Understanding Bond Basics: A Prerequisite to Calculating Returns

Bonds are a type of investment security that represents a loan made by an investor to a borrower, typically a corporation or government entity. In essence, when you buy a bond, you are lending money to the borrower for a fixed period, usually several years. In return, the borrower agrees to make regular interest payments, known as coupon payments, and to return the principal amount at maturity. Bonds are often referred to as fixed-income securities because they provide a regular income stream to the investor.

There are various types of bonds, each with its unique characteristics and benefits. Government bonds, such as U.S. Treasury bonds, are backed by the credit and taxing power of the government. Corporate bonds, on the other hand, are issued by companies to raise capital for various purposes. Municipal bonds are issued by local governments and other public entities to finance infrastructure projects. Understanding the different types of bonds and their features is essential to making informed investment decisions.

Before diving into the complexities of calculating bond returns, it is crucial to grasp the basics of bonds. This includes understanding the bond’s face value, coupon rate, maturity date, and credit rating. A solid understanding of these concepts will provide a foundation for accurately calculating the return on a bond and making informed investment decisions. In fact, knowing how to calculate the return on a bond is vital to evaluating the performance of your bond portfolio and making informed decisions. In the following sections, we will delve into the details of calculating bond returns and explore strategies for maximizing returns.

What is Return on Investment (ROI) and Why Does it Matter?

Return on Investment (ROI) is a crucial concept in bond investing, as it measures the return or profit that an investor earns from their investment. In the context of bonds, ROI represents the total return on a bond, including the interest payments and any capital gains or losses. Understanding ROI is essential for investors, as it helps them evaluate the performance of their bond portfolio and make informed decisions about their investments.

In bond investing, ROI is a key metric for evaluating the success of an investment. It provides a standardized way to compare the performance of different bonds and investment opportunities. By calculating the ROI of a bond, investors can determine whether their investment is generating the desired returns and make adjustments to their portfolio as needed. Furthermore, ROI helps investors to identify areas of their portfolio that may require rebalancing or optimization.

When it comes to calculating the return on a bond, understanding ROI is vital. It is the foundation upon which investors can build their investment strategy and make informed decisions about their bond portfolio. In the following sections, we will delve into the details of calculating bond returns, including the formula and examples, and explore strategies for maximizing returns.

How to Calculate the Return on a Bond: A Step-by-Step Approach

Calculating the return on a bond is a crucial step in evaluating the performance of a bond investment. To accurately calculate the return on a bond, investors need to understand the various components that make up the bond’s return. In this section, we will provide a step-by-step guide on how to calculate the return on a bond, including the formula and examples.

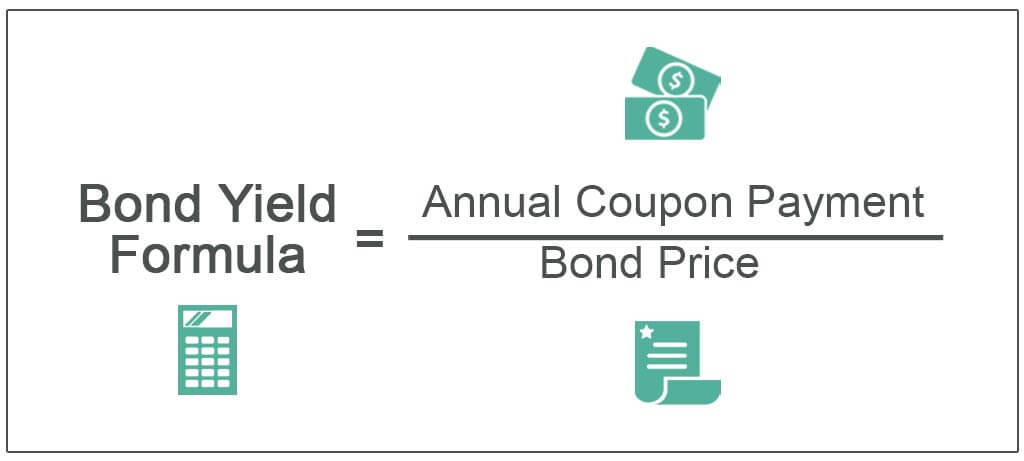

The formula to calculate the return on a bond is as follows:

Return on Bond = (Coupon Payment + Capital Gains) / (Face Value + Accrued Interest)

Let’s break down each component of the formula:

– Coupon Payment: The regular interest payment made by the borrower to the investor.

– Capital Gains: The profit earned from selling the bond at a higher price than its face value.

– Face Value: The principal amount of the bond, also known as the par value.

