Understanding Bond Yields: The Basics

Bond yields are a crucial component in evaluating bond investments, as they provide a measure of the return on investment. When learning how to calculate rate of return on bonds, it’s essential to understand the different types of bond yields. The three primary types of bond yields are nominal yield, current yield, and yield to maturity. The nominal yield, also known as the coupon rate, is the interest rate paid periodically to the bondholder. The current yield, on the other hand, takes into account the bond’s current market price and is a more accurate representation of the bond’s return. The yield to maturity, also known as the total return, is the total return an investor can expect to earn if they hold the bond until maturity. Understanding the differences between these yields is vital in determining how to calculate rate of return on bonds and making informed investment decisions. By grasping the concept of bond yields, investors can better navigate the complex world of bond investments and make more informed decisions about their portfolios.

How to Calculate Bond Returns: A Step-by-Step Approach

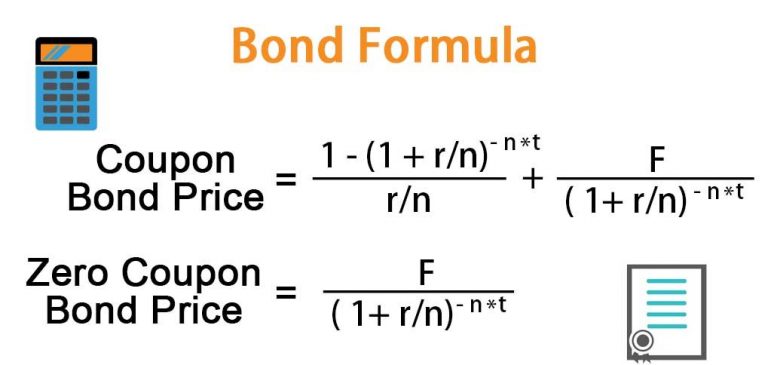

Calculating the rate of return on bonds is a crucial step in evaluating bond investments. To accurately determine how to calculate rate of return on bonds, it’s essential to follow a step-by-step approach. The formula to calculate the rate of return on bonds is as follows: Rate of Return = (Coupon Payment + Capital Gain) / Current Price. This formula takes into account the coupon payment, which is the periodic interest payment made to the bondholder, and the capital gain, which is the profit earned from selling the bond. The current price is the bond’s current market value. To illustrate this formula, let’s consider an example. Suppose an investor purchases a bond with a face value of $1,000, a coupon rate of 5%, and a current price of $900. If the bond is held until maturity, the investor will receive a coupon payment of $50 (5% of $1,000) and a capital gain of $100 ($1,000 – $900). Using the formula, the rate of return would be (50 + 100) / 900 = 16.67%. By following this step-by-step approach, investors can accurately calculate the rate of return on bonds and make informed investment decisions.

The Role of Face Value, Coupon Rate, and Maturity

When learning how to calculate rate of return on bonds, it’s essential to understand the impact of face value, coupon rate, and maturity on bond returns. These factors play a crucial role in determining the rate of return on bonds and can significantly affect the calculation. The face value, also known as the principal, is the amount borrowed by the issuer and repaid to the investor at maturity. The coupon rate, on the other hand, is the interest rate paid periodically to the bondholder. The maturity date is the date on which the bond expires and the issuer repays the face value. To accurately calculate the rate of return on bonds, investors must consider these factors and how they interact with each other. For instance, a bond with a higher face value and coupon rate will generally offer a higher rate of return, while a bond with a longer maturity date may offer a lower rate of return due to the increased risk of default. By understanding the role of face value, coupon rate, and maturity, investors can make more informed decisions when calculating bond returns and maximize their investment potential.

