Understanding Bond Basics: Yield, Maturity, and Coupon

Before learning how to calculate the price of a bond in Excel, understanding fundamental bond terminology is crucial. This includes yield to maturity (YTM), coupon rate, face value, and maturity date. The yield to maturity represents the total return an investor anticipates receiving if holding the bond until its maturity date. It considers all coupon payments and the difference between the purchase price and face value. The coupon rate determines the annual interest payments relative to the face value. For example, a 5% coupon rate on a $1,000 bond means annual interest payments of $50. The face value is the amount the bond issuer will repay at maturity. Finally, the maturity date specifies when the bond’s principal will be repaid. Understanding these components is critical for accurate bond pricing, a skill that this guide will help you master, including how to calculate the price of a bond in Excel.

Consider a simple example: a bond with a $1,000 face value, a 4% coupon rate, and a 10-year maturity. This means the bond pays $40 annually ($1,000 x 0.04). If the YTM is 5%, the bond’s current price will be less than its face value, reflecting the higher market yield. Conversely, if the YTM is 3%, the price will be higher. This relationship between yield and price is essential when learning how to calculate the price of a bond in Excel. Accurate calculations require a precise understanding of these fundamental concepts. This guide will show you how to calculate the price of a bond in Excel, taking these factors into account.

This section provides the foundation for using Excel to calculate bond prices. Mastering these core concepts is essential before proceeding to the practical Excel applications detailed in the following sections. Accurate bond pricing depends on a clear understanding of yield, maturity, coupon payments, and face value. The ability to correctly interpret these factors is paramount to understanding how to calculate the price of a bond in Excel. This foundational knowledge will allow you to confidently navigate the intricacies of bond valuation and use Excel effectively to analyze bond investments.

The Mechanics of Bond Pricing: Present Value Calculations

Bond valuation hinges on the fundamental concept of present value (PV). A bond’s price reflects the present value of all its future cash flows. These cash flows consist of periodic coupon payments and the final repayment of the bond’s face value at maturity. To calculate the price of a bond, one must discount these future cash flows back to their present value using an appropriate discount rate. This discount rate is typically the bond’s yield to maturity (YTM), representing the total return an investor anticipates receiving if the bond is held until maturity. Understanding how to calculate the price of a bond in excel is crucial for accurate bond pricing and analysis.

The present value formula forms the basis for this calculation. For a single cash flow, the formula is PV = FV / (1 + r)^n, where PV is the present value, FV is the future value (coupon payment or face value), r is the discount rate (YTM), and n is the number of periods until the cash flow is received. However, since bonds involve multiple cash flows, calculating the bond’s price requires summing the present values of each individual coupon payment and the face value at maturity. In essence, to determine how to calculate the price of a bond in excel, one must apply this present value concept to each individual cash flow.

For example, consider a bond with a face value of $1,000, a coupon rate of 5%, and a maturity of 5 years. If the YTM is also 5%, each year’s coupon payment would be $50 ($1,000 * 0.05). To determine the price, one would calculate the present value of each $50 coupon payment and the present value of the $1,000 face value, then sum these values. This process, while feasible manually for simpler bonds, becomes significantly more efficient when using Excel’s built-in functions, significantly streamlining how to calculate the price of a bond in excel. Excel offers functions specifically designed to handle these complex present value calculations efficiently and accurately. This makes Excel an indispensable tool for bond valuation and analysis. Understanding the relationship between present value calculations and bond pricing is critical to mastering bond valuation techniques.

How to Calculate Bond Price Using Excel’s PV Function

This section details how to calculate the price of a bond in Excel using the PV function. This function calculates the present value of a series of future payments. For bonds, these payments are the periodic coupon payments and the face value at maturity. The process is straightforward, but understanding each input is crucial for accurate results. To learn how to calculate the price of a bond in excel, follow these steps.

Excel’s PV function requires five arguments: rate, nper, pmt, fv, and type. In the context of bond valuation, ‘rate’ represents the yield to maturity (YTM), expressed as a decimal (e.g., 5% YTM is entered as 0.05). ‘nper’ is the total number of payment periods until maturity. ‘pmt’ represents the periodic coupon payment, calculated as the coupon rate multiplied by the face value and divided by the number of payments per year. ‘fv’ is the face value or par value of the bond, representing the amount repaid at maturity. ‘type’ indicates when payments are made (0 for end of period, 1 for beginning). Bond coupons are usually paid at the end of the period, so use 0. For example, to price a bond with a 5% YTM, 10 years to maturity, a $1,000 face value, and a 4% coupon rate (paid annually), the formula would be: =PV(0.05,10,-40,1000,0). The result is the present value, or price, of the bond. Knowing how to calculate the price of a bond in excel empowers you to accurately assess investment opportunities. The function efficiently handles the present value calculations, providing a quick and accurate bond price.