– Accrued Interest: The interest earned on the bond since the last coupon payment.

To illustrate how to calculate the return on a bond, let’s consider an example. Suppose an investor purchases a 10-year government bond with a face value of $1,000 and a coupon rate of 4%. The bond is currently trading at a premium, with a market price of $1,050. If the investor sells the bond after 5 years, how would they calculate the return on the bond?

Using the formula above, the return on the bond would be:

Return on Bond = ($40 coupon payment + $50 capital gain) / ($1,000 face value + $20 accrued interest) = 6.67%

By following this step-by-step approach, investors can accurately calculate the return on a bond and make informed decisions about their investment portfolio. In the next section, we will discuss the various factors that influence bond returns, including interest rates, credit ratings, and market conditions.

Factors Affecting Bond Returns: Interest Rates, Credit Ratings, and More

When it comes to calculating the return on a bond, several factors come into play. Understanding these factors is crucial for investors to accurately calculate bond returns and make informed investment decisions. In this section, we will discuss the various factors that influence bond returns, including interest rates, credit ratings, and market conditions.

Interest Rates: One of the most significant factors affecting bond returns is interest rates. When interest rates rise, the value of existing bonds with lower interest rates decreases, resulting in a lower return on investment. Conversely, when interest rates fall, the value of existing bonds with higher interest rates increases, resulting in a higher return on investment.

Credit Ratings: The credit rating of the bond issuer also plays a critical role in determining bond returns. Bonds issued by companies or governments with high credit ratings tend to offer lower returns, as they are considered to be less risky. On the other hand, bonds issued by entities with lower credit ratings offer higher returns to compensate for the increased risk.

Market Conditions: Market conditions, such as supply and demand, also impact bond returns. When demand for bonds is high, prices tend to rise, resulting in a higher return on investment. Conversely, when demand is low, prices tend to fall, resulting in a lower return on investment.

Inflation: Inflation is another factor that affects bond returns. When inflation rises, the purchasing power of the bond’s interest payments and principal amount decreases, resulting in a lower return on investment.

Duration: The duration of the bond also affects its return. Bonds with longer durations tend to be more sensitive to changes in interest rates, resulting in a higher return on investment.

By understanding these factors, investors can better navigate the complexities of bond investing and make informed decisions about their bond portfolio. In the next section, we will explore the role of Yield to Maturity (YTM) in bond return calculations.

The Role of Yield to Maturity (YTM) in Bond Return Calculations

Yield to Maturity (YTM) is a critical concept in bond investing that plays a significant role in calculating the return on a bond. YTM represents the total return an investor can expect to earn from a bond if they hold it until maturity. In this section, we will delve into the world of YTM and explore its relationship to bond returns.

Calculating YTM involves considering the bond’s coupon rate, face value, and market price. The formula to calculate YTM is as follows:

YTM = (Coupon Payment + (Face Value – Market Price) / Years to Maturity) / ((Face Value + Market Price) / 2)

For example, let’s consider a 10-year bond with a face value of $1,000, a coupon rate of 4%, and a market price of $900. If we calculate the YTM, we get:

YTM = ($40 coupon payment + ($1,000 – $900) / 10 years) / (($1,000 + $900) / 2) = 5.56%

The YTM of 5.56% indicates that the bond is expected to generate a total return of 5.56% per annum if held until maturity. This information is crucial for investors, as it helps them evaluate the bond’s potential return and make informed investment decisions.

It’s essential to note that YTM is not the same as the bond’s coupon rate. While the coupon rate represents the regular interest payments, YTM takes into account the bond’s capital gains or losses, providing a more comprehensive picture of the bond’s return.

By understanding YTM and its relationship to bond returns, investors can better navigate the complexities of bond investing and make informed decisions about their bond portfolio. In the next section, we will explore real-world examples of calculating returns on different types of bonds.

Real-World Examples: Calculating Returns on Different Types of Bonds

Now that we’ve covered the basics of bond returns and YTM, let’s apply these concepts to real-world scenarios. In this section, we’ll explore examples of calculating returns on different types of bonds, including government bonds, corporate bonds, and municipal bonds.

Example 1: Government Bond

Suppose we have a 10-year U.S. Treasury bond with a face value of $1,000, a coupon rate of 2%, and a market price of $950. To calculate the return on this bond, we can use the formula:

Return = (Coupon Payment + (Face Value – Market Price) / Years to Maturity) / ((Face Value + Market Price) / 2)

Plugging in the numbers, we get:

Return = ($20 coupon payment + ($1,000 – $950) / 10 years) / (($1,000 + $950) / 2) = 3.15%

This means that if we hold the bond until maturity, we can expect a total return of 3.15% per annum.

