Understanding the Holding Period Return Concept

In investment analysis, grasping the holding period return (HPR) concept is vital for making informed decisions. The HPR represents the total return on an investment over a specific period, encompassing capital gains, dividends, and interest earned. This metric is essential for evaluating investment performance, comparing different investment opportunities, and optimizing portfolio returns. Unlike other return metrics, such as the internal rate of return (IRR) or the return on investment (ROI), the holding period return provides a comprehensive picture of an investment’s profitability. To accurately calculate the holding period return, it’s crucial to understand how to calculate the holding period return, its significance in investment analysis, and how it differs from other return metrics. By doing so, investors can unlock valuable insights into their investments and make data-driven decisions to drive long-term success.

Why Accurate Calculations Matter in Investment Decisions

Accurate holding period return calculations are crucial in making informed investment decisions. When investors understand how to calculate the holding period return, they can evaluate investment performance, compare different investment opportunities, and optimize their portfolios. Inaccurate calculations can lead to misguided decisions, resulting in suboptimal returns or even significant losses. By mastering the art of holding period return calculations, investors can gain a competitive edge in the market, identifying opportunities that others may miss. Moreover, accurate calculations enable investors to refine their investment strategies, adjusting their portfolios to respond to changing market conditions. In today’s fast-paced investment landscape, the importance of accurate holding period return calculations cannot be overstated. It is essential for investors to grasp the significance of this metric and learn how to calculate the holding period return to make data-driven decisions that drive long-term success.

How to Calculate Holding Period Return: A Step-by-Step Guide

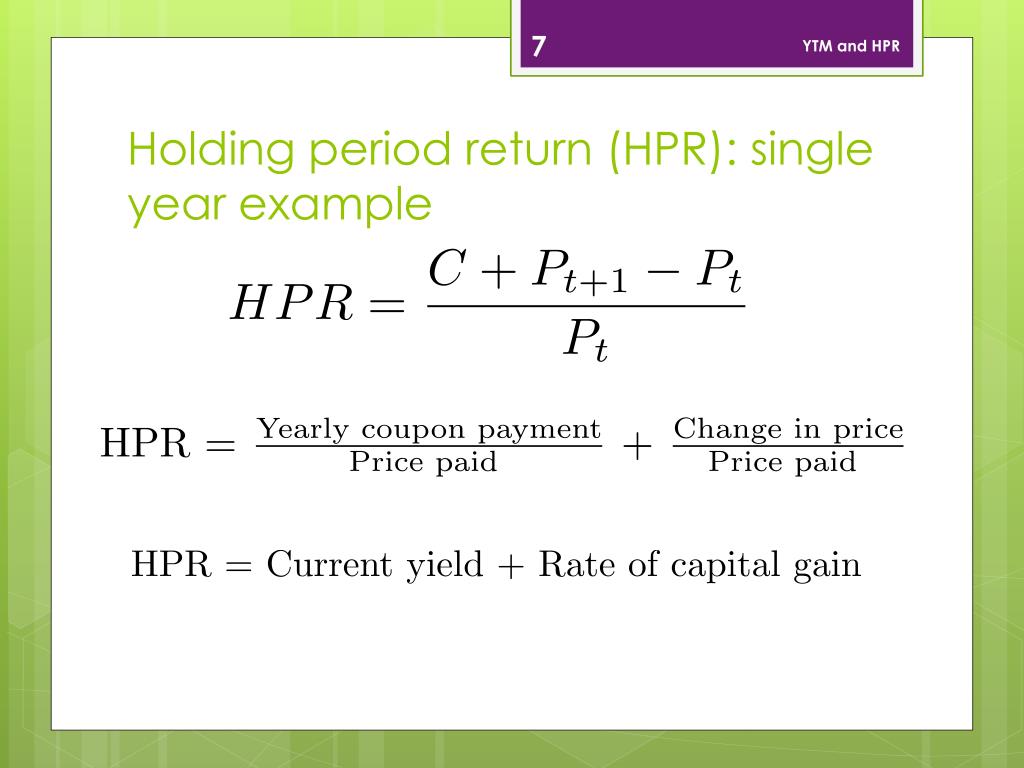

To accurately calculate the holding period return, it’s essential to follow a step-by-step approach. The holding period return formula is as follows: HPR = (Ending Value – Beginning Value + Dividends and Interest) / Beginning Value. To break it down, let’s examine each component of the formula:

1. Beginning Value: This is the initial investment amount or the value of the investment at the start of the holding period.

