculate the yield to call, investors can make more informed investment decisions and optimize their bond portfolios. In this article, we will delve into the world of yield to call, providing a step-by-step guide on how to calculate this critical metric and exploring its significance in bond investing.

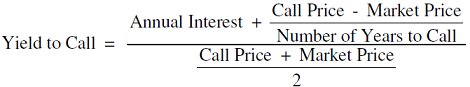

The Formula for Calculating Yield to Call

The formula for calculating yield to call is as follows: YTC = (C + (CP – PV) / (CP \* (Y – T))) \* (1 – (1 + Y)^(-T)), where YTC is the yield to call, C is the coupon rate, CP is the call price, PV is the present value of the bond, Y is the yield to maturity, and T is the time to call. To break it down, the coupon rate represents the periodic interest payments made by the bond issuer, while the call price is the price at which the bond can be redeemed. The present value of the bond is the current market value of the bond, and the yield to maturity is the total return on investment if the bond is held until maturity. The time to call represents the number of years until the bond can be called. By understanding each component of the formula, investors can accurately calculate the yield to call and make informed investment decisions. In the next section, we will provide a step-by-step example of how to calculate the yield to call, using a real-world scenario to illustrate the process.

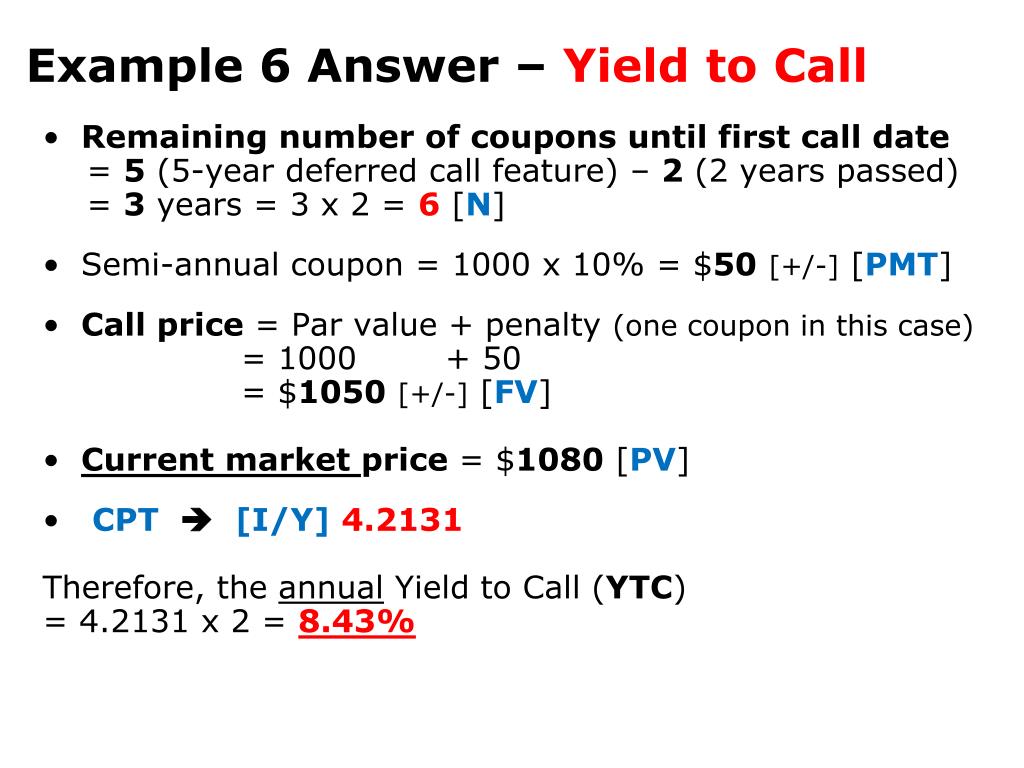

How to Calculate Yield to Call: A Step-by-Step Example

Calculating yield to call can seem daunting, but with a clear understanding of the formula and its components, investors can make informed decisions. Let’s walk through a step-by-step example to illustrate the process.

