What is a Coupon Rate and Why is it Important?

In the realm of bond investing, understanding the coupon rate is crucial for making informed investment decisions. A coupon rate, also known as the nominal yield, is the interest rate that a bond issuer promises to pay to the bondholder periodically until the bond matures. It is expressed as a percentage of the bond’s face value and is typically paid semi-annually or annually. For instance, if you purchase a bond with a face value of $1,000 and a coupon rate of 5%, you can expect to receive $50 in interest per year.

The coupon rate plays a vital role in determining the overall return on investment (ROI) of a bond. It directly affects the bond’s yield, which is the total return on investment, including the coupon rate and any capital gains or losses. A higher coupon rate generally translates to a higher yield, making the bond more attractive to investors. Conversely, a lower coupon rate may result in a lower yield, making the bond less appealing.

When considering how to calculate the coupon rate of a bond, it is essential to understand its significance in bond investing. By grasping the concept of the coupon rate, investors can make more informed decisions about their bond portfolios and optimize their returns. In the following sections, we will delve deeper into the calculation of the coupon rate and its applications, providing a comprehensive guide to mastering this critical aspect of bond investing.

Understanding Bond Basics: Face Value, Maturity, and Yield

Before diving into the calculation of the coupon rate, it’s essential to understand the fundamental components of a bond. A bond is a debt security issued by an entity, such as a corporation or government, to raise capital from investors. The three key components of a bond are face value, maturity date, and yield.

The face value, also known as the principal or par value, is the amount borrowed by the issuer and repaid to the bondholder at maturity. It is the basis for calculating the coupon rate and is typically stated on the bond certificate. For example, a bond with a face value of $1,000 represents a loan of $1,000 from the investor to the issuer.

The maturity date is the date on which the bond expires and the issuer repays the face value to the bondholder. Bonds can have varying maturity dates, ranging from a few months to several decades. The maturity date affects the bond’s yield, as investors demand higher returns for longer-term investments.

The yield, also known as the total return, is the total income earned from a bond, including the coupon rate and any capital gains or losses. It represents the bond’s overall performance and is a critical factor in investment decisions. Understanding the relationship between the face value, maturity date, and yield is crucial for accurately calculating the coupon rate and making informed investment decisions.

By grasping these fundamental concepts, investors can better comprehend the coupon rate and its significance in bond investing. In the next section, we will explore how to calculate the coupon rate of a bond using a simple formula, providing a step-by-step guide to mastering this critical aspect of bond investing.

