Understanding Bond Pricing Fundamentals

Before delving into the intricacies of how to calculate the price of a bond in excel, it is crucial to grasp the fundamental concepts of bond valuation. A bond, at its core, represents a debt instrument where an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period at a variable or fixed interest rate. The key components of a bond include its face value (the amount repaid at maturity), the coupon rate (the interest rate paid on the face value), and the maturity date (the date when the principal is repaid).

The face value, often $1,000, represents the amount the bond issuer promises to pay back to the bondholder at the maturity date. The coupon rate, expressed as a percentage of the face value, determines the periodic interest payments the bondholder receives. The maturity date signifies the end of the bond’s term, when the issuer repays the face value. Understanding these elements is paramount to accurately determine how to calculate the price of a bond in excel.

A foundational principle in bond valuation is the inverse relationship between interest rates and bond prices. When interest rates rise, the value of existing bonds typically falls, and vice versa. This occurs because new bonds are issued with higher coupon rates, making older bonds with lower coupon rates less attractive to investors. To understand how to calculate the price of a bond in excel, this relationship between interest rates and bond price is crucial. Grasping these fundamentals provides a solid base for understanding how to calculate the price of a bond in excel and utilizing Excel functions to determine bond values effectively.

How to Determine Bond Price Using Excel: A Step-by-Step Approach

This section offers a clear, step-by-step guide on how to calculate the price of a bond in Excel. The primary focus will be on utilizing the PV function, a powerful tool for bond valuation. The PV function calculates the present value of an investment or loan, and it’s perfectly suited for determining how to calculate the price of a bond in Excel. We will explore each argument of the PV function in detail to ensure clarity. The arguments are: rate, nper, pmt, and fv. ‘Rate’ refers to the discount rate per period (yield to maturity). ‘Nper’ is the total number of payment periods. ‘Pmt’ represents the periodic payment (coupon payment). ‘Fv’ stands for the future value (face value of the bond).

Let’s illustrate how to calculate the price of a bond in Excel with a practical example. Consider a bond with a face value of $1000, a coupon rate of 5%, maturing in 5 years, and a yield to maturity of 6%. First, determine the annual coupon payment: 5% of $1000 equals $50. Now, in an Excel sheet, input the following values into separate cells: Yield to Maturity (6% or 0.06), Number of Periods (5), Coupon Payment ($50), and Face Value ($1000). Then, in another cell, enter the PV function: “=PV(0.06, 5, 50, 1000)”. Press Enter. The result will be the calculated bond price. Ensure the rate reflects the yield to maturity, and nper corresponds to the total number of periods until maturity. The pmt is the periodic coupon payment, and fv represents the bond’s face value at maturity.

The Excel formula “=PV(0.06, 5, 50, 1000)” shows exactly how to calculate the price of a bond in Excel. Note: The PV function returns a negative value because it represents an outflow of cash (the purchase price of the bond). To display the price as a positive value, simply put a negative sign in front of the PV function: “=-PV(0.06, 5, 50, 1000)”. By understanding and correctly applying the PV function, one can efficiently determine bond prices in various scenarios. This method provides a foundation for more advanced bond valuation techniques. It’s crucial to double-check all inputs to ensure the accuracy of the calculated bond price. Knowing how to calculate the price of a bond in Excel is a valuable skill for financial professionals and investors alike.

Calculating Present Value of Future Cash Flows

The principle behind bond valuation lies in understanding how to calculate the price of a bond in excel by determining the present value of its future cash flows. These cash flows consist of two components: the periodic coupon payments and the face value received at maturity. To accurately assess a bond’s worth, each of these future cash flows must be discounted back to its present value. This process reflects the time value of money, acknowledging that money received today is worth more than the same amount received in the future.

Each coupon payment represents a stream of income received at regular intervals, typically semi-annually or annually. To determine the present value of these payments, each one is discounted using the appropriate discount rate (yield to maturity) and the time until it is received. The sum of these present values represents the present value of the coupon payments. Similarly, the face value, which is the amount the bondholder receives at maturity, is also discounted back to its present value. The present value of the face value represents the value today of receiving that lump sum in the future.

To illustrate, consider a bond with a $1,000 face value, a 6% annual coupon rate (meaning $60 annual payments), and a maturity of 3 years. If the yield to maturity is 7%, we can calculate the present value of each cash flow. The table below demonstrates how to calculate the price of a bond in excel. Each coupon payment ($60) is discounted back to its present value, and the $1,000 face value is also discounted. The sum of all these present values provides the bond’s total present value, which is its theoretical price. This method underscores that understanding how to calculate the price of a bond in excel relies on accurately discounting future cash flows. As a result, the bond price is the total of these discounted values.