Suppose we have a bond with the following characteristics:

- Face value: $1,000

- Coupon rate: 5%

- Call price: $1,050

- Years to call: 5 years

- Current market price: $980

To calculate the yield to call, we’ll use the following formula:

Yield to Call = (Coupon Rate x Face Value + (Call Price – Current Market Price) / Years to Call) / ((Face Value + Call Price) / 2)

Plugging in the numbers, we get:

Yield to Call = (0.05 x $1,000 + ($1,050 – $980) / 5) / (($1,000 + $1,050) / 2)

Yield to Call ≈ 5.43%

In this example, the yield to call is approximately 5.43%. This means that if the bond is called at the specified call price, the investor can expect a return of 5.43% per annum.

It’s essential to note that the yield to call calculation assumes the bond will be called at the specified call price. If the bond is not called, the yield to maturity will be the relevant metric.

By understanding how to calculate the yield to call, investors can make more informed decisions when evaluating bond investments. Remember, the yield to call is a critical component of bond analysis, and it’s essential to consider it in conjunction with other metrics, such as yield to maturity, to get a comprehensive view of a bond’s potential return.

Factors Affecting Yield to Call

When calculating yield to call, it’s essential to consider the various factors that can influence the result. These factors can impact the bond’s price, yield, and overall performance, making it crucial to understand their effects on yield to call.

One of the primary factors affecting yield to call is interest rates. Changes in interest rates can impact the bond’s price and, subsequently, its yield to call. When interest rates rise, bond prices tend to fall, increasing the yield to call. Conversely, when interest rates fall, bond prices rise, decreasing the yield to call.

Credit ratings also play a significant role in determining yield to call. Bonds with higher credit ratings are generally considered less risky, resulting in lower yields to call. Conversely, bonds with lower credit ratings are considered riskier, leading to higher yields to call.

Market conditions can also impact yield to call. In times of economic uncertainty or high inflation, investors may demand higher yields to compensate for the increased risk. This can result in higher yields to call. On the other hand, in times of economic stability or low inflation, investors may be willing to accept lower yields, leading to lower yields to call.

In addition to these factors, other market and economic conditions can influence yield to call, including:

- Supply and demand for the bond

- Issuer’s creditworthiness

- Industry and sector trends

- Regulatory changes

By understanding these factors and their impact on yield to call, investors can make more informed decisions when evaluating bond investments. It’s essential to consider these factors in conjunction with the yield to call calculation to get a comprehensive view of a bond’s potential return.

Remember, calculating yield to call is just one aspect of bond analysis. By considering the various factors that influence yield to call, investors can gain a deeper understanding of the bond’s potential performance and make more informed investment decisions.

Common Mistakes to Avoid When Calculating Yield to Call

When calculating yield to call, it’s essential to avoid common mistakes that can lead to inaccurate results. These mistakes can be costly, resulting in poor investment decisions. By understanding the common pitfalls, investors can ensure accurate calculations and make informed investment decisions.

One of the most common mistakes is incorrectly inputting data. This can include using the wrong face value, coupon rate, or call price. To avoid this mistake, double-check the bond’s terms and conditions to ensure accurate data entry.

Another mistake is ignoring the bond’s call schedule. The call schedule outlines the specific dates and prices at which the bond can be called. Failing to consider the call schedule can result in inaccurate yield to call calculations.

Failing to account for compounding is another common mistake. Yield to call calculations should take into account the compounding effect of interest rates. Ignoring compounding can lead to inaccurate results and poor investment decisions.