To demonstrate how to calculate the price of a bond in excel with semi-annual payments, consider a bond with a 6% YTM, 5 years to maturity, a $1,000 face value, and a 5% coupon rate paid semi-annually. The rate would be 0.06/2 = 0.03, nper would be 5*2 = 10, pmt would be (0.05*1000)/2 = 25, and fv would remain 1000. The Excel formula becomes: =PV(0.03,10,-25,1000,0). This calculation accurately reflects the semi-annual payments. Remember, the key to mastering bond valuation in Excel lies in correctly identifying and inputting these parameters. By understanding how to calculate the price of a bond in Excel, you gain valuable insights into bond pricing dynamics, enabling informed investment decisions. The flexibility of the PV function allows for variations in coupon payments, maturity periods, and yields, allowing for comprehensive bond price analysis.

Working with Different Payment Frequencies: Semi-Annual Bonds

Many bonds make coupon payments semi-annually, not annually. This requires adjustments to the Excel PV function to accurately calculate the price of a bond in excel. To handle semi-annual payments, one must modify both the discount rate and the number of periods. The discount rate (YTM) needs to be halved to reflect the semi-annual yield. Similarly, the number of periods (nper) must be doubled to account for the increased number of payment periods. For example, a bond with a 10-year maturity and annual payments would have an nper of 10. With semi-annual payments, the nper becomes 20. This adjustment ensures the present value calculation accurately reflects the bond’s cash flows.

Consider a bond with a 6% annual coupon rate, a 10-year maturity, and a face value of $1,000. If the bond pays annually, the YTM is used directly in the PV function, and nper is 10. However, if the bond pays semi-annually, the YTM is divided by 2 (3% in this case), and the nper is multiplied by 2 (20 periods). The coupon payment (PMT) is also adjusted. It becomes half of the annual coupon payment ($30 instead of $60). Using Excel’s PV function with these adjusted inputs provides the correct bond price. This precise calculation is crucial for understanding how to calculate the price of a bond in excel, especially when dealing with semi-annual payments. Incorrectly handling payment frequency can lead to significant errors in bond valuation.

The ability to accurately reflect semi-annual payments is a key aspect of mastering how to calculate the price of a bond in excel. By correctly adjusting the rate and nper inputs within the PV function, one can confidently price bonds with various payment frequencies. This skill enhances the overall accuracy and reliability of your bond valuation models. Remember to always double-check your inputs and ensure consistency between the coupon payment frequency and the adjustments made to the YTM and nper parameters for precise results when you calculate the price of a bond in excel.

Handling Irregular Coupon Payments: Advanced Scenarios

Standard bond valuation methods, and consequently, how to calculate the price of a bond in excel, assume consistent coupon payments. However, some bonds deviate from this regularity. For instance, a bond might have skipped coupon payments due to financial distress or have a different payment schedule than the standard semi-annual or annual frequency. These irregular payment schedules complicate the straightforward present value calculations described earlier. The accuracy of determining how to calculate the price of a bond in excel hinges on accurately accounting for all cash flows, regardless of their timing.

To handle irregular coupon payments when learning how to calculate the price of a bond in excel, one effective approach involves breaking down the bond’s cash flows into individual payments. Each payment receives its own present value calculation. This requires careful consideration of the time elapsed between payments to accurately discount each cash flow to its present value. Excel’s PV function can still be applied individually to each payment, requiring adjustments to the ‘nper’ (number of periods) parameter for each segment. This segmented approach ensures each coupon payment is appropriately valued based on its precise timing, leading to a more accurate overall bond price. This method of calculating the price of a bond in excel provides flexibility in handling non-standard situations.

Another method involves using Excel’s XIRR function. XIRR calculates the internal rate of return for a series of cash flows that don’t occur at regular intervals. This provides a way to determine the bond’s yield to maturity even with irregular payments. Once you determine the effective yield, one can calculate the present value of all cash flows using the determined yield as the discount rate in individual PV calculations. This approach offers a powerful tool for more advanced bond valuation scenarios. Remember that accurately understanding the payment schedule is paramount when learning how to calculate the price of a bond in excel for any bond with irregular payments. Using these methods provides a pathway to achieving accurate results.

Analyzing Bond Yields: Interpreting Your Results

Understanding how to calculate the price of a bond in Excel is only half the battle. Equally important is interpreting the calculated price in relation to the bond’s yield to maturity (YTM). The YTM represents the total return anticipated on a bond if it is held until maturity. The calculated bond price reflects the present value of all future cash flows, discounted at the YTM. A higher YTM leads to a lower present value (price), and vice-versa. This inverse relationship is fundamental to bond valuation.

For example, if Excel calculates a bond price lower than its face value, it suggests that the market’s demanded yield (implied by the current market price) is higher than the bond’s coupon rate. Investors are demanding a higher return because of increased perceived risk, lower market interest rates (making the bond less attractive), or other market factors. Conversely, a bond price exceeding its face value indicates that the market’s demanded yield is lower than the bond’s coupon rate. This could reflect the bond’s perceived safety or higher market interest rates that make the higher coupon more desirable, impacting how to calculate the price of a bond in excel in different scenarios. Remember, accurately calculating the price of a bond in excel requires a precise understanding of all input variables. The bond price directly reflects the interplay between the YTM and the bond’s coupon payments. Analyzing these relationships provides critical insights into market conditions and investment opportunities.