| Year | Cash Flow | Discount Factor (7%) | Present Value |

|---|---|---|---|

| 1 | $60 | 1 / (1+0.07)^1 = 0.9346 | $56.08 |

| 2 | $60 | 1 / (1+0.07)^2 = 0.8734 | $52.40 |

| 3 | $60 | 1 / (1+0.07)^3 = 0.8163 | $48.98 |

| 3 (Face Value) | $1,000 | 1 / (1+0.07)^3 = 0.8163 | $816.30 |

| Total Present Value (Bond Price) | $973.76 | ||

Advanced Bond Valuation Techniques in Excel

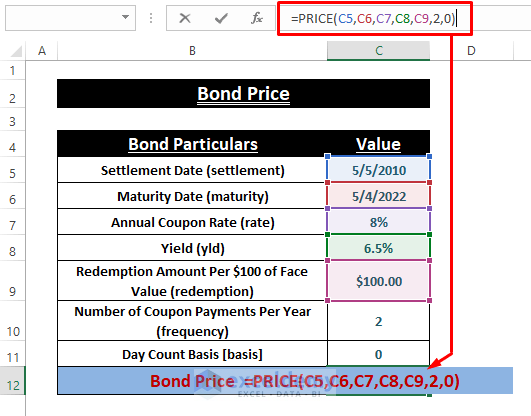

Understanding how to calculate the price of a bond in Excel becomes more nuanced when dealing with complexities like semi-annual coupon payments or accrued interest. Many bonds distribute coupon payments semi-annually rather than annually. This necessitates adjustments to the interest rate and the number of periods in the PV function. To accurately how to calculate the price of a bond in excel, divide the annual coupon rate by two and multiply the number of years to maturity by two. For instance, a bond with a 6% annual coupon rate paid semi-annually over 10 years would be entered into the PV function with a rate of 3% and 20 periods. This adjustment reflects the more frequent cash flows. Using the PV function with these adjusted values provides a more precise bond price.

Another factor influencing bond prices is accrued interest. When a bond is purchased between coupon payment dates, the buyer compensates the seller for the interest earned since the last payment. This accrued interest is added to the quoted price (clean price) to arrive at the total price (dirty price) the buyer pays. Excel offers functions to assist with calculating accrued interest. The COUPNUM function determines the number of coupon payments between the settlement date and maturity, while the COUPDAYS function calculates the number of days in the coupon period. These functions, while not directly calculating accrued interest, provide valuable inputs for its computation. The formula for accrued interest is typically: (Coupon Payment / Days in Coupon Period) * Days Since Last Payment. Factoring in accrued interest is critical for accurately determining the total cost of a bond purchased in the secondary market. This impacts how to calculate the price of a bond in excel when bought in the secondary market.

Failing to account for semi-annual payments or accrued interest can lead to significant errors in bond valuation. Accurately how to calculate the price of a bond in excel demands careful attention to these details. While the core principle of discounting future cash flows remains consistent, the practical application requires a thorough understanding of the bond’s specific features and the relevant Excel functions. By correctly adjusting inputs for semi-annual payments and calculating accrued interest, investors can gain a more realistic assessment of a bond’s true value. Ignoring these elements compromises the accuracy of the valuation and can lead to poor investment decisions. Careful use of Excel’s functions, coupled with a strong grasp of bond market conventions, will enable users to navigate these advanced scenarios with confidence and enhance their ability to how to calculate the price of a bond in excel.

Calculating Yield to Maturity (YTM) Using Excel

Yield to Maturity (YTM) represents the total return anticipated on a bond if it is held until it matures. Understanding how to calculate the price of a bond in excel is fundamental, but knowing the YTM provides a more complete picture of the bond’s potential investment return. Unlike the coupon rate, which is fixed, YTM takes into account the current market price of the bond, the face value, the coupon payments, and the time remaining until maturity. It’s a crucial metric for comparing different bonds.

Excel offers several methods for calculating YTM. The RATE function can be employed when the bond pays annual coupons. The syntax is `RATE(nper, pmt, -pv, fv)`, where `nper` is the number of periods, `pmt` is the coupon payment per period, `pv` is the present value (the bond’s current price, entered as a negative value), and `fv` is the future value (face value of the bond). For bonds with semi-annual coupon payments, adjust the inputs accordingly. Multiply the number of years to maturity by 2 to get the correct `nper`, and divide the annual coupon rate by 2 to get the periodic `pmt`. If the RATE function does not give the accurate YTM, excel also offers the Goal Seek function. Goal Seek is particularly useful because YTM calculation is iterative, involving repeatedly solving for the discount rate that equates the present value of all future cash flows to the current bond price. Since Goal Seek performs these iterations automatically, it can provide an accurate approximation of the YTM.

It’s important to differentiate YTM from current yield. Current yield is simply the annual coupon payment divided by the current bond price. While easy to calculate, current yield does not account for the time value of money or the difference between the purchase price and the face value received at maturity. YTM, on the other hand, incorporates all these factors, offering a more accurate measure of a bond’s overall return. While how to calculate the price of a bond in excel is important, understanding the YTM offers greater context. For example, a bond trading at a discount will have a YTM higher than its current yield, as the investor will receive the face value at maturity, which is higher than the purchase price. Conversely, a bond trading at a premium will have a YTM lower than its current yield. Therefore, YTM is a better indicator of the total expected return from a bond investment. Using Excel tools effectively simplifies the complexities inherent in accurately determining a bond’s Yield to Maturity.