2. Ending Value: This is the value of the investment at the end of the holding period.

3. Dividends and Interest: These are the distributions or earnings generated by the investment during the holding period.

By plugging in the relevant values, investors can calculate the holding period return. For example, let’s say an investor purchased a stock for $100 and sold it for $120 after one year, earning a $10 dividend during that period. The HPR would be: HPR = ($120 – $100 + $10) / $100 = 30%.

Understanding how to calculate the holding period return is crucial for investors, as it provides a comprehensive picture of an investment’s performance. By mastering this calculation, investors can make informed decisions, comparing the performance of different investments and optimizing their portfolios for maximum returns.

Handling Dividends and Interest: The Impact on Holding Period Return

When calculating the holding period return, it’s essential to account for dividends and interest earned during the holding period. These distributions can significantly impact the overall return on investment, and neglecting them can lead to inaccurate calculations. To accurately calculate the holding period return, investors must consider the effects of compounding and timing on investment returns.

Compounding occurs when dividends or interest are reinvested, generating additional earnings. This can lead to a snowball effect, where the investment grows exponentially over time. For example, if an investment earns a 10% annual return and distributes a 5% dividend, the investor can reinvest the dividend to earn an additional 0.5% return in the following year. This compounding effect can significantly boost the overall holding period return.

Timing is also crucial when accounting for dividends and interest. The timing of dividend payments or interest accruals can affect the holding period return calculation. For instance, if an investment distributes a dividend at the beginning of the holding period, it will have a greater impact on the return than if it were distributed at the end of the period.

To accurately account for dividends and interest, investors can use the following formula: HPR = (Ending Value – Beginning Value + Dividends and Interest) / Beginning Value. By including dividends and interest in the calculation, investors can gain a more comprehensive understanding of their investment’s performance and make informed decisions about their portfolio.

Mastering how to calculate the holding period return, including the impact of dividends and interest, is essential for investors seeking to optimize their portfolios and achieve long-term success. By understanding the intricacies of holding period return calculations, investors can make data-driven decisions and navigate the complex world of investment analysis with confidence.

Dealing with Multiple Periods: Calculating Holding Period Return over Time

Calculating the holding period return over multiple periods can be a complex task, but it’s essential for investors seeking to evaluate their investments’ performance over time. When dealing with multiple periods, investors must consider varying time frames, compounding, and reinvestment to accurately calculate the holding period return.

One of the primary challenges of calculating holding period return over multiple periods is handling the varying time frames. Investors may need to calculate the holding period return for different time periods, such as quarterly, annually, or over a specific number of years. To overcome this challenge, investors can use a time-weighted return calculation, which takes into account the length of each period and the returns earned during that period.

Compounding also plays a significant role when calculating holding period return over multiple periods. As mentioned earlier, compounding occurs when dividends or interest are reinvested, generating additional earnings. To accurately calculate the holding period return, investors must account for the compounding effect over multiple periods. This can be achieved by using a formula that takes into account the returns earned in each period and the compounding effect.

Reinvestment is another crucial aspect to consider when calculating holding period return over multiple periods. When dividends or interest are reinvested, they can generate additional returns, which must be accounted for in the calculation. Investors can use a formula that takes into account the reinvestment of dividends and interest to accurately calculate the holding period return.

To illustrate the calculation of holding period return over multiple periods, let’s consider an example. Suppose an investor purchases a stock for $100 and holds it for three years, earning a 10% return in the first year, 8% in the second year, and 12% in the third year. To calculate the holding period return, the investor would need to account for the compounding effect and reinvestment of dividends. By using a time-weighted return calculation and accounting for compounding and reinvestment, the investor can accurately calculate the holding period return over the three-year period.

Mastering how to calculate the holding period return over multiple periods is essential for investors seeking to evaluate their investments’ performance over time. By understanding the intricacies of holding period return calculations, investors can make informed decisions about their portfolio and optimize their returns over the long term.

Common Pitfalls to Avoid in Holding Period Return Calculations

When calculating the holding period return, it’s essential to avoid common mistakes and pitfalls that can lead to inaccurate results. These errors can have significant consequences, including misinformed investment decisions and suboptimal portfolio performance.