In addition to these mistakes, other common errors include:

- Using the wrong yield to call formula

- Ignoring the bond’s credit rating and issuer’s creditworthiness

- Failing to consider market conditions and interest rate changes

To avoid these mistakes, it’s essential to:

- Verify the bond’s terms and conditions

- Use a reliable yield to call calculator or spreadsheet

- Consider multiple scenarios and stress test the bond’s performance

- Consult with a financial advisor or bond expert if necessary

By understanding these common mistakes and taking steps to avoid them, investors can ensure accurate yield to call calculations and make informed investment decisions. Remember, calculating yield to call is a critical component of bond analysis, and accuracy is essential for achieving investment goals.

Now that we’ve covered common mistakes to avoid, let’s move on to comparing yield to call with yield to maturity. Understanding the differences between these two metrics is crucial for making informed investment decisions.

Yield to Call vs. Yield to Maturity: Which is More Important?

When evaluating bond investments, it’s essential to consider both yield to call and yield to maturity. While these two metrics are related, they provide distinct insights into a bond’s potential performance. Understanding the differences between yield to call and yield to maturity is crucial for making informed investment decisions.

Yield to call represents the total return an investor can expect to earn if the bond is called by the issuer before its maturity date. This metric is particularly important for bonds with call features, as it helps investors understand the potential return on investment if the bond is redeemed early.

Yield to maturity, on the other hand, represents the total return an investor can expect to earn if the bond is held until its maturity date. This metric provides a more comprehensive view of a bond’s potential performance, as it takes into account the entire life of the bond.

So, which metric is more important? The answer depends on the investor’s goals and risk tolerance. For investors seeking short-term returns, yield to call may be more relevant. However, for investors with a longer-term horizon, yield to maturity may be more important.

It’s essential to consider both metrics when evaluating bond investments. By doing so, investors can gain a more comprehensive understanding of a bond’s potential performance and make more informed investment decisions. For example, an investor may prioritize yield to call if they believe the bond is likely to be called early, but still consider yield to maturity to understand the bond’s overall potential return.

In addition, understanding the relationship between yield to call and yield to maturity can help investors identify potential opportunities and risks. For instance, if the yield to call is significantly higher than the yield to maturity, it may indicate that the bond is more likely to be called early, which could impact the investor’s returns.

In conclusion, both yield to call and yield to maturity are important metrics for bond investors. By understanding the differences between these two metrics and considering them in conjunction, investors can make more informed investment decisions and achieve their financial goals.

Now that we’ve discussed the importance of considering both yield to call and yield to maturity, let’s move on to exploring how to incorporate yield to call into a comprehensive investment strategy.

Putting it All Together: How to Use Yield to Call in Your Investment Strategy

Now that we’ve covered the importance of yield to call and how to calculate it, it’s essential to understand how to incorporate this metric into a comprehensive investment strategy. By doing so, investors can make informed decisions and achieve their financial goals.

When selecting bonds, investors should consider yield to call as one of the key factors. This metric provides valuable insights into a bond’s potential return, especially for bonds with call features. By understanding how to calculate yield to call, investors can identify bonds that offer attractive returns and minimize potential losses.

In addition to bond selection, yield to call can also inform portfolio management decisions. For example, investors may want to diversify their portfolio by including bonds with different call features and yields to call. This can help mitigate risk and increase potential returns.

Another key consideration is how to balance yield to call with other bond metrics, such as yield to maturity and credit ratings. By taking a holistic approach to bond analysis, investors can gain a more comprehensive understanding of a bond’s potential performance and make more informed investment decisions.

When building a bond portfolio, investors should also consider their overall investment goals and risk tolerance. For example, investors seeking short-term returns may prioritize yield to call, while those with a longer-term horizon may focus on yield to maturity.

To get the most out of yield to call, investors should regularly monitor and adjust their bond portfolio. This can involve rebalancing the portfolio to maintain an optimal mix of bonds, as well as adjusting the bond selection criteria to reflect changing market conditions.

By incorporating yield to call into a comprehensive investment strategy, investors can make more informed decisions and achieve their financial goals. Remember, understanding how to calculate the yield to call is just the first step – the key is to use this metric to inform investment decisions and drive long-term success.