Dealing with Different Bond Types in Excel

Adapting Excel calculations for varied bond types enhances the versatility of bond valuation models. This section addresses how different bond characteristics influence cash flows and, consequently, the bond’s price. This includes examining zero-coupon bonds and callable bonds, and understanding how their unique features are factored into “how to calculate the price of a bond in excel”.

Zero-coupon bonds, which do not offer periodic coupon payments, simplify the present value calculation. The investor receives only the face value at maturity. To determine the price of a zero-coupon bond, the PV function in Excel is streamlined. It requires only the face value, yield to maturity, and time to maturity. Essentially, the bond’s price represents the discounted value of its face value. This contrasts with coupon-bearing bonds, where “how to calculate the price of a bond in excel” involves summing the present values of both coupon payments and the face value.

Callable bonds introduce complexity due to the issuer’s option to redeem the bond before its maturity date. This call feature affects the bond’s potential cash flows, introducing uncertainty in how to calculate the price of a bond in excel accurately. Valuing callable bonds requires considering different call scenarios and their probabilities. Advanced models may incorporate option pricing techniques to account for the call option’s value. While Excel can assist with discounted cash flow analysis under various call scenarios, precise pricing of callable bonds often necessitates specialized financial software or models. Understanding these nuances is critical for anyone seeking to master “how to calculate the price of a bond in excel” across diverse bond types.

Avoiding Common Pitfalls in Bond Pricing with Excel

Calculating bond prices accurately in Excel requires careful attention to detail. One frequent error involves incorrect data entry. Ensuring the correct face value, coupon rate, and maturity date are inputted is crucial. A seemingly minor typo can significantly skew the results when determining how to calculate the price of a bond in excel.

Another common mistake is confusing annual and semi-annual rates. Bonds often pay coupons semi-annually, meaning the annual coupon rate must be divided by two for calculations. Similarly, the number of periods (nper) in the PV function should reflect the total number of payment periods, not just the number of years. For instance, a 5-year bond with semi-annual payments has 10 periods. Failing to adjust these values will lead to an inaccurate bond price. When considering how to calculate the price of a bond in excel, double-check that all rates and periods are aligned with the payment frequency.

Ignoring accrued interest is another pitfall, especially when purchasing bonds between coupon payment dates. Accrued interest represents the portion of the next coupon payment that belongs to the seller. The buyer compensates the seller for this accrued interest, which affects the total cost of the bond but not its quoted price. Failing to account for accrued interest can distort your understanding of the true investment cost. Always factor in accrued interest when analyzing bond transactions to gain a complete picture. Understanding the timing of cash flows and double-checking all inputs are essential steps to avoid these errors. By being mindful of these potential pitfalls, you can ensure the accuracy of your bond pricing calculations in Excel and make more informed investment decisions. Accurately determining how to calculate the price of a bond in excel is vital for successful bond investing.

Creating a Bond Valuation Model in Excel

A dynamic bond valuation model in Excel offers a flexible tool for analyzing bond prices under various conditions. To construct such a model, begin by setting up a clear and organized spreadsheet. Designate specific cells for input parameters such as the face value of the bond, the coupon rate, the yield to maturity (YTM), and the maturity date. Label these cells clearly for easy identification. Formulas will reference these input cells to calculate the bond price, ensuring that any change to the inputs automatically updates the calculated price. This approach allows users to quickly assess how different factors influence the bond’s value. This is an effective way to understand how to calculate the price of a bond in excel.

Next, implement the bond pricing formula. This typically involves using the PV function or breaking down the calculation into the present value of coupon payments and the present value of the face value. For instance, if using the PV function, the ‘rate’ argument would reference the cell containing the YTM, ‘nper’ would represent the number of periods (years to maturity), ‘pmt’ would be the coupon payment per period (coupon rate multiplied by face value), and ‘fv’ would be the face value. Ensure the correct signs are used for cash inflows and outflows. Data validation can be added to the input cells to minimize errors. For example, set a data validation rule to ensure that the yield to maturity is a reasonable percentage and that the maturity date is in the future. This helps prevent incorrect entries that could skew the bond valuation model results. One of the best ways of learning how to calculate the price of a bond in excel is by practicing to avoid any errors.

Further enhance the model by incorporating scenario analysis. Excel’s Scenario Manager tool allows you to define different scenarios with varying interest rate assumptions. For each scenario, you can specify different YTM values and observe how the bond price changes accordingly. This enables a comprehensive understanding of the bond’s sensitivity to interest rate movements. Present the results of the scenario analysis in a clear and concise manner, perhaps using charts or tables, to facilitate easy comparison. Furthermore, consider adding calculations for other relevant metrics, such as duration and convexity, to provide a more complete picture of the bond’s risk and return characteristics. These advanced features make the bond valuation model a powerful tool for investment analysis and risk management. Knowing how to calculate the price of a bond in excel gives you an advantage in investment analysis.