To further illustrate, consider two scenarios: one where a bond’s calculated price is at a discount (below face value), and another where it’s at a premium (above face value). In the discount scenario, investors are essentially paying less than the face value, expecting a higher return to compensate for additional risk. The premium scenario, however, indicates a lower risk perception, resulting in a higher price. Mastering how to calculate the price of a bond in Excel, and subsequently interpreting the results, allows investors to make informed decisions based on the relationship between price and yield.

Building a Bond Valuation Spreadsheet Template: A Step-by-Step Guide

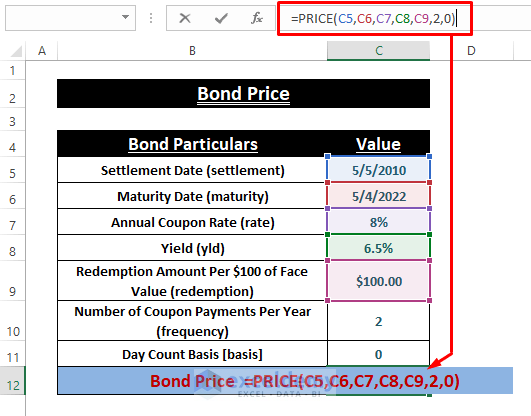

Creating a reusable Excel template simplifies how to calculate the price of a bond in excel. This section guides users through building a template to streamline bond valuation. Begin by setting up input cells for key variables. These include the yield to maturity (YTM), coupon rate, face value, maturity date, and payment frequency. Clearly label each cell for easy understanding. Use separate cells for each input parameter, ensuring clear distinction between the input values and the calculated results. This improves the readability and maintainability of the template. Remember, accurate labeling is crucial when learning how to calculate the price of a bond in excel.

Next, incorporate formulas to automatically calculate the bond price. The core formula will utilize Excel’s PV function. Refer to the previous sections for a detailed explanation of this function and its parameters. The formula should directly reference the input cells created in the previous step. This dynamic link ensures that changes to the input values automatically update the calculated bond price. This automated calculation feature significantly reduces manual effort and the risk of errors when learning how to calculate the price of a bond in excel. Consider adding data validation to input cells to ensure data integrity. This limits incorrect inputs and prevents unexpected results.

Finally, enhance the template’s functionality. Add cells to display intermediate calculations, such as the periodic coupon payment and the number of periods. This enhances transparency and allows for easier error detection. Format the spreadsheet professionally. Use appropriate number formatting for currency values and dates. Organize the template logically, separating inputs, calculations, and results. This well-structured template facilitates efficient bond valuation, providing a reusable tool for repeated calculations. The template helps users learn how to calculate the price of a bond in excel quickly and accurately, while also promoting a deeper understanding of the underlying valuation principles.

Beyond the Basics: Incorporating Accrued Interest

When buying a bond between coupon payment dates, the buyer pays not only the bond’s price but also the accrued interest. Accrued interest represents the interest earned since the last coupon payment. This means the total amount paid, often called the “dirty price,” is higher than the “clean price,” which excludes accrued interest. Understanding how to calculate and incorporate accrued interest is crucial for accurately determining the total cost of a bond. This is especially important when using Excel to calculate the price of a bond in excel, ensuring a truly comprehensive valuation.

Accrued interest is calculated as a fraction of the next coupon payment. The fraction is determined by the number of days since the last coupon payment divided by the total number of days in the current coupon period. For example, if a bond pays semi-annual coupons on June 30th and December 31st, and the purchase date is October 26th, the accrued interest would be calculated based on the number of days from June 30th to October 26th, divided by the total number of days between June 30th and December 31st. Once the accrued interest is calculated, it is added to the clean price (obtained using Excel’s PV function as previously described) to arrive at the dirty price, representing the actual amount the buyer pays. To calculate the price of a bond in excel, including accrued interest, you need to calculate the clean price separately using the PV function. Then, add the accrued interest to this clean price to obtain the dirty price.

To integrate accrued interest into your Excel bond valuation template, add input cells for the last coupon payment date and the settlement date. Use the DAYS function in Excel to calculate the number of days between these dates. Divide this result by the total number of days in the coupon period. Multiply this fraction by the coupon payment amount to obtain the accrued interest. Finally, add this accrued interest figure to the bond’s clean price (calculated using the PV function) to determine the dirty price. This enhanced template provides a more accurate and complete bond valuation, accounting for the nuances of accrued interest and providing a more realistic representation of how to calculate the price of a bond in excel. Remember that accurate calculations are essential, especially when dealing with significant investments. Using Excel effectively allows for precise calculations and the development of reusable templates for efficient bond valuation.