How to Calculate the Coupon Rate of a Bond: A Simple Formula

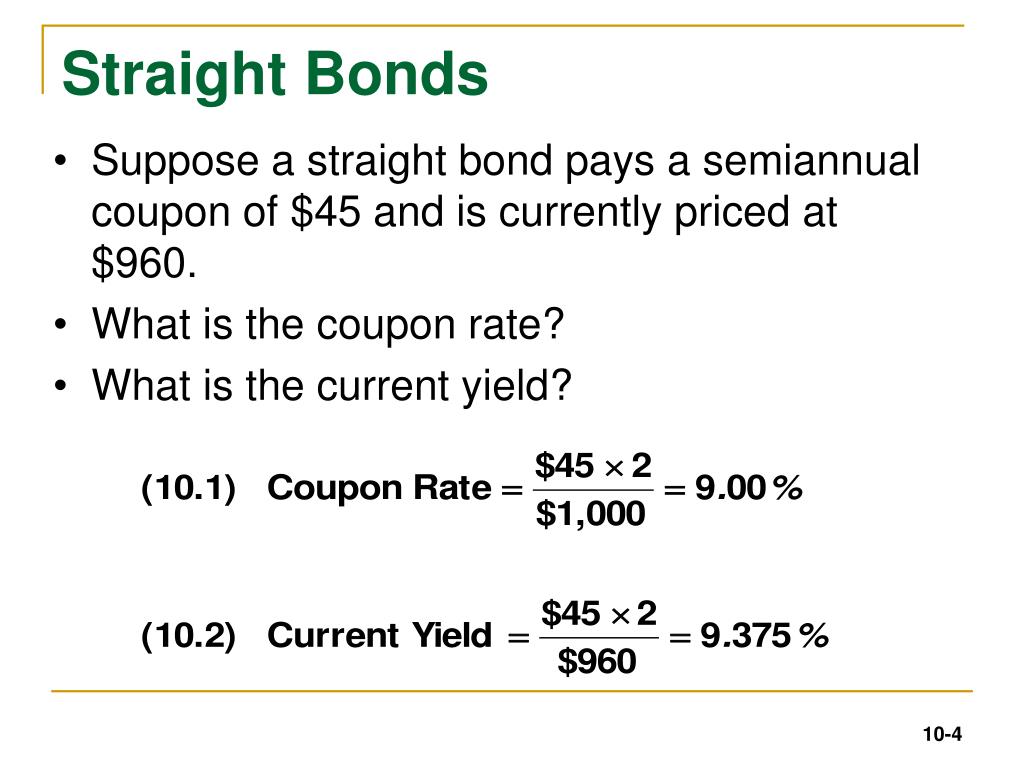

Calculating the coupon rate of a bond is a straightforward process that involves a simple formula. The coupon rate, also known as the nominal yield, is the interest rate that a bond issuer promises to pay to the bondholder periodically until the bond matures. To calculate the coupon rate, you need to know the bond’s face value, coupon payment, and frequency of coupon payments.

The formula to calculate the coupon rate of a bond is:

Coupon Rate = (Annual Coupon Payment / Face Value) x (1 / Frequency of Coupon Payments)

For example, let’s say you have a bond with a face value of $1,000, an annual coupon payment of $50, and semi-annual coupon payments. To calculate the coupon rate, you would plug in the values as follows:

Coupon Rate = ($50 / $1,000) x (1 / 2) = 5%

This means that the bond has a coupon rate of 5%, which is the rate at which the issuer will pay interest to the bondholder periodically until the bond matures.

It’s essential to note that the frequency of coupon payments can affect the coupon rate. Bonds with semi-annual coupon payments will have a higher coupon rate than those with annual coupon payments, assuming the same face value and coupon payment.

By understanding how to calculate the coupon rate of a bond using this simple formula, investors can make more informed decisions about their bond portfolios and optimize their returns. In the next section, we will explore the various factors that influence the coupon rate, providing a comprehensive understanding of the broader context.

Factors Affecting the Coupon Rate: Credit Rating, Market Conditions, and More

When it comes to calculating the coupon rate of a bond, several factors come into play. Understanding these factors is crucial to accurately determining the coupon rate and making informed investment decisions. In this section, we will explore the key factors that influence the coupon rate, including credit rating, market conditions, and economic indicators.

Credit Rating: A bond issuer’s credit rating plays a significant role in determining the coupon rate. A higher credit rating indicates a lower risk of default, which results in a lower coupon rate. Conversely, a lower credit rating suggests a higher risk of default, leading to a higher coupon rate. For example, a bond issued by a company with a AAA credit rating may have a coupon rate of 3%, while a bond issued by a company with a BB credit rating may have a coupon rate of 6%.

Market Conditions: Market conditions, such as interest rates and inflation, also impact the coupon rate. When interest rates are high, bond issuers must offer higher coupon rates to attract investors. Conversely, when interest rates are low, coupon rates tend to be lower. Additionally, inflation can erode the purchasing power of bondholders, leading to higher coupon rates to compensate for the loss.

Economic Indicators: Economic indicators, such as GDP growth and unemployment rates, can also influence the coupon rate. A strong economy with low unemployment and high GDP growth may lead to lower coupon rates, while a weak economy may result in higher coupon rates.

Other Factors: Other factors that can affect the coupon rate include the bond’s maturity date, face value, and frequency of coupon payments. For example, a bond with a longer maturity date may have a higher coupon rate to compensate for the increased risk of default over time.

By understanding these factors and how they interact, investors can better appreciate the complexities of calculating the coupon rate and make more informed investment decisions. In the next section, we will explore real-world examples of calculating the coupon rate for different types of bonds, providing practical insights into the application of these concepts.

Real-World Examples: Calculating Coupon Rates for Different Types of Bonds

To illustrate the practical application of the coupon rate formula, let’s consider several real-world examples of calculating the coupon rate for different types of bonds.

Example 1: Government Bond

A 10-year U.S. Treasury bond has a face value of $1,000 and an annual coupon payment of $30. To calculate the coupon rate, we can use the formula:

Coupon Rate = ($30 / $1,000) x (1 / 1) = 3%

This means that the bond has a coupon rate of 3%, which is the rate at which the U.S. government will pay interest to the bondholder periodically until the bond matures.

Example 2: Corporate Bond

A 5-year corporate bond issued by XYZ Inc. has a face value of $1,000 and a semi-annual coupon payment of $25. To calculate the coupon rate, we can use the formula:

Coupon Rate = ($25 / $1,000) x (1 / 0.5) = 5%

This means that the bond has a coupon rate of 5%, which is the rate at which XYZ Inc. will pay interest to the bondholder periodically until the bond matures.