One of the most common pitfalls to avoid is using incorrect data. This can include using outdated prices, incorrect dividend or interest rates, or inaccurate time frames. To avoid this pitfall, investors should ensure that they are using reliable and up-to-date data sources.

Inconsistent time frames are another common mistake to avoid. When calculating the holding period return, investors must ensure that they are using consistent time frames for all periods. This includes using the same frequency of returns, such as monthly or quarterly, and accounting for any variations in time frames.

Neglecting fees and expenses is also a common pitfall to avoid. Fees and expenses can significantly impact investment returns, and failing to account for them can lead to inaccurate holding period return calculations. Investors should ensure that they are including all relevant fees and expenses in their calculations.

Another common mistake to avoid is ignoring the effects of compounding and timing. As discussed earlier, compounding and timing can have a significant impact on investment returns. Investors should ensure that they are accounting for these effects in their holding period return calculations.

Finally, investors should avoid using simplistic or overly complex formulas to calculate the holding period return. While a simple formula may be easy to use, it may not accurately capture the complexities of investment returns. On the other hand, an overly complex formula may be difficult to understand and implement. Investors should strive to use a formula that accurately captures the holding period return while being easy to understand and implement.

By avoiding these common pitfalls, investors can ensure that their holding period return calculations are accurate and reliable. This, in turn, can help investors make informed investment decisions and optimize their portfolio performance. Mastering how to calculate the holding period return, including avoiding common pitfalls, is essential for investment success.

Real-World Applications: Using Holding Period Return in Investment Analysis

Holding period return is a powerful tool in investment analysis, and its applications are diverse and far-reaching. In this section, we’ll explore how holding period return is used in real-world investment analysis, including evaluating mutual fund performance, comparing investment strategies, and optimizing portfolio returns.

One of the most common applications of holding period return is in evaluating mutual fund performance. By calculating the holding period return of a mutual fund, investors can gain insights into its historical performance and make informed decisions about whether to invest in the fund. For example, an investor may compare the holding period return of different mutual funds to determine which one has performed better over a specific time period.

Holding period return is also used to compare investment strategies. By calculating the holding period return of different investment strategies, investors can determine which strategy has performed better over time. For instance, an investor may compare the holding period return of a value investing strategy with a growth investing strategy to determine which one has generated higher returns.

In addition, holding period return is used to optimize portfolio returns. By calculating the holding period return of different assets within a portfolio, investors can identify areas for improvement and make adjustments to optimize returns. For example, an investor may use holding period return to determine which assets are underperforming and rebalance their portfolio accordingly.

Another application of holding period return is in performance attribution analysis. By calculating the holding period return of different components of a portfolio, investors can identify the sources of returns and make informed decisions about how to allocate their investments. For instance, an investor may use holding period return to determine the contribution of different asset classes to their portfolio’s overall returns.

In conclusion, holding period return is a versatile and powerful tool in investment analysis, with a wide range of applications in evaluating mutual fund performance, comparing investment strategies, optimizing portfolio returns, and performance attribution analysis. By mastering how to calculate the holding period return, investors can gain valuable insights into their investments and make informed decisions to achieve their investment goals.

Conclusion: Mastering Holding Period Return Calculations for Investment Success

In conclusion, accurate holding period return calculations are crucial in investment analysis, as they provide valuable insights into investment performance and inform investment decisions. By mastering how to calculate the holding period return, investors can evaluate investment opportunities, compare investment strategies, and optimize portfolio returns. Moreover, understanding the nuances of holding period return calculations, including how to handle dividends and interest, multiple periods, and common pitfalls, is essential for making informed investment decisions.

Throughout this article, we have explored the significance of holding period return in investment analysis, the importance of accurate calculations, and the step-by-step process of calculating holding period return. We have also discussed the challenges of handling dividends and interest, multiple periods, and common pitfalls, as well as the real-world applications of holding period return in investment analysis.

By applying the concepts and techniques discussed in this article, investors can gain a deeper understanding of their investments and make data-driven decisions to achieve their investment goals. Remember, mastering how to calculate the holding period return is an essential skill for investment success, and with practice and patience, investors can unlock the full potential of this powerful investment metric.