Types of Bond Returns: Current Yield, Yield to Maturity, and Total Return

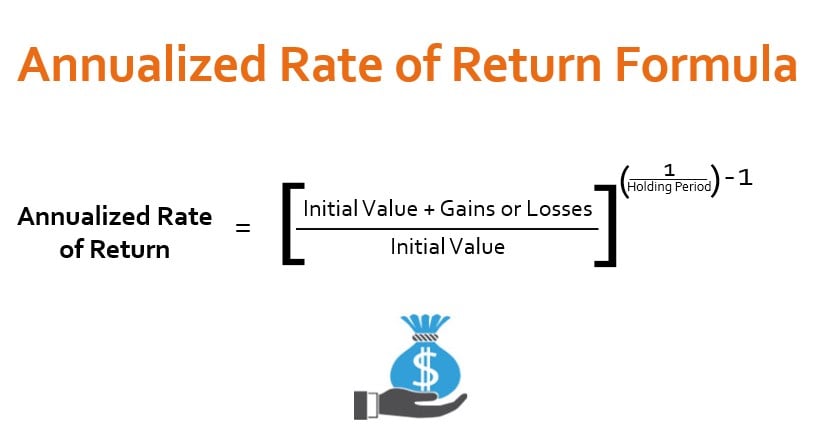

When learning how to calculate rate of return on bonds, it’s essential to understand the different types of bond returns. There are three primary types of bond returns: current yield, yield to maturity, and total return. Each type of return provides valuable insights into the bond’s performance and can help investors make informed investment decisions. The current yield, also known as the coupon yield, is the bond’s annual coupon payment divided by its current market price. This type of return is useful for investors seeking regular income from their bond investments. The yield to maturity, on the other hand, is the total return an investor can expect to earn if they hold the bond until maturity. This type of return takes into account the bond’s coupon payments, capital gains, and compounding. The total return, also known as the holding period return, is the bond’s total return over a specific period, including coupon payments, capital gains, and compounding. By understanding these different types of bond returns, investors can gain a more comprehensive understanding of how to calculate rate of return on bonds and make more informed investment decisions. For instance, an investor seeking regular income may focus on the current yield, while an investor seeking long-term growth may focus on the yield to maturity or total return.