Example 3: Municipal Bond

A 7-year municipal bond issued by the City of New York has a face value of $1,000 and an annual coupon payment of $40. To calculate the coupon rate, we can use the formula:

Coupon Rate = ($40 / $1,000) x (1 / 1) = 4%

This means that the bond has a coupon rate of 4%, which is the rate at which the City of New York will pay interest to the bondholder periodically until the bond matures.

By examining these real-world examples, investors can gain a better understanding of how to calculate the coupon rate for different types of bonds and make more informed investment decisions. In the next section, we will discuss common mistakes to avoid when calculating the coupon rate, providing valuable insights to help investors navigate the bond market with confidence.

Common Mistakes to Avoid When Calculating the Coupon Rate

When calculating the coupon rate of a bond, it’s essential to avoid common mistakes that can lead to inaccurate results and misinformed investment decisions. Here are some common errors to watch out for:

Mistake 1: Confusing Coupon Rate with Yield

One of the most common mistakes is confusing the coupon rate with the yield. While both terms are related to bond returns, they are not interchangeable. The coupon rate represents the periodic interest payment, whereas the yield represents the total return on investment, including capital gains or losses.

Mistake 2: Ignoring Compounding Frequency

Another mistake is ignoring the compounding frequency when calculating the coupon rate. Failing to account for the frequency of coupon payments can lead to inaccurate results. For example, a bond with semi-annual coupon payments will have a different coupon rate than one with annual payments.

Mistake 3: Using Incorrect Face Value

Using an incorrect face value can also lead to errors in calculating the coupon rate. Make sure to use the correct face value, which is the principal amount of the bond, to ensure accurate results.

Mistake 4: Failing to Consider Credit Rating

Failing to consider the credit rating of the bond issuer can also impact the accuracy of the coupon rate calculation. A bond with a lower credit rating will typically have a higher coupon rate to compensate for the increased risk of default.

By being aware of these common mistakes, investors can avoid errors and ensure accurate calculations of the coupon rate. In the next section, we will explore online resources and tools that can help simplify the process of calculating the coupon rate.

Using Online Calculators and Tools to Simplify the Process

In today’s digital age, calculating the coupon rate of a bond has become easier than ever. With the advent of online calculators and tools, investors can quickly and accurately determine the coupon rate of a bond, saving time and reducing the risk of errors.

One of the most popular online resources for calculating the coupon rate is a bond calculator. These calculators are available on various financial websites and allow investors to input the necessary parameters, such as face value, coupon payment, and maturity date, to calculate the coupon rate. Some popular bond calculators include Investopedia’s Bond Calculator and NerdWallet’s Bond Calculator.

In addition to bond calculators, investors can also use financial websites and online platforms to calculate the coupon rate. For example, websites like Yahoo Finance and Google Finance provide bond data and calculators that can be used to calculate the coupon rate. Online platforms like Bloomberg and Reuters also offer advanced bond calculators and analytics tools.

When using online calculators and tools, it’s essential to ensure that the inputs are accurate and up-to-date. Investors should also be aware of any assumptions or limitations built into the calculator, as these can affect the accuracy of the results. By leveraging online resources and tools, investors can simplify the process of calculating the coupon rate and make more informed investment decisions.

By understanding how to calculate the coupon rate of a bond and utilizing online resources and tools, investors can gain a deeper understanding of the bond market and make more informed investment decisions. In the next section, we will summarize the key takeaways from this article and emphasize the importance of accurately calculating the coupon rate.

Conclusion: Mastering the Art of Calculating Coupon Rates for Informed Investing

In conclusion, calculating the coupon rate of a bond is a crucial step in bond investing. By understanding the concept of a coupon rate, its significance in bond investing, and how to calculate it using a simple formula, investors can make more informed investment decisions. Additionally, being aware of the factors that influence the coupon rate, such as credit rating and market conditions, can help investors navigate the bond market with confidence.

By following the step-by-step guide outlined in this article, investors can master the art of calculating the coupon rate of a bond. Whether using online calculators and tools or manual calculations, accurately determining the coupon rate is essential for evaluating the potential return on investment and making informed decisions.

Remember, how to calculate the coupon rate of a bond is not just a mathematical exercise, but a critical component of bond investing. By grasping this concept, investors can unlock the full potential of bond investing and achieve their financial goals. With the knowledge and tools provided in this article, investors can confidently navigate the bond market and make informed investment decisions.