Example 2: Corporate Bond

Let’s consider a 5-year corporate bond with a face value of $1,000, a coupon rate of 5%, and a market price of $1,050. Using the same formula, we get:

Return = ($50 coupon payment + ($1,000 – $1,050) / 5 years) / (($1,000 + $1,050) / 2) = 4.29%

This example illustrates how corporate bonds typically offer higher returns than government bonds to compensate for the increased credit risk.

Example 3: Municipal Bond

Suppose we have a 7-year municipal bond with a face value of $1,000, a coupon rate of 3%, and a market price of $980. Calculating the return, we get:

Return = ($30 coupon payment + ($1,000 – $980) / 7 years) / (($1,000 + $980) / 2) = 3.53%

This example demonstrates how municipal bonds often offer lower returns than corporate bonds due to their tax-exempt status.

By examining these real-world examples, investors can gain a better understanding of how to calculate returns on different types of bonds and make informed investment decisions. In the next section, we’ll discuss common mistakes to avoid when calculating bond returns.

Common Mistakes to Avoid When Calculating Bond Returns

When calculating bond returns, it’s essential to avoid common mistakes that can lead to inaccurate results and poor investment decisions. In this section, we’ll highlight some of the most frequent errors investors make and provide tips on how to avoid them.

Mistake 1: Ignoring Compounding

One of the most significant mistakes investors make is ignoring the power of compounding. Compounding occurs when interest is earned on both the principal amount and any accrued interest. Failing to account for compounding can result in underestimating the true return on a bond.

TIP: Always use the compound interest formula to calculate bond returns, especially for longer-term bonds.

Mistake 2: Misunderstanding the Impact of Interest Rates

Interest rates have a significant impact on bond returns, and misunderstanding their effect can lead to inaccurate calculations. For example, failing to account for changes in interest rates can result in overestimating or underestimating the return on a bond.

TIP: Always consider the current market interest rate and how it affects the bond’s yield to maturity.

Mistake 3: Failing to Account for Credit Risk

Credit risk, or the risk of default, can significantly impact bond returns. Failing to account for credit risk can result in overestimating the return on a bond.

TIP: Always consider the credit rating of the issuer and the bond’s credit spread when calculating returns.

Mistake 4: Not Considering the Bond’s Maturity

The maturity of a bond can significantly impact its return. Failing to consider the bond’s maturity can result in inaccurate calculations.

TIP: Always consider the bond’s maturity and how it affects the return on investment.

By avoiding these common mistakes, investors can ensure accurate calculations and make informed investment decisions. In the next section, we’ll explore expert strategies for maximizing bond returns.

Maximizing Bond Returns: Strategies for Savvy Investors

Now that we’ve covered the basics of bond returns and common mistakes to avoid, it’s time to explore expert strategies for maximizing bond returns. By implementing these strategies, savvy investors can optimize their bond portfolios for optimal returns.

Strategy 1: Diversification

Diversification is a key principle of investing, and it’s especially important when it comes to bonds. By spreading investments across different types of bonds, investors can reduce risk and increase potential returns. This can include diversifying by issuer, credit rating, maturity, and sector.

Strategy 2: Laddering

Laddering involves investing in bonds with staggered maturities, which can help to reduce interest rate risk and increase returns. By laddering bonds, investors can create a steady stream of income and reduce the impact of market fluctuations.

Strategy 3: Active Management

Active management involves regularly monitoring and adjusting a bond portfolio to take advantage of market opportunities and minimize losses. This can include rebalancing the portfolio, adjusting credit exposure, and taking advantage of market inefficiencies.

Strategy 4: Credit Analysis

Credit analysis involves evaluating the creditworthiness of bond issuers to identify opportunities for higher returns. By analyzing credit ratings, financial statements, and industry trends, investors can identify bonds with higher yields and lower credit risk.

Strategy 5: Tax-Efficient Investing

Tax-efficient investing involves optimizing a bond portfolio to minimize tax liabilities. This can include investing in tax-exempt bonds, such as municipal bonds, and structuring the portfolio to minimize capital gains taxes.

By implementing these strategies, investors can maximize their bond returns and achieve their investment goals. Remember, calculating bond returns is just the first step – it’s equally important to have a solid investment strategy in place to optimize returns over the long term.

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity-5bf078bc6f6147d4ae99e549fe87611b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_A_Guide_to_Calculating_Return_on_Investment_ROI_Aug_2020-01-82c5e4327e174fab8b2905ea7220417d.jpg)