Real-World Examples: Calculating Returns on Government and Corporate Bonds

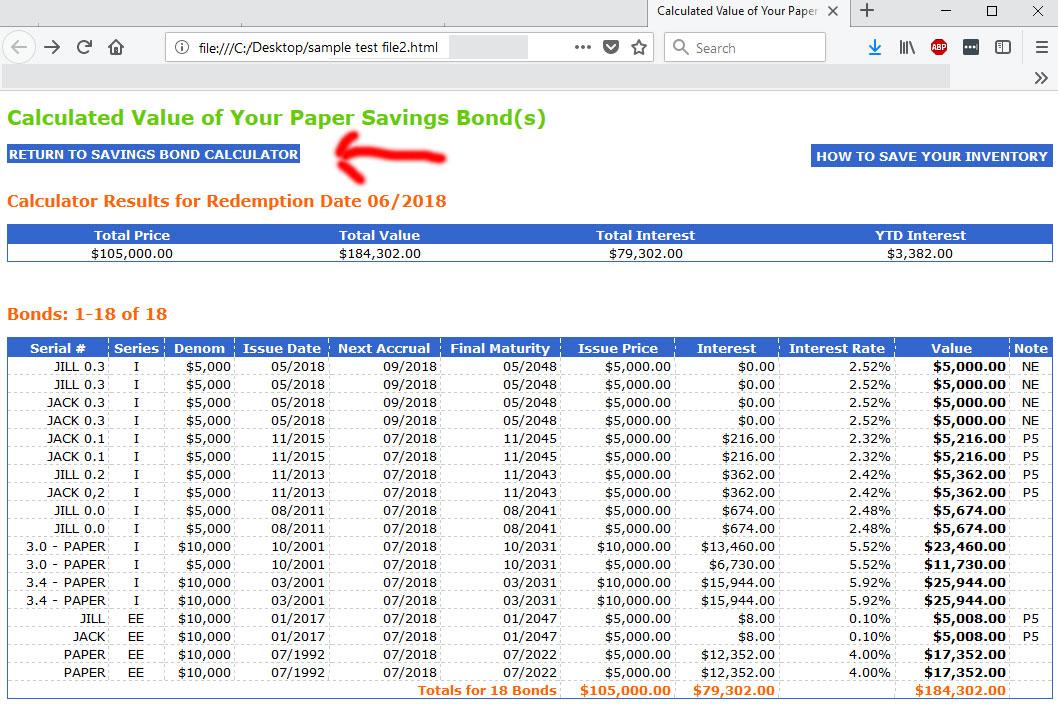

To illustrate how to calculate rate of return on bonds, let’s consider two real-world examples: a U.S. Treasury bond and a corporate bond. Suppose we have a 10-year U.S. Treasury bond with a face value of $1,000, a coupon rate of 2%, and a current market price of $950. To calculate the current yield, we can use the formula: current yield = (annual coupon payment / current market price). In this case, the current yield would be 2.11% (=$20 / $950). To calculate the yield to maturity, we would need to use a financial calculator or a spreadsheet to determine the bond’s internal rate of return, which takes into account the bond’s coupon payments, capital gains, and compounding. Let’s say the yield to maturity is 2.50%. Now, let’s consider a corporate bond with a face value of $1,000, a coupon rate of 4%, and a current market price of $1,050. Using the same formulas, we can calculate the current yield and yield to maturity. The current yield would be 3.81% (=$40 / $1,050), and the yield to maturity might be 4.20%. By comparing these examples, we can see how different types of bonds and market conditions can affect the calculation of bond returns. Understanding how to calculate rate of return on bonds is crucial for investors seeking to make informed investment decisions and maximize their returns.

Common Mistakes to Avoid When Calculating Bond Returns

When learning how to calculate rate of return on bonds, it’s essential to avoid common mistakes that can lead to inaccurate results. One common mistake is ignoring compounding, which can significantly impact the bond’s total return. Another mistake is using incorrect formulas or failing to account for the bond’s coupon payments, face value, and maturity. Additionally, investors may overlook the impact of taxes on bond returns, which can affect the bond’s net return. Furthermore, investors may not consider the bond’s credit risk, which can affect the bond’s yield to maturity. To avoid these mistakes, investors should carefully review the bond’s terms and conditions, use accurate formulas, and consider all relevant factors when calculating bond returns. By doing so, investors can ensure accurate calculations and make informed investment decisions. For instance, when calculating the yield to maturity, investors should use a financial calculator or spreadsheet to determine the bond’s internal rate of return, rather than relying on a simple formula. By avoiding common mistakes, investors can gain a more accurate understanding of how to calculate rate of return on bonds and make more informed investment decisions.

Using Bond Return Calculations to Inform Investment Decisions

Accurately calculating bond returns is crucial for investors seeking to make informed investment decisions. By understanding how to calculate rate of return on bonds, investors can evaluate bond performance, compare returns across different bonds, and make informed decisions about their investment portfolios. For instance, investors can use bond return calculations to determine which bonds offer the highest returns, and adjust their portfolios accordingly. Additionally, investors can use bond return calculations to assess the creditworthiness of bond issuers, and make more informed decisions about the level of risk they are willing to take on. Furthermore, bond return calculations can help investors identify opportunities for diversification, and create a more balanced investment portfolio. By using bond return calculations to inform investment decisions, investors can maximize their returns, minimize their risk, and achieve their long-term investment goals. For example, an investor may use bond return calculations to compare the returns of a U.S. Treasury bond with a corporate bond, and determine which bond offers the highest return for a given level of risk. By doing so, the investor can make a more informed decision about which bond to invest in, and optimize their investment portfolio.

Conclusion: Mastering Bond Return Calculations for Investment Success

In conclusion, accurately calculating bond returns is crucial for investors seeking to maximize their bond investments. By understanding how to calculate rate of return on bonds, investors can make informed investment decisions, evaluate bond performance, and compare returns across different bonds. To achieve investment success, it is essential to master the art of bond return calculations, avoiding common mistakes and considering all relevant factors. By doing so, investors can optimize their investment portfolios, minimize risk, and achieve their long-term investment goals. Remember, calculating bond returns is not a one-time task, but an ongoing process that requires continuous monitoring and evaluation. By staying informed and up-to-date on bond return calculations, investors can stay ahead of the curve and make the most of their bond investments. Whether you’re a seasoned investor or just starting out, mastering bond return calculations is a critical step towards achieving investment success.